When Swedish nationals Nami Zarringhalam and Alan Mamedi founded Truecaller in 2009, they didn’t have India on their radar, not even remotely. They had built the caller-id app for personal use, to screen calls from angry companies who wanted reviews on their workplaces taken down from a website founded by Zarringhalam and Mamedi. That site was called Jobbigt, meaning troublesome, it was later sold for $20,000, and the money was used to buy equipment to test Truecaller.

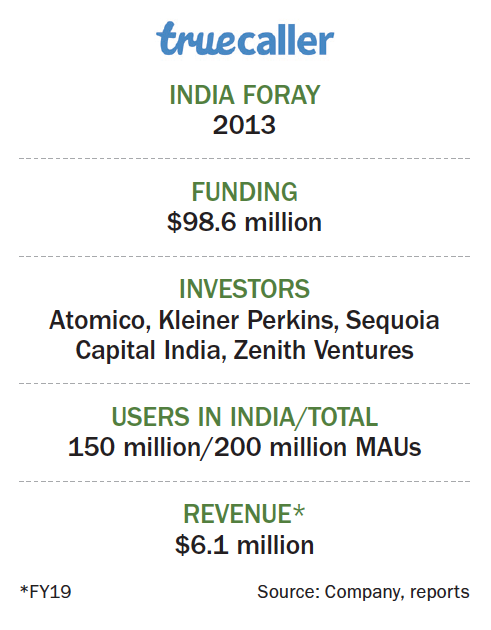

The call-screening app was an instant hit, when it was shared on an internet forum. Downloads had touched 10,000. Over days and months, it crossed hundreds of thousands, and today it has 200 million monthly active users (MAUs)! The icing on the cake — the company has not spent a single dollar on customer acquisition. The success caught them by surprise, but what really changed the course of their lives was the popularity of the app in India.

More than 75% of the app’s users are in this country, which the two had never visited till 2013, the year Sequoia India brought the founders’ attention to the potential in this market. The firm even led an $18.8 million round of funding for Truecaller, which had till then faced rejections from over 15 venture capitalists. Today, the app has raised close to $100 million from several investors including Atomico, Kleiner Perkins and Zenith Ventures.

Talking to Outlook Business from the Stockholm headquarters, co-founder and chairman Zarringhalam says, “India found us. It is our home market”. Truecaller is the third-most downloaded app here, after Google and Facebook.

In 2018, India was the top spam call and message-receiving country in the world with the average spam call per user at 22.6/month, with the USA second at 20.7. Today, India has dropped to fifth on the list, but that’s not because the number of spam calls has dropped, in fact it has increased to 25.6. The ranking changed because the numbers have worsened in other countries — Brazil now ranks first with 45.6, which is also a growth market for the company with over 300,000 MAUs.

Big India play

It is definitely a huge opportunity but Truecaller isn’t sitting pretty. It’s working hard to make the most of it. For one, it has increased its presence in its biggest market. Their team is distributed across Stockholm, Bengaluru, Delhi and Mumbai. ”We have more people in India (125) than in Stockholm (100),” says Zarringhalam. Then, it is tying up with the developer community to further improve ease of use and add features that will appeal to this geography. Truecaller now comes in 30 Indian languages with transliteration facility.

Currently, through the app, a user can sign-in into apps from multiple developers. For example, you can log into Oyo or Gaana, using your Truecaller username and password. The tie-up also helps Truecaller be part of a “collaborative network” with developers, so that any new feature added into the call-screening app can be bridged more easily with the popular apps. That is, if you are friends with the cool kids, then anything you do can find a wider reach.

Truecaller has also ventured into WhatsApp’s stronghold — messaging. It has built a feature only for India, through which Truecaller becomes the default SMS app. It then segregates messages into personal, business/others and spam. It also issues notifications, which show users important information from the SMS in a simpler and actionable way with a ‘pay now’ option for regular bills such as mobile, electricity, DTH and more. Ankur Pahwa, partner and national leader – e-commerce and consumer internet, EY India believes Truecaller has become much more than just a spam-detection app. “It has the first-mover advantage with a massive user base. With a host of ancillary services, it will continue to attract users,” he adds.

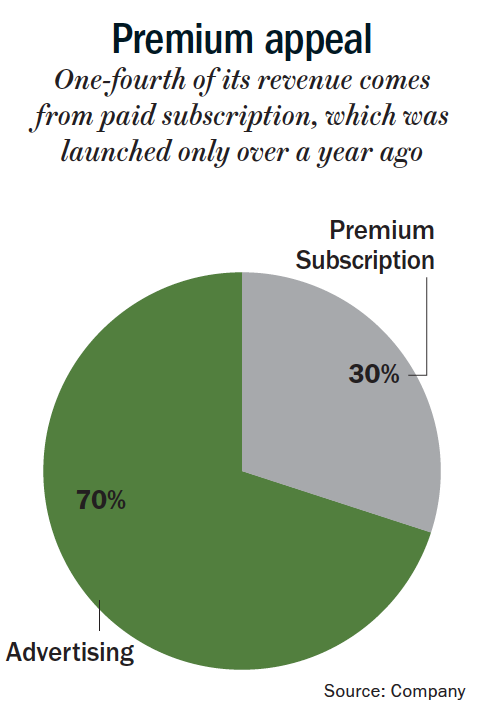

The app has managed to make the right friends and appeal to Indian weaknesses, but is it making money yet? 2020 is going to be the first profitable year for them, with last year’s revenue standing at $6 million. Truecaller had promised its users it would never monetise its core service — caller ID and blocking. So, other ways of making money had to be found. Its largest revenue stream right now, which earns 70% of its income, is advertising. There is a captive audience for targeted messaging but Truecaller has another edge, which Zarringhalam terms “non-appointment viewing”.

Appointment viewing is when people set aside time to watch a TV programme. In the pre-Netflix age, these slots got channels most of their ad revenues. But Truecaller needs no such hook, because they can place their ads on the phone screen around every call that comes from unknown numbers. This, they say, happens six to seven times a day. “This is our most premium inventory,” says Zarringhalam. When the monetisation of the app started in 2015, the advertising gave them 95% of their revenue. Today, that share has fallen and the revenue share of its paid subscription service — Truecaller Premium — has gone up to 30% (See: Premium appeal).

Appointment viewing is when people set aside time to watch a TV programme. In the pre-Netflix age, these slots got channels most of their ad revenues. But Truecaller needs no such hook, because they can place their ads on the phone screen around every call that comes from unknown numbers. This, they say, happens six to seven times a day. “This is our most premium inventory,” says Zarringhalam. When the monetisation of the app started in 2015, the advertising gave them 95% of their revenue. Today, that share has fallen and the revenue share of its paid subscription service — Truecaller Premium — has gone up to 30% (See: Premium appeal).

The premium service was launched a year and a half back. The app charges #75 monthly or #44/month paid yearly, which gives users an ad-free experience, the option to request details of more than 30 contacts per month and the ‘who viewed your profile’ feature among others. The company claims to have a million paying users for this, which will reflect in their FY20 revenue. Zarringhalam is expecting that number to double in the coming year. They also recently started Truecaller Gold, priced at #999 per year.

Meanwhile, Google is planning to introduce a spam-screening solution. But Zarringhalam is undeterred. “It is tough for other companies to match our scale and accuracy. Our spam algorithm and our community that helps report and tag calls and SMS are unique. It is not something that can be easily replicated,” he says. Moreover, the company is also banking on its decade-long experience in the space to protect its market share. Pahwa agrees. He says Truecaller has become the de-facto digital telephone directory for millions of Indian users. “It has an enviable reach, which few others in the arena have. The app is used by a large number of SMEs as well, which the company seems to be targeting through in-chat financial features,” he explains.

Fintech pie

Even as it prepares for impending competition, the caller-id app is testing its fintech product Truecaller Credit. Through the first, you can transfer money and pay your bills. Yes, like Paytm and Google Pay. Through the second, it will extend small loans between #10,000 and #500,000 at market rates. For example, if a person receives an electricity bill that he or she cannot pay at the moment, with a click of a button, he can apply for credit. It is processed within minutes. To check creditworthiness, Truecaller relies on a partner, who will look at the past transactions, messages of bounced payments and invoices of customers. With these, Truecaller will be competing with established players and start-ups such as Lendingkart, ZestMoney and NeoGrowth.

Zarringhalam seems far from daunted and despite the hit that retail credit may suffer due to the COVID-19 pandemic, the company is going ahead with its plans. “When we launched a dialer and messaging product in 2015, not only were we competing with messaging apps, but also with OEMs’ own products. I can argue that was a much bigger challenge because these companies had distribution from day zero while we had to acquire customers,” he says. That SMS product is now five years old and Truecaller has half the market in India. Zarringhalam believes with a strong NBFC partner underwriting the loans, their fintech services can have a meaningful market share over five years. However, Sanchit Vir Gogia, founder, Greyhound Research, isn’t too optimistic. “What works for them is that the app is already on a user’s smartphone,” he says. But lending products are heavily based on user trust. “Truecaller, sadly, is still not beyond suspicion, even in the savvy user’s mind, when it comes to the safety of data and transactions,” he adds.

In 2018, there were reports of Truecaller allegedly creating UPI accounts of its users without their consent. It was later found to be a bug, which was fixed by the company. Then in 2019, a newspaper reported that private data, which was allegedly taken from the app’s database, was being sold on the Dark Web. The company claimed it wasn’t so and that customer data was safe. Gogia says, “What Truecaller is doing is not dramatically different from WhatsApp or Google. What may be arguable or worth contesting is the user education. Even amongst the more educated, they have to communicate better, in terms of how they aggregate data and what they do with data.” Zarringhalam admits that they are questioned almost every day. “It’s a misconception that Truecaller extracts contacts and uploads the database. Apple and Google do not allow such practices on their app stores. They pull out apps and that has not happened with Truecaller,” he says while accepting they still need to work hard on their communication.

To grow, Truecaller will keep offering every possible service on its platform. It would want to be a super app, like WeChat in China but it has to remember that WeChat didn’t click in India, because WhatsApp is wildly popular. “I don’t feel India is still a market for super apps. It hasn’t been proven sufficiently,” says Gogia. Also, the concept of a super app was promising five years ago, when device storage space was limited and one could download only so many apps. So, it made sense to download one super app and avail multiple services from that. Now, that constraint has been lifted. But Zarringhalam says the efforts towards being a super app will continue, with other features being added over time. The company also plans to be IPO-ready by 2022, so it will help if the app has many monetisable wings.