In his 26-year-long illustrious stint, at the helm of the country’s premier private sector bank, Aditya Puri won innumerable accolades. They came not just from India, but from across the world. The Economist in its November 2020 edition acknowledged Puri as the “world’s best banker” for “creating something from nothing and delivering long-term shareholder return while supporting the economy”.

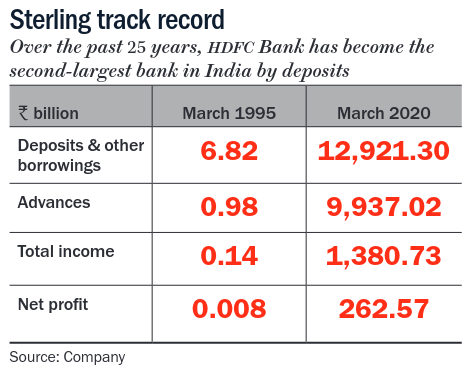

HDFC Bank was incorporated in 1994 under a strategic alliance between HDFC and the UK-based NatWest Markets. In March 1995, it went public raising Rs.50 million, through an at-par IPO, which was oversubscribed 55x. The ‘something from nothing’ remark can be gauged from this one statistic — since May 1995, the stock has delivered a whopping 33.64% CAGR. Simply put, Rs.10,000 invested then, would be Rs.14.1 million today. Not to mention the Rs.457,950 worth of dividends. At its listing price of Rs.40 in 1995, on equity of 2 billion shares, the bank was worth Rs.8 billion. Today, it is worth Rs.7.91 trillion! The bank has the highest weightage in the Nifty 50, at 11.21%.

Just as it seemed to be reaching another pinnacle, the bank began being weighed down. First, there were market whispers when the outgoing CEO cashed out his entire holding. Then, the market began getting antsy about top-level executives resigning in significant numbers and, finally, the RBI came down hard on HDFC Bank, when the latter’s digital services stalled a few times. And, all of this was happening against the backdrop of the pandemic, which has given rise to concerns over the possibility of retail loans turning bad.

It is a difficult time for a new CEO to take charge. But Puri has handed over the reins to Sashidhar Jagdishan, who was heading the HR and finance functions at the bank. The new chief is not unfamiliar to the investment community, and he is well-liked and is known to get things done. Sounds good. But, are these enough to carry forward the intimidating legacy of Puri (See: Sterling track record)?

Will Jagdishan create one of his own?

The simmering cauldron

For the compounding machine that Puri had created, it was surprising to see the outgoing CEO cashing out of his holdings. Of the 7.796 million shares (0.14%) he held in the bank, Puri sold 7.42 million shares between July 21 and July 24 and his recently vested options on October 21 and November 3. However, Puri played it down in a media interview stating that it was part of an asset allocation advice given by his colleagues that he should diversify a bit. “I was actually thinking too much about the bank,” he said. Interestingly, Jagdishan was one of the advisors behind the sale. He told analysts in the August 3 concall: “For a person who is reaching 70 years of age, we needed to advise him on lessening the proportion of equity... that is why the balance 30% he is going to de-risk and put it in lesser riskier financial assets.”

As per details of the ESOP scheme, shared by the bank with the US SEC, when an employee including a director to whom the options are granted retires, the employee concerned has to exercise the options within six months from the date of retirement, failing which the options would lapse. Part of the selling was attributed to the requirement for funds for the ESOPs. Jagdishan told analysts over the call, “When retirement happens, there is the scheme under which a lot of options would vest at the time of retirement. So, you need to provide a fair amount of liquidity for this. In Mr Puri’s case, this was going to be a substantial amount of liquidity, which needed to be there to exercise these options.” The HDFC Bank management did not respond to queries from Outlook Business. Putting the sale into context, Suresh Ganapathy, analyst at Macquarie Capital Securities explains the sale is not like cutting the umbilical cord. “70% of that money is going to come back into the bank. As per the terms and conditions of employment, whenever the CEO retires his options vest immediately. When the options vest immediately, you need a massive sum of money to buy those options. So for that 70% of the money is going to come back, depending on the schedule.”

Putting the sale into context, Suresh Ganapathy, analyst at Macquarie Capital Securities explains the sale is not like cutting the umbilical cord. “70% of that money is going to come back into the bank. As per the terms and conditions of employment, whenever the CEO retires his options vest immediately. When the options vest immediately, you need a massive sum of money to buy those options. So for that 70% of the money is going to come back, depending on the schedule.”

Even as the management played down the sale, Puri, in his parting mail to the bank employees in August, wrote: “our best is yet to come... Suffice to say that in him [Jagdishan] you have the best person to lead and I have the worthiest person to hand over the baton to.” Jagdishan had joined the bank in 1996 as manager-finance and went on to become the chief financial officer in 2008. In 2019, Srinivasan Vaidyanathan took over as the CFO, while Jagdishan was promoted as additional director and head of finance and HR.

In the run-up to the succession, however, the bank saw an exodus of several old hands, prominent among them was Paresh Sukthankar, the deputy managing director who was seen as a likely successor. In fact, a report by Ambit Capital highlighted the talent drain: since 2017, the bank had seen 18 senior-level exits. This included group heads — Munish Mittal (IT), Ashok Khanna (auto loans), Abhay Aima (private banking), Nitin Chugh (digital banking), Rajesh Kumar Rathanchand (retail credit and risk) — all of whom had spent anywhere between 18 and 25 years in the bank. In the Q1FY21 earnings call, Puri tried to assuage concerns by stating that while Mittal had left for further studies to Oxford, Aima wanted to pursue a different path. “We have a clearly defined succession plan,” said Puri.The Street, too, is keeping its faith in the bank. Raamdeo Agrawal of Motilal Oswal Financial Services (MOFS) believes the next HDFC Bank can only be HDFC Bank given it is fairly institutionalised. “There is discipline, processes… it’s not a one-person dependent bank.” Even though the name of the successor was revealed only early this year, for analysts, the name was quite evident. Nitin Aggarwal, analyst at Motilal Oswal Securities, says: “For more than a year now, Sashi used to lead the calls, he would call out names of group heads to answer some questions…it was clear to us that Sashi was being groomed to take over.” Ganapathy adds, “He is an excellent taskmaster with great execution ability. He is not brash but a people’s guy and gels with a lot of people very well… more amenable and that’s a positive thing.”

Puri, in his parting email, sought the same love and affection that he was showered with for Sashi. But, it was not to be.

Welcome punch!

Jagdishan began his innings with an apology to the bank’s customers. The banking regulator had pulled up HDFC Bank, in a first such stricture, for a snag that disrupted the latter’s digital services. Incidentally, Shyamala Gopinath, former deputy governor of the RBI, is the chairperson of the bank, and also a member of the bank’s IT strategy committee.

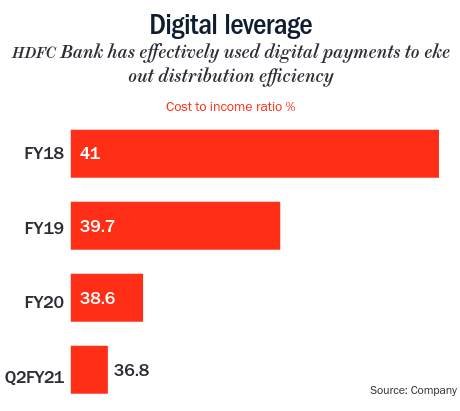

While HDFC Bank is the second-largest bank in India by deposits, it leads in terms of digital transactions processed. In FY20, about 95% of the bank’s retail transactions were conducted digitally, up from about 85% in FY18. How critical digital has been for the bank in gaining distribution efficiency can be gauged by the fact that over the past decade, the cost-to-income ratio has improved by 900 basis points to 36.8% (Q2FY21) as against 43.48% for ICICI Bank and 59.44% for Kotak Bank (See: Digital leverage). But, in the process, it appears that the bank has struggled in building adequate capabilities to strengthen its digital footprint.

While HDFC Bank is the second-largest bank in India by deposits, it leads in terms of digital transactions processed. In FY20, about 95% of the bank’s retail transactions were conducted digitally, up from about 85% in FY18. How critical digital has been for the bank in gaining distribution efficiency can be gauged by the fact that over the past decade, the cost-to-income ratio has improved by 900 basis points to 36.8% (Q2FY21) as against 43.48% for ICICI Bank and 59.44% for Kotak Bank (See: Digital leverage). But, in the process, it appears that the bank has struggled in building adequate capabilities to strengthen its digital footprint.

The regulator has barred the bank from launching its Digital 2.0 initiative, under which the bank is trying to bring all customers’ digital transactions, including payments, savings, investments, shopping, trade, insurance and advisory services, onto one platform. The RBI has also barred the bank from sourcing new credit card customers and any revenue accruing digital initiatives. HDFC Bank was looking to migrate the origination of two- and four-wheeler loans to the digital platform, and since these loans account for 18% of its retail portfolio, a delay will impact growth.

Yet, analysts don’t seem too worried about the turn of events. Santanu Chakrabarti of Edelweiss Securities believes the incident is not a reflection on the bank’s new leadership but the fact that their IT systems were old. But, the clampdown of sourcing new business is what analysts feel is a bit harsh, considering that technical glitches have been a way of life for customers. “The problem is not just about HDFC Bank, we have several instances where ATMs of several public sector banks are out of order for days. So, while the intent of the regulator is right, the punishment is severe,” feels Aggarwal.

Rating agency Moody’s believes the episode could result in an increase in spending to improve the bank’s digital infrastructure, which would strain its profitability. However, analysts feel the move is a blessing in disguise for the bank. “It also puts HDFC’s tech plan on a non-discretionary accelerated time frame. If the bank uses this opportunity to go ahead with all its near-term planned fixes and not just restrict itself to merely the regulator’s mandate, it could, on balance, gain from this incident,” mentions Chakrabarti in his report.

While Motilal Oswal’s Aggarwal says growth will be impacted for a quarter or two, structurally nothing changes for the bank. “Once they plug the gap and the RBI does a digital audit, growth will be back on track.” Agrawal, too, believes the bank will overcome the challenge. “It could be that RBI wants to send an earnest message to the entire banking sector to take digital disruption seriously. But in digital, you do not know how soon and how fast you will grow, so you need that extra buffer… my sense is that it’s a surmountable problem. I would have been worried only if the earlier leadership had left behind a bad book.”

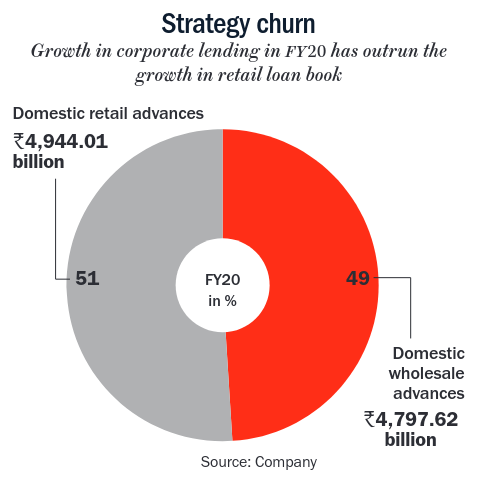

While over business cycles the bank has never seen NPAs go beyond 2%, a section of the market feels things could be different. Even as FY20 saw overall credit growth at an over five-decade low of 6.14%, the bank outgrew the industry at 21% (See: Strategy churn). Its better performance was largely led by corporate banking (29% year-on-year growth), while retail loan growth was soft at 15%. A report by Bernstein in March raised a red flag over the bank having the highest exposure to unsecured retail credit compared with ICICI Bank and Axis Bank (9% of loan mix). “While Axis Bank and ICICI Bank have also changed their growth strategy towards unsecured consumer segments, they have a much smaller book and, thus, their growth has been recent and off a lower base,” the brokerage stated. Bernstein points out that since the bank is a consumer finance market leader, it has greater sensitivity to its bottom line with 24% earnings and 36% earnings growth coming from unsecured loans.

While over business cycles the bank has never seen NPAs go beyond 2%, a section of the market feels things could be different. Even as FY20 saw overall credit growth at an over five-decade low of 6.14%, the bank outgrew the industry at 21% (See: Strategy churn). Its better performance was largely led by corporate banking (29% year-on-year growth), while retail loan growth was soft at 15%. A report by Bernstein in March raised a red flag over the bank having the highest exposure to unsecured retail credit compared with ICICI Bank and Axis Bank (9% of loan mix). “While Axis Bank and ICICI Bank have also changed their growth strategy towards unsecured consumer segments, they have a much smaller book and, thus, their growth has been recent and off a lower base,” the brokerage stated. Bernstein points out that since the bank is a consumer finance market leader, it has greater sensitivity to its bottom line with 24% earnings and 36% earnings growth coming from unsecured loans.

What’s in the book?

Though the pandemic has raised questions over the impact on unsecured loans, HDFC Bank seems to be sitting pretty for now. Of its total unsecured portfolio of 16%, 6% comprises cards and 10% is personal loans. However, 75% of the personal loans are to salaried employees of A-rated top-tier clients. “HDFC Bank always said they cater to the top 20-25% customers in various markets that they operate… they are not going to cater to a customer that a Bajaj Finance caters to. They really cater to crème-de-la-creme customers, who clearly are far more resilient,” says Ganapathy.

Similarly, in the case of wholesale lending, 80% is to AA and above clients, while 80% of the small and medium enterprises are covered by additional collateral. In fact, Q2 has seen a greater drawdown by highly rated entities and an increased demand for working capital. In wholesale SME, the bank added 1,550 new customers in Q2FY21, which is 3x of the first quarter.

As of Q2FY21, the advances book stood at Rs.10,383 billion, of which 47% was from retail advances ( Rs.4,850 billion) and 53% was from wholesale ( Rs.5,534 billion). Kotak Institutional Equities believes, as the loan book shifts towards a less aggressive portfolio (mostly state-owned entities), margin contraction may be inevitable.

In the earnings call, the management mentioned that the weighted average rating of the book — on an internal scale that ranges from 1-10, with 1 being highest-rated corporates and 7 corresponding to an external ‘A’ rating — is currently at 4.4. Post demonetisation, the bank has been showing higher-than-usual corporate book growth, as it utilised the excess liquidity and the low cost of funds environment in building the corporate book. “In fact, much before COVID, the bank had already started going slow in retail, especially auto loans,” says Aggarwal.

Even in a worst fiscal like the current one, the bank has continued to stay conservative. The bank has made contingent provisions of Rs.23.04 billion, including Rs.11.3 billion for specific accounts and Rs.11.73 billion to strengthen the balance sheet in Q2FY21. While the Supreme Court has passed an interim order stating that those accounts that had not been declared NPA till August 31, 2020 should not be declared as bad loans until further orders, and the bank has complied with the orders, it has used analytical models to estimate potential NPA on a pro-forma basis. A pro-forma financial statement is based on certain assumptions and projections and not actual numbers. As of Q2FY21, the bank’s gross NPA (pro-forma) stands at 1.37%. “It takes guts for a fellow taking over to do it,” Puri told analysts during the Q2FY21 earnings call. The bank’s collection efficiency on the non-moratorium book stood at 99%, while on the moratorium book stood at 95%.

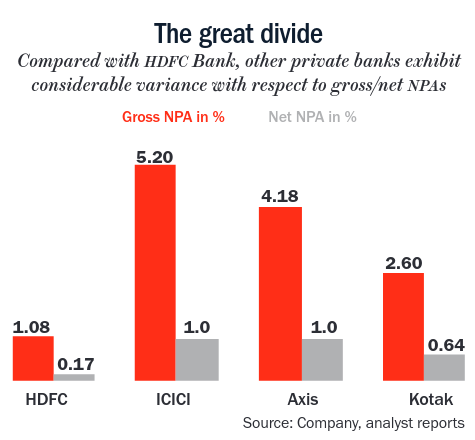

In fact, among private banks, HDFC does not have a NPA (gross/net) variance (1.08%/0.17%) to the extent that ICICI, Axis and Kotak have at (5.2%/1.0%), (4.18%/1.0%) and (2.6%/0.64%), respectively (See: The great divide). Avinash Tanawade of Dalal & Broacha mentions in his report that the bank’s loan book quality across segments is significantly stronger than the rest of the industry, which should hold it in comparatively better stead. Even if the NPA numbers turn out to be higher, analysts believe the bank is much better placed than its peers. “Uncertain times put a premium on resilience, which is what HDFC Bank offers — a strong balance sheet and likely higher residual capital than most,” mentions Chakrabarti of Edelweiss.

In fact, among private banks, HDFC does not have a NPA (gross/net) variance (1.08%/0.17%) to the extent that ICICI, Axis and Kotak have at (5.2%/1.0%), (4.18%/1.0%) and (2.6%/0.64%), respectively (See: The great divide). Avinash Tanawade of Dalal & Broacha mentions in his report that the bank’s loan book quality across segments is significantly stronger than the rest of the industry, which should hold it in comparatively better stead. Even if the NPA numbers turn out to be higher, analysts believe the bank is much better placed than its peers. “Uncertain times put a premium on resilience, which is what HDFC Bank offers — a strong balance sheet and likely higher residual capital than most,” mentions Chakrabarti of Edelweiss.

In fact, Ganapathy believes the competitive landscape by far is the best-ever for HDFC Bank. “You have extremely weak public sector banks, only a handful of private banks, the old private sector banks are dying; we have NBFCs failing. So, why not take it this way that it’s the best time for the CEO to do even better?”

The bank has also been gaining on the liabilities side, aided by the flight-to-safety sentiment, especially from PSUs and corporates. In Q2FY21, total deposits increased 20.3% ( Rs.2.08 trillion) year-on-year to Rs.12.29 trillion, of which current account comprises Rs.7.1 trillion and savings accounts Rs.3.4 trillion. Siji Philip, analyst, Axis Securities, points out the competitive environment remains weak due to COVID-19, which will ensure that the bank continues to gain market share. “Recent episodes with Yes Bank and PMC Bank further imply that savers are more comfortable choosing larger banks such as HDFC,” she says. The focus on strong deposits franchise has resulted in healthy liquidity coverage ratio at 153%, well above the regulatory requirement. Though the excess liquidity has impacted net interest margin by 15 basis points, analysts believe with higher capital adequacy and strong provisioning buffer, the bank is in a better position to withstand any upcoming economic upheavals.

The bank has disbursed a quarter of new credit in India since 2017. Going ahead, the bank is only looking at a higher pie. In December 2019, Puri stated that, globally, top three banks get 80% of the business. “Our aim is to be the number one bank in your wallet, but as long as we are in the top three banks for you, we will get enough business,” said Puri.

But the big difference is that unlike in the past, the bank will have to battle the growing clout of fintech firms.

Competitive landscape

HDFC Bank is a market leader in payments and has plans to further double its merchant reach. It has reached one million touch points since demonetisation and plans to touch four million by FY21. Through digital mode, the bank has already acquired 6.5 million new customers. Though the competitive intensity from fintech firms is rising, Ganapathy believes the bank is in a different league altogether.

“Fintechs are just disintermediating the payment business, which anyway doesn’t make any money. Look at Paytm’s P&L,” explains Ganapathy. Further, the analyst believes that though fintechs will grow, they will still need to ally with banks. “If someone wants an auto loan, will they go to Paytm? If you want a housing loan over Rs.10 million, will any fintech give that? Google Pay has market share but I need a HDFC Bank account to have G Pay. Tomorrow, if Google Pay wants to cross-sell to customers when they are at 40% market share, to whom will they cross-sell? They will have to come to a bank,” opines Ganapathy.

Agrawal, too, believes that the bank is best positioned to make the most of the growth in the coming years. “As we go from a $3 trillion economy to $5 trillion, credit intensity will double. At present, the total credit is Rs.150 trillion for Rs.200 trillion GDP, that is a credit-to-GDP ratio of 75%. Be assured that it will minimum go to 100% if not 150% for the next $2 trillion. Over the next six years, you will have to write Rs.150 trillion of credit, and there are only five players who can do it: SBI, HDFC Bank, ICICI Bank, Axis Bank and Kotak Bank.”

Going ahead though Ganapathy believes the immediate challenge for Jagdishan will be to build scale as the bank is already on a very high market share. “Building scale is everything. HDFC Bank was taken from a market share of 1% to 10% by Puri, but from 10% to 20%, it’s going to be a more difficult task,” he says.

Thus far the bank’s growth has largely been organic, barring the merger with Times Bank in 2000 and acquisition of Centurion Bank in 2008. So, would an acquisition get it heft? Ganapathy believes otherwise. “To begin with, there is no large player available in the market and anyway they are gaining 1-2% market share every year.”

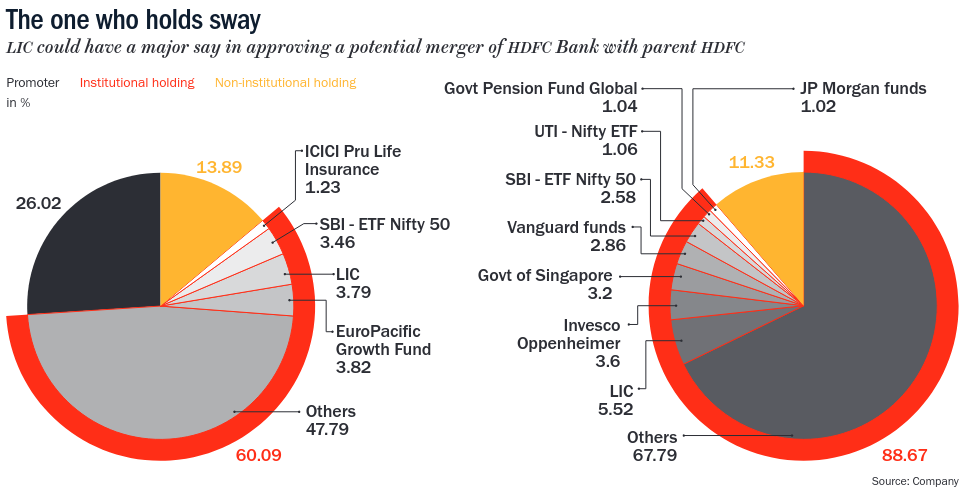

However, the possibility of a merger — with its own parent — could prove to be a rather challenging one for Jagdishan. Every once in a while, talks about a potential merger of HDFC Bank with HDFC comes up because of the vulnerable position non-banks find themselves in due to lack of access to low-cost deposits. Aggarwal believes the merger will depend on swap ratios and how investors perceive the impact on financials. Currently, while FII holding is scattered, LIC holds 3.79% in the bank and 5.52% in the parent (See: The one who holds sway). “A larger share of mortgage will mean lower RoA, but higher RoE as housing gets the benefit of lower risk rate. Any such transaction will raise caution levels and will put pressure on the stock price of both,” feels Aggarwal.

If a merger goes through, the new entity will have to set aside higher reserves applicable for banks for the whole entity, something HDFC does not have to as a non-bank. Ganapathy feels a merger can happen only if there is a statutory relaxation. “Otherwise, it will be debilitating on the profitability, for both the institutions and negative for shareholders,” he says. Seconds Agrawal, “A lot depends on the regulator’s approach. You either create a condition for voluntary conversion or there is a regulatory push... samay batayega kya hoga.”

Not only with respect to a merger with its parent, but in all respects how Jagdishan plays his cards will be vital. “Mr Puri was two steps ahead of everyone on the latest trend, is Jagdishan like Puri in having the vision? I don’t know. You have to give him at least five years to take a call on his ability to deliver,” says Ganapathy. And the delivery that is expected is no easy ask — Puri got 26 years but Jagdishan’s time starts now.