In the early nineties, comic books in India were coming of age. Complexity was being added to stories and outlines of characters, and graphic novels were just a few years away. The books were a preoccupation with most adolescents, but not Asit Bhandarkar (then in the eighth grade). He was more fascinated by financial dailies, which were running stories of “Big Bull” Harshad Mehta.

The pink papers were full of his exploits and magazines wrote of his flamboyant lifestyle, including his Mumbai penthouse with a mini golf course and imported fleet of cars. “It was simply incredible for me as a kid to know that someone could increase wealth so fast by investing in the stock market,” recalls Bhandarkar. It seemed superheroic.

In a year, in 1992, that myth fell apart. Mehta’s scam was revealed, detailing how he had manipulated the market, taken advantage of the loopholes in the banking system to finance his buying and siphoned off funds in the process. Bhandarkar was absorbed by how fast it unraveled. People were committing suicide, criminal cases were being filed and the market came crashing down. “At that time, I thought to myself that the stock market is a different animal that needs to be scrutinised and analysed to develop further understanding. And that’s how my interest in the stock market began,” he says.

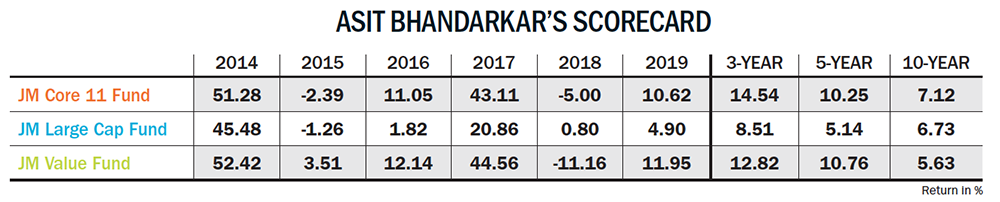

This interest soon developed into a passion, and eventually, profession for Bhandarkar, who currently handles four funds at JM Financial Asset Management. “I am one of the luckiest few people who chose where he wants to be and managed to reach there,” says Bhandarkar, who holds an MBA in finance. He handles the JM Arbitrage Fund, JM Value Fund, JM Large Cap Fund and JM Core 11 Fund — each catering to a different investment need. And across these funds, Bhandarkar has been able to deliver consistent return to investors, year after year.

Learning Ground

Bhandarkar’s success lies in his ability to identify opportunities and then to build skill-sets to capitalise on them. For instance, he says, during his MBA in 2000-02, he observed that there were few jobs in the capital markets. But, at the same time, there were few takers for the job of a pharma analyst. Incidentally, his father worked in a pharmaceutical company and Bhandarkar was familiar with industry jargon. Therefore, he did his summer intership as a pharma analyst at a leading private sector mutual fund. Similarly, taking the contrarian route, when the dot-com bubble burst and people lost interest in tech businesses, Bhandarkar began tracking that space.

After completing his masters, Bhandarkar started his career on the ‘sell’ side, as a research analyst with Sushil Finance Consultants for a year. This stint helped him study a company in-depth and demanded a rigour that sharpened his accounting skills. At the same time, it left him craving for more. “I knew a lot about the 20 companies I tracked as an analyst. But I was just holding a piece of the puzzle. I wanted to work on the larger picture,” he says.

Not surprisingly, he jumped at the opportunity of becoming a junior fund manager at SBI Mutual Fund. “On the ‘buy’ side, what matters most is our decision-making skills. I would also visit plants, meet managements and do thorough research to fine-tune my understanding of the business and the macro indicators,” he says. After spending two years at SBI MF, he worked with Lotus India AMC as a fund manager for a year. And, in December 2006, he joined JM Financial Asset Management. He grasped the gravity of what a fund manager does only when he became one. “Before that, when I read about Warren Buffett having a ~ 28% CAGR over his investing career, I would wonder what was the big deal about it when we saw so many stocks doubling every year?” he laughs at his early ignorance. Bhandarkar soon realised that it’s not child’s play to deliver consistent return for decades.

Tracing the Waterfall

Tracing the Waterfall

He adds that the fund house’s philosophy is in alignment with his investment strategy. “It believes in strong fundamentals, follows a cautious approach and takes measured risk,” he explains.

The fund house prefers to stay away from companies that have a tendency to guzzle cash, raise huge debt, or those that have regulatory or corporate governance issues. “We also never bet on possibilities of a turnaround. We like to buy success, not the possibility of success,” he says. The idea is to buy liquid stocks and hold on to them, as a result of which, the churn-rate in most of its schemes is low.

It seems like common sense but of course there are finer filters added. Bhandarkar follows what he calls the ‘waterfall’ checklist. It has to flow smoothly in the right direction. The right business would be scalable, have a simple corporate structure where things do not get lost in multiple subsidiaries, and have a management that is competent, has a vision and does not compromise on corporate governance. Lastly, the company needs to have solid cash flow. “It is a concern for an investor if a business requires money continuously from outside. Markets are cyclical in nature and the company may end up getting stuck in a down cycle, and a great idea may collapse,” he says. Bhandarkar also tracks macro cues while picking stocks, and is always on the lookout for sunrise businesses in sectors which have opportunity to scale up in India.

Once a ‘winner’ has been identified, he believes in scoring a homerun. “A few of the stocks in our portfolio are not cheap. That is because we have realised if you sell a winner before it has played out, then you are doing injustice to the investor. You have to go the distance,” he says.

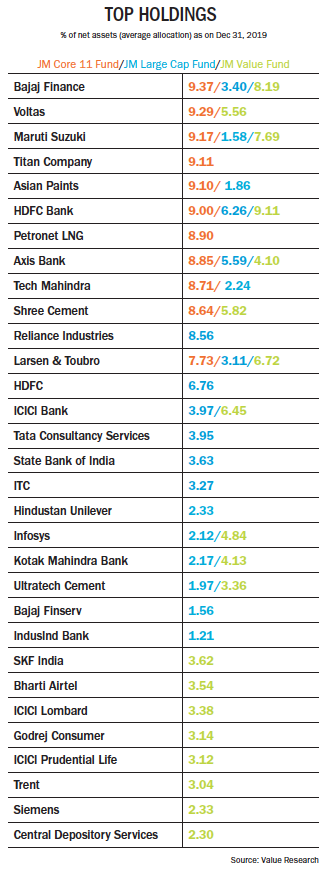

For instance, he has held on to Bajaj Finance for a while now. This NBFC was known as Bajaj Auto Finance in its earlier avatar before it morphed into a full-fledged financier. Bajaj Finance achieved robust growth because of its unique proposition of providing small loans for various aspirational needs of the Indian consumer. The management had a straight-forward business model, a clear view of how they wished to expand the business and huge credibility as a business group. After tracking their growth for a couple of years, Bhandarkar entered the stock in 2012. Since then, it has grown at CAGR of 68%.

Fund Formula

Application of the ‘waterfall’ mantra can be seen in the recurring names in his diversified funds — HDFC Bank, Reliance Industries, Asian Paints and HUL. This is because not only are these the best performers in their sector, they also constantly innovate, keep adding newer products and services and are ahead of competitors in identifying trends. He says, the stocks in his portfolios have performed because their business has done well and they have a clear runway of growth.

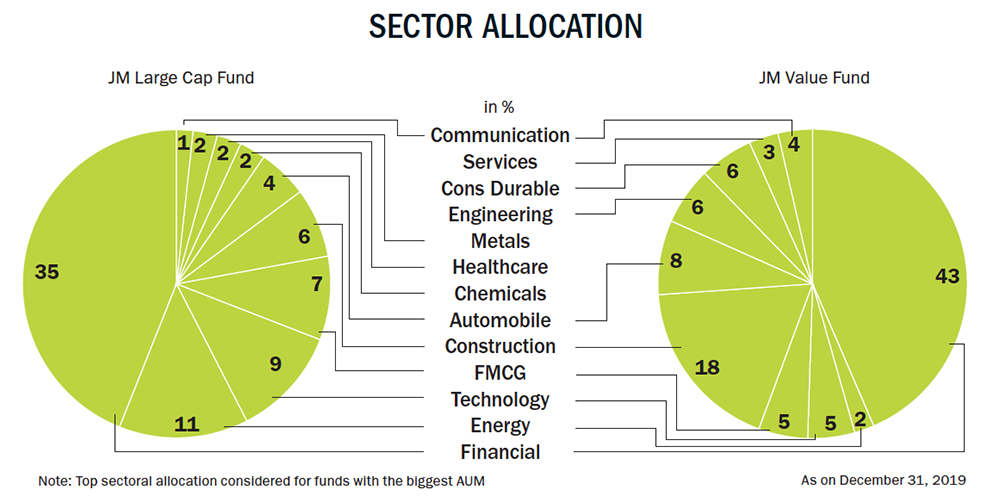

One of the key funds led by Bhandarkar is JM Large Cap Fund, which he has handled since 2017. With an AUM of Rs.33.08 billion as on December 31st, 2019, the fund primarily invests in big companies and is thus, best suited for conservative investors. Over the past five years, it has delivered a CAGR return of 5.14%.

Another fund he has been managing since 2009 is Core 11, which is the only one in the entire industry that has just 11 stocks. Bhandarkar says that, in this, the individual brilliance of a high growth company outshines that of the sector. “A sector can be fully absent or loaded in the portfolio. But it is driven by the stock and not by the sector,” he says. Delivering a 5-year return of 10.25%, this fund comprises best-performing companies such as Bajaj Finance, Shree Cement, Asian Paints and HDFC Bank, among others.

Another fund he has been managing since 2009 is Core 11, which is the only one in the entire industry that has just 11 stocks. Bhandarkar says that, in this, the individual brilliance of a high growth company outshines that of the sector. “A sector can be fully absent or loaded in the portfolio. But it is driven by the stock and not by the sector,” he says. Delivering a 5-year return of 10.25%, this fund comprises best-performing companies such as Bajaj Finance, Shree Cement, Asian Paints and HDFC Bank, among others.

In Core 11, one challenge comes from the SEBI regulation that stops funds from raising the holding of a stock to more than 10% of a portfolio. So all the 11 stocks hover between 7-9% in the fund, and that is a delicate balance to maintain. “If you have 9% weight and, if the stock falls even 20%, your fund loses 2%, and that is a lot. The margin of error is less,” he says. At the same time, managing this fund has enabled him to sharpen his focus on identifying real winners. “Discipline is critical. We are fine to let go of 10 money-making opportunities, but we avoid anything where we could remotely lose. We avoid distractions and taking short-term bets,” he adds.

While in Core 11 he sticks close to the rules, in Value Fund (which he has been handling since 2006) Bhandarkar follows a contrarian style of investing. It invests in stocks that are trading below their intrinsic value, and provide a ripe investment opportunity. Consequently, the fund has delivered a CAGR return of 10.76% in the past five years, beating the benchmark index S&P BSE 100 that delivered 8.39% in the same period, according to Value Research. Bhandarkar points out that impact of disruption is difficult to ascertain in the short term. “Managing the Value Fund is tricky. You don’t want to get stuck with a stock just because it is cheap and then find out later that it was cheap for the right reason,” he adds. So they churn the portfolio of this fund usually when market provides the opportunity. Bhandarkar quips that internally, they call this a ‘Vulture’ fund, because it swings into action when good stocks are going cheap.

Consider how this fund picked up Titan in 2016. For a long time, the company had been trying to make inroads in the highly unorganised jewellery market with its brand Tanishq. But in 2016, with the demonetisation drive, things changed swiftly. Cash was and is still king when it comes to jewellery buying, and the currency withdrawal resulted in 5-6% drop in sales, in the November-December period. Subsequently, its stock price dropped from Rs.370 to Rs.315 within five trading sessions post the announcement. P/E corrected from 55.4x for FY17 to 39.6x for FY18. However, introduction of GST in 2017 would result in Tanishq gaining market share from the unorganised segment. This served as a classic entry point for Bhandarkar’s Value Fund, which swooped in. The stock has since risen 218% to Rs.1,280 in January 2020, and currently trades at a steep valuation of 62x for FY20.

Consider how this fund picked up Titan in 2016. For a long time, the company had been trying to make inroads in the highly unorganised jewellery market with its brand Tanishq. But in 2016, with the demonetisation drive, things changed swiftly. Cash was and is still king when it comes to jewellery buying, and the currency withdrawal resulted in 5-6% drop in sales, in the November-December period. Subsequently, its stock price dropped from Rs.370 to Rs.315 within five trading sessions post the announcement. P/E corrected from 55.4x for FY17 to 39.6x for FY18. However, introduction of GST in 2017 would result in Tanishq gaining market share from the unorganised segment. This served as a classic entry point for Bhandarkar’s Value Fund, which swooped in. The stock has since risen 218% to Rs.1,280 in January 2020, and currently trades at a steep valuation of 62x for FY20.

Composed Stance

Despite his stellar record, Bhandarkar prefers to maintain a zen-like attitude while taking his investment decisions. “Every decision we make can have a binary outcome. It can be either right or wrong with 50% probability. All we do is monitor our original investment hypothesis, and keep tracking the company for any early tell-tale signs such as drop in quality of earnings,” he says.

Besides that, an increase in debt or loss in growth momentum is also a key concern. For instance, with Eicher Motors, the biggest differentiator was their bikes. It could never reach the volume of Bajaj or Hero, but continued to make huge margin in its niche space. But around 2018, the waiting period for the bikes started to come down owing to increase in production and stagnation in demand. This usually leads to higher discounting, which meant there was a risk of margins contracting and PE getting compressed. Accordingly, the fund trimmed its exposure to the stock.

The story was however different with Yes Bank, a stock they entered over a decade ago and which delivered phenomenal return with its high-risk lending. To be fair, no one anticipated the sudden fall in the stock, which occurred after the outbreak of the IL&FS crisis. Value destruction happened sooner than expected and Bhandarkar was quick to exit the stock.

Meanwhile, for an otherwise sector-agnostic Bhandarkar, financials sure seems to be a favourite. “India is a young and aspirational country, which is getting financialised and with last-mile connectivity improving, we remain extremely positive about the Indian economy,” he says, explaining his stance. But he says that the underlying theme is ‘consumption’. As more and more people cross higher income thresholds, India has a compelling opportunity to become “the consumption capital of the world”, he believes.

He is an optimist but a conservative one. “On the macro side, one word summarises what we see in the year ahead — disruption, either regulatory or business environment or competition driven. We want to invest where there is clarity. Investment cycle will pick up but we can’t predict accurately when that will happen, and we don’t want to speculate. We aren’t consciously in that game,” he says. Instead, Bhandarkar trusts transparency and patience, both which have served him well.