The US government is weighing a plan to take roughly a 10% equity stake in Intel by converting part of the company’s awards under the Chips and Science Act into stock, Bloomberg reported. This move would make the administration the chipmaker’s largest single shareholder and mark an unusual step for federal industrial policy.

Under the discussions, some or all of Intel’s allotted $10.9 billion in Chips Act grants, funds originally structured as milestone-based reimbursements for onshore commercial and military production, could be converted into equity.

At recent market values, a 10% holding would be worth roughly $10–11 billion. Intel can also tap up to $11 billion in loans under the 2022 law. Officials cautioned the plan is still fluid and no deal is final.

SoftBank’s $2Bn Investment

The talks come as SoftBank Group committed $2 billion to buy Intel shares, a primary issuance that represents roughly a 2% stake and was announced as a vote of confidence in the embattled chipmaker. The combined headlines, a private investor’s cash infusion and possible government equity, have driven volatile market reactions as investors parsed the political and commercial implications.

Policymakers see Intel’s sprawling Ohio manufacturing project and domestic chip capacity as strategically important. The company has struggled with market share, high costs and delays in advanced-node manufacturing, prompting repeated engagement from White House officials.

The proposed equity conversion is being framed as another way to accelerate Intel’s revival and secure domestic supply chains, though it would redraw the boundary between public support and ownership.

Political & Practical Questions Loom

Turning grant funds into stock raises legal, accounting and precedent-setting questions: Chips Act awards were designed as reimbursements tied to project milestones, not as equity injections. Officials have floated similar ideas elsewhere, and recent precedents include the Pentagon’s preferred equity move into a rare-earths firm.

Observers say converting grants into equity could speed capital delivery but would also expose taxpayers to greater ownership risk and political scrutiny.

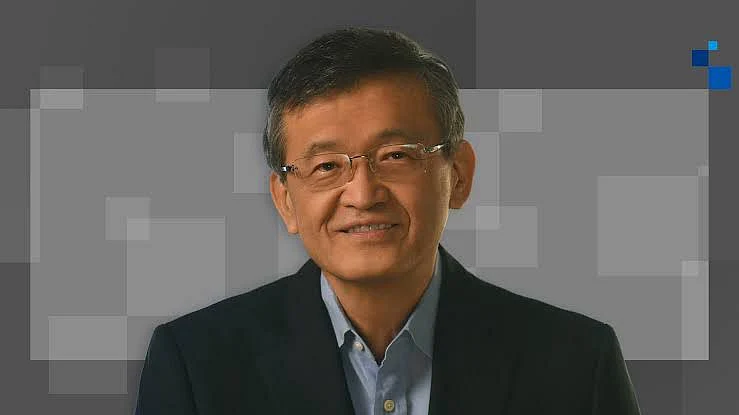

Intel chief executive Lip-Bu Tan recently met President Trump as discussions advanced; company and White House spokespeople declined to confirm details. Any conversion would require careful negotiation over timing, valuation and governance terms, and the White House has not announced a decision.