Back in 2018, Gurgaon-based start-up founder Himanshu Arya decided it was time to upgrade his ride from a Toyota Innova to a luxury car. With a ₹50-lakh budget in hand, Arya, then 33, was hunting for a pre-owned vehicle. The idea was that the car would offer the prestige of a premium badge and save several lakhs compared to buying brand-new on a loan.

Reality, however, proved more complicated. As a newcomer to the luxury-car market, Arya soon realised that used-car dealers often lacked proper service records or accident histories. In the end, he found his perfect match not at a dealership but through a friend: a Mercedes-Benz E-Class.

That experience would eventually inspire Arya to launch Luxury Cart, a platform dedicated to pre-owned luxury cars, aiming to make the process transparent and trustworthy for other buyers.

Arya is emblematic of a class of young, ambitious consumers in India. The country’s richest have long bought German sedans and British SUVs, but the next generation of buyers—founders, professionals and self-made business owners—sees luxury differently. They seek access over ownership, flexibility over permanence. Aware of this change, carmakers are remodelling the economics of luxury.

The landscape of luxury-car ownership has evolved dramatically in recent years. Today, automakers seek to capture a broader audience. Flexible financing schemes, lease options, decade-long loans and guaranteed buybacks are changing what it means to own a luxury car in India.

“From the manufacturer’s lens, this isn’t just about sales, it’s about lifecycle value,” explains Harshvardhan Sharma, group head of auto tech and innovation at NRI Consulting. “When a buyer returns every 3–4 years through, say, a guaranteed buyback, the brand gains repeat business, stable residual values and even second-life revenue when that car enters the certified pre-owned pool.”

In other words, for the luxury carmaker, every sale is just the beginning of a much longer relationship.

Broadening the Base

For years, policymakers and businesses have debated the true purchasing power of Indian consumers. Today, automakers are seeing it firsthand as a new class of young high-net-worth individuals (HNIs) drives demand.

“While there’s a low-base effect behind the luxury car market’s growth, deeper structural factors are also at play,” says Rajan Amba, managing director of luxury-vehicle manufacturer JLR India. He highlights the rapid rise of India’s HNI and ultra-HNI population, entrepreneurial success fuelled by start-ups and a growing propensity to spend on luxury goods.

According to Knight Frank’s The Wealth Report 2025, India boasted 85,698 HNIs (assets over $10mn) last year. The count is projected to reach 93,753 by 2028. Meanwhile, the number of people declaring annual incomes above ₹50 lakh has jumped five-fold from 1.85 lakh in 2013–14 to 9.39 lakh in 2023–24.

“As income levels rise, the proportion of people wanting to buy luxury vehicles naturally increases,” says Hardeep Singh Brar, chief executive and president of BMW India.

The demographic shift is equally striking. Mercedes reports that nearly 65% of its new customers are under 45, with an average age of 38. BMW sees a similar trend, with buyers in the 35–40 age group forming a substantial share of its clientele. “Today’s generation is ready to spend tomorrow’s money today,” says Shiv Shivakumar, board member at Advent International, a private-equity firm.

Luxury carmakers are adapting fast. To woo younger, tech-savvy buyers, they’re packaging cars like gadgets and smartphones sold on equated monthly installments (EMIs).

With in-house financial-services arms, players like Mercedes, BMW and Audi have the flexibility to tweak payments creatively. For instance, BMW’s “ballooning” EMI plan starts low and rises over time. “Since RBI guidelines for banks are stricter, they can’t offer the flexibility that we can. That allows us to provide customised financial solutions to customers,” says Brar.

Buyers who can afford to pay upfront also benefit from these schemes. Programmes such as Mercedes’ Star Agility and BMW’s 360° Financial Plan reduce monthly EMI outflows by 20–30%, helping customers upgrade without strain.

Arya breaks down the maths. “A salaried person with ₹50 lakh in savings for a car, without an EMI, would usually be in their mid-50s because the first major purchase from savings is typically a house.” But with an EMI of ₹80,000, a buyer only needs a take-home salary of ₹5–7 lakh per month, roughly ₹80 lakh–1 crore annually. IT professionals, young entrepreneurs and start-up founders now fall squarely in this potential buyer pool.

“Many of these buyers are comfortable stretching their loan tenure from five to seven years. Attractive financing schemes are the key enabler,” Arya adds.

These programmes also encourage repeat engagement, reinforcing brand loyalty. The impact is evident in the numbers: Mercedes’ core segment, comprising vehicles priced between ₹50 lakh and ₹80 lakh, accounted for 60% of its sales in September, registering a 10% year-on-year growth.

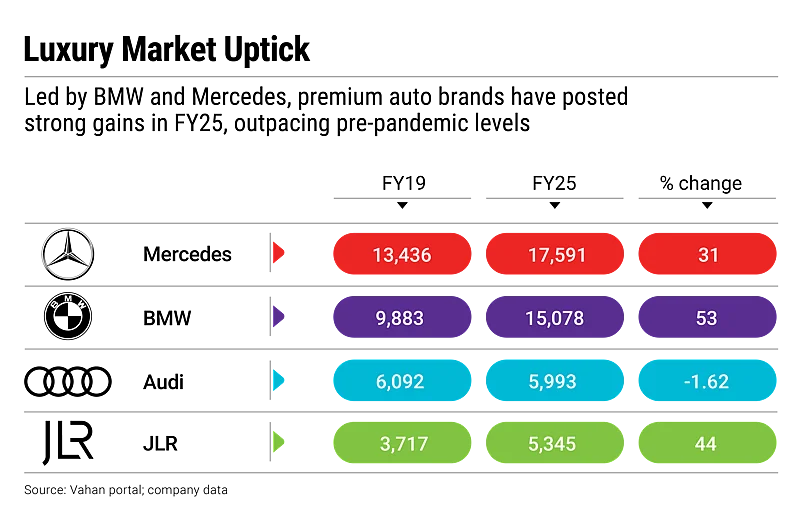

Over the past five years, Mercedes and BMW have posted annual growth ranging from 10–56% and 9–47%, respectively, while the overall passenger-vehicle market grew just 4–23%.

Moreover, India’s luxury car market in 2024–25 crossed the 50,000-unit mark for the first time, recording over 51,400 sales. The two companies contributed over 60% of the total.

Going Places

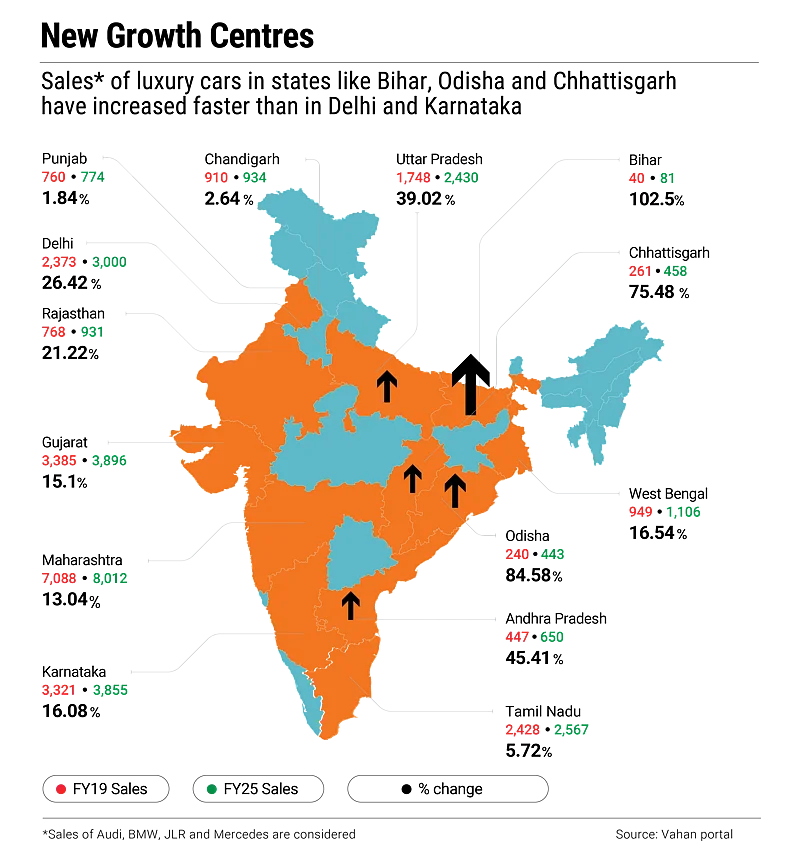

For years, luxury carmakers relied heavily on India’s metro cities to fuel growth. But these urban strongholds are approaching saturation. In the case of Mercedes, for instance, roughly a third of monthly sales come from just three dealerships in Delhi-NCR.

“Tier-I cities remain the largest market, but NCR can’t realistically grow from 500 to 1,000 units,” says Arya. The next frontier is India’s non-metro towns. Here, ambitious local business communities are embracing luxury, undeterred by imperfect roads or infrastructure.

While individual purchasing power may be lower than in metros, rapid expansion in smaller cities has helped maintain consistent growth in absolute sales. BMW, for instance, plans to open dealerships in nine new cities this year, including Kozhikode, Ranchi, Lucknow and Guwahati. Sales are now evenly split between metro and emerging markets, according to the company.

“The growth potential in these smaller towns is even higher because people haven’t yet experienced luxury firsthand,” says BMW India’s Brar.

Mercedes has already credited Tier-II and -III markets for its record September sales, up 36% year on year. The company recently opened its first showroom in Patna and plans to extend its network to 50 cities.

First Step to Prestige

Luxury carmakers are also turning resale into opportunity. Guaranteed buybacks, a key part of ownership programmes, not only ease concerns for new buyers but also create a steady supply of pre-owned luxury cars at more accessible prices.

This opens the doors for consumers who dream of a premium badge. Online platforms like Spinny and Arya’s Luxury Cart are riding this wave, further democratising access to high-end vehicles.

India’s used car market has grown at a compound annual growth rate of 12–13% over the past five years, outpacing sales of new cars. Lower per capita incomes compared with countries like China or the US mean that resale and pre-owned segments are crucial. The trend has trickled into luxury, as HNIs continue to upgrade every 3–4 years, fuelling a secondary market.

“As economic capacity increases, ownership tenures decrease,” says Hanish Yadav, senior vice-president and business head at Spinny. “With cars averaging 10–12 years in life, used-car transactions are 2.5–3 times the number of new car sales.”

For Spinny, luxury used car sales in 2024–25 jumped a staggering 50% year on year, almost double the growth of its non-luxury retail segment at 25%. “Luxury car sales have been on a steady upswing for Mercedes, BMW and Audi over the past 4–5 years,” says Yadav.

The growth of the new luxury vehicles market directly feeds the used segment, as cars filter into resale channels. While luxury pre-owned vehicles still account for less than 5% of total sales for Spinny, their contribution to revenue has risen significantly to about 13% from 5% due to higher average selling prices. The company plans to reach 30% by 2030.

Carmakers also maintain their own certified pre-owned verticals. Mercedes, Audi and BMW have operated these almost since introducing vehicle financing. However, dedicated platforms like Big Boys Toyz and Luxury Cart help preserve the exclusivity of new car sales while expanding access to pre-owned vehicles.

Audi, for example, does not disclose pre-owned sales numbers for its Audi Approved:plus programme, but the business grew 50% in 2023–24. “The goal is to make the Audi experience more accessible and extend the brand’s reach,” says Balbir Singh Dhillon, India head, Audi.

Expansion of pre-owned networks is rapid. Audi has grown from seven locations in 2020 to 27. And it’s a smart play as 20–35% of pre-owned buyers eventually upgrade to a new luxury car within 2–3 years, creating customer lifetime value rather than one-off sales, according to Sharma.

Still, experts caution that growth has its limits. Financing options can broaden reach, but they cannot overcome income constraints of a large segment of buyers. Slow growth in the mass-market passenger-vehicle segment reflects this reality. Geopolitical uncertainties may also disrupt imports of luxury vehicles.

Yet, the potential is striking. Representing less than 2% of India’s overall market, luxury cars are scaling up rapidly, powered by younger buyers and expansion into smaller cities. Together, these trends signal a market that is reaching critical mass where aspiration, innovation and opportunity converge.