As someone who helps start-ups raise venture capital and prepare for their next round of funding, Pushkar Singh, partner at Tremis Capital, is a stickler for numbers. Keeping a hawk’s eye on the unfolding trends in the fintech marketplace, he has noted that Indian fintech start-ups are struggling, despite having raised $5 billion in 2022.

“This is a significant drop from the $10 billion number of 2021 but still a step up from $3.5 billion in 2020,” he notes. Grill him further, and he reveals that this decrease in funding is primarily due to a smaller size of late-stage deals where the valuations have decreased due to the global slowdown in venture funding. However, he does not see a massive impact in early-stage deals.

His observation is belied by Tracxn’s Geo Annual Report: India Tech 2022. According to it, despite receiving more investor attention compared to start-ups in other sectors, fintech in the country is not immune to the effects of the funding slowdown and has seen a drop in funding of 41% in 2022 compared to last year.

One reason for this disruption to the fintech sector was the RBI policy prohibiting non-bank financial institutions (NBFIs) from loading their prepaid instruments using credit lines. This ruling has impacted the business model of companies like Slice and Uni Cards.

Furthermore, with cryptocurrency experiencing major volatility in asset prices this year, crypto exchanges across the globe are facing operational difficulties.

Neha Singh, co-founder of Tracxn, says, “Rising interest rates and fears of global recession have led to investors becoming more risk-averse, continually slowing down the funding momentum in the Indian start-up ecosystem. The funding winter, which began in Q4 2021, will persist in 2023 as well. To survive the drought, start-ups are taking unit economics more seriously, illustrated through the series of mass layoffs this year.”

She admits that although the industry is currently experiencing a slump, the situation is prompting start-ups to establish more precise and sustainable paths to growth as investors’ evaluation metrics begin to emphasise good profitability over growth at all costs. The writing is on the wall, and most research agencies repeat the etchings.

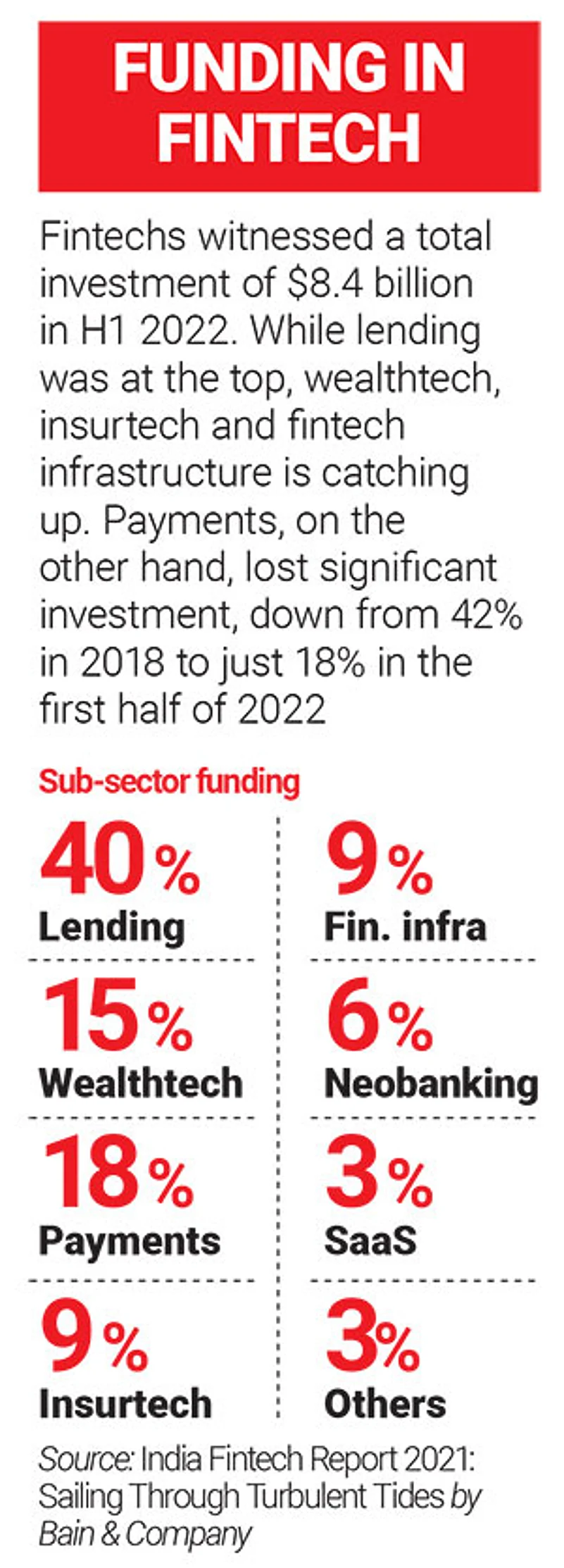

When Bain & Company conducted a survey for its India Fintech Report 2022, it found that 88% of the investors viewed the sector as an attractive opportunity due to the existence of a large, addressable market. But it warns against increasing regulatory and compliance scrutiny, concluding that global headwinds to funding will see consolidation in the sector.

Interest for Non-Digital Payment Companies

While strong demographics, increased digital adoption, low penetration of banking channels and the demand for simpler and more transparent customer journeys have defined the irresistible rise of fintechs in India, another trend is underway within the sector. And that is of slowing interest among investors when it comes to backing digital payment providers. Instead, they are increasingly inclined to invest in companies from other domains of the fintech ecosystem. The reasons are simple: The space of digital service providers has matured; established players such as Google Pay and WhatsApp Pay are casting a long shadow leading to fewer entrepreneurs wanting to have a start-up in providing online payments. Other aspects of fintech such as insurtech, wealthtech and lending hold larger prospects of disruption. Not to forget the entry of Jio Financial Services.

Experts add that data at the disposal of digital payment providers could have been a massive attraction for investors, but lack of clarity on two legislations around data protection and privacy has dampened spirits.

Number crunching as always, Pushkar shares that in Q2 FY23, online payment companies accounted for a meagre 11% of the fintech funding. “The chief reason for this low amount is that a majority of the payment fintech companies are already in their late or pre-IPO stage and have little differentiation in features. For example, Razorpay, Billdesk or CitrusPay broadly offer similar features,” he points out.

Insurtech, on the other hand, has received better funding because start-ups in this sector are in their nascent stages, and the potential to disrupt the industry is huge. Traditional insurance is a broken industry and insurtech companies will sooner or later wrest the market share from these incumbents.

This trend is visible worldwide. The BCG’s India Insurtech Landscape And Trends report shows that global funding in insurtechs grew 7 times in the last five years. Closer home, in India, equity funding in this domain has doubled in the previous two years, going up from $380 million in 2019 to $800 million in 2021.

For which Sector does the Bell Toll?

The question now is whether online payments, the once shining star of India’s fintech sector, is no longer a lucrative opportunity for investors. Tanul Mishra, founder of Bengaluru-based fintech-focused incubator Afthonia Lab, sure seems to think so.

Nruthya Madappa, director of early-stage venture capital firm 3one4 Capital, also notes that the core rails for payments in India have matured and larger winners in the space are now driving consolidations. Several revenue-generating business models that leverage the core payments stack with opportunities for significant market expansion have emerged today.

Beyond payment service providers, specialised solutions across banking, lending, and insurance stacks continue to attract investor interest. Fintech, SaaS and infrastructure that leverage these stacks are other sub-sectors of key interest, leading to deeper capabilities and access. For instance, as co-lending accelerates due to regulatory support, there is a need for underlying infrastructure and banking software to service this scale-up.

Madappa adds, “Other emerging tailwinds influencing what innovative start-ups are being built around include supply chain financing, real-time lending over payment flows, cross-border finance, product and distribution expansion into Tier III India and beyond, verticalised solutions for specific sectors of consumers and deeper partnerships between banks and platforms.”

Insurtech Gains Traction

There are opportunities in other areas of the fintech sector because of possible interest rate arbitrage between different geographies. Many start-ups like Open, Cashfree Payments, Fairexpay and PayNearby are solving real-time issues like cross-border payments, while B2B lending and ecosystem enablers like Oxyzo and Decentro are also seeing great traction in rural parts of India.

There is a lot of interest in insurtech as well.

According to a 2022 McKinsey report, venture capital investment has grown faster than the more mature private -equity or public -markets funding. “In 2021 alone, the total amount of VC invested in insurtechs surpassed $11 billion, double the amount invested in 2020. In addition, private -equity investors are increasingly looking to invest sooner, further increasing the amount of capital flowing into the market,” it states.

According to Mishra, this interest is likely to remain flat this year in India, primarily because of LIC’s tepid performance on the stock market and the ongoing funding winter.

However, the good news is that start-ups in the space are constantly innovating to disrupt this highly complicated and significantly regulated space.

“Insurtechs are looking beyond life insurance and getting into newer categories focused on a particular segment. There are a few targeting just the SMEs and others providing micro-insurance for gig workers using data analytics and deep tech,” she says.

White Spaces Abound

According to the Economist Intelligence Unit Report 2021, India has emerged as the global leader in UPI-based transactions as the country worked to modernise its payment systems. But the biggest innovation was spearheaded by the Indian government and continues to be free of cost. As a result, while India sees a continuous movement away from cash, start-ups focusing only or majorly on providing online payment services are no more the toast of investor-town. Case in point, the fate of Paytm at the Indian bourses. “We see continued expansion away from cash, PGs, PAs and POS providers to the full-stack merchant and cross-border payment solutions,” Madappa states.

Certain white spaces still exist in the backend processes in the payments space for a start-up to monetise. Since no banking interface is required for the transaction of digital rupee, digital payment fintech companies are likelier to go beyond their existing ambit to introduce features or services that could lead to massive adoption of this digital currency.

Those that stick to their lane of focusing on digital payment transactions will soon find themselves edged out by peers. This will happen faster than they can anticipate, considering the significant headwinds in operations, fundraising and regulatory challenges.

India’s household consumption and MSMEs continue to be underserved by formal credit, with credit penetration in most living expenditure categories hovering at less than 5% for households. According to Bain’s India Fintech Report 2022, MSMEs also lack access to formal credit, with more than 60% relying on costly informal sources of credit.

Fintech companies that can bridge this funding gap and offer other ancillary fiscal services are the others that will capture investor eyeballs. Could this signal a consolidation in the fintech sector through M&As based on clear differentiation in their respective value proposition? Only time will tell.