A remark made by his mother when he was barely a teenager still brings a smile to Dilip Suryavanshi’s face. His father was in the police department and the family had to undergo the torture of him being transferred almost every other year. The challenge of getting the children into new schools and adjusting to a new environment meant Suryavanshi’s mother eventually ran out of patience. “Khud, kuch karo,” Janaki Devi would often snap in frustration. “I don’t think she advised me to start my own business but that’s what I ended up doing. There was no joy in working for someone,” says the 61-year-old, who today is the chairman and managing director of Bhopal-based Dilip Buildcon.

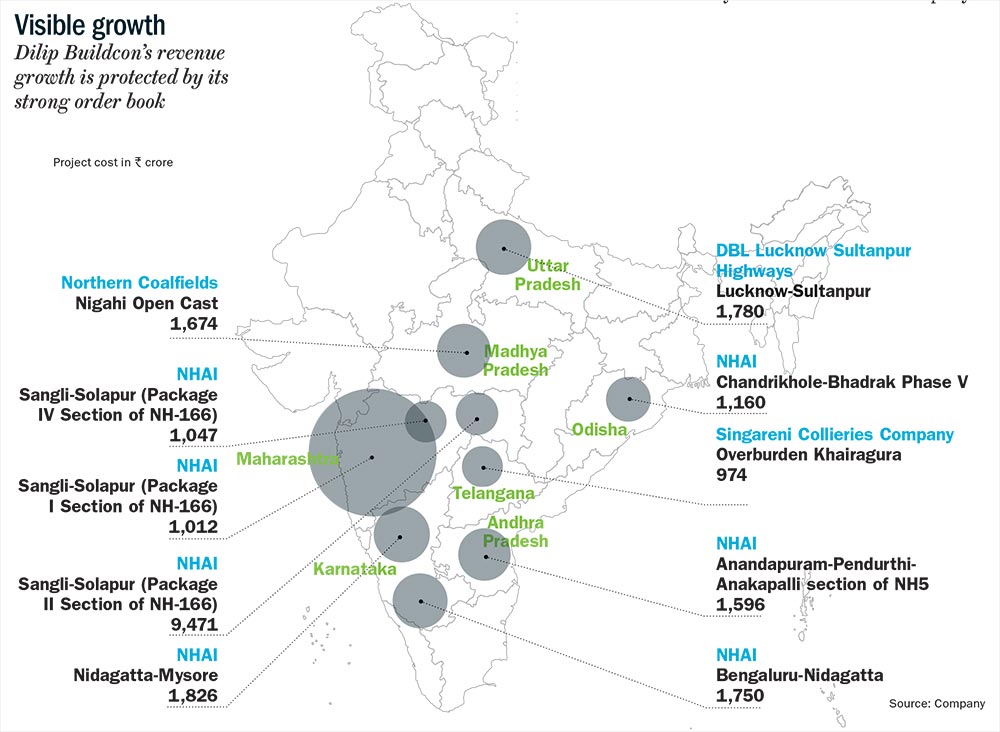

The company has stuck to its core business of EPC (engineering, procurement and construction) road development steadfastly and it is a decision that has paid off. From the time it was incorporated in 1987, it has laid 15,000 kilometres of roads in India, with 8,000 km having been completed in just the past five years. The order book at the end of the third quarter of FY18 stood at Rs.15,500 crore and with some big wins in March, it is expected to close the year at Rs.28,000 crore, or 4x FY18 projected revenue.

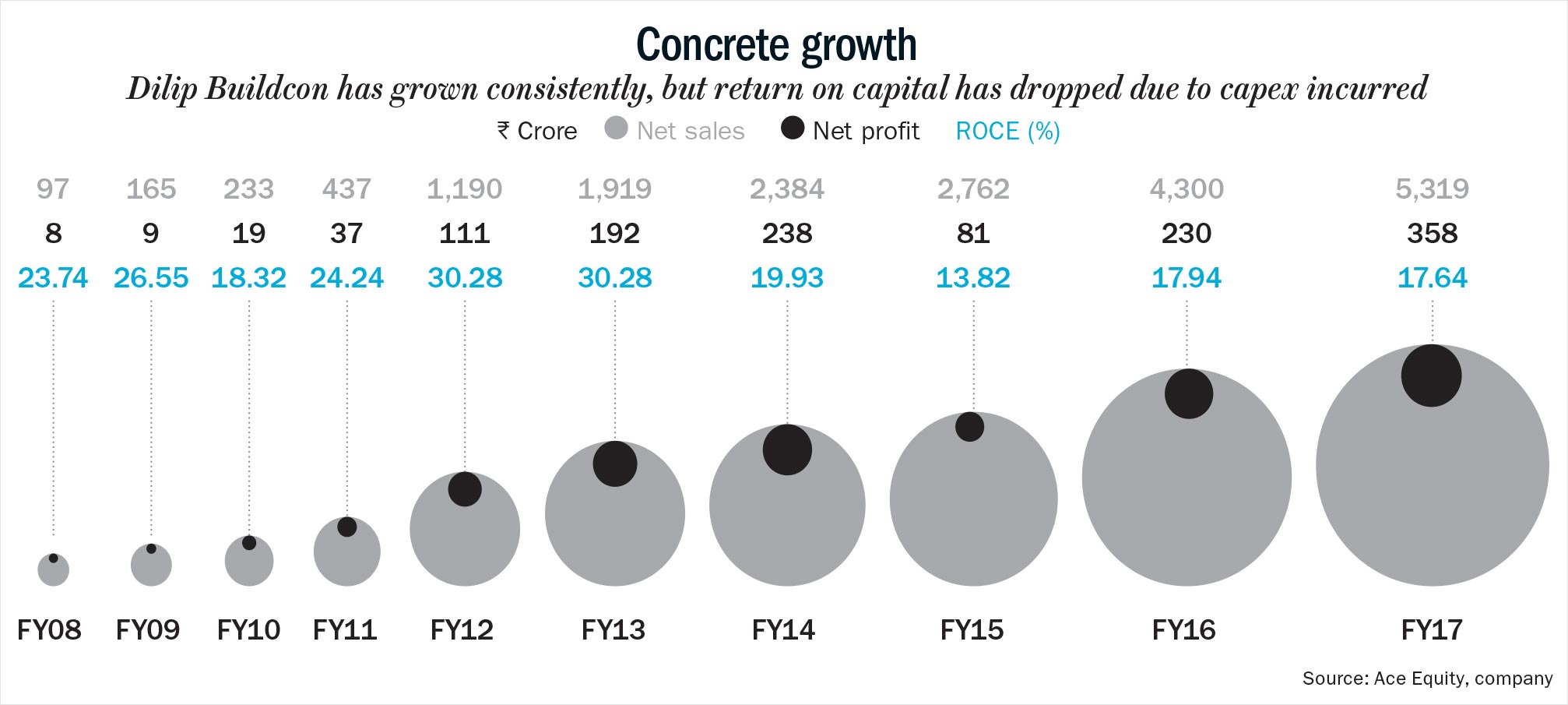

That has reflected in the way the stock price, too, has moved. After listing in August 2016 at Rs.219, it quotes at Rs.1,150 today. Naval Totla, managing director of BanyanTree Finance, a private equity fund, that invested in Dilip Buildcon in 2012, says the management marries the right combination of caution and aggression. “Sticking to road construction was a smart thing to do. They have got better at it and improved their execution capabilities, which has resulted in taking on larger projects successfully,” he says. This has gone a long way in Dilip Buildcon’s revenue increasing from Rs.233 crore in FY10 to Rs.5,320 crore in FY17. For 9MFY18, standalone revenue was Rs.5,190 crore.

Big dreams

In early 2007, the top brass at Dilip Buildcon sat down for a strategic meeting. It had been just over a year since the company had worked with Mumbai-based Valecha Engineering to construct a part of the Rs.80 crore Ashta-Kannod road project in Madhya Pradesh. It was a 80 km project and the first time that Dilip Buildcon had taken on a project on its own, with Valecha receiving only a fee. Dilip Buildcon needed a partner since they did not have the experience to meet the requirement of taking on the project on their own. Thus far, the company had only been working as an EPC contractor to private players.

Suryavanshi travelled to Mumbai on a few occasions to thrash out the deal with Valecha, who would then lead the Ashta-Kannod project by virtue of being the larger player. Rohan, Suryavanshi’s son, then a 20-year-old, recalls his father being smitten by Mumbai’s tall buildings and promising the youngster that he would one day take him to the city. Recalling the story with a laugh, Rohan says the project gave the company confidence to take on bigger challenges. When the team convened for the strategy meeting, the company had an order book of Rs.100 crore. “We set a very stiff target of having a Rs.1,000 crore order book by FY10,” says Suryavanshi.

That target was achieved. But Suryavanshi, by then, was convinced that the company had to change its strategy. It had to reduce the proportion of private contracts, which was well in excess of 80% of the order book. The company was still the EPC contractor for the likes of Sadbhav Engineering, Ashok Buildcon and Essel Infraprojects. “We were doubling our revenue each year because of the private sector. What struck us as strange was that many of them were making money without really having the expertise. It was only because of easy access to cash, and every player, irrespective of competence, just jumped into the business,” he explains.

“We learnt a lot about road construction during this phase and realised that success here depended greatly on the extent to which one had control over raw materials,” says Suryavanshi.

By 2012, the private sector pipeline had slowed down. The government’s inability to push through key issues such as environmental clearances, land acquisition and the economy slowing down, meant many of the feisty and ambitious folks were now in limbo. This is when Suryavanshi decided to change tack and look outside the private sector for growth opportunities. Suryavanshi decided to push aggressively for more government orders, which in FY12,made up just 17% of his order book. In FY14, that surged to 61%. “Today, at least 95% of our order book is government road construction projects,” says Rohan, who heads strategy and planning for Dilip Buildcon.

Branching out

It was in early 2012 that BanyanTree invested Rs.75 crore for close to a 10% stake in the company. “Infrastructure was not a great place to deploy your money. We were impressed with their ability to execute well,” recalls Totla. The low level of leverage also struck the right chord with him. According to him, what they liked the most was the management’s willingness to listen to the investor. “We asked them to stay out of BOT (build-operate-transfer) projects and focus on the working capital cycle,” says Totla. Several companies that went into BOT projects — where the private player lines up funding and makes money through a fee from the government or through toll revenue — had landed up with huge debt, and were looking to get back to EPC where the money comes in upfront. In August 2016, when the company went public, BanyanTree exited its investment pocketing a 3x return.

If avoiding BOT projects saved Dilip Buildcon from sinking like other rivals, Suryavanshi’s second strategic decision to look for projects outside the home state of Madhya Pradesh laid the growth path. In 2009, the company completed its first road project in Himachal Pradesh, in a joint venture with Valecha, which was its breakthrough. This was followed by some smaller projects and it was in 2011 that the company was chosen to build the Ahmedabad-Godhra road in Gujarat. “To grow our business, we had to step out. There was only so much we could do in MP,” says Suryavanshi, though the home state, even in 2011, contributed well over 60% of the order book. Dilip Buildcon is known to be close to the powers that be in the state, though the management refuses to talk about it. “To diversify across states requires courage — it’s not easy. Most companies would rather stay back in the home state and make the most of their strengths,” says Totla.

Sandeep Raina, associate director (research), Edelweiss, too, gives credit to the company’s foresight to look at new markets; today, no more than 10% of the order book is from Madhya Pradesh with the company now having projects across 17 states. “Except L&T, no other infrastructure company in India has a presence that is geographically so diverse. It was important for Dilip Buildcon to do this, since being in one state would not have given them the scale,” he says. The company has recently won orders in states such as Karnataka, Jharkhand, Andhra Pradesh, Uttar Pradesh, Maharashtra and Odisha, with just one project coming from Madhya Pradesh. “This is hugely beneficial to curtail revenue risk in a year, when there will be elections in two to three major states and eventually the general elections. A high order book will help the company in sweating the existing machinery base,” he adds.

Getting it right

Doing things differently has helped Dilip Buildcon in registering higher margins. At a time when its peers such as KNR Constructions and PNC Infratech have Ebitda margins of around 15%,it earns at least 300 basis points higher. There are a few strategic reasons for this sizeable difference.

Devendra Jain, Dilip Buildcon’s CEO, points out that the decision to not have sub-contractors alone leads to 1-2% higher Ebitda margin. This leads to a greater control over the process as it employs its own staff across locations in India. “We have noticed how other companies depend a lot on sub-contractors. That eats into the project time and we believe it is not an efficient way of working,” he says. Raina says an end-to-end control on execution helps the company complete projects well in advance. “That leads to an early completion bonus, which goes directly to the bottomline,” he says. Last year, the bonus earned was to the extent of Rs.106 crore, with this year expected to be around the same number. “Over the past five years, we have earned Rs.320 crore just by way of bonus,” chips in Rohan. That component goes on to add another 1-2% to the Ebitda margin. “Because of zero sub-contracting, there are no quality issues,” adds Rohan.

Having control over execution also means the company owns a large fleet of equipment and vehicles (about 10,000), with names such as Caterpillar for excavators and Ashok Leyland for trucks. Jain says placing orders of this size ensures getting good rates and a commitment with respect to service. “That translates to significant economies of scale, which with discount at the time of purchase would add around 2% to the bottomline,” he says. According to him, the company, on a full-time basis, employs 19,000 drivers and another 30,000 employees at various levels.

Suryavanshi continues to demonstrate high levels of ambition and says he wants a larger piece of the infrastructure pie. Jain terms it as being a full service infrastructure player, with intentions to look at areas such as dam construction, canals and railway infrastructure. “We would like to be wherever there is road construction in any form. According to him, the strategy is to have co-location projects, which means laying the road and also looking for another opportunity. For instance, in 2016, the company bagged a contract from the government to construct a 640 metre eight-lane bridge across the Zuari river in Goa. This Rs.550 crore contract comes with the approach of road connectivity, which in all, adds up to Rs.1,600 crore. “The objective is to sweat our machinery to the maximum extent possible,” he says.

According to Totla, at the time of putting in a bid for a new project, Dilip Buildcon does elaborate research on the location to understand the topography. “That kind of location scanning gives them a clear picture of how long it would take to complete the project,” Totla says. Jain says every equipment is attached with a GPS, which tracks everything from the life of the tyre to how much fuel a truck consumes. “You need that kind of cost obsession to make it work in a business like this.”

The road ahead

EPC will continue to be the bread and butter for the company and that became evident when it sold its entire BOT portfolio of 24 road projects (14 operational, four under-construction and six hybrid annuity model, referred to as HAM) in August last year to the Shrem Group for Rs.1,600 crore. Suryavanshi says Dilip Buildcon was looking to exit for a while. “It’s not as if we are against BOT projects but the lack of revenue certainty makes us uncomfortable. We decided it did not make sense to hold on,” he explains. This will reduce the debt on Dilip Buildcon’s balance sheet, which took off sharply from Rs.764 crore in FY14 to Rs.1,573 crore the following year, Rs.1,760 crore in FY16 and Rs. 2,236 crore in FY17. Jain says this was capex that went into investing in new machinery. As a consequence, depreciation and interest costs, too, increased, most prominently in FY15 and pulled down net profit. The RoCE also took a beating in the same period. According to Raina, the RoCE dropped due to the capex investments the company made in equipment and machinery to grow quickly. A majority of these investments started in FY13 and the RoCE then started falling since then to reach a low of 13.8% in FY15 against 30.2% in FY13. “However, due to high growth and sweating of existing investments, the RoCE, since then, has improved and we expect it to reach 25% in FY20,” he says.

According to Raina, the deal with Shrem will help the company earn the required capital to chase higher growth. “There will not be much pressure on its balance sheet as well. Selling old projects allows the management to focus and grow the high-margin EPC business,” he says.

While the company is steering clear of BOT, it is slowly taking on HAM projects. Under HAM, the National Highways Authority of India releases 40% of the project cost, while the other 60% is brought in by the road developer. The model spreads the risk between the government and the developer. “It is a good model but we are concerned about how much debt it will entail. It offers a safe flow of revenue with money coming in every six months,” says Jain.

He remains confident that revenue will continue to grow by 25-30% annually for the next three years at least. “Just the size of the order book will take care of this. There are enough opportunities in each of the states that we operate in,” says Jain. According to him, related infrastructure opportunities will be identified at the same time. “If we continue to do what we are doing and make the best use of our assets, the margins, too, will sustain,” he adds.

Ajay Garg, managing director, Equirus Capital says the order-book-to-bill ratio of most players is in the range of 2.5x to 4x and with aggressive awarding of HAM projects, this ratio will increase further. “That will mean higher revenue visibility over the next two to three years,” he adds. That, however, is not devoid of challenges and Garg points to the timely execution of the order book as being one of them. “This means availability of labour, material, sufficient management bandwidth and project management staff will be critical,” he points out. That apart, raising necessary capital is another concern. “That is a function of market condition and investor sentiment at that point in time. Investors will become cautious as we near the pre-general election phase (post-November 2018).”

In the time to come, the thrust on EPC will continue for the company and with the government speaking of the Bharatmala project to develop close to 84,000 km of roads at an investment of Rs.692,000 crore, there is a lot to look forward to for those in the industry. How Dilip Buildcon manages to make the most of that will determine the next stage of growth.