The National Stock Exchange (NSE) is gearing up to launch monthly electricity futures in the coming weeks, aiming to offer power sector participants a much-needed hedge against price volatility.

Speaking at a media roundtable on June 26, Sriram Krishnan, Chief of Business Development Officer, at NSE said the exchange will announce the official launch date within the next two to three weeks. The development comes after NSE received the green light from market regulator SEBI on 11 June to introduce electricity derivatives.

The contract, which will be cash settled, is designed to be active throughout the year. It will begin on the first business day of each month and expire a day before the month ends. With a lot size of 50 megawatt hours, which is 50,000 units of electricity, the contract allows buyers to gain if the market spot price goes above the futures price at expiry.

The exchange expects a wide range of participants: from power generators and discoms to traders, corporates like malls and hotels, and even high net worth individuals. However, NSE officials were clear view of the product not being developed for speculative frenzy. Globally, electricity derivatives markets are usually just three times the size of the spot market, a far cry from equity derivatives where volumes are nearly 100 times that of the cash market.

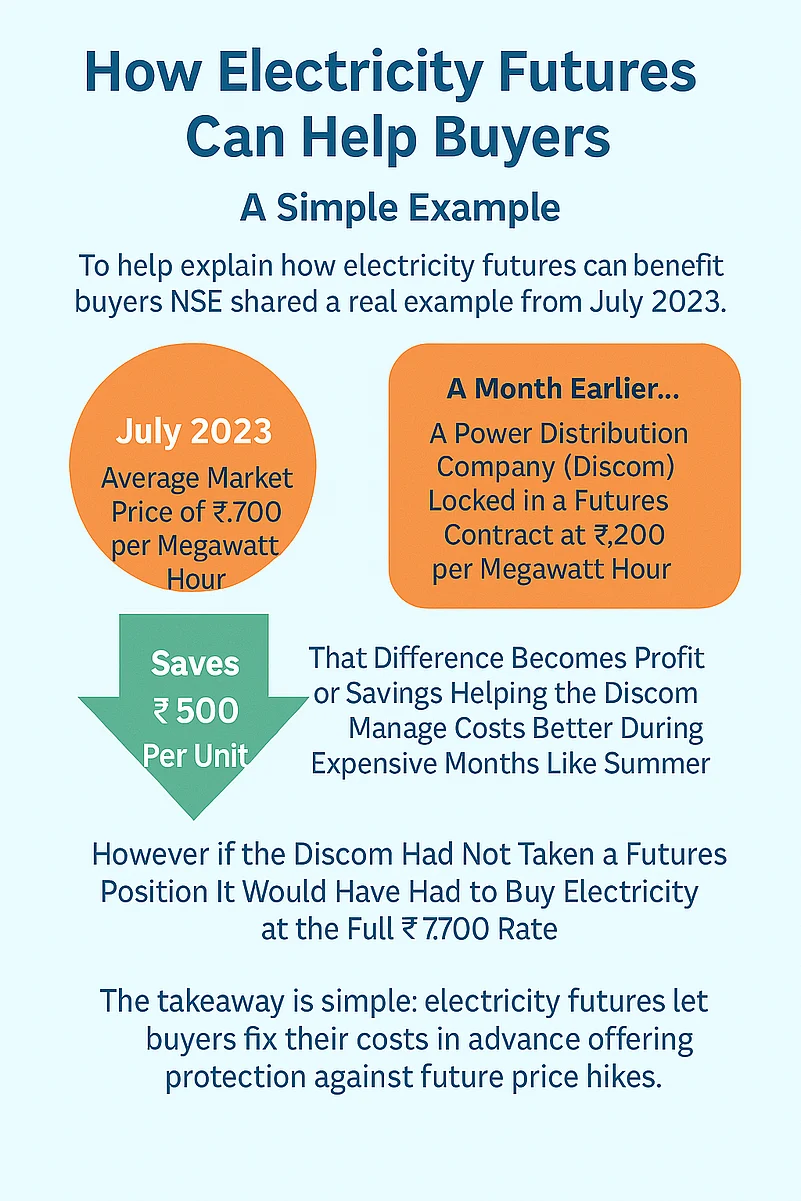

To illustrate how this works in real life, NSE presented a simple example from July 2023. That month, the average spot price for electricity was ₹7,700 per MWh. If a discom had locked in a futures contract earlier at ₹7,200, they would have effectively saved ₹500 per unit, a smart hedge against price spikes during peak demand.

“Without a futures position, the discom would’ve ended up paying ₹7,700,” Ahuja, who heads sustainability, power and carbon markets and listings at NSE, explained. “But with the hedge in place, the effective purchase price drops to ₹7,200. That’s real cost protection and better visibility.”

The example shows how electricity futures can help discoms smooth out costs during high-demand months like summer or the festive season. For producers, it’s a way to secure revenue in advance, while traders get the flexibility to take positions, speculative or hedged.

NSE also plans to gradually roll out quarterly and annual contracts. All these contracts will be cleared and settled by NSE Clearing Ltd, which is SEBI-recognised as a qualified central counterparty and comes with a strong settlement guarantee framework.

India is expected to generate 1,900 billion units of electricity in 2025, making it the third largest power producer globally. According to NSE’s own estimates, based on global benchmarks, the country’s electricity derivatives market could potentially grow to around 8,000 billion units.

With the groundwork laid and regulatory approvals in hand, the focus now shifts to how efficiently the exchange can turn this into a functioning, transparent tool that supports India’s growing and increasingly complex power sector.