The wait is over, Maruti Suzuki announced before unveiling their first all-electric car in the Indian market at the Bharat Mobility Expo in the national capital earlier this year.

Maruti Suzuki was not the only one. At the country’s biggest auto expo, electric vehicles (EVs) took centrestage with some of the biggest names in the industry—Tata Motors, Mahindra & Mahindra (M&M), JSW MG Motor and Hyundai—showcasing their new offerings. The signal is clear: competition in the electric four-wheeler segment is about to get tight.

Companies are gearing up as well. Tata Motors managing director Shailesh Chandra said on the sidelines of the mobility expo that increasing competition would be a net positive for the industry. But it comes with a caveat. “Competition should lead to market expansion. If the market does not expand, it will be a challenge for all the players,” he said.

Meanwhile, stakeholders are waiting to see how market expansion pans out. Last year was not a good one for the passenger vehicle (PV) segment in the country. Numbers with the Federation of Automobile Dealers Associations (Fada) show that PV sales grew by 5% last year compared to over 10% in 2023.

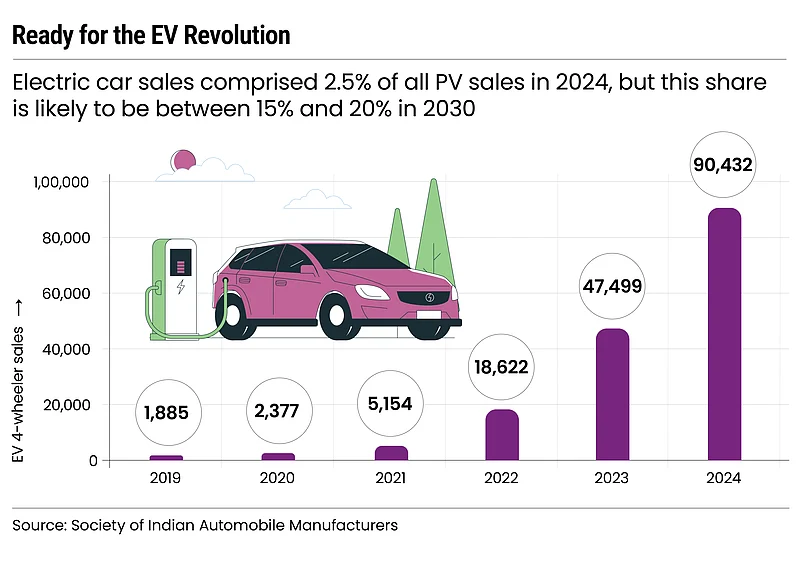

And while PV sales posted sluggish growth, EV sales rose 20% to touch nearly 1 lakh in 2024. This also makes it clear why automakers are turning to EVs. Though electric car sales accounted for only 2.5% of all PV sales in the country in 2024, by the financial year 2030, the industry sees it reaching 15–20%.

Competition Gets Tight

For 40 years, Maruti Suzuki consistently held the record for the highest-selling car. Then came Tata Motors with its sports utility vehicle (SUV) Tata Punch. The model emerged as the bestseller in 2024, with 2.02 lakh sales. Maruti Suzuki’s WagonR followed in the second place with 1.91 lakh units.

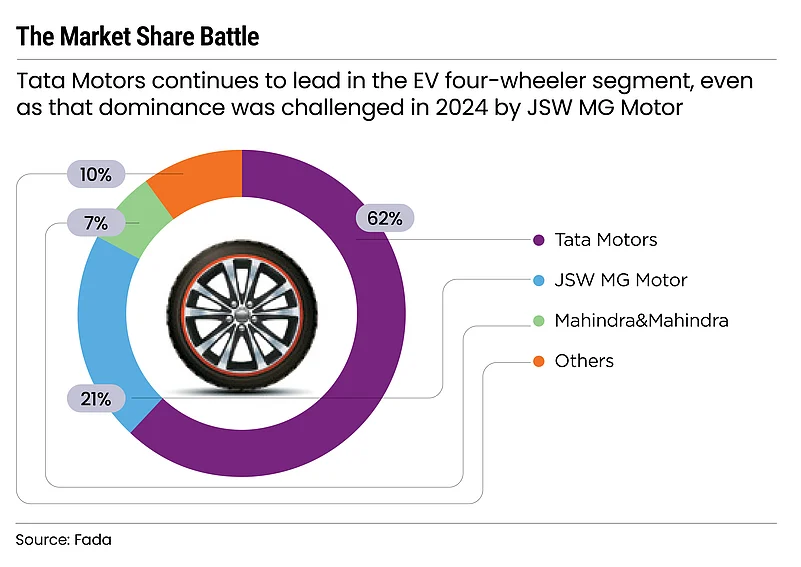

As Tata Motors challenges the dominance of Maruti Suzuki, the latter may look to chip away at the share of the former in the EV market. For some years now, Tata Motors has maintained a significant lead in this segment, with a market share of 62% in 2024.

But with M&M, Maruti and Hyundai launching new electric cars, the space is about to get more crowded, a prospect that is affecting the incumbent’s outlook.

The spree of investments in the EV segment is also increasing. For the 2024–27 period, M&M plans to invest Rs 12,000 crore in its electric unit while Tata Motors will invest Rs 16,000–18,000 crore. Maruti Suzuki has invested Rs 3,100 crore to set up its first EV plant in Gujarat. Steel-to-paint conglomerate JSW Group ventured into the auto space in 2024 with an investment in Chinese giant MG Motor. With the infusion of Rs 5,000 crore from new investors, the company is ramping up its presence in the EV space.

Srihari Mulgund, partner at strategy consulting firm EY Parthenon, says the race is an opportunity for Indian auto giants to make a space for themselves. “The ICE [internal combustion engine] era was dominated by the Americans and the Japanese. But EV has levelled the field for everyone, and now Indian giants have an opportunity to develop their own platforms, which can bring them up in the value chain,” he says.

Spending in R&D has also been significant. Tata Motors spent Rs 29,398 crore on research, or 6.2% of its revenue, in the last financial year. M&M spent Rs 2,765 crore on R&D, which was 3% of its total turnover in the last fiscal.

New Battlegrounds

Apart from plans of investments, other areas are emerging as focus points for analysing the competition. Saji John, senior research analyst at investment services company Geojit Financial Services, says there is caution if the momentum can last.

“Players are expanding at a rapid pace, but still, there are concerns over the cost. Will the new category be able to penetrate the mass market and gain sizeable volume to have a large-scale impact remains a question for many,” he says.

On average, EV models cost 10–15% more than their ICE counterparts. The infrastructure for after-sales support for electric cars is also under development in most of the country.

With steep development costs on high-tech EV cars and limited volumes in the market, automakers accept that profitability is some way off. In a post-earnings call at Maruti Suzuki, chief investor relations officer Rahul Bharti said that EV margins would not match those of ICE vehicles for some time.

Moreover, the focus on volume in price-sensitive markets like India indicates that firms need to address major pain points. On a rough count, the battery accounts for around 40% of the cost of an EV. Battery cell demand for EVs is mostly met through imports and the country will domestically meet only 13% of overall EV battery demand by 2030, projects automotive intelligence and forecasting firm S&P Global Mobility.

In the drive to localise, Tata Motors is taking the lead, with the conglomerate starting to manufacture battery cells next year via its global battery arm, Agratas. But it is the presence in diverse price ranges that the firm believes is its strength right now.

Investments are increasing, but with steep development costs and limited volumes in the market, automakers accept that profitability is some way off

In the recently concluded earnings call, Tata Motors’ Chandra said the biggest advantage of the firm was its presence in the price range Rs 8 lakh to Rs 22 lakh.

EY Parthenon's Mulgund, however, believes that as the sourcing ecosystem for components is controlled by a few key players, pricing will eventually converge across the industry. In such a scenario, the differentiating factor will be something else.

“A major factor in this EV war is going to be about who can offer a better in-cabin experience. Innovation in tech features in the new cars will prove to be crucial,” he says. Spending on R&D could then turn out to be crucial in gaining an edge over other players. The battle to offer a better tech platform could also bring global players into the picture.

Electric Dreams

Unlike ICE vehicles, EVs do not have different regulatory standards across countries. While this presents a greater opportunity for exports, the global market today is dominated by China’s BYD and the US’ Tesla.

But with EV sales worldwide rising 25% in 2024, according to a Reuters report, and Maruti Suzuki investing in EV production for the international market, India is set to play a key role in the global EV landscape.

But Bharath Rao, founder of Emobi, an EV start-up, says it will be imperative for players to prove their platforms domestically first. “We can think about exports then. Even for global players, it will be difficult to just enter the Indian market and succeed due to the vast expertise needed to crack distribution,” he explains.

Rumours of Tesla chief executive Elon Musk entering the Indian market have also been around for some years. But with Musk insisting on import duty cuts, the company’s entry into the Indian market has been delayed.

With US President Donald Trump back in the Oval Office, there are also questions about whether India may need to ease its tariff policies to gain favour with the US administration. Mulgund, however, does not anticipate any significant pressure from international players.

“India’s EV market won’t be able to gain that much volume in a short period of time which will justify entry for global players. Given the auto sector produces significant output and jobs in the country, it’s unlikely there will massive cuts to this sector,” he said.

For Indian automakers, the battle in the electric car segment is just beginning. Each will leverage its strengths in the growing clean mobility market, which is projected to expand from $5bn in 2024 to $18bn in 2029. In the meantime, the competition is under close watch to determine who earns bragging rights in the years to come.