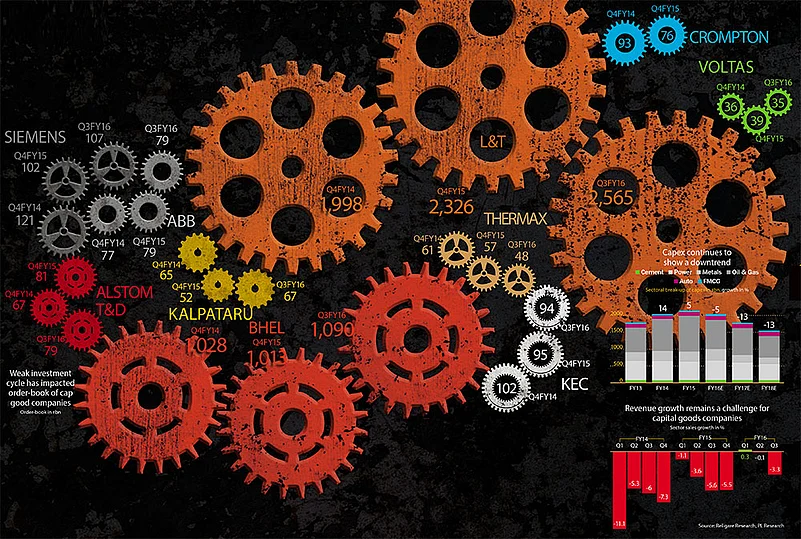

With the current fiscal having come to a close, India’s growth outlook does not look different from what it was at the beginning of the year. The country’s private investment cycle continues to lose steam on the back of a sluggish economy and financial stress in the country’s biggest infrastructure companies. Although the central bank has done its bit by cutting interest rates, the investment cycle is showing no sign of recovery, as state-owned banks are trying to find their way out of the bad loans mess. Q3FY16 was the 11th consecutive quarter of declining revenues for capital goods companies, which have been struggling to stay profitable anyway. Demand from core industries such as cement, steel and power continues to be weak. Not surprising, then, that new investment proposals have declined by 74% y-o-y in the December quarter. The government is doing its best to spur public expenditure; the first nine months of FY16 witnessed large y-o-y growth in expenditure on roads and highways, urban development and railways, but this has not yet translated into tangible orders for the capital goods sector. Against this backdrop, the worst clearly doesn’t seem to be over yet.

Outlook Image Photo: Outlook Description

Outlook Image Photo: Outlook Description

Published At:

MOST POPULAR

WATCH

×