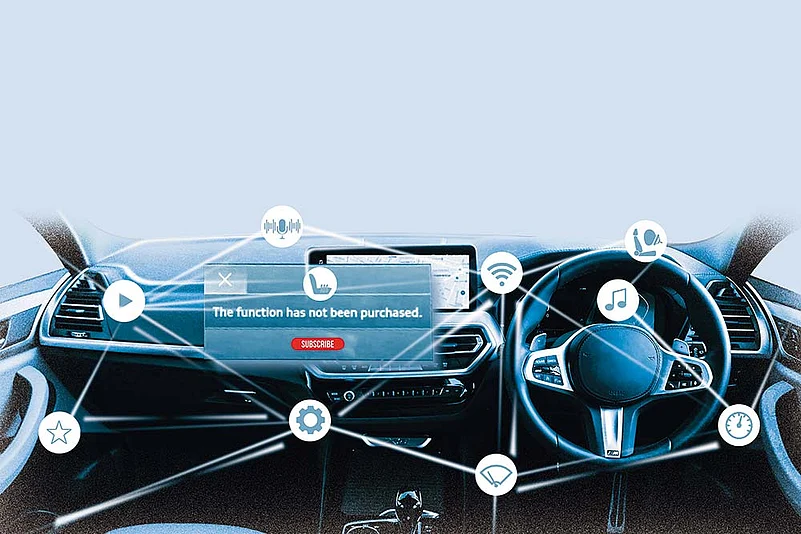

Imagine you live in a cold place. You are on your way back home after a long day at work and it is 5° Celsius outside. The frost on the ground and cold winds make you want to snuggle into your BMW and you reach out to switch on the heated car seat feature to feel warm again. Shockingly, you discover that you must pay a monthly subscription to activate the already installed heated seats in your vehicle. Now, is that not a bummer?

Most car owners were stunned just like that when BMW recently announced that it would charge $18 a month, $180 annually or $450 for the car’s lifetime to activate the heated car seat functionality in Japan, Malaysia, South Africa and several European countries. They felt that this move was unwarranted because they had bought the car with all the necessary components. However, the automobile company placed a software block on their functionality, and buyers had to pay to remove this restriction.

Those not convinced by the subscription model have the option of buying this and other features outright individually. For instance, in the UK, the electronically controlled adaptive M suspension feature can be added retrospectively for £399 through BMW’s website. Similarly, a heated steering wheel will cost customers £200 in the UK and NZ$350 in New Zealand or they can opt for a subscription—for three years (£150, NZ$250), annually (£100, NZ$250) or monthly (£10, NZ$20).

This is not the first time BMW has ventured into the software-as-a-service (SaaS) domain. It first steered into this sector in 2019 when it decided to charge $80 per year or $300 for a 240-month subscription to use Apple CarPlay, a feature many owners consider essential and one that even the cheapest cars provide for free.

Mumbai-based Jaya Khanna, a Mercedes-Benz car owner, however, is reluctant to pay for features like live traffic information, remote engine start through an app or online voice control if such services came to India. “I can always use Google Maps for route planning or predictive navigation. Why would I pay additional fees for this or other services?” she questions. “I have already paid a premium for a high-end car. So, the hardware and the software under the bonnet and within the car should belong to me,” Khanna asserts.

SaaS Pioneers of Auto

BMW is far from being the first auto company to offer paid subscription services. OnStar Corporation, a subsidiary of General Motors (GM), has been providing subscription-based communications, in-vehicle security, emergency services, hands-free calling, turn-by-turn navigation and remote diagnostics systems for over two decades in the US, Canada, China, Mexico, Europe, Brazil and Argentina.

GM is betting big on OnStar, which had 4.2 million paying subscribers in 2021. It predicts that by 2030, 30 million of its vehicles in the US will have connected car technology, leaving it with a serviceable addressable market of $80 billion. At an investor meeting in October, Alan Wexler, senior vice president of innovation and growth at GM, had said that the company expected its in-car subscription services to generate an additional incremental revenue of up to $25 billion by the end of this decade. While $6 billion would be from insurance, the rest would come from one-time purchases and subscriptions.

Last year, automaker Stellantis outlined its strategy to generate about $22.5 billion in incremental annual revenue from software services and subscriptions by 2030. The company, a merger between Italian-American Fiat Chrysler Automobiles and France’s PSA Group, has 12 million monetisable connected cars globally. By 2026, this is expected to grow to 26 million vehicles and generate approximately €4 billion in total revenue. It is projected to touch 34 million cars and about €20 billion in annual revenues by 2030.

According to technology intelligence firm ABI Research, connectivity will be available in over 70% cars in 2028 globally but only 58% of subscriptions will be paid by consumers. Connected services adoption is low, especially among low-tier vehicles. The firm said that the increase in free trial periods means that the ratio of paid subscriptions will contract by 20% between 2021 and 2028.

Revenue in the Car

Experts project a gradually declining revenue contribution from aftersales in the sector at a time when there is an increased need to engage customers throughout the ownership life cycle. This has compelled carmakers to find newer ways to alter the revenue pool.

Vehicles capable of over-the-air (OTA) updates are essential for automakers to generate recurring revenue through newer technologies and subscriptions—from entertainment to driver assistance features. According to Acumen Research and Consulting, the global automotive OTA updates market size is estimated to grow at above 18.1% CAGR between 2021 and 2028 and reach a market value of around $8.5 billion by 2028.

“Many OEMs, traditionally, have had vehicle identification number-focused systems but are now shifting towards a customer- and/or usage-focused view to their systems and operations. That is an important starting point for the SaaS business model,” says Atul Jairaj, director, consulting, Deloitte India. “With increased adoption of electric vehicles (EV) and connected vehicles, additional revenue will be realised through data monetisation (for preventive and predictive repairs, and fleet management). The ecosystem of battery charging and battery swapping is also evolving and we are witnessing the birth of new concepts like battery as a service,” he adds.

Elon Musk’s Tesla is racing ahead to dominate this space. A premium connectivity package is offered on a subscription basis after Tesla’s EV is delivered, costing owners anywhere between $99 and $199 per month based on the features they opt for. In 2016, it even shipped cars with battery packs that had their range limited by software and owners had to pay a fee to unlock the full capacity. This did not go down well with customers, forcing the company to stop offering the software-limited batteries.

Lexus, Toyota and Subaru also invite owners to pay for the ability to lock or start their cars through an app. Toyota charges its US customers a monthly fee to use its app, cloud services, in-car Wi-Fi and other services, including the GPS. Chevrolet’s Super Cruise hands-free driving feature costs Americans $25 per month.

According to Aseem Uppal, principal analyst, connected car, vehicle experience and monetisation strategy, S&P Global Mobility, carmakers are testing hardware-based subscription offerings in some mature markets to understand user preferences. If enough pushback is received, he believes that some paid offerings could even be scrapped, like Tesla did. “Automakers in India have also been offering pure software-based features and connected services packages for years. For new customers, these connected services packages are available free of cost for three to five years, depending on the company. After that, they must pay a fee to renew the services,” he elaborates.

Other industry experts believe that once premium car companies, like BMW, Audi, Porsche and Volvo, have enough data from different regions and have done thorough market research locally, they, too, might offer hardware-based paid subscription packages in India. Mercedes-Benz’s Indian website already offers several digital products wherein customers can log into their account to activate the relevant service.

Enhancing Hardware Efficiency

Connected or value-added subscription services are mainly driven by data and content generated within and outside a car. Vehicle-related data segments hold significant value depending on how this data changes in the future. “Increasing vehicle digitalisation brings about rising development complexities and costs. To shape future changes, OEMs are rethinking the strategies around technical development, while current product development practices are nested in in-vehicle hardware. The focus is shifting, placing software development right at the forefront,” Uppal explains.

With rapid technological evolution in automobiles, software is eclipsing hardware as the primary performance driver, with connectivity across domains emerging as a critical enabler for new features.

A McKinsey & Company report anticipates that by 2030, fully autonomous cars will comprise 15% of the global automotive sales. Automakers are gearing up for massive technological changes, which hinge on a SaaS-based model, collaborating with tech companies like Google and Amazon to drive innovation like autonomous driving, connected vehicles and shared mobility around cloud and software services. With the help of cloud platforms, global automakers can offer connected services like remote diagnostics, eCall (emergency calls) and software updates to generate revenues.

Closer home, Bosch India and Mahindra & Mahindra recently collaborated to develop the AdrenoX Connect vehicle platform in the carmaker’s flagship XUV 700 SUV range.

Modern vehicles can install software and enable or disable features wirelessly without visiting a dealer. With rising connectivity, improving autonomous driving capabilities, modern vehicle platforms and software content, cars are transforming into software-defined transportation tools.

Uppal notes that recent software-enabled innovations in internal combustion engines, like rapid stop-start technology, minimise idling while variable valve timing improves efficiency. Software is even more critical for EVs, particularly for trade-offs between performance and range. The latest automotive innovations, including intuitive infotainment, cloud connectivity, OTA update, virtual personal assistants, self-driving abilities and electrification, depend less on mechanical ingenuity and more on software quality, execution and integration.

“The transition from relatively mechanical-driven vehicles to digitally enabled platforms led the underlying architecture to grow in complexity and cost. The growing consumer demand for connected features and driver assistance systems warrants a shift to the electronic architecture and the supporting software ecosystem. The increasingly interconnected systems are laid on top of multiple software layers to manage the transmission, analysis and actuation between the different components and subsystems,” Uppal notes.

The Driving Force

With the growing digitisation of cars, more automakers in India are expected to join the ranks of their peers already offering hardware-based subscription models. While luxury automakers will initially tread this path, since their deep-pocketed, digitally savvy customer base is more likely to opt for the incremental costs, mass-market cars will soon follow their track.

Jairaj points out that thanks to pay-as-you-go options becoming common in other sectors, along with the rise in convenient payment options, customers are a lot more comfortable and amenable to subscription services options today than ever before. According to Deloitte’s 2022 Global Automotive Consumer Study, customers in India are, by and large, willing to share personal data generated from a connected vehicle if it helps improve experience related to maintenance, vehicle health, road safety or insurance.

“Customers are also attracted by the concept of OTA updates, which imply that the carmaker has the ability to roll out features, enhancements, etc. remotely without the need for the customer to take the car to a dealership. This opens up a plethora of possibilities for the carmaker, given the hardware is already installed,” he notes.

However, given that the country is a cost-conscious market, automakers must present a unique and specific use case for India. Uppal suggests dipping their toes in the water with subscription services like range extender, suspension variation, smart route planners, etc., which will capture the fancy of buyers of EVs.

“Most luxury automakers focus on EVs where the vehicle platform is most important. EVs, like BMW iX, Mercedes-Benz EQS and Volkswagen ID series, are built on new platforms that enable end-to-end software updates, allowing automakers to tweak the vehicle functionality once it is sold,” he notes.

Data is definitely the new oil in the automotive industry as buying decisions are increasingly driven by the quantum of technology packaged within a car. The rapid adoption of digitally enabled systems will significantly increase the complexity of the underlying software functions and interfaces.

Carmakers must transform beyond product sales and focus on data centricity and the usage of the data generated by the car for use cases like personalisation. Jairaj believes that they need to invest in a strong analytics backbone that churns this high volume of data generated by car sensors into meaningful and actionable insights. This can then be reused to improve vehicle experience or data monetisation as applicable.

Forward-thinking automobile companies have already started donning the mantle of being tech-first mobility providers rather than just car manufacturers. After all, they can either press the accelerator now or get engulfed by the dust left behind by their speedier competitors zooming past them.