You could be excused for thinking B Prasada Rao heads a railway equipment manufacturing company. As we settle into our meeting, bolstered by steaming cups of filter coffee, he delves deep into the technologies that go into making different types of rail locomotives. The talk then shifts to a ₹1,000 crore investment in a greenfield facility at Bhilwara, Rajasthan, to make electrical multiple units (EMUs) and then to the opportunities in the urban metro rail market. All very interesting, but we are in the office of the chairman and managing director of Bharat Heavy Electricals (BHEL) and what is conspicuous by its absence in Rao’s conversation is a discussion on power equipment, the ₹50,015-crore public sector undertaking’s mainstay.

It’s a telling omission. BHEL is India’s largest power equipment manufacturer, with a 57% share in total installed generating capacity contributing 69% to the total power generated; at ₹39,577 crore in FY13, the power business accounted for nearly 80% of the maharatna’s turnover. But now, there are plans to change that. In the next four-five years, BHEL wants to increase the share of non-core business from the current 20% to 30% of revenue and by FY22, that is, the next eight years, wants to take it to as much as 50%. The contribution of the locomotive sector, says Rao, will then increase “from the current 4-5% to 10% of turnover”. It’s a dramatic change and one driven as much by the declining prospects in BHEL’s bread-and-butter business as by growing opportunities in the non-power space. How does the public sector behemoth plan to go about this shift and, more importantly, will it work?

Powerless

First, though, a little background on what’s been happening in the power business. From its inception in 1964 till the mid-2000s, BHEL enjoyed a virtual monopoly in a highly profitable business, supplying power equipment to state and central power utilities. In FY13, though, for the first time in 11 years, the PSU posted a 6% drop in profit after tax and stated it would miss its FY17 revenue target of ₹1 lakh crore. And in Q1FY14, it posted net profit of ₹465.43 crore, nearly 50% lower than the ₹920.90 crore in Q1FY13.

But, truth be told, the business started losing power much earlier. When Rao came on board in October 2009, BHEL was looking set to close FY09 with a record 44,000 MW of orders. By the next year, though, the order book dipped to 40,000 MW. The influx of Chinese power equipment manufacturers over the previous half-decade or so was making its presence felt. The Chinese companies had three pluses in their favour: they were cheaper for the buyers, they delivered on time and they also offered vendor credit at very low rates. As companies such as Lanco, Adani Power, Reliance Power, Vedanta, JSW and even the Haryana state utilities switched loyalties, BHEL saw its market share dropping. By FY12, Chinese companies had grabbed close to 30% of the power market in India.

Turf war

If that wasn’t bad enough, a clutch of private domestic players, in partnerships with big multinational companies, have also been steadily gaining share (see: Turf war). “The power sector was always complaining that the manufacturing sector was not keeping pace with it. In the past, BHEL could roll out only 5,000 MW of power sets every year. It raised its capacity to 7,000 MW in 2007 and to 20,000 MW in 2012. But even that was not enough,” says RV Shahi, former power secretary. A recent report by Citi Research points out that “over the last five to six years, BHEL faced stiff competition from Chinese suppliers. The problem has been compounded by the rise of domestic equipment suppliers like L&T-MHI (Mitsubishi), Toshiba-JSW, Bharat Forge-Alstom, BGR-Hitachi, Doosan, Thermax-Babcock Wilcox, Cethar Vessels and GB Engineering Ansaldo.”

The impact: additions to the order book have dropped steadily from FY09, from 17,020 MW that year to a low of 2,820 MW in FY12; the slight upswing last year, to 7,791 MW, is still nowhere close to what was garnered in earlier years (see: Tripping over). The government came to BHEL’s rescue last year when it increased the import duty on power generation equipment, from 5% to 21%. With increasing murmurs about quality issues in Chinese equipment, the higher price of imported equipment means “the Chinese aren’t such a big threat now”, says Rao. “Power producers in India are now aware of the problems Chinese-produced equipment pose and two, BHEL has been able to successfully outbid Chinese vendors where there is competitive bidding.”

That’s because while BHEL can’t match its Chinese rivals when it comes to price (although with the import duty and rupee depreciation, the price differential has narrowed considerably), it scores on technical parameters such as customising equipment to match clients’ needs and providing a higher output level. The PSU has also won projects from companies that have opted to stick with homegrown suppliers, such as the Jaiprakash Group and Shishir Bajaj group. Sources in the industry point out that the bid for the latter’s 1,980 MW Lalitpur project near Jhansi (to be commissioned by 2015) deliberately didn’t encourage Chinese bidders and the project was won by BHEL. But, the good news for BHEL’s power sector business begins and ends there.

Three strikes and you’re out

It’s not a good time to be in the power business in India. As the Citi report says, “severe coal/gas shortages, high international coal prices, poor [state electricity utility] financials and land acquisition/environmental delays have shrunk the opportunity pie for BHEL.” Of course, it’s not just BHEL; Shahi points out that “all manufacturing companies have been hit on account of a slowdown in the power sector”. Also, points out analyst Pritesh Chheda of Emkay, current boiler turbine generator (BTG) prices have already hit a low. “Current BTG prices are [₹2.3 crore]/MW. This is the ultimate panic price! Because at [₹2.3 crore/MW], a player such as BHEL would generate margin of 17.8% and Ebidta of barely 4-6% at full capacity utilisation. This indicates far higher trouble for the rest of the players,” he says in a report.

But, with limited projects on offer, all power equipment manufacturers, including BHEL, will have to continue to bid more aggressively to win projects. Once the domestic private players indigenise production, they will be able to bring down costs and bid significantly lower prices for contracts. BHEL, by virtue of being a PSU, can’t bid for projects as aggressively as its rivals, both domestic and foreign. The Navin Jindal-promoted JSPL Group’s Godda project is a classic example. Sources say the boiler tender for the project is expected to be awarded to Thermax-Babcock Wilcox as the joint venture has the manufacturing assets on the ground, but no projects in hand. Moreover, says the source, “the price offered [by Thermax] was at variable cost, lower than even break-even”. Extending that logic, it is likely that the turbine contract for the same project will be bagged by the Toshiba-JSW joint venture of the Sajjan Jindal group.

It’s not just in India. According to Credit Suisse India Research, BHEL has also lost overseas orders worth an estimated ₹1,200 crore in the last quarter. Chinese power generation equipment manufacturers have been awarded contracts in Sudan, Uganda and elsewhere. That’s especially worrying in the current scenario, where a depreciating rupee should ideally have put BHEL in a competitive spot as far as exports are concerned.

For his part, Rao puts up a brave front at the potential loss of such large tenders. “We won’t bid for projects where we will have to sell our company,” he declares. Even if you accept that reasoning, BHEL seems especially jinxed these days when it comes to projects — change in government policy has also resulted in it losing out on a couple of occasions. The EPC contract for the 1,320 MW Chhabra project in Rajasthan is a case in point. In 2011, the state government called for EPC bids for two projects — the 1,320 MW Suratgarh project and the one at Chhabra. BHEL was the lowest bidder in the initial tender. While negotiations were on to finalise the contract, the state decided to award only one contract to a company and called for retender. Again, say sources, BHEL emerged lowest in both projects. But the Chhabra project was offered to the second-lowest bidder, L&T- Mitsubishi, which was asked to match BHEL’s offer. “We just don’t know how to tackle this problem,” says a vexed BHEL official. “Such policies make it very difficult for us to bid.”

Now, Andhra Pradesh, too, is believed to be toying with the idea of adopting the same policy for three 800-MW projects coming up at Krishnapatnam, Vijaywada and Rayalseema. “Even if we bid aggressively for all three, we know we will get only one. And if we bid aggressively for one and are lax on the others, we would be subject to public scrutiny since we are a PSU,” says the executive.

It’s not as if BHEL doesn’t have enough work. At the end of Q1FY14, its outstanding order book stood at ₹108,600 crore, which should keep it going for another five years. Trouble is, its 20,000 MW installed capacity is about five times as much as the JV companies (see: Slow and steady) and as fresh orders dry up, it runs the risk of capacity lying idle. Given that BHEL is struggling to get it right in its core business, what are its chances of success in non-core areas?

Non-core to the fore

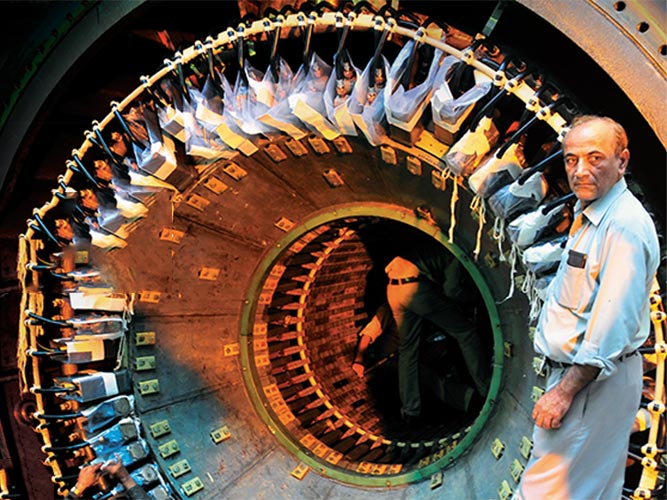

To be fair, non-power isn’t a new business area for BHEL. The PSU has been present in the transportation sector for over 40 years, supplying locomotives to Indian Railways from its factory in Jhansi — 75% of all electrical equipment for the railways comes from BHEL. Certainly, there’s no dearth of orders from the railways. BHEL is now gearing up to supply state of the art, three-phase IGBT-based propulsion systems for 1,400 horsepower AC EMUs and 6,000 hp electric locomotives — hence, the upcoming facility in Rajasthan. Analyst Renu Baid of Batliwala & Karani Securities thinks the plans of expansion in the locomotive sector is a good idea since “transportation can be the next power sector to see huge growth”.

But it’s not quite that cut and dry. Analysts point out that in the railways, BHEL by virtue of being a PSU has been granted contracts on a nomination basis. But “rail transportation” also includes urban metro rail projects and here, it will face stiff competition from companies such as BEML, Bombardier, Siemens, Alstom et al. “Once the transportation sector is opened to competition, it will offer huge business to other players as well,” agrees Sunil Chaturvedi, COO of Bharat Forge and director of Alstom-Bharat Forge.

What makes this business especially tricky is that growth in transportation is dependent on the politically-sensitive railways ministry. And growth in metro rail is dependent on coordination between the urban development ministry and the state governments. Again, BHEL hasn’t had too much luck here. Its strategy for this new business is partnerships, but its tie-up with Hitachi missed out when it came to bidding for the Hyderabad metro project. But Rao is convinced of the potential. “There’s a growth opportunity here in future and we are looking to tie up with a technology partners,” he says.

His other area of interest is an equally tricky one. In the highly competitive photovoltaic (PV) business, BHEL has plans to set up India’s first silicon manufacturing facility in Vidarbha, Maharashtra. With contributions from the National Clean Energy Fund, it intends to set up a 500 MW PV plant, investing ₹1,300 crore. It’s tied up with Abengoa of Spain to set up an experimental concentrated solar power project in association with IIT Jodhpur and Indian Oil Corporation. All good on paper, but the track record of most firms in the solar energy space has been abysmal, which doesn’t lead analysts to hold out hope for BHEL’s venture. “Solar potential would only be realised if we develop the green transmission corridor and ensure cost of manufacturing is low,” says former power secretary Anil Razdan.

AK Puri, MD of Hinduja National Power Corporation and former CMD of BHEL, says there is nothing new in BHEL’s plan to push for growth in non-core areas. “In the mid-1980s, too, it had attempted something similar,” he recalls. But as the company’s track record shows, that strategy did not play out. In fact, in 2000, it had even announced its intention of setting up a non-banking finance company, to bridge the gap in power financing. The idea was stillborn. Around the same time, there was the plan of forming equity partnerships with state utilities to set up large projects using supercritical technology. Except for one project in Karnataka, nothing’s moved on that front. Will the maharatna achieve 50% growth from the non-power business by FY22? Rao has a good story to tell but knows he won’t be answerable if the script goes awry — he will hang up his boots by early next year. Will his successor carry forward this strategy?