Last year was unpredictable for sure but what has been equally surprising is the market hitting an all-time high. Jinesh Gopani, fund manager at Axis Mutual Fund, says that increase in home loans disbursal and fewer job cuts indicate that things did not turn out as bad as was expected. He tells Outlook Business how digitisation has mitigated the disaster that was COVID-19, and how the fund is betting on the innovation happening in venture investing.

Last year was unpredictable for sure but what has been equally surprising is the market hitting an all-time high. Jinesh Gopani, fund manager at Axis Mutual Fund, says that increase in home loans disbursal and fewer job cuts indicate that things did not turn out as bad as was expected. He tells Outlook Business how digitisation has mitigated the disaster that was COVID-19, and how the fund is betting on the innovation happening in venture investing.

What has been your strategy through the market volatility, when it cratered last year, and now as it has hit an all-time high recently?

Frankly, we had never anticipated the lockdown. The economic activity went down to zero. The initial period was spent understanding health issues and their impact on the economy. If you recall, even before the COVID-19 crisis, economic activity had been slowing down for two years; GDP growth had declined from 8.5% to 4.5% over that period. So, even before the pandemic struck, we had been investing only in opportunities that would see good growth irrespective of the economy. Fortunately, we were also sitting on a decent amount of cash, which was 7-10% on average across our funds.

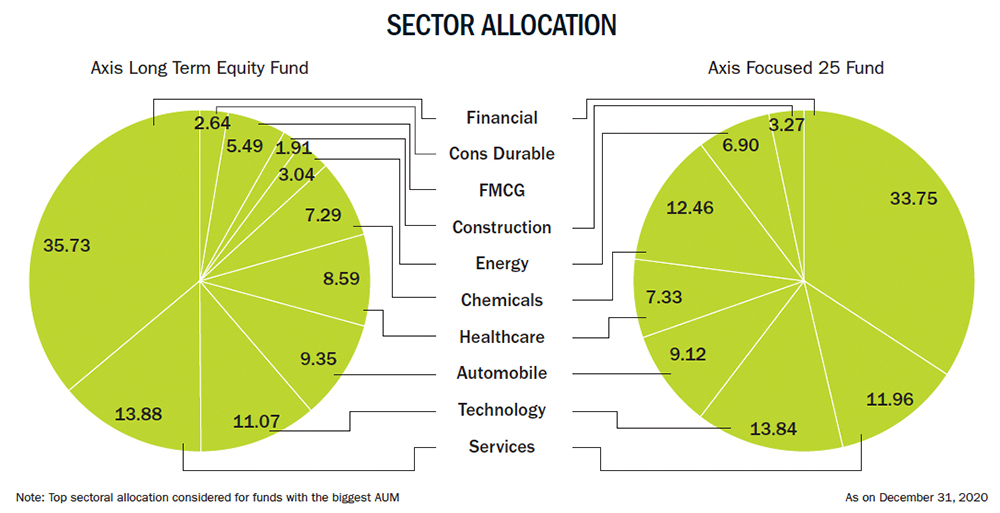

When the lockdown happened, the only thing we did was to see how balance sheets of our companies would be affected and move to those which had the resilience to withstand this difficult period. Ex-financials, most of our companies are debt free, so we handled that initial period well, when the market was down 35% during March. Since financials is a leveraged sector, we cut some of our positions and went into pharma. The next few months we were cautious and, by August-September, when we sensed that the recovery was good and the bounce-back was solid with the support of government spending, we loaded up again with some of the names that we felt were strong and could become winners going forward. Now in our portfolio, we again have companies from the financial and capital goods space, and so on.

Overall, although 2020 was unpredictable, our portfolio companies managed well. From the largest among them such as Reliance Industries to the smallest such as Phoenix Mills, they were able to raise capital. Overall, companies with strong balance sheets and good management have been able to navigate this cycle well. What has worked well this year is safety and consistency, rather than high beta. These are the things we captured in our portfolios as well.

Do you think the recovery we are seeing is for real?

When demand started to recover, people were saying that it was pent-up demand and that it will go down again. But, if you really look at it, it is demand recovering after three years because we were in slowdown even before COVID-19. We are surprised that even demand for home loans has gone up and that is a big-ticket item. This is because, in the organised segment, there have been virtually no job losses. When we looked at the Top 200 companies and spoke to the managements, everyone had hiked salaries, and none had laid off staff and they had just dealt with their regular attrition. In the IT and financial services sectors, and even in a company such as L&T, which employs 400,000 at any given point, things are back to pre-COVID levels. Perhaps, the fear of job losses has not come true. Plus, financials which is 40% of Nifty’s basket has recovered smartly.

One important point to note is that, while the organised sector has bounced back, the unorganised part of the economy is still struggling. There is clear shift in market-share from unorganised to organised across sectors. Even in real estate, even as housing momentum has picked, top builders are able to sell their property pretty fast whereas developers having one or two properties are struggling to make a comeback.

Going forward, unless we have a second or a third wave that is massive and the government declares a lockdown, we should be okay. But we have to be cautious as investors.

Why do you say financials have recovered smartly? Even after the moratorium period, banks have not reclassified their bad assets.

I am not saying everything is hunky dory. There are pockets of pressure. But the initial estimate after the lockdown was that the retail cycle will play out because there will be huge job losses in the organised segment, but that never happened. This has been reaffirmed by an increase in home loan disbursals, which would not have gone up if the cycle was bad. The disbursals indicate that top-tier banks and non-banks are comfortable in terms of asset quality.

Besides, the Emergency Credit Line Guarantee Scheme for the SME players really helped banks to pass on some of the risk to the government. The total package for this was around Rs.3 trillion and, in the current fiscal, it is about Rs.2 trillion. This sovereign guarantee has helped banks stay on course, both with SME loans as well as with the retail ones. If SMEs had gone down, it would have triggered a domino effect and burdened the smaller companies’ employees as well.

Besides, the Emergency Credit Line Guarantee Scheme for the SME players really helped banks to pass on some of the risk to the government. The total package for this was around Rs.3 trillion and, in the current fiscal, it is about Rs.2 trillion. This sovereign guarantee has helped banks stay on course, both with SME loans as well as with the retail ones. If SMEs had gone down, it would have triggered a domino effect and burdened the smaller companies’ employees as well.

What about the recovery in the stock market? Do you feel that is sustainable?

Overall, thanks to the advance in digitisation and the ability of companies to adapt fast, listed companies have delivered better than expected Q2 and Q3 numbers. That is why the market is where it is. Everything is not froth. Obviously, there is huge liquidity that is helping it stay higher, but at the same time, Nifty Top 10 stocks, which account for 62% of the index, most of them have delivered better than estimates. Investors are also placing a high premium on companies that are able to deliver and have strong balance sheets.

The point that you made, of well-managed companies having been able to raise cash, is pertinent. Even as some of these businesses are struggling to make a recovery, their stocks have run up. Do you think that run up is justified?

The Tier-1 companies in each segment are becoming leaders again by market share, and Tier 3 and 4 companies are genuinely under stress. In every sector, the profit pools of two to three companies have been disproportionate. This is not only because of their financial strength but also because of their high ability to innovate. Look at the financial sector, for example. If any foreigner wants to invest in India, there are only five good stocks to participate in. So largely, I think leaders in every segment will continue to be strong.

Can you give me an example of how innovation is making a difference? How is it setting apart some players from the rest in the same sector?

Look at how India’s largest private sector company has transformed from an old-world, refining business to a new-age business of telecom, data and retail. If the customer is moving in a certain direction and you are not headed that way, someone else will come and take your place. The world is moving so fast that every company has to think how to leverage or adopt technology. In auto, for example, as the electric story starts to gain traction, if companies do not have a transition planned, they will start getting de-rated.

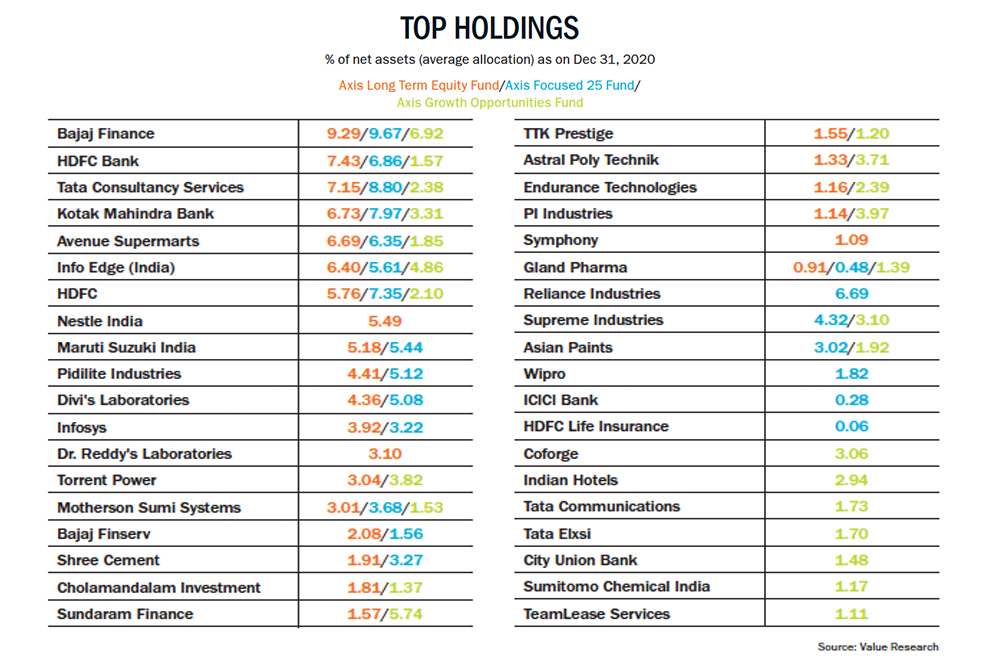

Since you own two auto-ancillaries, Motherson Sumi and Endurance Technologies, what do you think this electric trend will mean for the entire ecosystem of auto ancillaries and players?

There are about 100 auto ancillaries that are listed, and most of them will start getting de-rated. Either these companies get into the new production cycle or they will face the risk of extinction in about 10 to 15 years, but the de-rating will start anyway. So you have to carefully watch who is doing what because that will decide the fate of the company and the stock. It is an evolving process.

One of the biggest auto-ancillary companies that we have in our portfolio has electric vehicles making 20% of its order book. In about five years, this number may go up to 30-40%. Also, in electric vehicles, engine power is not a selling point, so OEMs talk about cosmetic additions such as GPS, mirrors and sensors. The content of the product is going up. So, if you are part of the supply chain and manage to capture 5-10% increase in the content, it can bolster growth. You can play the electric story through the stock market, but it will take five to six years for this to play out.

How can a traditional player be a play on electric, since the larger part of the business will keep contracting while the smaller part grows? So, the net effect will be of remaining in the same place.

How can a traditional player be a play on electric, since the larger part of the business will keep contracting while the smaller part grows? So, the net effect will be of remaining in the same place.

It is all about continuing the growth momentum of the company. It is hard to predict whether the company can grow at 15-20% for the next five years. You can only ensure that the new technology also brings you growth and that you do not miss out on that altogether.

Staying with technology, in one of your interviews, you had said that COVID-19 is a Y2K moment for IT. Is that really the case or will we go back to normal growth?

COVID-19 has really accelerated the digitisation programme. Companies that were planning digitisation programmes probably over the next three to four years have advanced the timelines by one year or so, and the budgets have also been enhanced. Now it is a question of survival. Companies will be up against the likes of Amazon, Google or Microsoft, and they have to get online fast because customers are migrating. When Amazon or Microsoft Cloud does well, you will also see system integrators doing well since they service providers who bring together all of these things, from cloud and Saas to Artificial Intelligence and Machine Learning. They will take up the entire project and execute the transformation. So, truly, it is like the Y2K moment and they could see double-digit growth for the next two to three years.

How about pharma? Is it just sector rotation?

Pre-COVID, about three to four years were bad for pharma. But, because of the pandemic, the demand for drugs has gone up significantly, and the USFDA has become slightly lenient. Plants are not being investigated, and demand is huge from both the US and Europe, so companies are seeing good growth.

Once things stabilise, getting into next year, USFDA inspection will begin again. If a plant has a problem, then the company will once again face the heat. Growth will normalise with pent-up demand for products suddenly reducing, especially after the vaccination programme is over. A good part of the journey is over.

You have PI Industries among your top holdings. Specialty chemicals stocks have done exceptionally well for more than five years now. Do you see this trend continuing?

We have been evaluating every quarter. At the end of the day, if numbers are coming in, then you don’t have to worry.

There are also consumer names such as Nestle and Britannia. Again, are these in the overvalued zone?

What we are doing now is identifying two to four stories in each sector that we understand well and do detailed work on them. This is not the time to ignore any sector. All depends on how the market behaves. If there is a sell-off suddenly, you will move to consumption stocks, because they are more of compounders, so you don’t have any worry from a longer-term point of view. To put it simply, we are diversifying by sectors, and concentrating on companies. We are in unchartered territory, unsure of what is going to happen. This year may be very volatile.

If you are sensing volatility in 2021, would you not want to avoid stocks that are over-owned?

That is a technical matter. We are not looking to double our return every year. If you look at some of these leaders in businesses such as IT or consumer, these are all 15-20% compounding stories. So even if there is a correction, they will be back in line. Please understand that nobody wants to take the risk of getting into Tier-3 or Tier-4 story because it might be good in the near term but eventually it can be difficult to exit these. That is a big risk you are running in the Indian market.

Is the internet company you hold a reflection of your bullishness on their core business, or on the possible IPO of one of its investee companies?

There is so much innovation happening in India on the venture investing side. As an investor, we cannot participate directly. We like the company and even if one or two winners come out of it, it is a good way to get the action in the unlisted space.