Union Budget, Markets Today: A big cheer for consumption stocks came-in as FM Nirmala Sitharaman proposed new personal income tax slabs in the Union Budget. Nifty FMCG, which has remained in the red territory for the better part of last year, skyrocketed by over 2,000 points or nearly 3% during the budget day.

Major FMCG giants, including Hindustan Unilever (HUL), Nestle India and ITC, witnessed a sharp rise in their share prices and became the top performing stocks from the Sensex pack.

At 12:40 pm, the Nifty FMCG index was up by 2.77% or 1,567 points and was trading at 58,259 level.

Shares of the food delivery platform Zomato also surged by nearly 6% and became the best performing stock from the Sensex pack. Rival company, Swiggy's stock also climbed by nearly 7% on both the bourses.

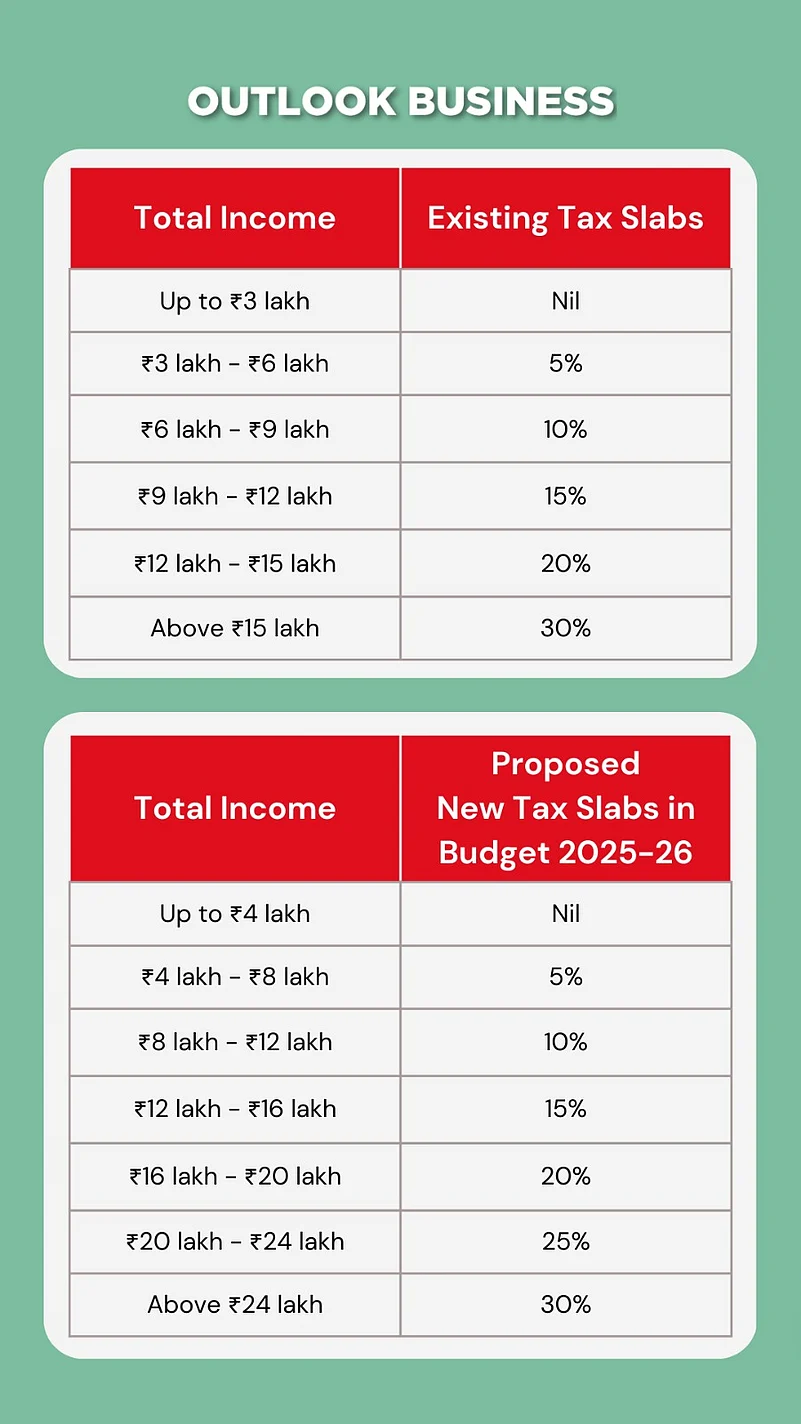

This optimism was largely driven by a favourable change in the tax structure. In a major relief for the middle class, the budget introduced a nil tax slab for income up to Rs 12 lakh. Earlier this limit was set at Rs 7 Lakh.

"The budget through tax rate rationalisation has provided tax savings in the range of Rs 70,000 to Rs 1.1 lac to 8 crore income tax return filers which are mostly middle class," said Bhavik Thakkar CEO of Abans Investment Managers Pvt Ltd.

This is being viewed as a euphoric factor for the middle class, as it could boost their spending power, which is much needed right now.

Demand Revival in-sight?

As evident in the recent quarter earnings of India Inc., demand has been slowing down. The recent change in tax structure could bring the much-needed revival the corporate space is hoping for.

Lower sales volumes coupled with higher input costs owing to complicated geopolitical picture, has also weighed heavily on the margins of major FMCG giants. Amidst this complicated picture, the recent tax relief will help industry players to tackle out the challenging environment, as demand will get a boost owing to the surge in disposable income.

"A lower tax rate is expected to boost revenue as an increase in the Sec 80C investment limit would raise disposable income. This would directly benefit FMCG companies like HUL, ITC, Dabur, and Nestle, with indirect gains for their suppliers such as Polyplex and Uflex," said T Manish, Research Analyst, Samco Securities.

Besides giving a much-needed boost to demand levels, the new tax slabs could help FMCG companies see healthier earnings in the quarters ahead.