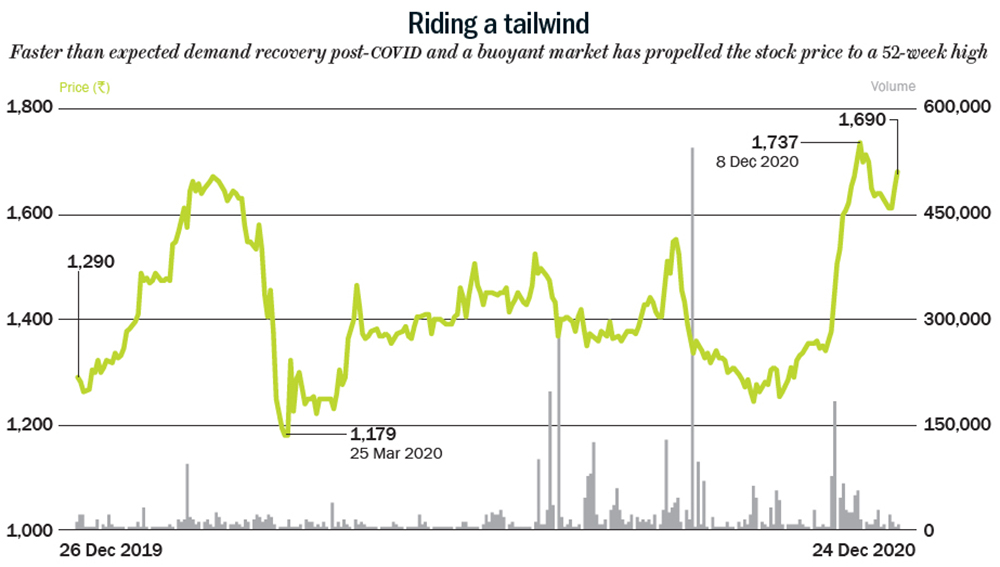

The stock that promises a good night’s sleep has been delivering high excitement over the past few months. Sheela Foam has soared from Rs.1,320 on November 10 to Rs.1,690 on December 24! That is 22% in just over a month. Of course, a buoyant stock market has helped, but there are other factors at play as well. Analysts have attributed the surge to the improved performance of the company’s subsidiaries in Australia and Spain, a faster than expected recovery in demand and the festive season.

The stock that promises a good night’s sleep has been delivering high excitement over the past few months. Sheela Foam has soared from Rs.1,320 on November 10 to Rs.1,690 on December 24! That is 22% in just over a month. Of course, a buoyant stock market has helped, but there are other factors at play as well. Analysts have attributed the surge to the improved performance of the company’s subsidiaries in Australia and Spain, a faster than expected recovery in demand and the festive season.

Sheela Foam has had a great track record, so far. In a low-involvement business such as mattress, creating a brand is never easy. But, the company that started as a foam manufacturer in 1971 has managed to do it with its Sleepwell range, which is now the largest player in the segment. Sheela Foam today gets 82% of its revenue from home comfort products, of which the mattress line is a big part. The remaining 18% comes from technical foam, which is used in the automotive industry, sportswear and sound absorption systems.

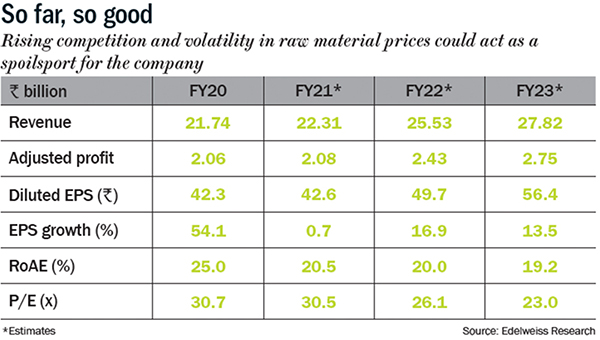

“Brand building in the mattress business is quite a challenge. It took a good five years after we started off in the mid-1990s before any semblance of the exercise became successful,” says Rahul Gautam, managing director, Sheela Foam. In FY20, the company posted revenue of Rs.21.73 billion, up from Rs.15.50 billion in FY16. It grew its profit from Rs.1.04 billion to Rs.1.94 billion, over the same period.

Power behind the nap

Gautam, whose company is named after his mother who founded it, says that there are no entry barriers in the business. This translates to a highly competitive space, and there were plenty of challenges to surmount. “In the past, mattresses were never a top-of-mind purchase item. High government taxes with no proper store network were serious challenges that the industry had to counter,” he says.

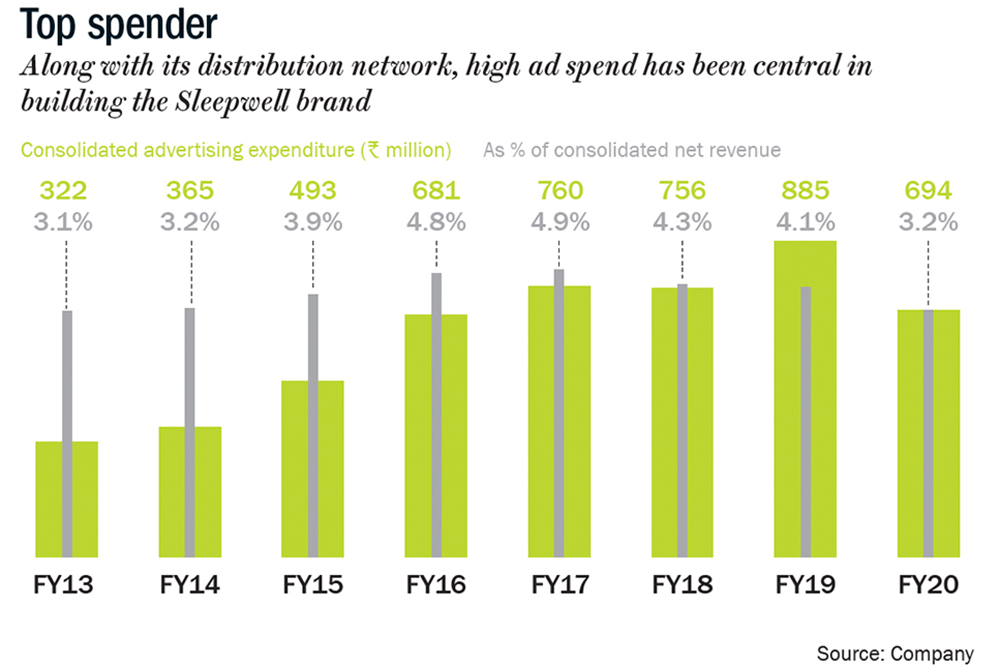

When asked why his company has done so well despite the hurdles, he points to the distribution network (See: Top spender). The brand has a presence across 6,000 outlets in India, of which 4,400 are exclusive franchise outlets, with the other 1,600 being multi-brand. Contrast that to rival Kurlon with a presence in 1,500 exclusive retail outlets; for FY19, says a report from ratings agency, ICRA, Kurlon had revenue of Rs.11.16 billion and net profit of Rs.740 million.

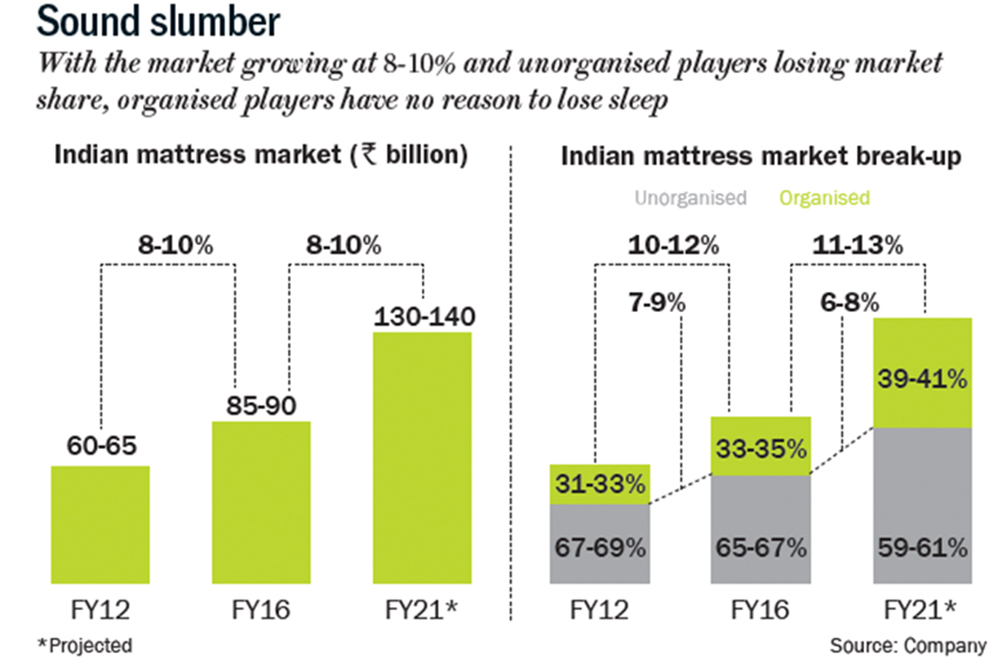

Along with its thrust on distribution, the company has increased the number of manufacturing plants. It has 11 today and it ensures greater proximity to the market. Today, of the company’s total domestic business, about 40-45% comes from the North with the South and West each accounting for 20-25%. The East with 5-10% is the smallest chunk. Manoj Menon, head of research, ICICI Securities, thinks Sheela Foam’s decision to have factories across India reduces logistics costs. “It is a great competitive advantage and helps it to respond faster to dynamic market requirements. Mattresses are bulk products and managing the cost of moving it around is a key recipe for success,” he explains. The company now has over 30% of the Indian mattress market, 28% of foam manufacturing, and is the only listed player. It still has a huge market opportunity to tap, according to Suvarna Joshi, senior research analyst, Axis Securities. The size of the mattress market, according to Joshi, is Rs.100 billion. This includes everything that is made of foam, foam-based and coir based; if one includes cotton mattresses, the total number is at least 3x larger. “Around 60-65% of the consumers still use cotton-based mattresses. That is what makes the market opportunity huge for a player like Sheela Foam,” she says.

The company now has over 30% of the Indian mattress market, 28% of foam manufacturing, and is the only listed player. It still has a huge market opportunity to tap, according to Suvarna Joshi, senior research analyst, Axis Securities. The size of the mattress market, according to Joshi, is Rs.100 billion. This includes everything that is made of foam, foam-based and coir based; if one includes cotton mattresses, the total number is at least 3x larger. “Around 60-65% of the consumers still use cotton-based mattresses. That is what makes the market opportunity huge for a player like Sheela Foam,” she says.

ICICI Securities’ Menon, too, cites the low penetration of mattresses in India (See: Sound slumber) as a big opportunity for the company. He adds, “Importantly, as the replacement cycle of mattresses reduces (ideally seven to eight years), industry growth is likely to accelerate and a player like Sheela Foam stands to gain.”

This underserved market and its growing appetite has not gone unnoticed by Sheela Foam.

The times we live in

About three years ago, Gautam decided to look closely at the lower end (priced less than Rs.4,000, compared with Sleepwell’s starting price at Rs.6,000 going all the way to Rs.50,000) as a potential market. “There was an opportunity to launch a value for money brand to bridge the unorganised and organised segment of the market,” he says. It gave birth to Starlite in July 2017 which is now a Rs.1.5 billion brand. Since June 2020, it has grown upwards of 25% compared to last year. The reason can be attributed to the pandemic as consumers are downtrading to more affordable options.

Nihal Jham, research analyst, Edelweiss Securities, says Starlite helps in the process of transitioning consumers from the unorganised segment and strengthens the company’s presence at multi-brand outlets. “In that sense, it allows Sheela Foam to play both the price and channel game,” he says. Axis Securities’ Joshi adds that Sheela Foam, with its diverse product portfolio, is positioned well across the price-value chain. “It offers products right from the economy to the premium range,” she says.

The distribution is understandably different, with Starlite not being sold at any of Sleepwell’s exclusive brand outlets. “It is available at the multi-brand establishments and that in turn goes out to smaller centres across India,” says Gautam. He estimates that Starlite sells at around 6,000 stores. With its pricing comes the natural worry on how it might pull down Sheela Foam’s margins.

According to Gautam, the cost structure is lower with less spend on marketing and advertising. “That protects the margins,” he says. Edelweiss’ Jham adds that optimum spend on advertising and trade incentives help manage the Ebitda margins.

While the pandemic has expanded the market for lower-end mattresses, it has also creaked open the gates for online mattress brands. Even Sheela Foam has an online presence through SleepX, a brand launched two years ago specifically for the medium up against the likes of Wakefit, a Bengaluru-based sleep and home solutions brand that has taken the D2C (direct-to-consumer) route. Jham says the medium, unlike offline stores, gives you the advantage of having more SKUs (stock keeping units). “With no distributor margins, it opens a new market altogether and one is already seeing disruption with brands such as Wakefit”, he adds.

While the proportion of sales today from online is small, analysts expect it to capture 40% of incremental growth. Already, Wakefit has FY20 topline of nearly Rs.2 billion, is profitable and valued at Rs.19 billion after its latest fund raise.

But, Gautam still is betting heavily on the offline channel. He says, “There is a lot of headroom to grow the offline market. We do not see any disruption in terms of online turning the offline market upside down. Discerning consumers will want to go through the entire shopping experience.” He estimates the online market to be no more than 5% of the overall pie.  Joshi, too, agrees that the physical experience of shopping still matters in this category. “Online purchase is still only from urban centres, with physical sales continuing to contribute a major portion. We see that continuing given the preference of Indians especially when it comes to consumer durables to verify, try, test and feel the product before making the final purchase,” she elaborates.

Joshi, too, agrees that the physical experience of shopping still matters in this category. “Online purchase is still only from urban centres, with physical sales continuing to contribute a major portion. We see that continuing given the preference of Indians especially when it comes to consumer durables to verify, try, test and feel the product before making the final purchase,” she elaborates.

While the domestic market remains favourable, the overseas market is opening up for the company as well with the anti-China sentiment. Referring to this, Joshi says, “Certain export opportunities to the US have opened up with more enquiries coming in as indicated by the management in their Q2FY21 concall. This will lead to an improvement in topline as business to the US starts.” As of now only 20% of Sheela Foam’s business comes from overseas through its B2B business, while 80% comes from the domestic market, with its B2B and B2C businesses.

Sheela Foam currently trades at trailing 12-month P/E of 46x, a premium compared to its global peers such as Tempur Sealy and Sleep Number which trade at 24x. Joshi says, “This is on account of the large growth opportunity in India driven by factors such as population growth, urbanisation, nuclear families and rising disposable incomes.” For now, Axis Securities has a ‘hold’ rating with a target price of Rs.1,406, which has been breached (See: Riding a tailwind).

In his November report, post the Q2FY21 result, when the stock price was Rs.1,308 Edelweiss’ Jham reduced his price target from Rs.1,525 to Rs.1,407. His report stated, “While Q2FY21 performance is impressive, the headwind — rising raw material prices of both TDI and polyol— overshadowed it. Hence, we are adjusting down profit after tax 5% to factor in lower margins. Valuing the standalone/subsidiary operations at 35x/10x FY22 estimated EPS.” (See: So far, so good)

In his November report, post the Q2FY21 result, when the stock price was Rs.1,308 Edelweiss’ Jham reduced his price target from Rs.1,525 to Rs.1,407. His report stated, “While Q2FY21 performance is impressive, the headwind — rising raw material prices of both TDI and polyol— overshadowed it. Hence, we are adjusting down profit after tax 5% to factor in lower margins. Valuing the standalone/subsidiary operations at 35x/10x FY22 estimated EPS.” (See: So far, so good)

Sheela Foam is going strong, even after nearly five decades, thanks to its strong brand and distribution network. Even the pandemic lockdown has turned out favourable for its business. While the online brands are disrupting the market, Sleepwell has breathing space with consumer behaviour in the segment not having changed much. For now, the stock price has surpassed most analysts price targets and investors should sleep over their decision to buy the stock at the current price.