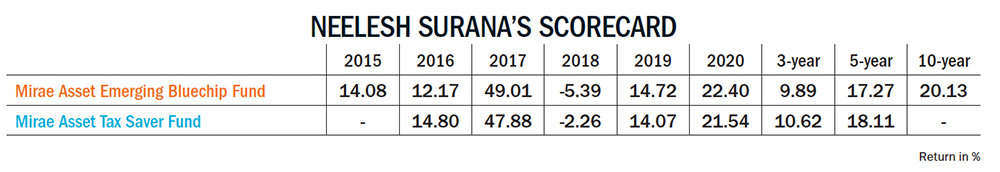

The market’s impressive pullback post the pandemic has caught many off guard, including Neelesh Surana, who manages Rs.177.89 billion at Mirae Asset Mutual Fund. Surana has topped the Value Research 10-year ranking table three times in succession. Today, he believes that earnings of leading companies will grow 85% over the next three years and is optimistic about the financial sector. In his latest interview, he shares how Mirae has positioned its portfolio and the risk factors that he is tracking closely

The market’s impressive pullback post the pandemic has caught many off guard, including Neelesh Surana, who manages Rs.177.89 billion at Mirae Asset Mutual Fund. Surana has topped the Value Research 10-year ranking table three times in succession. Today, he believes that earnings of leading companies will grow 85% over the next three years and is optimistic about the financial sector. In his latest interview, he shares how Mirae has positioned its portfolio and the risk factors that he is tracking closely

Are you surprised by the way the market has moved over the past one year? Is it even justified?

We are not surprised by the direction of market recovery. However, the pace of the upmove was not expected. We were of the view that COVID-19 was a ‘one-off event’, which would impact one or two years of earnings. With this assumption, when we did a DCF valuation of businesses, the fall in intrinsic value was marginal compared to the severe correction in the stock prices we have seen during the pandemic. The price correction has been significantly more than value, and this provided exceptional investment opportunity.

Equity markets have recovered sharply with normalising of economic activity, low interest rates, continuation of reforms and FII flows. Market recovery has been partly aided by strong FII flows which, since September 20, have been at massive $25.3 billion.

Overall, we believe the market levels are broadly justified from a long-term view since we believe India is at the cusp of multi-year revival in earnings, and also considering the low cost of capital.

We expect growth, both in GDP as well as corporate profit-to-GDP over the next few years. Versus a pre-pandemic level of low base of 4.2% GDP growth, and 15-year low corporate profit-to-GDP ratio of 2.2% in FY20, corporate profit-to-GDP is estimated to increase to about 4% of GDP in FY23E. Going ahead, while there could be volatility and corrections, at an overall level, we expect about 12-15% annual return over the long term.

What is your expectation with respect to earnings growth for the next three years? What will drive earnings growth?

There is broad-based earnings growth across most sectors. The base of Nifty50 companies was at about Rs.3.57 trillion in FY20. Over the next three years, that is, by FY23, the earnings of top-50 companies will increase to Rs.6.6 trillion, which is an increase of 85% absolute or 23% CAGR. Of the incremental pool of Rs.3.03-trillion profit, about 34% will be from financials, 17% by the energy sector, and about 10-11% each by technology, auto and telecom. The robust performance over the last two quarters has confirmed the strong earnings upgrade momentum, with Nifty FY21/22 consensus EPS estimates up 15% and 10%, respectively since October 2020.

Six consecutive years of anaemic growth in earnings had led to polarised markets, skewing towards only a few performing companies. But now we are seeing a broad-based recovery in earnings growth. This is primarily led by a bottom-up rebound in certain large sectors such as financials, consumer discretionary, telecom, infrastructure and IT. Each sector has different drivers, but at an aggregate level, the earnings outlook is more benign than pre-pandemic levels. For example, the largest of all sectors, financials, will report decade-high RoE in FY23 (after FY13!). Overall, the revival in earnings growth and low interest rates would support valuations.

What kind of risk do you see from fresh bad loans because of COVID-19? As banks have still not reclassified bad assets, will we have another nasty surprise?

We believe that the asset-quality prognosis for FY23 has improved compared to the initial fears and to RBI’s rather conservative estimates. While a clear picture would emerge only by September 2021, we believe there won’t be any nasty surprises, for several reasons. One, while the banks have not classified borrower accounts as NPAs because of the Supreme Court order, the proforma slippages reported by large banks are at about 1.5% only. Also, the restructured book at about 0.7% of loans till December 2020 is much lower than expectation. The government’s helping hand to MSMEs through 100% collateral-free loans, given through the Emergency Credit Line Guarantee Scheme (ECLGS), also prevented a severe cash crunch and reduced slippages.

Two, the collection efficiency reported by well-managed banks is at around 93-95%, which is almost similar to pre-pandemic levels. Three, the banks have already beefed up their provision cover to consider the impact of existing stress (proforma slippages plus the restructured book) besides keeping an additional buffer for any other stress that may come up in FY22 (Estimates). On average, banks are carrying additional provisions to the tune of ~1% of loans over and above the ~65-70% coverage on the existing pool of stress.

Finally, with the economy picking up, the underlying stress in many sectors has reduced. Earlier worries on unsecured credit and MSMEs have also abated. However, any threat to this pace of recovery, such as second wave of COVID, is a risk and needs to be tracked.

Finally, with the economy picking up, the underlying stress in many sectors has reduced. Earlier worries on unsecured credit and MSMEs have also abated. However, any threat to this pace of recovery, such as second wave of COVID, is a risk and needs to be tracked.

With credit cost moderating by FY23, the RoE of banks is set to normalise. To reiterate, we think most banks in our portfolio will report a decadal high RoE in FY23, that is, their best since FY13.

Within the banking universe, you seem to be still betting on quality retail banks and other financials? Private-sector quality was preferred over the last few years since public-sector balance sheets were destroyed. If there is going to be a reversal in the bad-loan cycle, and there is a privatisation play too, then won’t PSBs be a better bet? Even by sheer valuation, the trade seems to favour PSBs.

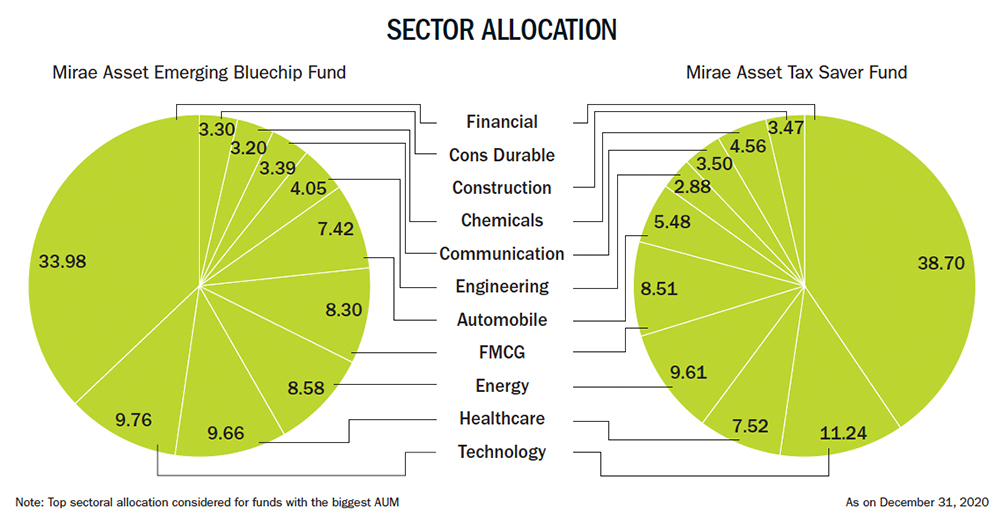

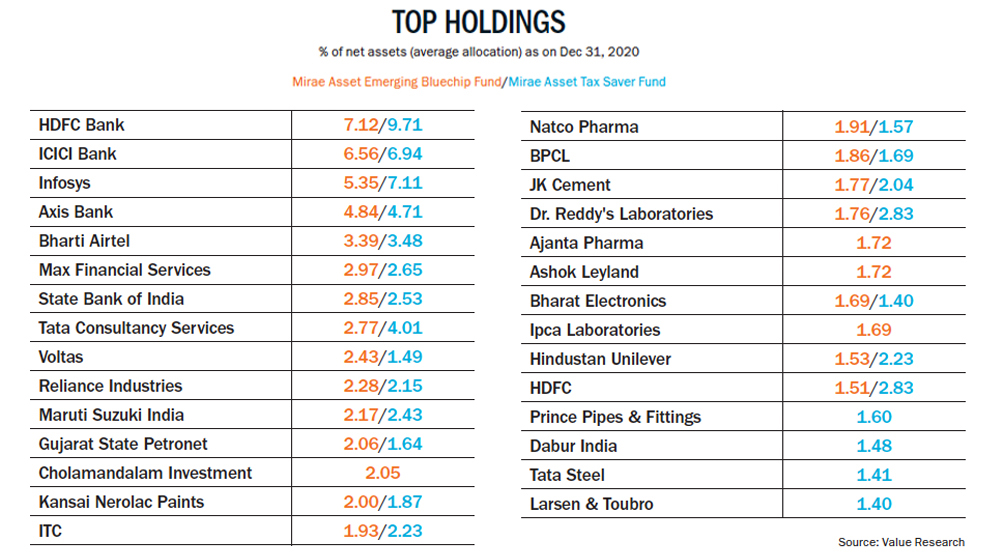

We continue to like private financials given structural growth drivers from increase in loan-to-GDP, and also market-share gains. Well-managed private sector banks have gained market share on both sides of the balance sheet. Over the last decade, the deposit market share of private sector banks has increased from 16% to 28%, while that of PSB (ex-SBI) has reduced from 56% to 44%. Similarly, the loan market share has also increased steadily to about 34%, which is a gain of about 14% from PSB (ex-SBI). Cost-to-income ratio of well-managed private sector banks is also significantly lower.

We believe private-sector banks have established sustainable economic moats over the years through focus on risk and measured growth, low cost-to-income ratio, high focus on cross-selling, digital push which would improve operating efficiency, and driving down the cost-to-income ratio.

With PSBs, we need to be extremely selective. In our view, the starting point should not be valuation discount, but on the quality and sustainability of a franchise. In our portfolios, we do have exposure to one PSB that we believe is a standout given the quality of franchise, as demonstrated by its past track record of maintaining market share gains across segments.

You are still holding on to insurance plays. At these valuations, does it make sense?

India remains both uninsured and underinsured, compared to global peers. Over the last 20 years, life insurance premium-to-GDP has increased from 2.1% to 2.7%, which is still very low compared to say South Africa at 10.2% or Taiwan at 17%. An important aspect of insurance penetrating levels of 2.7% is that it needs to be adjusted for high share of saving products given the popularity of ULIPs in India. If we look at the protection part of the life insurance business, the runway to grow is long, as only 10% of the total addressable population is covered, and that too not adequately.

We participate only if our internal assessment of value is higher than prevailing stock prices.

How are you looking at the public-sector universe in general? Some stocks have already moved up, others have seen muted gain. Where do you see scope for further growth/re-rating?

We need to be very selective while choosing PSUs. In our view, valuation should not be the key investment rationale while investing in PSUs, as the same could result in a value trap. We need to select PSUs just like any other business, based on their sustainability of earnings, RoCE, potential change in capital allocation, prospects of privatisation and so on.

We are positive on select PSUs and have about 10- 15% exposure across funds. We are particularly positive on candidates that could be privatised since that can unlock significant value.

You seem to be betting more on industrial recovery, with Ashok Leyland, SKF, Orient, Kansai, JK Cement, L&T and so on. Why?

Each of these businesses, except for the infrastructure conglomerate, are driven by a bottom-up approach, rather than any top-down call of industrial recovery. Our investment philosophy is centred around participating in quality businesses, but up to a reasonable valuation. Analysis of all three parameters – business (growth and RoCE filters), management, and valuation – is important from a risk-reward perspective. Each of the above businesses meets these criteria on a bottom-up basis.

From a growth perspective, if government spending on infra is stepped up as anticipated, do you see opportunities in infrastructure stocks? Can sheer growth make them opportunistic bets?

As per the National Infrastructure Pipeline, India needs an investment of about Rs.110 trillion (US$1.6 trillion) over the next five years to build about 7,300 infrastructure projects. Energy, roads, railways and urban projects are estimated to account for a bulk of projects. The centre (39%) and state (39%) governments are expected to have an almost equal share in implementing the projects, while the private sector has 22% share.

But, from a stock-ideation perspective, the above opportunity is unfortunately limited because not all growing infrastructure businesses are good stocks. Many of them do not meet the filters of RoCE, management quality and so on.

Overall, our portfolios are under-indexed to infrastructure companies. We believe that there will be indirect participation given the multiplier impact that infrastructure development has on the economy. One rupee spent by the government on public infrastructure adds about Rs.2.5 to the economy. The rising economic activity will benefit a host of other businesses, particularly the banking sector.

Are there any sectors/stocks ripe for correction? If so, what could be the trigger?

We see two pockets which are ripe for correction. One is a set of few sub-par businesses, particularly within the small-caps, which have participated in the recent upmove, driven by liquidity. At the other extreme, many of the high-quality and great franchises have been re-rated over the last decade and now trade at exorbitant P/E multiples. In our view, such businesses could correct as the actual earnings delivery is more than baked in the valuations.

How long do you think interest rates can remain at current levels? Do you see it posing a threat to growth going forward? What do you think are the key risks to markets going forward?

The RBI has done an excellent job in trying to balance its priority of supporting growth amid inflation risks. We expect the RBI to keep its policy repo rate unchanged through 2021, since the output gap stays negative (despite the cyclical recovery) and inflation remains within the RBI’s band. We do not expect more than 50 basis points increase in repo rate, and that too next year. Despite any such hike, interest rate would still be low by ~200 basis points during this cycle.

We would like to track three risk factors closely. One, any significant increase in commodity prices, particularly oil prices, will impact the macros since the government may be compelled to reduce excise duties to protect the consumer. Two, after strong consecutive monsoons, any disappointment would impact rural consumption. Lastly, any significant reversal in global ‘print and spend’ by policymakers and government, and any abrupt increase in interest rates could impact flows to emerging markets.

Your assets under management have grown substantially. Is size beginning to hurt performance?

We need to look at the individual fund category to decide on the capacity, based on market share and liquidity constraints of that segment. Overall, we are currently ranked No.9 in terms of market share of active equity AUM and believe that we have a long way to grow at a steady rate, particularly in products that are in large-cap or hybrid segments.

We are also cognisant of liquidity issues, particularly in certain categories such as mid-caps. Liquidity and low capacity are key reasons for us not launching a small-cap fund. We have in the past restricted inflows in one of the funds when the assets growth was too fast in short period (Mirae Asset Emerging Blue-Chip Fund). This fund now has steady and predictable growth.

As for future return, we would expect return of about 12-15% in the long term, which bakes in an alpha of about 100-200 basis points over the benchmark.

What is the one profound investment lesson the past year has taught you?

The investment lesson for our research team during last year’s volatility was to stick to the basic framework of investing processes. The pandemic led to revisiting earnings model, and fine-tuning our DCF-based valuation model – this gave us confidence while valuing businesses and helped us take rational decisions when stock prices were volatile, driven by greed and fear.