Just a few days before the financial year came to an end in 2018, it seemed like Manipal, the fourth-largest hospital chain by beds at the time, was within striking distance of moving to pole position.

The promoters of Fortis were in serious need of cash and Manipal scion Ranjan Pai had quickly chalked out a deal to buy out the Delhi-based hospital chain. All that remained was a dab of ink on the dotted line.

Pai didn’t expect what came next.

A group of minority shareholders of Fortis, including the likes of Rakesh Jhunjunwala and YES Bank, revolted as they thought they were getting a raw deal. The board of Fortis was ousted. Meanwhile, a handful of competing suitors emerged from the shadows—the Burmans, the Munjals, Chinese conglomerate Fosun and Malaysian health-care major IHH.

Over the next few months, a bidding war ensued which Manipal ultimately lost. Next year, it went out on a campaign to buy out Medanta, and that deal fell through as well. “All of it helped us learn and strengthen our resolve,” Pai, chairman of Manipal Education and Medical Group (MEMG), says.

Of course he wasn’t going to give up trying.

Pai’s first brush with a career disappointment had happened early in life—he terms it a “wake-up call”—when he failed to get into a medical college run by his own family. He initially had to settle for a lower-ranked college, but fought back and secured a seat in Manipal a year later.

That doggedness to come back up from a defeat has remained with Pai. So, when he sensed an opportunity to acquire the Indian assets of Columbia Asia Hospitals during Covid, he had to take another shot.

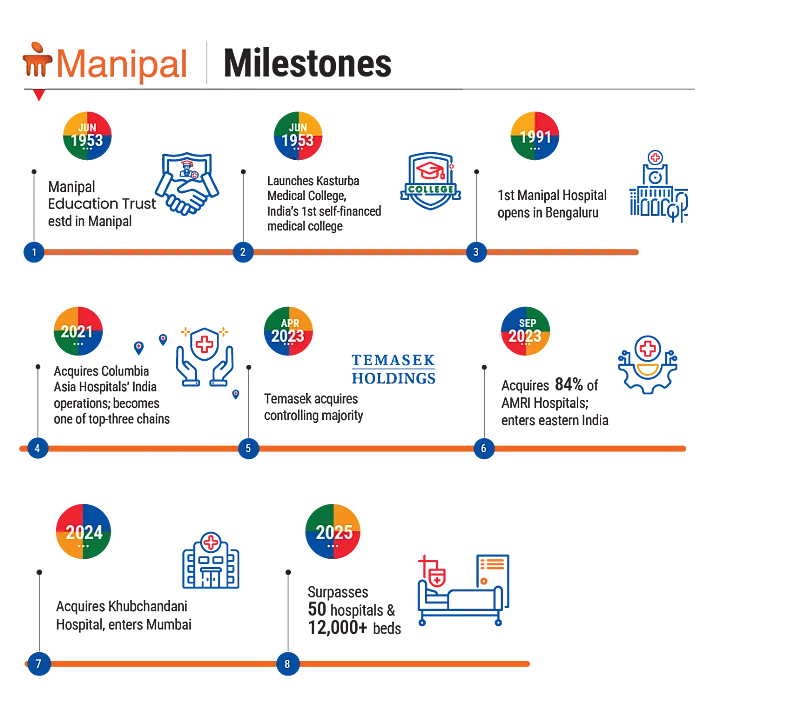

Not only did the ₹2,100-crore purchase bring 1,600 hospital beds, perhaps more importantly it broke the jinx of failing to crack the big deals. Between then and now, Manipal has been on a buying streak—it has gobbled up four more chains for over ₹10,300 crore.

And, its latest acquisition of the Pune-based Sahayadri Hospitals this year has catapulted it to the No. 1 position with over 12,000 beds, ahead of the bellwether Apollo Hospitals.

“Manipal’s aggressive acquisition-led growth has redefined the Indian health care consolidation playbook. It is emerging as India’s first hospital chain with both regional depth and pan-India breadth, something that has eluded most of its competitors so far,” says Harshal Dasani, an equity analyst at INVasset, a firm that manages money for high networth individuals.

Private Matters

There was one major difference between Manipal’s failed campaign for Fortis and the success with Columbia Asia. In the latter’s case there were no splintering groups of shareholders to contend with or stock price to take care of; it was privately owned by one company.

For Pai, it went through with the relative ease of a private-equity deal which was a game that he had mastered over the course of a decade and a half.

From the 1950s, when Ranjan’s grandfather TMA Pai founded Kasturba Medical College in Manipal, the group was built as a self-financed educational outfit. That began to change in the 1990s when Ranjan’s father opened the first full-fledged private hospital on Old Airport Road in Bengaluru.

But the real turning point came after 2000 when the third-generation scion took over the reins.

At the time, the health-care business wasn’t in a great shape and making losses. First, he brought in professional management to replace retired doctors who were running it. Next, he turned to private equity to fund its growth.

“I told my father either we get out and focus on education or let me figure out if I can turn the business around,” he recalls.

By the time the Columbia deal happened, Pai had already raised about $1bn from marquee private-equity (PE) investors such as TPG, Temasek, Premji Invest, IDFC Private Equity and True North.

What’s more, he has also managed to consistently create profitable exits for them either through buybacks or finding new investors.

“Ranjan is very savvy with finance and capital. He has raised money from various PE funds at different points; and across nearly 20 years, he has consistently made money for every investor,” says Mohandas Pai, who closely works with the Manipal supremo in various roles. (The two Pais are not related.)

Such a reputation is very difficult to cultivate, especially in heavily regulated sectors like health care and education. For this reason, when Manipal needed a $600mn loan to pay for the $700mn Sahayadri Hospitals deal this summer, PE giant KKR was more than happy to foot the bill.

One could say the trust runs both ways. Oftentimes, entrepreneurs who build up a family business from scratch are wary of ceding a controlling stake to PE players. But, Pai did not hesitate to let Temasek raise its stake in the hospital chain to over 50% in 2023. Of course it helped that the company was valued at an eye-popping $5bn in the deal.

He says it was partly necessary because when he hit age 50 the preceding year, he wanted to clear out the debts from the group’s balance sheets. Also, he wanted to create a corpus to get a taste of being on the other side of the cap table, which has since happened through audacious bets like Aakash and Zepto.

Craft of Scale

One of the biggest tragedies in India’s hospital sector was when 92 people died in a fire at an AMRI hospital in Kolkata in 2011. There was immense blowback: several board members were arrested, its licence was revoked and it remained shut for a few years.

Even after the hospital was allowed to reopen in 2014, the promoter Emani Group wasn’t too chuffed. Its 70-year-plus co-founders thought the decision to invest in the sector was a mistake.

As they were looking for a suitor, Manipal saw an opportunity. AMRI would not only strengthen its eastern footprint with three hospitals in Kolkata and one in Bhubaneswar with 1,200 beds, but also help tap into the rising medical tourism from Bangladesh. The deal was locked in 2023 at about ₹2,300 crore.

“We look at geography. Mostly, Tier–I and –II cities are good for us. We have an internal map of cities we like. When opportunities come up in those cities, we prefer to acquire existing assets,” says Pai.

Before its acquisition spree started in 2020 with Columbia, the company was heavily concentrated in a handful of cities in the South. Its only two other campuses in India were in Jaipur and Delhi. However, its presence has now expanded to more than 20 cities, rivalling Apollo, which is expected to help amplify its brand pull.

Another axis of the company’s acquisition strategy has been going for multi-speciality hospitals, rather than single-speciality ones which have of late been attracting the most interest from PE firms.

“The main benefit is supply chain strengthening and better negotiation power. This is reflected in the margins at scale in pharmacy, medical equipment, machines etc. Another value driver at scale is shared resources—quality doctors and professionals. Also, patient experience is uplifted as you have the bandwidth to divert resources across hospitals as per the requirement,” says Kulmani Rana, chief executive of venture platform Fibonacci X.

According to industry insiders, Manipal has cracked the code of leveraging patient density for operational efficiencies. For example, it already had a hospital in Kolkata from the Columbia acquisition before it bought AMRI. The strategy was to double down on the geography to improve margins.

“You can’t just plant a hospital everywhere. You need density in each region before you go national. Manipal seems to have understood that better than most,” says Vivek Srivastava, a health-care industry executive.

Its numbers are telling. While revenue has jumped four times to ₹8,363 crore over the past five years of rapid acquisitions, its profit has jumped almost 20 times to more than ₹1,081 crore, according to data platform Tracxn.

Vital Signs

Yet, there is one metric where Manipal has not yet topped the charts.

A key indicator of monetisation in the hospital business is the average revenue per occupied bed (ARPOB).

Driven by factors like price increases, more cross-selling of services and rising international footfall, the Indian hospital industry is seeing this number grow steadily in the range of 8–10%.

While ARPOB has crossed ₹70,000-75,000 levels for chains like Max and Fortis, it has remained in the range of ₹40,000-65,000 for Manipal’s hospitals.

Experts believe that doesn’t need to be a cause of worry. Scale itself can add an extra 150–200 basis points to operating margins, where Manipal is behind a couple of the large players currently. As utilisation rates improve, every incremental bed pushes up margins faster than costs, according to Dasani of INVasset.

That’s something the Bengaluru-based company is betting on as it plans to add 1,400 more beds in the next couple of years and venture deeper into Tier–II and –III geographies.

Will that be enough to retain its crown?

“I don’t know. We hope to keep growing…When my father gave me a free hand, he said make this into the best hospital network,” says Pai.

That won’t be easy. For one, Manipal’s metamorphosis into a corporate giant and its rapid growth in the post-Covid era have been on the back of PE, while there’s been an uproar against secretive money managers controlling the fate of health care in the West.

But one thing is certain: he will keep trying.