India has emerged as the global leader in the initial public offering (IPO) market, hosting twice as many IPOs as the US and 2.5 times more than Europe, according to a report by Pantomath Group.

The global IPO market recorded 1,215 deals raising $121.2 billion, marginally below 2023 levels. However, the second half of 2024 witnessed improved performance, with the US reclaiming the top spot for IPO proceeds and a record 55 per cent participation from foreign issuers.

“India achieved a historic milestone by securing the top position globally in terms of IPO volume for the first time, surpassing both the US and Europe, with nearly double the number of IPOs listed compared to the US and two-and-a-half times more than Europe. In contrast, the US reclaimed the lead in IPO proceeds for the first time since the peak in 2021, reinforcing its status as the most vibrant and appealing market for global investors,” the report said.

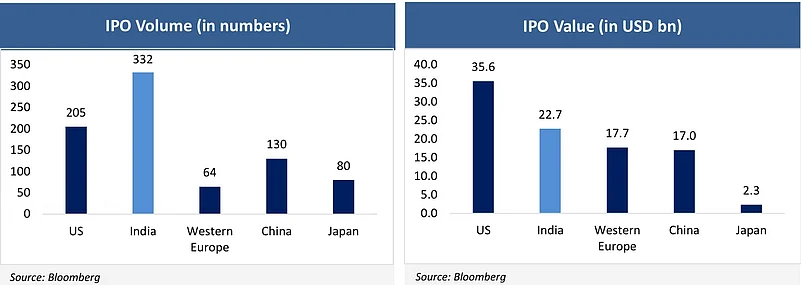

According to the Panthom Group, India leads globally in IPO activity, with 332 IPOs, significantly outpacing the US at 205 and China at 130. Western Europe and Japan trail far behind with 64 and 80 IPOs, respectively.

Although the US has fewer IPOs, it leads with a total IPO value of $35.6 billion, suggesting larger average IPO sizes. India ranks second with $22.7 billion, showing a dynamic but smaller IPO market. Western Europe and China have similar IPO values of $17.7 billion and $17.0 billion, respectively, while Japan trails behind with just $2.3 billion. This underscores the significant differences in the scale of IPOs across regions.

Tighter regulations in mainland China resulted in the weakest IPO performance in a decade in that region. The Technology, Media and Telecommunications (TMT), industrials, and consumer sectors were the leading drivers of global IPO activity, collectively representing about 60 per cent of the total IPOs by both number and proceeds.

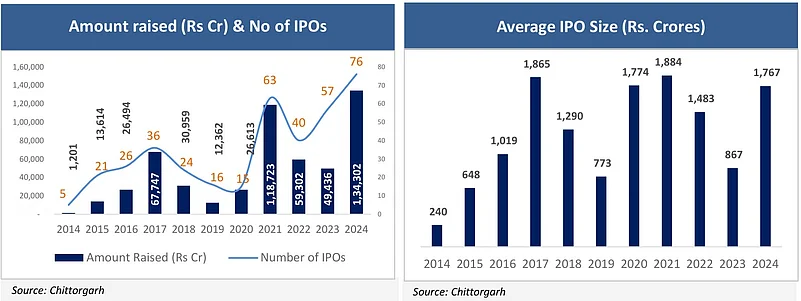

In India, 76 mainboard IPOs raised Rs 1.3 trillion in the first 11 months of 2024, driven by favourable regulatory reforms and investor confidence fuelled market momentum even during downturns.

“Multinational corporations have demonstrated the strategic advantages of listing in India. Factors such as reduced capital costs, wide consumer market, robust regulatory regime, encourage global players to consider Indian markets for their equity offerings. Increasing participation of multinational corporations on Indian Exchanges adds a new dimension to Indian capital market.”, stated Mahavir Lunawat, Managing Director of Pantomath Capital.

Notably, a record 143 DRHPs were filed with SEBI in 2024, compared to 84 in 2023 and 89 in 2022. This record-breaking surge in IPO draft filings comes on the back of strong market performance indicating that strong fundraising will continue through IPO in upcoming year, the report added.

For 2025, 34 companies have already received the requisite SEBI approval for IPOs, targeting a combined Rs 41.462 crore. Additionally, 55 firms await regulatory clearance, intending to raise about Rs 98,672 crore. This record-breaking surge in IPO draft filings comes on the back of strong market performance indicating that strong fundraising will continue through IPO in upcoming year.

“With the continued momentum in the markets, we now project that equity raised through IPOs will cross Rs 2 lakh crore in the year 2025. This milestone is a testament to the resilience of India’s capital markets, the confidence of investors, and the critical role IPOs play in fueling economic growth,” Lunawat said.

Despite ongoing short-term challenges such as geopolitical tensions, weak corporate earnings, a slowing economy, and persistent foreign outflows in secondary markets, the long-term outlook for the Indian market remains strong. While lower-quality IPOs may struggle, well-established companies with solid profitability and clear business prospects are likely to attract strong investor interest, the report said.