As the year comes to an end, the small-cap space seems to be gaining heightened investor attention yet again. And the haunting loss figure in the derivate space has a lot to do with it.

Rs 1.81 Lakh crore, that's the price tag of speculation that traders in the Futures and Options (F&O) space paid between FY22 and FY24. And while the loss figure was shocking, this segment remains the darling of the retail investors. In October, the market watchdog, aka Securities and Exchange Board of India (SEBI), introduced strict measures to curb this frenzy in F&O.

From increasing the contract size to the range of Rs 15-20 Lakh to reducing the number of weekly expiries, the market regulator announced various measures to offset the retail fever in derivative trading.

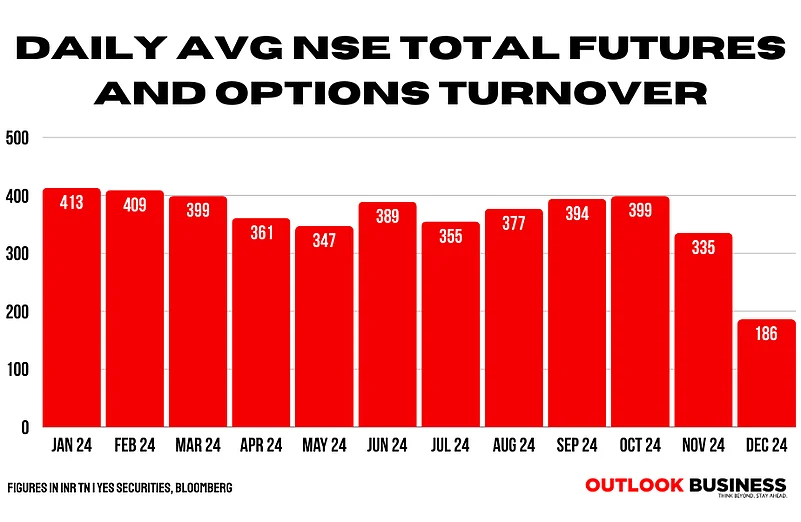

Result? As expected the trading volume came tumbling down.

A sigh of relief for market custodians?

Not for long.

The focus of traders now seems to shift to another risky asset class: the small-cap space. D-street analysts pointed out that the trading volume might be shifting from Index derivates to small-cap cash market, owing to better price-stability and growth in the asset class.

There's no doubt the small-cap index touched another record high earlier this month, but just as before, analysts continue to raise the valuation flag in the space.

Yes Securities in its latest report stated that there is a likely shift of trading volumes from Index derivates to the small-cap cash market. "We sense that investors are increasingly focusing on small-cap opportunities, given the broader price resilience in these stocks compared to their large and mid-cap counterparts over the last three months," the brokerage house said.

Does that mean small-cap stocks can witness another rally at a time when even the broader market indices are experiencing heightened volatility? D-street analysts weigh in-

Derivatives aren’t alone in Sebi’s crosshairs

In November, the average daily trading volume (ADTV) for the F&O segment experienced a sharp decline. This was primarily owing to the barriers introduced by Sebi a few months back, which included upfront collection of premiums from options buyers and increased monitoring on intraday position limits.

The daily average NSE total turnover dropped to Rs 335 trillion in November month. As per exchange data, the volume witnessed a sharper blow in December as the figure plummeted to Rs 186 trillion.

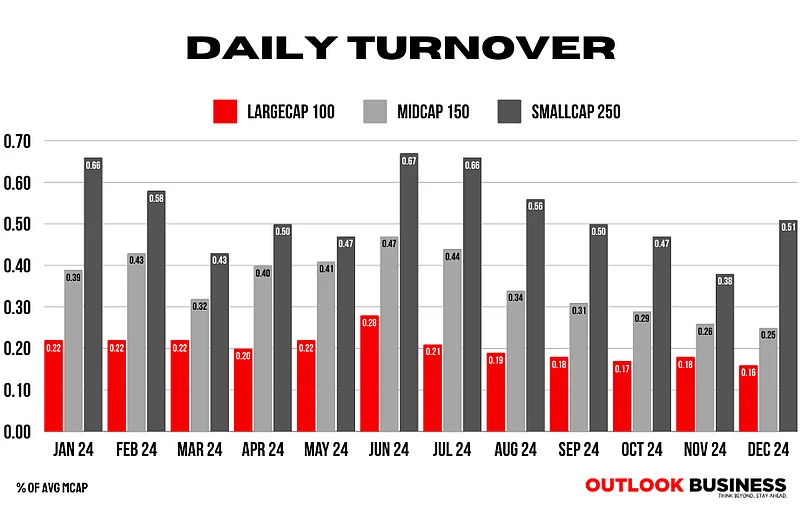

While the market watchdog mainly targeted the derivative market, the segment was not the only one feeling the heat. The daily average cash market turnover also took a hit, especially in the large-cap and mid-cap segments.

The small-cap space turned out to be the only gainer during the period, witnessing an opposite trend. This was quite apparent in the performance of indices as well during the past month.

On monthly basis, the BSE small-cap index has surged by over 2.24 per cent or more than 1,200 points. The BSE mid-cap index witnessed a marginal rise of around 1 per cent. However, the benchmark struggled to remain in the green territory, delivering negative returns of 2.3 per cent.

Swapnil Aggarwal, Director at VSRK Capital pointed out that restrictions on derivative trading could potentially trigger a fresh rally in small-cap stocks.

"By discouraging speculative activities in derivatives, traders are likely to shift their focus to the cash market, where better short-term opportunities may be found. Additionally, increased inflows into small-cap stocks typically drive up prices, which, in turn, attract more participants. This cycle has the potential to further fuel the rally in the small-cap segment," said Aggarwal.

A temporary trend?

While the shift looks quite apparent at the moment, some analysts also believe that this trend might be a temporary play. The last month of the year often experiences a slowdown in trading activity, especially because of foreign investors (FII) activity.

"This month, there has been a noticeable decline in F&O turnover. Historically, December often witnesses a dip in F&O turnover as FIIs tend to shift their funds from derivatives to the cash market. This year, the decline has also been impacted by increased restrictions," said Hardik Matalia, derivative analyst at Choice Broking.

He also pointed out that the trend might be temporary, as any influx of smart money into the small-cap space seems unlikely at current valuations. As for now, the disruption in market behavior is quite apparent, whether it’s short-term or long-term.

"Small-cap stocks could see short-term benefits as not all small-cap stocks are inherently risky. Investors are advised to diversify their portfolios across various futuristic sectors with strong growth potential, such as renewable energy, specialty chemicals and IT services," said Aggarwal.