Almost exactly a year ago, the chairman of Tata Sons, N Chandrasekaran, decided to restructure the $113 billion conglomerate (FY19 revenue). The plan was to have the group focus on 10 verticals, merge businesses that have synergies with each other and be among the top three in each vertical.

Almost exactly a year ago, the chairman of Tata Sons, N Chandrasekaran, decided to restructure the $113 billion conglomerate (FY19 revenue). The plan was to have the group focus on 10 verticals, merge businesses that have synergies with each other and be among the top three in each vertical.

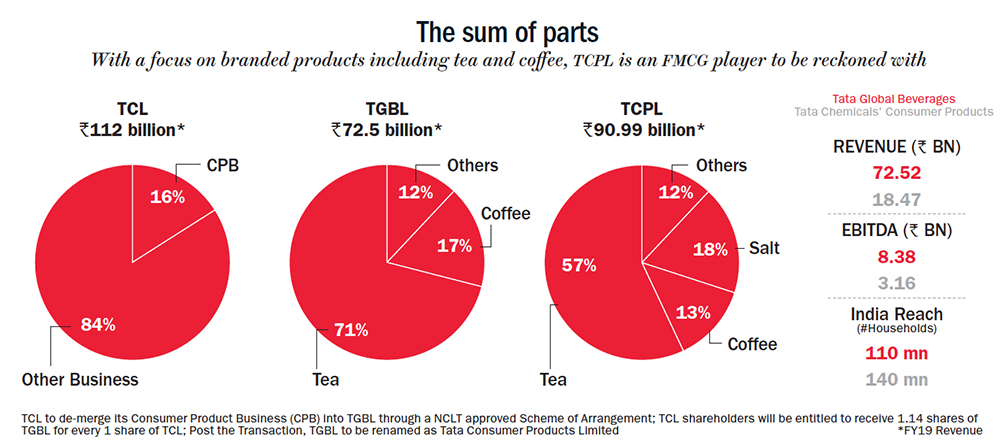

As a result, Tata Global Beverages (TGBL) and Tata Chemicals (TCL) decided to unite their consumer products businesses to form Tata Consumer Products (TCPL), a premier diversified consumer products company (See: The sum of parts).

TCL shareholders would receive 1.14 shares of TGBL for every 1 share of TCL. TCL shareholders now own 31.4% of the combined entity. The scheme of amalgamation became effective from February 7 this year and the company has been renamed Tata Consumer Products. The new name is more befitting the future plans that the Tata group appears to have with TCPL. This is the first of the many triggers that will play out.

TCPL has become the Tata group’s vehicle for its FMCG ambitions with 91% of the revenue coming from branded products. The combined company is now home to various brands and businesses and the revenue mix is also set to change going forward.

The company has the second largest branded tea company in the world and one of the largest in India, with iconic brands such as Tata Tea (first by volume and second by value in branded tea in India) and Tetley (among the top three brands in the UK and Canada). Post-merger, branded tea accounts for 57% of revenue, down from 71% pre-merger.

Coffee accounts for 13% of revenue, down from 17%. While Eight O’ Clock is the fourth largest player in coffee bags in the US, Tata Coffee Grand is an instant coffee brand in India launched in late 2015. An astounding 330 million servings of its beverage brands are consumed everyday globally.

Coffee accounts for 13% of revenue, down from 17%. While Eight O’ Clock is the fourth largest player in coffee bags in the US, Tata Coffee Grand is an instant coffee brand in India launched in late 2015. An astounding 330 million servings of its beverage brands are consumed everyday globally.

Starbucks India is a 50:50 joint venture with Starbucks that has 174 stores across 11 cities (as of December 2019). This business, which is already cash-positive, has a long runway for growing this iconic global brand in India. The company is taking a measured approach to expansion, much like group company Trent, which has built an outstanding retail fashion brand.

The company is present in the water business with Himalayan Natural Mineral Water, one of the biggest brands in India. It also has Tata Gluco Plus that makes a glucose-based energy drink for the masses. It’s attractively priced at #10 and sold in seven different flavours. Currently available only in three states, it will be gradually launched in the rest of the country.

The consumer products business, that comes from TCL, includes Tata Salt (the top branded salt in India with a two-thirds share of the branded market), and Tata Sampann that has branded pulses, spices and ready-to-cook packaged food. The penetration of branded pulses, and spices and condiments businesses in India are merely 1% and 30%, respectively.

TCPL expects strong growth in both these segments given the rise in modern trade, online trade and the secular trend of buying more branded goods. Their products are available with major online retailers such as Amazon, BigBasket and Flipkart. In fact, Tata Sampann is already the leading online pulses brand in India.

The next trigger will be the unfolding of the synergies between TGBL and TCL. We believe that TCPL will be able to leverage Tata Salt’s 2.5 million distribution points and widen its reach to over 200 million households across India. Moreover, TCPL will be able to leverage the Tata group’s other consumer-facing businesses, namely Trent, Indian Hotels and Vistara.

The other major trigger in the stock is the appointment of Sunil D’Souza, who takes over as managing director and CEO with effect from April 4, 2020. A graduate of IIM Calcutta, D’Souza joins from white goods major, Whirlpool of India. During his five-year tenure, Whirlpool’s sales grew 14% CAGR and profit grew 27% CAGR. Prior to that, he spent 14 years at PepsiCo’s Asian operations.

Besides Sunil D’Souza, TCPL has made several senior management changes, hiring fresh talent such as Ajit Krishnakumar (COO), Adil Ahmed (head of international), Rakesh Sony (head of strategy and M&A) and Rishi Dang (head of US business).

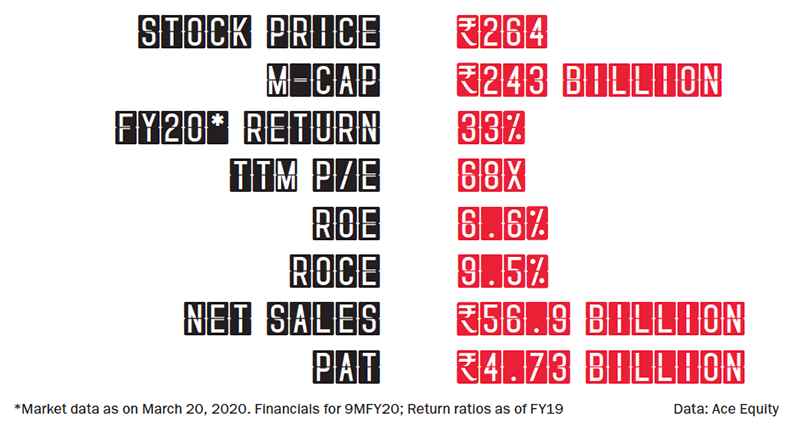

For a period of 10 years, that is, between 2006 and 2016 end, the stock price of the erstwhile TGBL went up a mere 32% from #94.50 to #124.45. As a result, investors had lost interest in the stock and missed the growth that came soon after Chandra assumed office as Chairman of the Tata Group on February 10th, 2017. The stock has since tripled to hit a lifetime high of #392, before falling to #265 (on March 20, 2020). This was led more by the coronavirus correction in global equity markets than any change in fundamentals. What’s more, with 66.8% free float, the stock trades $28 million a day (last 3 months average), making it among the top 50 most liquid stocks in India.

TCPL has a healthy balance sheet which generates free cash flow of #10 billion. Trailing twelve months (TTM) financials of TCPL have combined revenue of over #95 billion and Ebitda of over #12 billion. India will contribute more than 60% revenues, against 49% at TGBL.

While the stock is not cheap at 24.5x FY21 price to earnings, we estimate that the P/E will expand as the story plays out and the stock catches up to the high valuations of its listed peers, such as Hindustan Unilever, Nestle and Dabur.

Over the next five to 10 years, the company will introduce more FMCG products and pump them through its extensive nationwide distribution. We believe Tata Consumer Products is the next food and beverages giant in the making.