It’s 2am in Cape Town and Neel Hariram is preparing for a virtual meeting with colleagues in China. The call will review the sales performance of Chery, China’s biggest vehicle exporter, in South Africa and one of the world’s most competitive auto markets. As director of strategic planning for Chery South Africa, Hariram knows every number matters.

Since entering South Africa in 2021, Chery has climbed the charts with astonishing speed. Within a year, it broke into the top 10, selling more than 1,200 units in July 2022.

“The reason Chery grew so fast is that we have worked hard for it,” says Hariram. That drive is paying off. Chery now sells over 2,000 units every month and together with its sister brands Jetour, Omoda and Jaecoo, exceeds 4,000 units, making it the fourth-largest automaker in South Africa, ahead of Hyundai and Mahindra & Mahindra.

The rapid rise has set off alarms among established players like Toyota, Suzuki and Hyundai, many of which export heavily from India. Their long-held dominance in export markets is now under direct threat as Chinese brands surge ahead.

“All players in the market are our competitors. Their [Indian vehicles] price points and product ranges cover the majority of various segments. [But] Chinese products are becoming more aligned with global standards. Indian products still feel made for local consumption,” says Tony Liu, chief executive of Chery Group South Africa.

Under Pressure

Since the Galwan clash in 2020, the Indian government has kept a tight lid on Chinese investments, blocking automakers from expanding in one of the world’s fastest-growing car markets. But that has not completely shielded India-made vehicles from Chinese competition.

In markets like Africa and Latin America, where India-made vehicles have long been strong, Chinese brands are gaining ground and have already surpassed some European and American rivals.

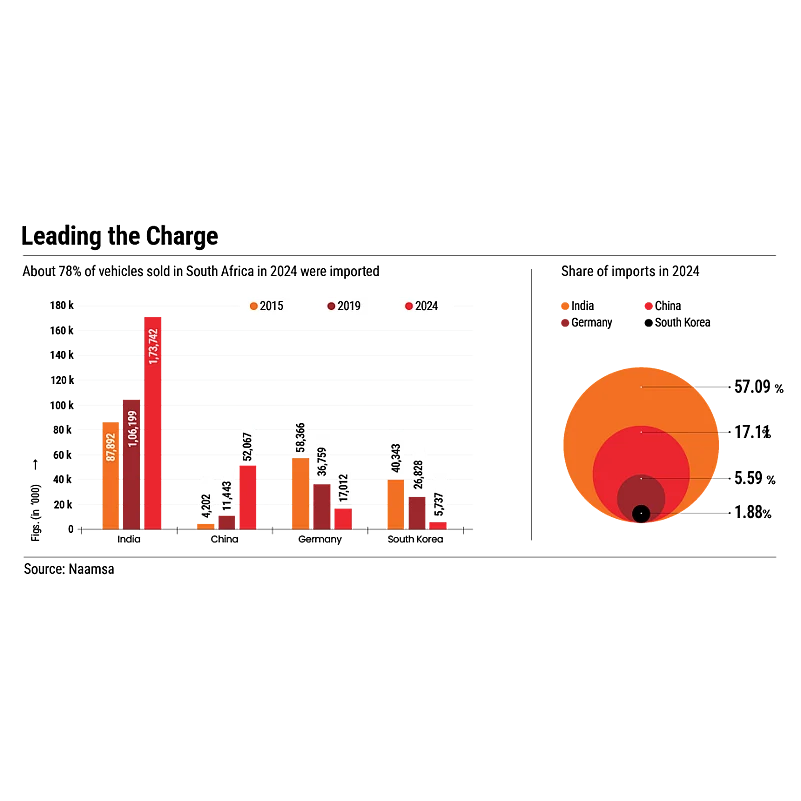

South Africa offers the clearest view of this shift. The continent’s biggest auto market sold 484,808 light vehicles in 2024, nearly two-thirds of them imported, according to the National Association of Automobile Manufacturers of South Africa.

India led with 57% of those imports, while China followed at 17%. But the gap is closing. In 2022, India’s share was 54.6% and China’s was 10.8%. During the same time, imports from Germany and South Korea almost halved from close to 40,000 to 22,000. India could be the next to feel the pressure.

As household budgets tighten, South Africa’s market is tilting from luxury to more affordable brands. Chinese automakers are at the forefront of this change, expanding market share from 3.1% three years ago to 14.8% in the second quarter of 2025, according to a report released in September by TransUnion Africa, a risk and information-solutions company.

“Over the same period, traditional OEMs’ [original equipment manufacturers] combined share fell from 68% to 51.6% as they struggled to match the pricing and feature levels offered by Chinese rivals,” it adds.

Aggressive pricing and feature-packed models are powering this rise. In 2024 alone, six new Chinese brands entered South Africa, on top of three the year before, bringing the total to 14.

Meanwhile, in Chile, Suzuki’s Baleno led sales in September with 799 units, but Chery’s Tiggo 2 wasn’t far behind at 715. In the SUV segment, the Tiggo dominated, outselling Suzuki’s Fronx by more than double. Yet both the Tiggo and Baleno are priced almost identically.

After South Africa and Saudi Arabia, Chile is Maruti Suzuki’s biggest export market, and its Baleno and Fronx are India’s most-exported cars. But the surge of Chinese rivals is narrowing that advantage.

China’s automakers have carved out opportunities at a time of crisis. During the 2021 chip shortage in the global auto sector, companies like Chery still posted record exports

Market Synergies

Markets in Africa and South America mirror India’s price-sensitive buyers, tough terrains and demand for affordable mobility. For Indian automakers, these regions are natural hunting grounds.

Maruti Suzuki, for instance, India’s largest carmaker, has openly said it is leaning on exports to counter sluggish domestic demand.

“To proactively manage the impact of fluctuations in the domestic market, the company has expanded its focus to newer markets and customer segments. The strong export performance is a direct outcome of this strategy,” it said in its 2024–25 annual report.

Exports now account for 15.2% of India’s total passenger-vehicle (PV) production, up from 13.2% in 2020–21. Though the share is still shy of pre-pandemic highs, the attraction is clear: better prices and margins. “Exported cars usually have higher build quality and features, allowing companies to charge a premium,” says Gaurav Vangaal, associate director at S&P Global Mobility, an automotive intelligence firm.

For China, the renewed focus on exports follows stagnation in the domestic market and overcapacity. Exports are not just a means to improve margins but to minimise losses due to overcapacity and price wars in the local market while keeping production lines busy.

“Exports have become an increasingly important growth driver for Chinese automakers as China is no longer a first-time buyer market. The landscape has shifted,” says Lei Xing, a US-based automobile consultant.

More Than Scale

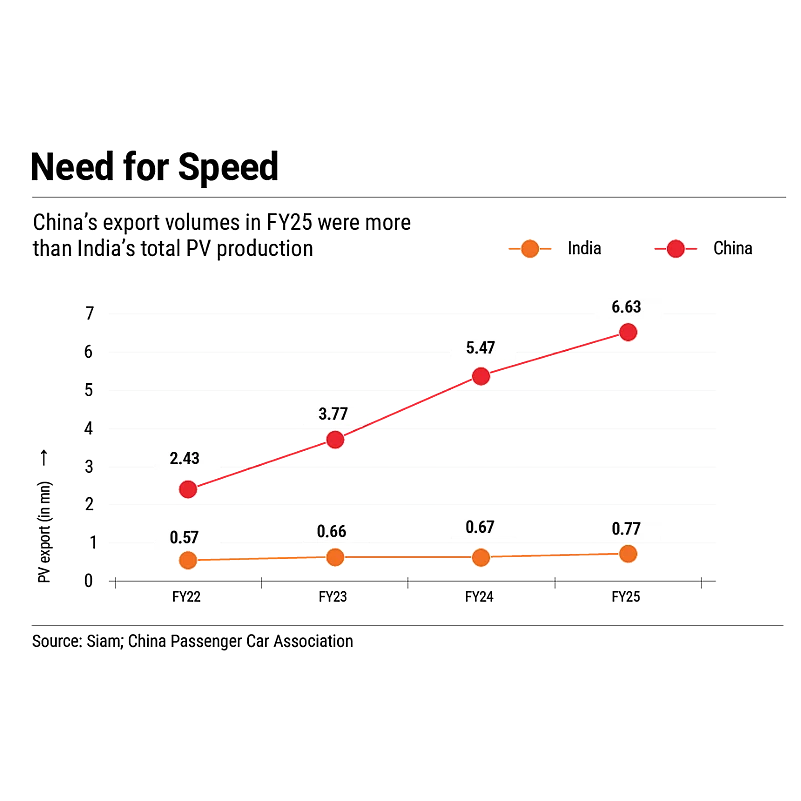

China’s exports have more than doubled between 2021–22 and 2024–25, from 2.43mn to 6.63mn, well over India’s total PV production of 5mn in the last financial year. Its economies of scale and deep automotive supply chain, especially in EVs, have allowed it to sell vehicles at lower margins than competitors.

The country’s automakers have also carved out opportunities at a time of crisis. During the 2021 chip shortage in the global automobile sector, companies like Chery still posted record exports. It shipped close to 2.7 lakh vehicles that year, crossing the 2-lakh mark for the first time.

Additionally, Chinese automakers are regularly bailed out by provincial governments. “Many provinces and regions in China want to have their own domestic automotive champion emerge from their area,” says Lei, explaining how government subsidies are designed to keep local carmakers alive and competitive.

Experts in India argue that low selling price and premium features cannot be the only means to gain consumer confidence in foreign markets. After all, a brand’s reputation is built after the sale, through service quality, reliability and the ease of procuring spare parts.

Chinese two-wheeler manufacturers know the repercussions of poor service networks first-hand. In the last decade, their budget two-wheelers initially saw good sales volumes in parts of West and East Africa.

But consumers shifted to veterans like Bajaj Auto and TVS that offered robust quality and reliable service. By 2018, the number of Chinese two-wheeler players in the region had declined.

“Similar things can happen in four-wheelers as well if they lose sight of customer support,” says Abhik Mukherjee, research analyst at Counterpoint, an analytics firm.

This time around, Chinese brands in the PV market are focusing on service networks. Chery, which first entered the South African market in 2008, wound up operations after business proved to be unsustainable due to limited parts availability and service quality, says Liu.

In its second stint, the company has set up around 150 dealer and service points, close to long-standing players like Toyota (around 200) and Hyundai (190).

Risky Business

While China’s automakers are clocking impressive volumes, the long-term sustainability of their growth remains uncertain. Apart from BYD and Li Auto, no listed Chinese automaker has reported a full year of profitability. Moreover, intense price wars in the domestic market are weighing on profits.

In contrast, Indian exporters are playing a slower but steadier game, focusing on margins rather than sheer scale. Maruti Suzuki and Hyundai, India’s top two PV exporters, both reported muted overall sales in the second quarter of 2025–26, but profits rose on the back of strong export performance.

Analysts warn that China’s growth story may face hurdles once government subsidies, especially in the EV space, begin to fade. While the direct-purchase subsidy has already ended, tax rebates are going to be slashed to half of what they were earlier.

That will not only make its vehicles expensive to produce but also erode the appeal of EVs in the domestic market, pushing companies further towards export.

So far, markets in Africa and Latin America have been slow to adopt EVs, giving India’s internal combustion engine (ICE) exporters some breathing room. But as markets start to prefer cleaner vehicles, challenges may mount for India-made cars.

India is a mature ICE market while EVs remain China’s strength. “Both sides will continue to defend their turf through their core competencies,” says Vangaal of S&P Global Mobility.

The stage is set for a rivalry that will play out not in Beijing or New Delhi, but on the roads of Johannesburg, Santiago and São Paulo. It remains to be seen who ultimately wins the race for the Global South’s driver’s seat.