Global trade uncertainties are casting a shadow over Wall Street's tech giants, with heavyweights like Nvidia and Amazon feeling the pinch. But Chinese tech stocks are perhaps riding on a relatively robust tone.

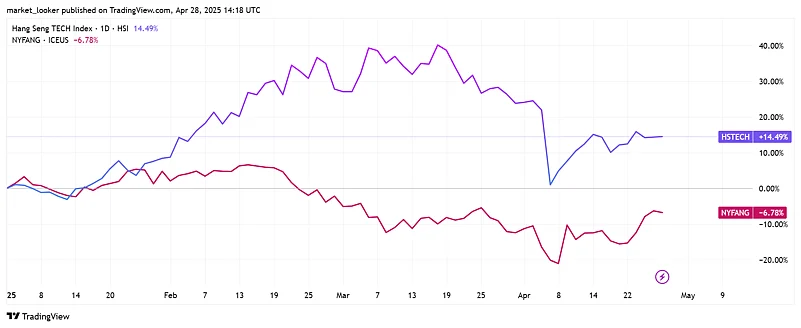

So far this year, the Hang Seng Tech Index has surged over 14.49%. In contrast, the NYSE FANG+ Index (majorly dominated by tech stocks) has risen by 6.31% during the same period. The real turbulence began after Trump's tariff announcement which sent US tech stocks into a volatile tailspin.

Analysts believe that the shift in policy books has played a major role in this recent change in market behavior. While Trump's tariff play has added complexity to the overall outlook for companies, China has rolled out a series of stimulus packages to revive its economy from the current downturn.

Policy Playbook Diverge

"Beijing has implemented monetary and fiscal policies aimed at revitalising their economy, supporting start-ups and tech companies in Silicon Valley, encouraging innovation and progression in the sector. On the other side, the introduction of tariffs and the US tightening immigration policies has created an unpredictable environment for US companies, which has created caution amongst investors," said Ross Maxwell, global strategy operations lead, VT Markets.

Just last week, the Dragon also published a set of measures in order to attract foreign investment in China's technology sector. The Commerce Ministry of China reportedly said it will support foreign institutions in issuing yuan-denominated bonds. The country will also encourage tech companies, including those with foreign investment, to raise funds through bond issuance.

While US interest rates remain high, putting pressure on the stock market, the Chinese government’s stimulus packages and favorable macroeconomic conditions are further fueling the growth of the tech sector, according to Mayank Mundhra, FRM- VP risk & head research, Abans Financial Services.

While policy measures alone might not entirely explain the stronger performance of Chinese tech stocks compared to the Magnificent 7, the recent regulatory actions are weighing down the overall outlook.

Old Giants, New Battles

Many US companies are also facing increasing regulatory challenges which again is impacting investor confidence as well as potentially affecting future growth prospects, as per analysts. Apple and Amazon are among the leading tech giants under heightened scrutiny, threatening their market dominance. Meanwhile, Meta is also embroiled in an ongoing antitrust trial.

Plus, the recent entry of DeepSeek in the tech space has also raised several questions around the dominance of US tech companies. The common belief that AI is all about heavy investments faded when China's low-cost AI model proved otherwise. "Competition in the sector has also helped create this situation, with the emergence of DeepSeek as an example, offering much cheaper alternatives to a US domination of the AI sector and showcasing China’s increasing capabilities, and increasing investor confidence in Chinese tech firms and their ability to compete with their US competitors," said Maxwell.

However, it would be a mistake to overlook China’s own uphill battle, with domestic economic challenges still looming large. As for US tech giants, long seen as the dominant and most attractive pick for investors, a lot will depend on how the Q1 performance pans out.