In every mature market, there comes a moment when stillness begins to crack and fissures appear on the wall that once seemed unbreachable. That moment has arrived for India’s paints industry.

And the man holding the new brush and a fresh palette is Kumar Mangalam Birla.

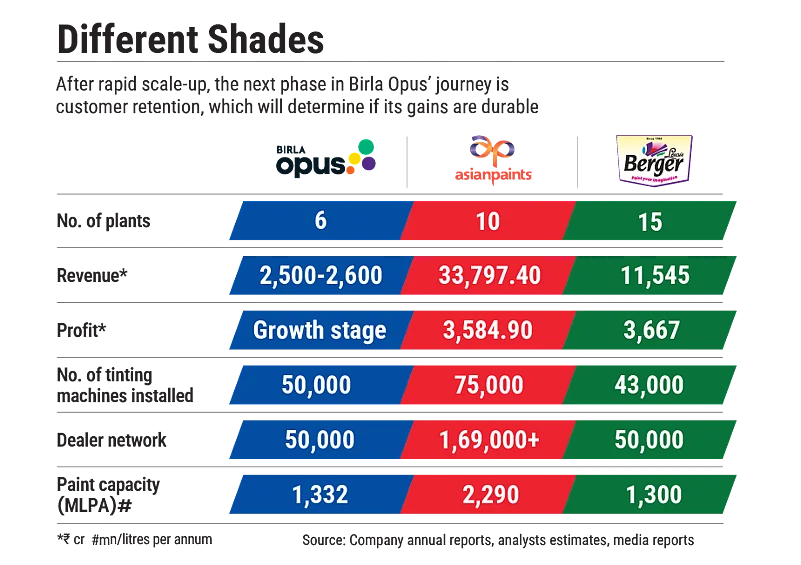

For nearly eight decades, Asian Paints has dominated the country’s paints market with over 50% market share. Its dealer network and supply chain were the envy of the industry. Competitors such as Berger and Nerolac could not unlock Asian Paints’ grip.

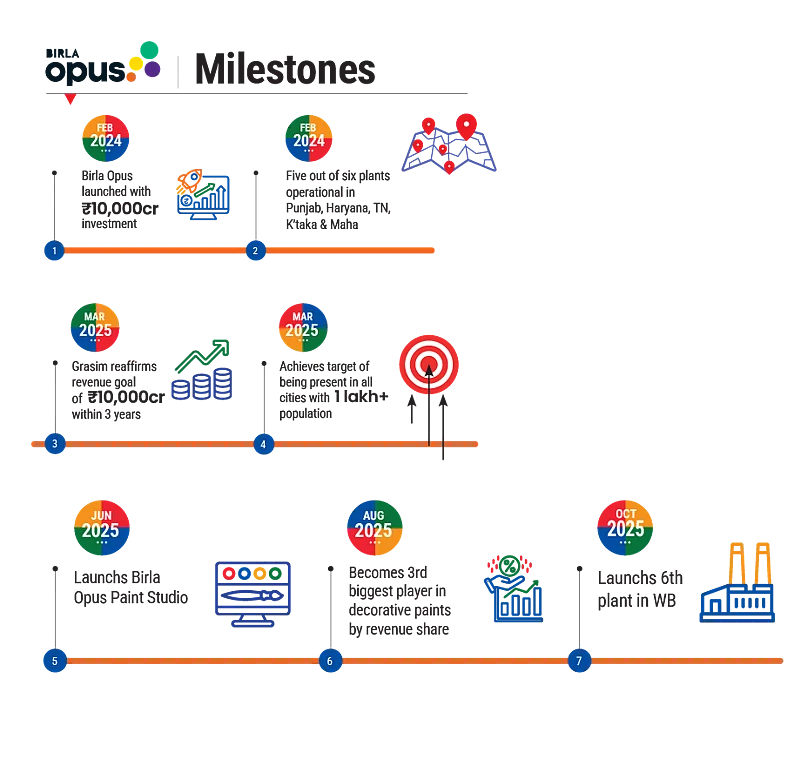

Then came Birla, with a fresh palette and an ambition few expected. In February last year Birla unveiled Birla Opus. The moment signalled more than the birth of a brand. It was the first stroke in a new picture for India’s $10bn paints market.

Grasim Industries, the Aditya Birla Group company behind Birla Opus, had quietly built an infrastructure designed to operate at full scale from day one. The group invested ₹10,000 crore, one of the largest outlays in its history, to ensure that every plant, pipeline and distribution channel was ready for a national rollout. By March 2025, Birla Opus had already entered the top-three decorative-paint brands by revenue.

In an age when the first-mover advantage reigns supreme, Birla Opus is reminding everyone that scale, backed by the capital to build it, still moves markets.

A Calculated Entry

From the outset, nothing about Birla Opus’ entry was small. Three of its six factories went live on day one—an industry first. Nearly 80% of the capital outlay went into production facilities. With products spanning six categories and over 2,300 colour shades, Birla Opus claimed a portfolio even broader than Asian Paints, which offers about 2,200.

Birla Opus is targeting a revenue of ₹10,000 crore and profitability by 2027–28. “To put our launch in a global context, no paints company has ever started with factories, operations, products and services at this scale,” Birla said at the launch.

A year on, the results have started to show. All six plants are now operational. Birla Opus has reached 8,000 towns, backed by 137 depots, the second-largest network in India’s paints industry. Industry watchers estimate that the paints division of Grasim Industries has already clocked ₹2,400–2,500 crore in 2024–25 revenue.

A New Coat

Paints business has always been a magnet for conglomerates. Over the past six years alone, at least four major groups—JSW Paints (2019), Pidilite and JK Cement (2023) and Astral (2024)—have entered the decorative-paints segment. The lure: a booming housing market and an expanding economy.

“These factors build the case for profitability...which is what is drawing many diversified conglomerates with large financial war chests to enter this sector,” says Sunny Agrawal, head of fundamental research at SBI Securities, a brokerage.

Yet behind every glossy wall lies a complex chain of painters, dealers, tinting machines and sales teams, making paints one of India’s toughest consumer-industrial networks.

According to Agarwal, India’s per capita paint consumption is barely 4–5kg, compared to 15–25kg in developed markets. “For a country at the forefront of economic acceleration, India ranks in the bottom 10% of paint consumption. That, to me, represents a galactic opportunity,” Birla said at the launch.

Over the past nine years, the Indian paints industry has more than doubled from ₹43,500 crore in 2015–16 to roughly ₹80,000 crore today. But the order of power had not changed. Asian Paints rules with more than half the market, followed by Berger Paints (17%) and Kansai Nerolac (11%). For every new entrant, this had been the wall that wouldn’t crack—until Birla Opus.

Tint and Tactics

Birla Opus broke convention before it sold a single can of paint by starting where real influence lies. Most paint companies chased customers through marketing. Birla Opus started with the dealers, whose loyalty hinges on a single piece of hardware: the tinting machine.

A tinting machine, an automated device that creates custom shades by mixing colourants into a base, is the beating heart of every paint dealership. No machine, no business.

For decades, Asian Paints has ruled this layer with near-total dominance, with around 75,000 tinting machines across India, more than double its nearest rival Berger. So, when Birla Opus entered the market, it didn’t start with billboards or celebrity campaigns. It began with the machines.

In a market where every dealer pays ₹1.5–2 lakh for a tinting machine, Birla Opus announced it would give them away for free. This sent shockwaves through the industry.

That wasn’t all. The machines were 40% smaller than competitors’, designed for small-town dealers with limited floor space. That single decision disrupted decades of dealer economics and allowed Opus to instal more than 45,000 tinting machines across 50,000 dealer outlets within a year of launch.

However, it knew that a one-time freebie won’t be sticky enough to keep the dealers hooked. So, it also offered 10% extra paint quantity at the same price and dealer margins that dwarfed that offered by rivals.

Further, Opus also wooed dealers by their working-capital requirements. While Asian Paints gives dealers five days to make payments, Birla Opus extended the window to 20, lowering dealer resistance and building loyalty fast.

For these reasons, dealers earn far more when they sell Opus. In Asian Paints, margins average around 4%; in Birla, they range between 12% and 16%.

But the real reason that enabled such a blitzkrieg by Birla lies elsewhere. It was the group’s existing network through UltraTech Cement that became its entry pass, linking to thousands of contractors, retailers and builders.

“Birla’s success stems from Grasim’s distribution,” says Jay Gandhi, analyst, institutional research, HDFC Securities, another brokerage. “It’s one of the few attempts where it seems there could be another serious competitor in an otherwise oligopolistic market.”

Cracks Appear

For Asian Paints, long accustomed to steady growth and dominance, the disruption was jarring. Its market share slipped from 51% to 47% in 2024–25, according to Antu Thomas, research analyst, Geojit Investments, a financial-services firm.

The company’s revenues and profits declined 4.5% and 32% year on year, respectively.

Thomas says while Berger and Nerolac have largely maintained their respective shares, both are facing heightened competitive pressure. “In response, leading players have increased their advertising and promotional spending by 15–20%,” he adds. For Birla Opus, the turbulence was proof of impact. In 2024–25, it seized roughly 7% of the market, triple the most optimistic analyst forecasts, and its revenue share had reached close to 10%, even as the rest of the industry stagnated or declined.

While some, like Asian Paints, responded by expanding offerings and cutting prices, others opted out. Akzo Nobel exited the race, selling its stake to JSW Paints.

Alongside aggressive pricing, Birla Opus also rolled out consumer-facing innovations such as QR codes on paint cans for product traceability, AI-powered visualisation tools that help homeowners preview shades and finishes and a one-year repaint assurance, features previously unseen in India’s decorative-paint market.

Pressure Points

Scale, as always, comes at a cost. The paints business is working-capital intensive, and scaling fast means burning cash even faster. Opus’ no-holds-barred strategy shows up on the balance sheet of its parent, Grasim Industries. Net debt has risen from ₹4,300 crore in 2021–22 to ₹35,402 crore in 2024–25.

“The challenge will emerge when profitability takes centre stage and discounting will need to ease,” says Sachin Bobade, director research, Dolat Capital, a financial-services firm. “They can’t continue that [burning cash to gain market share] for long…The real challenge is to retain consumers.”

The second act will test Birla’s staying power, translating scale into profitability. The paint is still drying on Opus’ big bet, but the industry’s colours have already changed.