The wise do not venture all their eggs in one basket, to paraphrase Sancho Panza, the realist sidekick to Don Quixote. It is this wisdom that has seen specialty-chemicals and pharmaceuticals manufacturer Aarti Industries through the highs and lows of the economy. The company supplies to a range of industries, from agrochemicals and oil refining to textiles and fast-moving consumer goods. It has invested more heavily in this strategy after the China story came under the cloud of environmental issues and there was heavy clampdown on the country’s manufacturing. Aarti Industries stepped up by investing aggressively in capacity expansion and diversified its product portfolio even further. “Doing that, over the past five to six years, has been a smart thing. During this phase, prices also went up and players such as Aarti benefited substantially,” says Archit Joshi, VP-research at Dolat Capital.

The numbers are proof of how Aarti Industries has progressed. At a consolidated level, its revenue rose from Rs.30 billion in FY16 to Rs.42 billion in FY20. Net profit, over the same period, went up from Rs.2.57 billion to Rs.5.36 billion.

While a large customer base will keep its topline growing, the company’s varied product portfolio will protect its bottomline, according to Vinod Nair, head of research at Geojit Financial Services. “Usually, the challenge is to sustain margins. This is where having value-added products helps even if there is a drop in volume,” he says.

Of course, COVID-19 has hit all companies hard, but Joshi says Aarti Industries will deliver high growth once the economy recovers. “In fact, there is clear visibility on growth for the next five years,” he adds. He believes that Indian chemical companies such as Aarti Industries will benefit from manufacturing shifting away from China. “The opportunity lies in high-quality processes and that augurs well for India,” says Joshi.

The chairman and managing director of the company, Rajendra Gogri, tells us why the next decade in India will be that of chemicals.

What is the size of opportunity for your key products in the domestic market?

We see three growth drivers. One is import substitution, the other is growth at the global level for chemicals and the third is customers looking to diversify their sourcing countries. The opportunity is there for the taking and it is left to us to see what we can make of it. We did about Rs.44 billion of revenue and can add Rs.100 billion over the next seven to eight years.

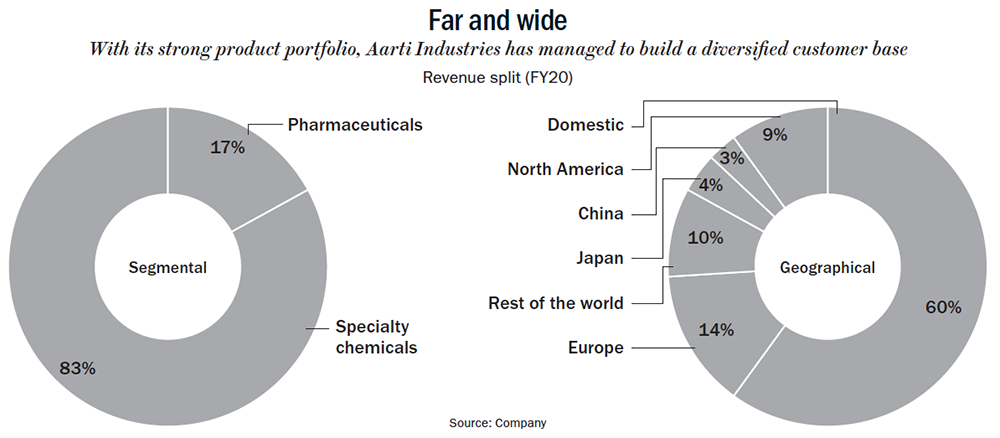

Our USP is that we have a diversified user base and strong customer relationships (See: Far and wide), especially with large MNCs. Also, the cost of manufacturing chemicals in India is around half of what it is globally. Therefore, India can become a good manufacturing destination for MNCs.

What growth are you expecting in your key end-user segments over the next couple of years?

We look at business in two parts — one that is linked to the economy and one that is not. For example, FMCG is economy-linked since people may be buying cheaper options while pharmaceuticals is economy-agnostic since people will always consume it. For the economy-linked sectors, I do not see any recovery for two years. The 2022 fiscal will be better than 2021 and normalcy should return at the beginning of 2023. Since 60% of our business revenue comes from economy-agnostic sectors, we have a good balance. Engineering polymers has had a steady 7-8% growth each year and there is also an expectation that certain parts of the herbicides business will grow. We are most optimistic about these two sectors. FY21 will be a year of flat growth, in terms of volume and profitability, but there should be some growth next year, on both parameters.

What is your growth strategy going forward?

It is to add newer product lines and get more business, maybe 70-75%, out of our existing customer base. Over time, we want the share of value-added products in the business to increase. Today, they bring in 74% of our revenue and basic products bring in the other 25%.

In new product lines, we will have downstream products in nitrochlorobenzene (used in the manufacture of drugs and agrochemicals) and chlorobenzene (used in the manufacture of agrochemicals and other industrial chemicals). We will also add a chain of chlorotoluene products, and for this, construction of the new plant will begin in FY22 and commencement of production in FY23.

Do you also plan to increase your reliance on long-term supply contracts?

Long-term contracts of at least three years duration account for 20-25% of our revenue. Customers have begun to prefer these because they want long-term supply security. In our business, there are a few large customers and a few large suppliers, therefore, the contracts are of large volume and there is customer stickiness.

One of the contracts we got into was similar to a manufacturing-outsourcing model, in which the customer provided us with the technology and money, and also picked up the products. The comfort they had was India being one of the lowest-cost markets for manufacturing specialty chemicals and yet high on quality. Another contract was about developing products along with the customer. They had the product developed through their R&D, and we had to scale it up. Besides, we had to optimize the process to make it commercially viable. In this, we put up the plant and exclusively supplied to them. The advantage in each of these approaches is that there is ready offtake for the product and minimum return is guaranteed.

There is the occasional hiccup. Recently, one backward integration deal was terminated because the customer decided to scrap the downstream project.

How big is the opportunity in toluene?

It can give us a topline of Rs.6 billion-8 billion over the next four to five years, and we have set up three dedicated plants in Jhagadia and Dahej (both in Gujarat). It can be a margin accretive business. It will service the same sectors, and this gives us a chance to offer more to the customer. The opportunity was downstream taking off globally and that convinced us. Of course, it also leads to higher visibility with the customer.

How are you countering demand compression in sectors such as auto and textiles?

The way out is to make more products for agro and pharma, where demand will exist. Or, we will need to move products to newer markets. The flat growth we spoke of earlier will not be possible if a higher proportion continues to come from sectors linked to the economy.

You have added huge capacity over the past four years. What utilization level are you operating at, right now?

In the case of nitrochlorobenzene, we are at 90% utilization. It is the same story with chlorobenzene. We are at 50-70% for nitrotoluene. We consider expansion only when capacities reach 85-90% utilization.

How are you placed in terms of leverage and cash position?

Our debt-equity is at around 0.7x. Operating on credit makes the working capital intensity quite high. Debtor days are typically 60-70. Cash was high last year because of the QIP. In general, it is at around Rs.2 billion. Credit cost at the domestic level has come down by around 1.5% and is at 7.5-8%. For the international market, it is down 0.75% and is now at 2-2.5%. The normal payback for recent and new projects is three to four years, and that has not really changed over time.

What kind of benefits do you see from the PLI (product-linked incentive) scheme? Do you intend to add any fresh capacities based on this?

Yes, we will be adding fresh capacity and that is at the design phase. With this scheme, the government is focusing on import substitution. PLI has been extended to pharma, of which some part will come for us, and the one for chemicals is said to be on the anvil. The increase in turnover could be to the tune of Rs.2.5 billion.

Is the exodus out of China permanent and the opportunity created for India, here to stay?

The environmental disruption in China affected both the volume and cost equation. In India, there is stricter implementation of environmental regulations but, in China, the stress was on volume. Therefore, the impact on the environment was significant. There were high levels of discharge into rivers and this should have been addressed earlier. Now, companies seem to be making a shift in strategy, by wanting to manufacture for China locally and for non-China markets outside China. This is a sweet spot for us.

For India, the next decade will be one of chemicals. We will see high domestic growth and import substitution along with exports, and chemical industry has low capex and opex. That said, this is not an easy industry to be in. You have to get it right on two key factors — environmental regulations and R&D.