Amazon Prime Video has left its India country director post vacant for nearly a year, with no official successor named since Sushant Sreeram’s move to its rival JioStar in July 2024. The role, key to shaping Prime Video’s strategy in the world’s fastest-growing OTT market where Reliance Jio has gone out all guns blazing to grab market share after its acquisition of Disney’s Hotstar, remains unfilled while the platform has rejigged its leadership structure in India.

Sreeram quit after a little over a year as country director to join Viacom18-owned rival JioCinema as chief marketing officer. Around the same time, Aparna Purohit, head of India and Southeast Asia originals at Prime Video, also exited after an eight-year stint and is now with Aamir Khan Productions.

On June 10, 2025, Prime Video formally posted an opening for “Director & Country Head for Prime Video in India, who will help shape this going-forward strategy as well drive our business & content” on its official LinkedIn handle. After Outlook Business inquired, the listing was removed.

“Prime Video India has reorganized its leadership team, establishing a robust structure with senior executives managing key functions across the business,” a company spokesperson said.

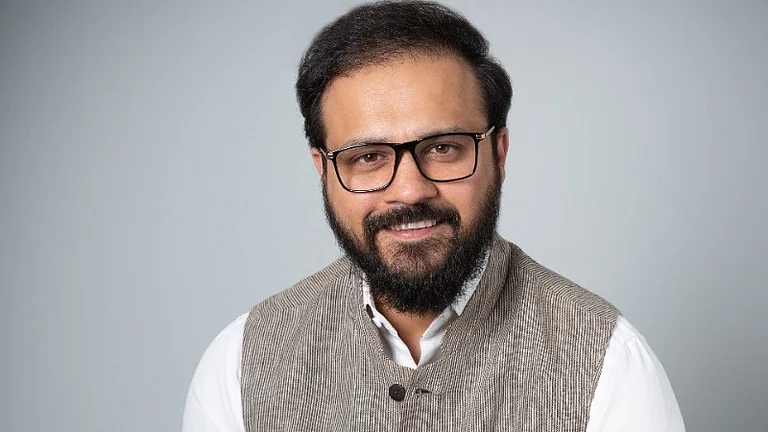

“Shilangi Mukherji (Director and Head, SVOD Business), Gaurav Bhasin (Head of Marketplace, Add-on Subscriptions and Movie Rentals), Sonal Kabi (Director and Head, Marketing), Nikhil Madhok (Director and Head, Original Content), Manish Menghani (Director and Head, Content Licensing), and Stuti Ramachandra (Director and Head of Productions & Post – International Originals), lead the India business, all reporting to Gaurav Gandhi, Vice President for APAC and MENA, alongside regional leaders from SEA, MENA and JP. Most of these business heads have been with the company for close to half a decade, providing continuity and deep institutional knowledge to the organisation.”

The deleted hiring post said the new country director would accelerate adoption of Prime Video’s offerings and join the platform’s Asia Pacific, Middle East & North Africa leadership team, reporting to the regional Prime Video vice president.

Responsibilities include customer acquisition, revenue, profitability and key performance metrics across both subscription video-on-demand (SVOD) and transactional video-on-demand (TVOD) services. The role also entails close collaboration with Amazon MGM Studios on local originals and cross-functional teams – including technology, distribution, advertising and retail – to deliver integrated outcomes.

In 2024, Prime Video India announced nearly 70 series and movies across languages and genres, with most scheduled to premiere over the next two years. More than a quarter of the audience for Indian titles comes from outside India.

“Prime Video maintains strong growth momentum in India and continues to be a front-runner across international locales in new customer adoption and Prime member engagement, while receiving viewership from 99% of the country’s pin codes,” the spokesperson added. “We’re excited about the future of Prime Video in India, as we continue to build a service that’s local at heart and global in ambition.”

According to PwC India, India’s OTT market grew 20.9% in 2023 to reach ₹17,496 crore ($2.1 billion) and is forecast to double by 2028 at a compound annual growth rate of 14.9%, the highest among the top 15 countries.

In February 2025, Reliance Industries’ Viacom18 and Disney merged JioCinema with Disney+ Hotstar into a single joint venture valued as part of an $8.5 billion consolidation of Indian media assets. Reliance holds a 63.16% stake, with Disney retaining 36.84%. At launch, JioHotstar boasted over 280 million users in India, leveraging exclusive sports rights and a vast local catalogue.

As of early 2025, Disney+ Hotstar commanded roughly 26% of India’s paid subscription market with 35.9 million subscribers, ahead of Amazon Prime Video and Netflix. In the Hindi movies segment, Hotstar led with 30% market share, followed by Prime Video at 25% and Netflix at 15%. Prime Video reaches an estimated 65.9 million Indian viewers – its second-largest market globally – while Netflix’s Indian subscriber base stood at about 12.4 million.