US President Donald Trump has teased plans to sign an executive order later today to lower prescription drug prices by a huge margin of around 30–80%. However, in classic Trump style, the announcement lacked specifics, leaving industry watchers, investors, and drugmakers guessing.

The US pays the highest prices globally for many prescription drugs, often nearly three times more than other developed countries, Trump stated in his Truth Social post. While Trump has voiced his intent to narrow this gap, he has yet to outline specific measures or share details publicly. It is this lack of clarity on how Trump plans to lower prices, or which pockets of the US drug market may come under his pricing policies that has sent Indian pharma companies and investors alike into wait-and-watch mode.

Why Are Indian Pharma Players in a Limbo?

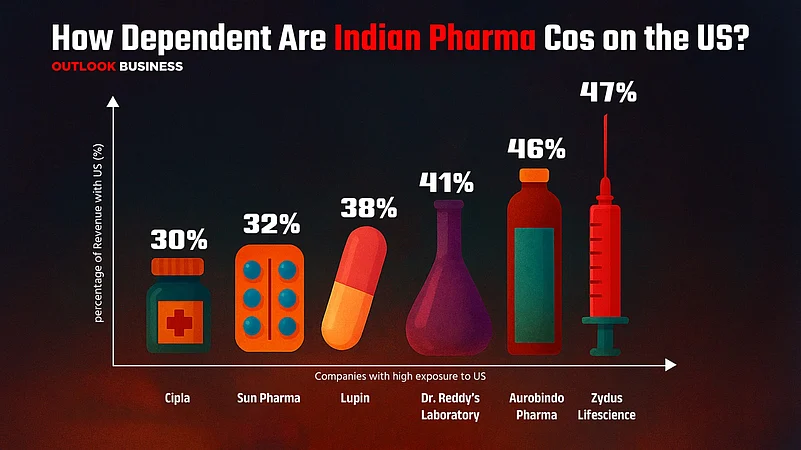

India’s pharma sector -- often termed ‘pharmacy of the world’, is at the forefront of India’s export industry with the US being a major consumer of its drug exports. Sales from the US make up a big chunk of revenue of upto 47% for many prominent drugmakers, including names like Sun Pharma, Cipla, Dr Reddy’s and Lupin, among others.

Competitive pricing is the elixir that Indian pharma players rely on to build their sales in the US. However, if US-based pharma companies are forced to bring down prices aggressively in response to Trump’s move, the pricing edge that Indian firms rely on could be eroded. This has prompted a cautious stance across the Street, with most analysts holding off on conclusions until more concrete information is available. The biggest question is whether the potential price caps will apply broadly, or be limited to specific segments, such as branded drugs, specialty therapies, or generics.

Tushar Manudhane, pharma analyst at Motilal Oswal Financial Services, flagged that the ambiguity in Trump’s announcement makes it too early to gauge the potential impact. “We don’t know the details yet—whether it’s linked to international reference pricing or if generics will also fall under its scope, there’s a lot that is still unclear,” he said.

Who Could Be the Worst Hit?

If the scope of Trump’s orders targets the prescription space or branded generics space, it will be Sun Pharma and Biocon taking the biggest hit, followed by Cipla, Zydus Life, Glenmark Pharma and Aurobindo Pharma.

Industry leader Sun Pharma has a strong focus on the branded specialty segment, in addition to its major dermatology drug Leqselvi, and two upcoming product launches this year also falling under the same category. Apart from Sun Pharma, it is Biocon, that is also vulnerable to be impacted due to its high exposure in branded biosimilars.

Cipla too has a decent hold in the US branded generic market, with a key revenue contributor--Lanreotide (tumour drug), falling in that category. Although Zydus Life has a presence in branded products, it has relatively limited exposure.

Glenmark is another active participant in the US branded respiratory market through its key nasal spray drug Ryaltris, while Aurobindo has minimal exposure through its acquisition of Spectrum Pharma.

On the other hand, the impact is seen to be minimal for players like Dr Reddy’s Laboratories, Marksans Pharma and Granules Pharma—all of which operate in the over-the-counter (OTC) generics space. The OTC generic segment is filled with off-patented drugs, which means it is prone to high competition as more players introduce their own versions of a drug, making price erosion a part and parcel of the business.

Moreover, drug generics are already sold at steep discounts as compared to patented drugs, which gives analysts some comfort in hoping for Trump to not target this segment of the market.

Echoing a similar views, an associate at an Indian pharmaceutical firm, who didn’t want to be named, told Outlook Business that since Indian companies are largely part of the supply chain rather than drug innovation, it remains to be seen whether they will be a focal point of Trump’s pricing crackdown.

Taking on a more bearish view, Shrikant Akolkar, pharma analyst at Nuvama Institutional Equities, believes that if Trump’s idea is implemented in the purest form, it will be a negative for pharma players across the board, including generics (both branded and unbranded) as well as biosimilars.

However, between branded and unbranded generics, Akolkar feels the former category will be harder hit, more so because the latter already faces price erosion. In totality though, Akolkar believes the impact of Trump’s US drug pricing cut plans will remain a sentimental negative for the overall sector.

How Did Investors React?

Caught below a hanging sword of Trump’s plans, the pharma sector woke up to a session in the red today, with the Nifty Pharma index slipping close to 2% in early trade. Industry leader Sun Pharma turned out to be the worst hit today, plunging as much as 7% on account of its strong presence in the US branded generics space—a pocket that remains vulnerable in the face of Trump’s plans. Other drugmakers like Biocon, Lupin, Glenmark and Ajanta Pharma were also down.

However, the strong bullish momentum across the Street lifted spirits even for pharma names, helping recover much of the day’s losses. The recovery from the day’s lows for shares like Sun Pharma, Biocon and Lupin also helped the Nifty Pharma index bounce back into the green.

On the other hand, relatively safer names like Mankind Pharma, Aurobindo Pharma, Dr Reddy’s Labs, Torrent Pharma and JB Chem Pharma rose 2–4%.

Looking ahead, analysts, drugmakers as well as innovators are keen to get the full scope of Trump’s drug pricing plans to gauge their impact on Indian pharma. In the meantime, investors have sorted their bets, moving in favour of most pharma players that pose a solid domestic presence.