Sridhar Vembu praises India’s GST reforms as timely economic stimulus

He publicly rebuked Trump’s “dead economy” remark on X

GST cuts aim to lower consumer taxes, boost festive-season spending

Analysts warn on fiscal cost, enforcement, and sustained growth needs

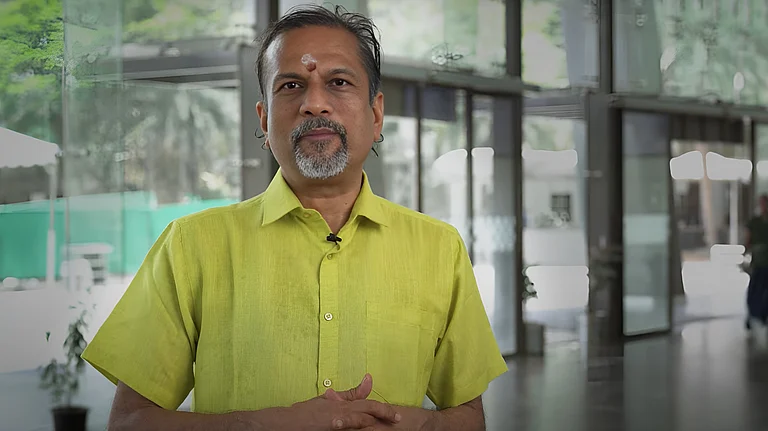

Zoho founder Sridhar Vembu on Thursday, September 4, 2025, publicly praised the government’s wide-ranging GST reforms. He also fired a pointed rebuke at US President Donald Trump’s recent characterisation of India as a ‘dead economy’, posting on X that New Delhi’s tax overhaul will demonstrate the country’s economic vitality.

The comment came as the GST Council approved a major simplification of rates that officials say is designed to boost consumption and investment ahead of the festive season.

Vembu lauded the package as “exactly the right mix”, cutting taxes to stimulate domestic demand while encouraging local production. In a direct shot at Trump’s earlier remark he said, “We will show them what a ‘dead economy’ looks like.”

The post reflects a wider chorus of industry leaders welcoming the policy shift as both a stimulus measure and a signal of confidence in India’s macro management.

GST Changes

The Council has significantly simplified the GST rate structure by consolidating numerous items into a narrower set of slabs and reducing levies on dozens of consumer goods.

Essential household items and consumer durables such as large-screen televisions, air-conditioners, monitors and dishwashers have been moved out of the highest bracket and will now attract lower tax rates, a step expected to bring down retail prices and stimulate consumer demand.

The reforms are scheduled to take effect on September 22, 2025, aligning strategically with the peak festive buying season.

Industry Impact

Analysts and corporate executives say the changes should lift consumer sentiment and likely produce a near-term rise in discretionary spending, particularly on appliances and small cars.

Industry bodies are forecasting meaningful retail-price relief across multiple categories, with marquee products expected to fall by several percentage points in sticker price once the lower GST is applied. The government acknowledges a fiscal cost to the change but frames it as a targeted, temporary boost to domestic demand.

Vembu’s public jab at Trump underscores how the GST move has been read not just as economic policy but as a political statement. The reforms arrive amid heightened trade frictions and high US tariffs affecting Indian exporters; business leaders say lower domestic levies help offset external headwinds by supporting home-market activity and job creation.

Stakeholder Reaction

Proponents of the reform, including several corporate and market voices, have described it as a timely “demand-side” stimulus expected to revive sectors struggling with slow sales. They argue that lowering rates on mass-market goods will particularly benefit middle-income consumers, thereby driving broader demand.

On the other hand, some economists have urged caution, highlighting risks related to leakage, enforcement challenges, and the importance of strong state–centre coordination on revenue sharing. They also stressed that while the tax cuts may provide short-term relief, sustained growth will ultimately depend on deeper structural reforms beyond fiscal adjustments.