MTNL shares: The shares of the government-owned telecom company attracted heightened investor attention earlier this year, after its parent, Bharat Sanchar Nigam Limited (BSNL) reported a profit of Rs 262 crore, for the first time in the last 17 years. This news caught D-street's attention, sparking hopes of a potential comeback.

Another trigger of optimism came after Pemmasani Chandra Sekhar, Ministry of State for Communication disclosed that Mahanagar Telephone Nigam Ltd. (MTNL) reported earnings of Rs 2,134 crore from the monetisation of land and building assets. (Since 2019)

"BSNL and MTNL are monetising only those land and building assets which are not required for their own use in the foreseeable future and for which it has the rights to transfer the ownership," the minister stated. Post this news the shares of MTNL rallied over 18% on the National Stock Exchange.

While D-street's confidence remains robust, the broader picture remains disguised as short-term blips in the markets.

MTNL’s Fight for Survival

In the last 5 years, both the state-owned companies, BSNL and MTNL, have generated around Rs 12,986 crore via monetisation of surplus assets, including land, buildings, towers and fiber. However, the company has remained under heavy debt during this time. Last year, multiple banks, including State Bank of India (SBI), Union Bank of India and Bank of India, classified loans to MTNL as NPAs.

The telecom company's overall debt stood at Rs 32,000 crore, which includes bank loans from Punjab National Bank (PNB) and Uco Bank as well. Plus, stiff competition from private players, like Bharti Airtel, Reliance Jio and Vodafone Idea, is also making the telecom market difficult to capture for MTNL. The recent deals signed by major domestic industry players with Elon Musk's Starlink to provide satellite internet services might also pressure in the overall outlook of the state-owned company.

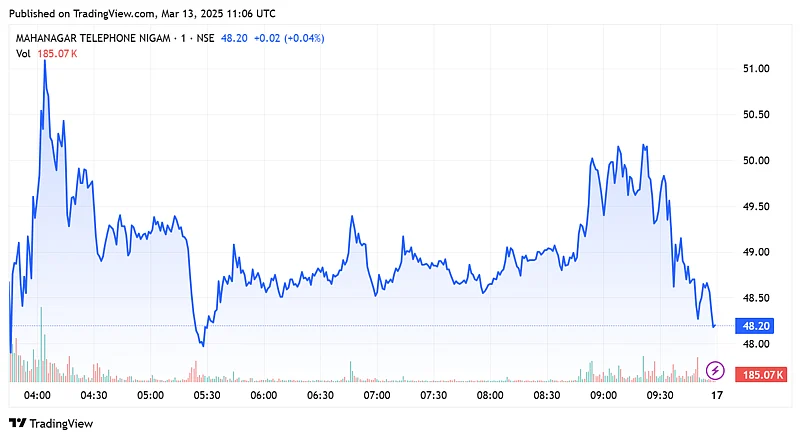

In the last 6 months, the shares of the company have remained in red, down by over 18% on the bourses. Despite the rally witnessed by the stock on Thursday, the stock continues to trade in the negative zone, on year-to-date basis, declining by around 6%.

Stock Outlook

In the first half of 2024, MTNL became a multibagger stock as reports of government intervention to improve operations surfaced. The company also signed a deal with NBCC worth Rs 1,600 crore, last year.

However, these measures failed to improve the overall outlook of the telecom company. Rating agencies remain pessimistic, with Crisil maintaining its 'Crisil D’ rating. The agency cited ongoing debt repayment delays (since June 2024) owing to strained liquidity, as a major factor behind the downgrade.

"The rating factors in the continued deterioration in the company’s operating performance and its persistent weak financial risk profile. The financial risk profile has weakened due to lasting delays in debt servicing of non-guaranteed facilities. Furthermore, the debt obligation for government-guaranteed bonds are being made by the government directly for bonds due in the second, third and fourth quarters of fiscal 2025 (as of date)," the rating agency said.

Technically, the PSU stock shows neutral momentum with no clear strength in either direction, as per analysts. It is trading near its 20-day EMA at 46.42 while encountering resistance at the 50-day, 100-day and 200-day EMAs.

"MTNL is currently trading in the range of 48-48.5 and remains in a consolidation phase with no clear trend direction. The stock has been moving sideways within a defined range, lacking strong bullish or bearish momentum. Immediate support is placed at 44 and 46, while resistance is seen at 50 and 53. Until a breakout occurs in either direction, the stock is likely to continue trading within this range," said Mandar Bhojane, equity research analyst at Choice Broking.

While the near-term trend looks positive, MTNL might need bring more to the table for long-term stability to win over investors confidence.