Imagine going into an investor’s office, to ask him/her to put money into building a manufacturing facility, and all you carry to make the presentation is your mobile phone. Sounds improbable?

But, a virtual-reality (VR) walk-through of a factory with the viewer interacting with his environment using just a mobile app is already a reality. L&T Technological Services (LTTS) has made it possible.

The portfolio of LTTS, which is one of the few pure plays in engineering services with a global scale, is more new age and its service portfolio more relevant than its peers. For example, the app-controlled simulation described above would fall under LTTS’ bid and asset management services, which include virtual-reality (VR) enabled product catalogues and augmented-reality (AR) based machine inspections. In another example, using its HoloLens-based application, it has helped a client use mixed reality to train its operators to replace a valve without help from the maintenance staff. The solution was built to be scalable, allowing the client to add any number of tutorials.

Similarly, LTTS’ expertise in plant-engineering along with its skills in embedded systems and semiconductor design is potentially a huge advantage with the coming IoT revolution in manufacturing. The company has 49% of its revenue coming from digital engineering and newer technologies such as IoT, AI and digital thread as of 3QFY21.

It has a great breath of vertical expertise, which makes it unique among its Indian peers. Creditably, this Vadodara-headquartered company has been identified as one of the best service providers to make the leap with industry 4.0 technologies, in Everest Group’s 2020 report. The selection had been made based on various parameters such as market adoption, portfolio mix, value delivered, innovation and investments, delivery footprint, and vision and strategy. There is also evidence of LTTS’ superior digital engineering services portfolio in its deal wins. One example is a recent $100 million-plus, five-year deal win in the oil and gas (O&G) vertical in the US, where LTTS is providing multi-discipline plant-engineering activities, from making sure the plant runs smoothly (site sustenance) to automating functions (control automation). It will be the primary engineering partner to support the O&G major’s integrated refining and chemicals manufacturing facilities, which are among the 10 largest downstream sites in the US.

Another recent win that validates the relevance of LTTS’ service portfolio is the multi-year engagement with Schindler (a global leader in elevators, escalators, moving walks and related services) to help the latter accelerate its digitisation and connectivity initiatives. LTTS is expected to provide the Switzerland-based company with services such as creating digital twins and enhancing wireless connectivity of its products.

LTTS is building digital engineering credentials in aerospace with its partnership with Airbus for the latter’s ambitious Skywise programme. The Skywise platform is an open data platform, which brings together in-flight, operational and maintenance data, developed by Airbus for the aviation industry. Using the platform, Airbus can connect the entire aviation ecosystem to better understand aircraft operations — from a single aircraft to large multi-aircraft fleets — and at each stage of the aircraft life cycle. We think that investing in developing such a capability during an industry downturn is an important strategic step that will help the service provider take advantage of the industry recovery when it happens a few years down the line.

LTTS is building digital engineering credentials in aerospace with its partnership with Airbus for the latter’s ambitious Skywise programme. The Skywise platform is an open data platform, which brings together in-flight, operational and maintenance data, developed by Airbus for the aviation industry. Using the platform, Airbus can connect the entire aviation ecosystem to better understand aircraft operations — from a single aircraft to large multi-aircraft fleets — and at each stage of the aircraft life cycle. We think that investing in developing such a capability during an industry downturn is an important strategic step that will help the service provider take advantage of the industry recovery when it happens a few years down the line.

LTTS keeps expanding its service portfolio with investments in new partnerships such as its recent certification as a Consulting and Professional Services Partner for Amazon Alexa Voice Service (AVS) Integration in various connected devices across multiple industries. For example, one can connect any device to Alexa, from lighting, switches and kitchen devices to door locks, routers and smart clocks. Where LTTS probably lags behind a global rival like the California-headquartered GlobalLogic is the UI/UX skills and design labs, and scaled up specialist software practices such as GlobalLogic’s Atlassian practice, which offers Jira Service Management, to help organisations make their service desks more efficient. On the other hand, LTTS has developed some successful intellectual property (IP) such as i-BEMS, which helps build and manage smart buildings and campuses, and is available on the Azure cloud or its predictive maintenance solution Avertle which uses machine learning (ML) and AI. LTTS has deployed over 150 instances of Avertle for over 35 equipment types (such as electric motors, chillers, diesel generators, HVAC) for over 15 global customers. LTTS has also developed its own narrow band IoT (NB-IoT) solution called nBoN. NB-IoT is a new cellular radio access technology to address the fast-expanding market for low-power, wide-area connectivity. nBoN has use cases ranging from smart metering, smart lighting, asset tracking, smart parking and smart agriculture.

The breadth of its clientele is one key aspect where LTTS scores over other pure play engineering services firms that are centred around a single industry (such as KPIT) or have an outsized exposure to a couple of clients (such as Cyient).

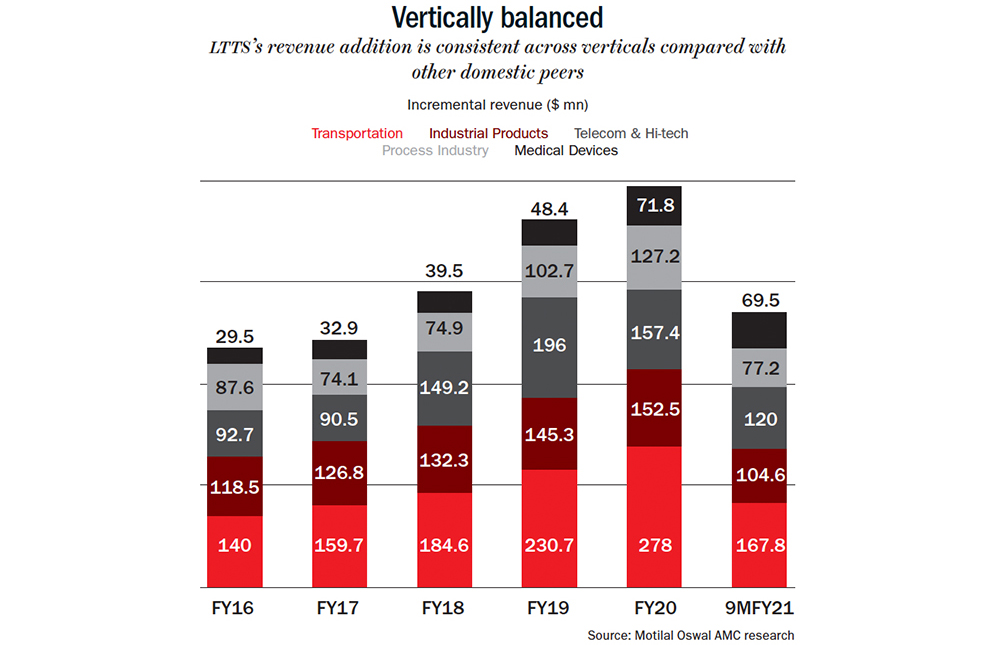

Even within individual industry segments such as transportation, LTTS has a broader portfolio versus its India peer group and has a minimum critical size as well for its practices. This is evident from its broad-based revenue addition over FY15-20 (See: Vertically balanced).

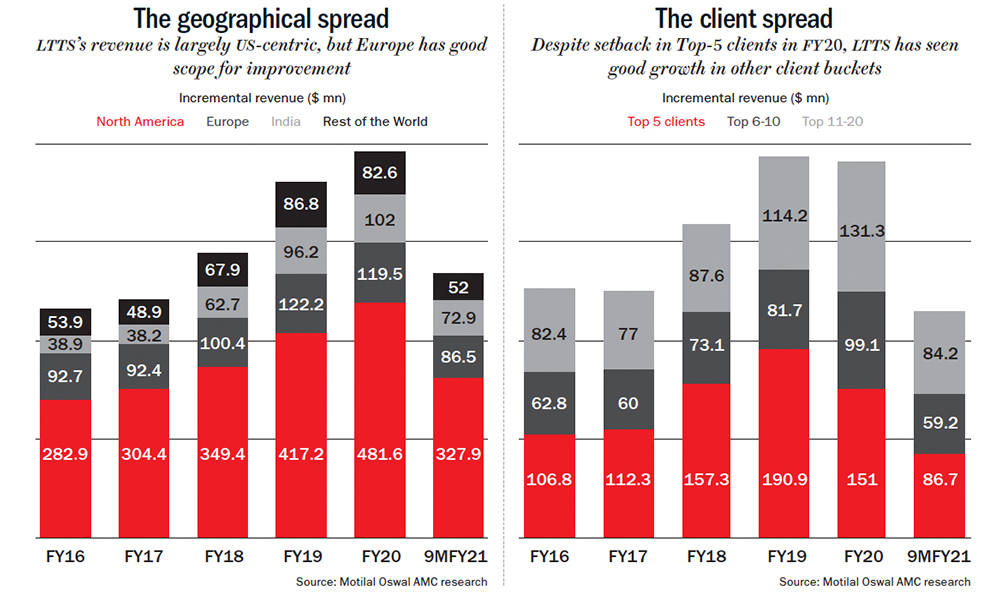

The company is also not dependent on a single geography. While the US has been a steady driver of revenue growth, its Europe operations have scope for improvement. We expect a tuck-in acquisition to improve its business in Europe (See: The geographical spread).

Its top-five client bucket has been a bit volatile after it lost the Cisco rebadging deal, when the latter sold the division to a private-equity firm that decided to in-source and rebadge LTTS employees. But LTTS’ client-mining strategy of focusing on its top-25 clients and then trying to add the adjacent three clients for each of these seems to provide it a robust funnel of deals (See: The client spread). Despite a significant decline in incremental revenue from its top-five clients over FY20, LTTS managed to clock 8.7% growth overall. LTTS’ clientele includes 69 Fortune 500 clients and 53 of the top-100 ER&D companies globally. We see plenty of headroom for LTTS to scale up these relationships.

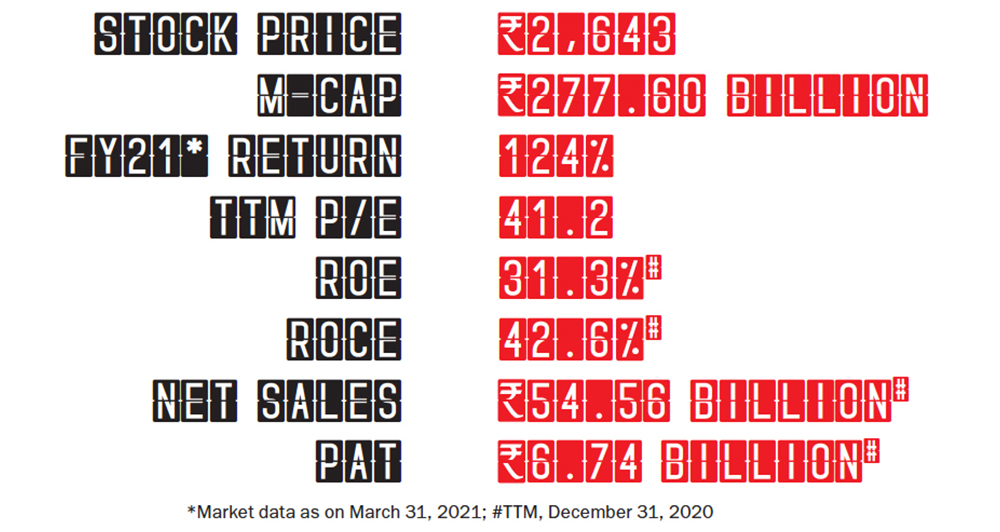

We expect that FY22 will be another year of over 20% growth for LTTS given its strong deal momentum. FY23 could also see mid to high-teens revenue growth or better as transportation vertical continues its revival and large aerospace clients such as Collins Aerospace and Airbus start ramping up again.

In terms of valuation, LTTS definitely deserves a premium over other pure play engineering services firms such as KPIT or Cyient because of its clientele, as mentioned earlier. But a good benchmark to compare LTTS with globally is GlobalLogic. The latter has 19,000 employees while LTTS has 16,000 globally, and the service portfolios of both have a substantial overlap in verticals such as energy and utilities, and manufacturing and industrial.

Between the two, LTTS seems like a steal. Let’s look at the numbers around GlobalLogic. Hitachi acquired GlobalLogic in March 2021 at 29.4x CY22 EV/EBITDA. If we use a similar multiple, we arrive at a valuation of $5.7 billion for LTTS versus the current EV of $3.7 billion — an upside of 50%. If we use the EV/sales multiple on CY20 revenue of $770 million for GlobalLogic and use the same multiple on LTTS’ CY20 revenue of $734 million, we arrive at an EV of $9.0 billion for LTTS versus the current EV of $3.7 billion (as LTTS has ~$200 million net cash as of December 31, 2020). This lends enough and more room for upside.

Disclosure: The writer does not have any personal holding in the stock, but it is part of the PMS portfolio that he manages.