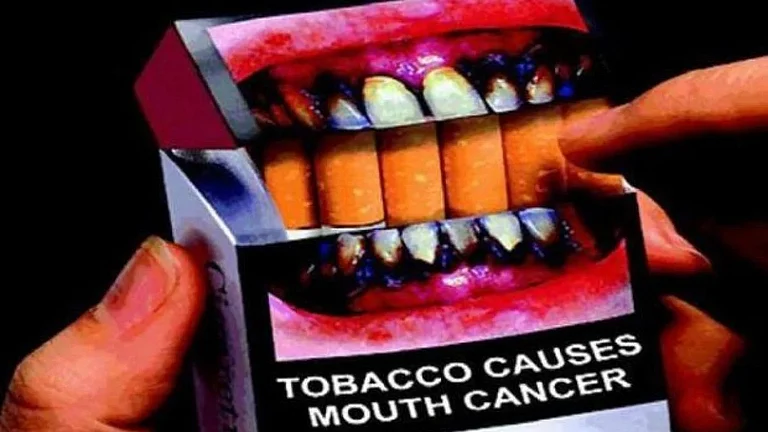

The recent speculation around GST hike on carbonated beverages has caused concern across the beverages brands and consumers. A Group of Ministers had proposed an increase in Goods and Services Tax (GST) on ‘sin’ items like aerated beverages and tobacco to 35 per cent.

Currently, the GST charged on such products is 28 per cent, including 12 per cent compensation cess --- taking the total tax to 40 per cent. An increase in GST to 35 per cent will further add the burden on companies selling carbonated or aerated beverages which include low-sugar, fruit-based and flavoured drinks, and zero-sugar aerated water.

The Indian Beverages Association which counts Coca Cola, PepsiCo, Red Bull and others has expressed concern over these speculations, calling it a “primary bottleneck” for the beverage industry in India. It called for the removal of 12 per cent cess, allowing for a sustainable 28 per cent tax rate.

“The removal of cess would support the sector's growth while fostering affordability and profitability for industry players. While the industry has consistently been achieving single-digit growth, we aspire for a much faster pace of expansion,” CK Jaipuria, Vice Chairman, IBA told Outlook Business.

Drawing a parallel between the taxation policy of countries like UK and India, he said Britain has implemented reduced tax rates for lower-sugar products, but India imposes a flat policy.

Even zero-sugar products are also taxed at 40 per cent which is a significant burden in a price-sensitive market like India, he said. Despite a staggering tax amount, the industry has made substantial investments to align with evolving consumer demands.

He said the industry can bolster the “Make in India” initiative and strengthen the country’s position as a global beverage processing hub if the government address the challenges like uninterrupted power availability in rural areas, and better taxation policy.

“We also get limited access to imported foreign machinery. As a result, we rely on high-capacity and efficient machines made in India or sourced from European nations. However, such investments require careful monitoring of profitability and affordability. This is why, as an industry, we cannot absorb even a half-percent increase in costs,” he added.