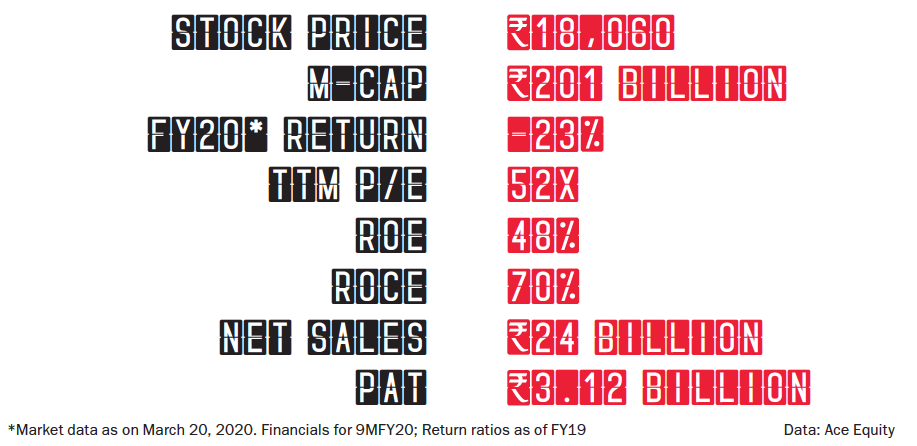

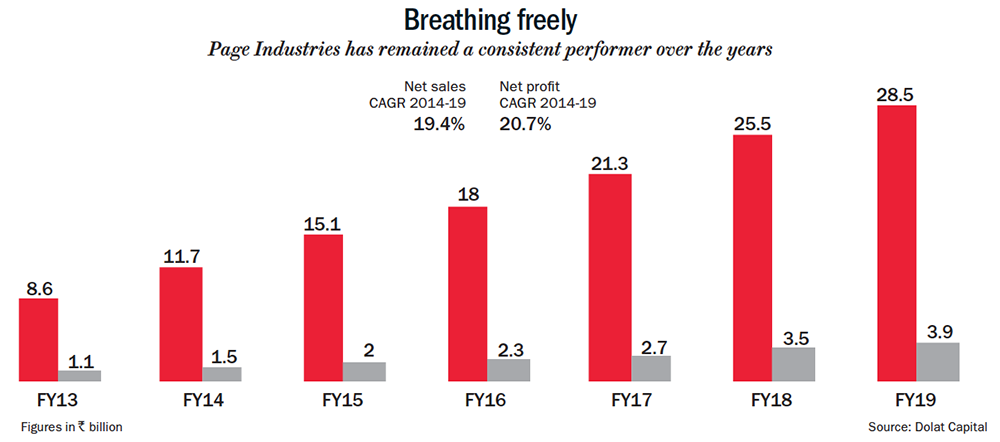

It fits like a song. The international brand that is known for comfort wear came to India in the mid ’90s and has since remained the first choice of innerwear for the aspirational youth. Sure, many came and went. The likes of VIP and Hanes have been a few competitors, but Jockey’s brand loyalty has only increased over time. With strong faith in its brand value, we believe Page Industries makes for a good bet, since it has had the exclusive rights to the brand in India since its entry in the market. In fact, the company has been reporting almost 35% CAGR growth over the past two decades. While its net sales grew at 19.4% CAGR from FY14-19, PAT grew at 20.7% CAGR (See: Breathing freely).

It fits like a song. The international brand that is known for comfort wear came to India in the mid ’90s and has since remained the first choice of innerwear for the aspirational youth. Sure, many came and went. The likes of VIP and Hanes have been a few competitors, but Jockey’s brand loyalty has only increased over time. With strong faith in its brand value, we believe Page Industries makes for a good bet, since it has had the exclusive rights to the brand in India since its entry in the market. In fact, the company has been reporting almost 35% CAGR growth over the past two decades. While its net sales grew at 19.4% CAGR from FY14-19, PAT grew at 20.7% CAGR (See: Breathing freely).

The promise of comfort

One cannot really miss the Jockey logo on a storefront in all its black and white glory. Distributed in more than 63,000 outlets across 2,800 cities in the country, the brand enjoys a monopoly in the premium innerwear segment. To stay with the times, this century-old brand also sells via most e-commerce platforms. Despite rising competition from brands such as Dollar, Lux, Van Heusen and Rupa, the management is confident of sustaining volume growth.

Strong recognition and high distribution are only a few factors that give Page Industries a pricing advantage over peers. To boost market share over the years, the company maintained advertising and promotion (A&P) spends at 4-5% and undertook calibrated price hikes. Even though minor price changes lead to major volume deviation in mass-category products, Jockey has proved an exception to this rule. The company has taken annual price hikes of 4-7% over a long period without having any impact on its volume. This goes to show that the brand has ‘stickiness’. One would hardly ever find discounts on Jockey products online as well. According to us, the brand strength is the ‘glue’. This has helped the company maintain its operating margin at 19-22% over FY08-FY19, which resulted in a similar growth in profitability.

We also expect the ongoing store additions and innovations to help the company sustain its growth rate over the next few years. It already boasts of more than 720 exclusive business outlets (EBOs) in over 250 cities, which contribute to nearly 10% of the company’s revenue. Out of these, 530 are located on high streets and 170 in malls. They are confident of increasing that number to 1,000 by FY22, which will further improve Jockey’s brand visibility. With the recent foray into kids wear and new launches in athleisure, cross selling in EBOs is expected to gain momentum.

Ladies, first

As with most trends these days, Page Industries’ Jockey is shifting its focus towards women. It has introduced new women’s wear products including the Miss Jockey Collection, which is aimed at teenage girls. During the past three years, contribution of Page’s dominant men’s segment has been gradually decreasing from 51% value in FY15 to 46% value in FY19. Volume has decreased from 61% to 54% over the same period.

While men’s segment grew at value and volume CAGR of 19% and 9%, respectively, that of the women’s wear grew at 27% and 17%. Seeing that athleisure is catching on in a big way with women, we expect that segment to continue to drive earnings. As of now, the brand dominates with 20% market share in premium men’s innerwear and 5% in women’s.

In a bid to diversify its portfolio and transform its men-centric brand image, Jockey also extended its foray in the kids’ category. Page Industries has emphasised that kidswear is another focus area, and losing no time, it has set up an independent team and realigned sales and marketing strategy for ‘Jockey Juniors’. With a view to strengthen its ground in the outerwear category, Jockey launched a new MOVE range for men and women.

This need to diversify and cover all its bases has come from growing competition in the premium space. From mass players such as Rupa, Lux and Dollar to sports and leisurewear names such as Puma, Benetton, Levi’s and others, many brands are vying for a share of the premium innerwear category. Van Heusen’s recent success in this space is surely on Page’s radar. But anecdotal evidence suggests that Jockey has always bounced back from similar phases in history. In the domestic market, the brand witnessed many turbulent phases where it had to compete with local and foreign brands.

The other challenge Page Industries has to face is an economic slowdown and sluggish consumer sentiment. For 9MFY20, the company’s revenue grew 7% YoY to Rs.24 billion, with volume growth of just 1% YoY. But the slowdown has hit companies across the board. Furthermore, after a year of average performance, we expect growth on a favourable base. Once the economy recovers, Page Industries’ volume will pick up and reach past levels.

Arsenal-ready

That has been reaffirmed through our interaction with multiple distributors. Page is ready with multiple new products, which can be launched any time. On ground, the sales team is focused on increasing the distribution and retail reach of kids wear, which can be a big lever in the coming decade. At an estimated FY21 P/E of 55.9x, its immediate valuation appears to be on the richer side, but it has long term potential to generate strong free cash flow along with a well-oiled inventory management and low requirement for incremental capex. Moreover, improvement in domestic demand will trigger significant growth in all the categories. With fundamentals in place and prospect of healthy volume growth, the company’s future prospects look snug.