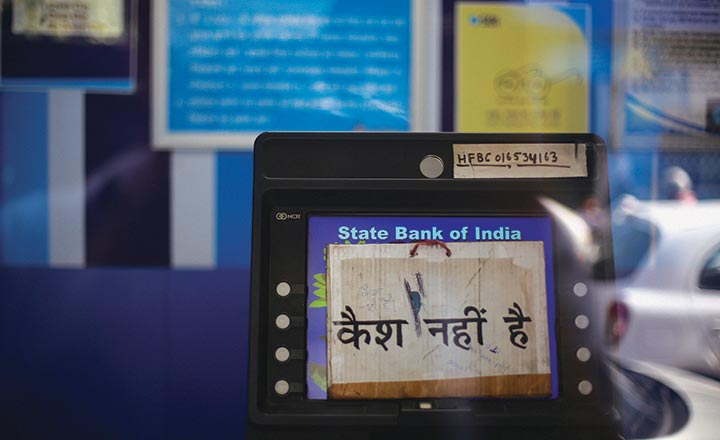

Mid-April saw the return of something that every Indian has dreaded for the past 18 months. It saw the return of the ‘no cash’ sign outside Automated Teller Machines (ATMs) across the country. Major problems were in states of Delhi, Uttar Pradesh, Telangana, Andhra Pradesh, Maharashtra, Gujarat, Chhattisgarh, Bihar, Madhya Pradesh, Karnataka and Rajasthan.

Every government institution seems to have a different reason for the problem. The finance ministry has said that this situation has ensued due to a sudden surge in currency demand in the states, while the RBI has blamed it on the fact that people are depositing less money and withdrawing more due to concerns about depositing cash with banks. SBI attributes the crunch to state governments doling out cash to farmers due to the onset of the procurement season and other welfare activities. However, this is highly improbable.

Economic affairs secretary, Subhash Chandra Garg, suspects that the public is hoarding Rs.2,000 notes due to its high value, which has led to less circulation of the notes in recent times. Market analysts also claim that cash circulation has not been the same since demonetisation.

Apart from this, KYC by e-wallets are also being blamed for the cash crunch as people have stopped using these applications and shifted to cash completely for daily transactions. It is also speculated that politicians are hoarding money in order to fund elections. Ironically, the crunch is despite cash circulation in the system having increased to Rs.18.4 lakh, which is around the same as before demonetisation. Demon or no demon, cash seems in short supply under the current administration.