Many investors buy a stock with a five- to ten-year horizon. For Rohit Singhania, fund manager at DSP MF, this does not work. “You can estimate but can’t be sure of what will happen in five years,” he says. Therefore, when he buys into a company, he does it with a one-two year horizon and he keeps questioning the investment basis continuously. He believes in keeping a close watch on his portfolio and correcting course at the earliest.

Many investors buy a stock with a five- to ten-year horizon. For Rohit Singhania, fund manager at DSP MF, this does not work. “You can estimate but can’t be sure of what will happen in five years,” he says. Therefore, when he buys into a company, he does it with a one-two year horizon and he keeps questioning the investment basis continuously. He believes in keeping a close watch on his portfolio and correcting course at the earliest.

This dynamism and open-mindedness also extend to how he judges a company’s management. Of course, he leaves no room for laxity in governance, but he also does not shut out a company because its management may have made a suboptimal decision in the past. “The situation might be completely different today, and that can present opportunities. Saying things like ‘the management has done this in the past, so I will never look at this company again’ may not be the optimal approach,” says Singhania.

It is only right that he values his receptiveness. It is a quality that landed him a profession that he is passionate about. No one in his family had been working in finance, but young Singhania overheard his friends and classmates discussing investing when he was in school. It piqued his curiosity, and made him wonder about the mechanics of investing. That’s how, as a teenager, he began reading about stocks and deals. He went on to pursue B.Com in 1998 and then MMS (Finance) in 2002.

Sell-side wisdom

Singhania started his career as a research analyst at IL&FS Securities and HDFC Securities, where he tracked sectors such as metals, cement, sugar and tea. During those initial years, he observed company managements closely and learnt that a management’s outlook is not cast in stone. He says working on the sell-side helped him develop his investing style in more ways than one.

“It’s a lot of hard work,” he says, “nothing is served on a platter. Before you pitch to a fund manager or a buy-side analyst, you need to do detailed work on the stock. For example, I was tracking the metals space, which had six to seven listed-companies. So, I needed to reason how I categorised them or ranked them, and how I formed any thesis. All of this shaped the way I think.” He takes nothing for granted and double-checks every premise.

He began working as a fund manager at DSP in 2010 and started by overseeing the DSP India T.I.G.E.R Fund, which now has an AUM of Rs.9.65 billion and includes stocks such as Supreme Industries, Siemens, ACC and L&T. This is an infrastructure and economic-reform driven fund, so it buys into sectors such as manufacturing, cement, metal, oil and gas. “In this we look at gross, fixed capital formation in the country and see which companies can benefit from it,” he says. Two years later, he was given charge of the Natural Resource Fund, with an AUM of Rs.4.73 billion. It also invests in cyclical stocks, but it has a smaller subset compared to the T.I.G.E.R Fund.

These two funds entail higher risk because they are sectoral and cyclical, and therefore they are not recommended for retail clients. “These funds are for HNIs and Ultra-HNIs who have the ability to take higher risk for higher return and who understand the cyclicality of businesses,” says Singhania.

These two funds entail higher risk because they are sectoral and cyclical, and therefore they are not recommended for retail clients. “These funds are for HNIs and Ultra-HNIs who have the ability to take higher risk for higher return and who understand the cyclicality of businesses,” says Singhania.

There are various ways to manage this risk. For example, commodities are highly cyclical and one needs to act fast. Another way he recommends is to track a stock’s historical valuation, such as price-to-book value. “If you buy it at less than 1x, say for 0.75x, then there is little chance of losing money. Added to this, you need to look at demand-supply, cost differential between India and the global markets, and whether the company is making money at that cost,” he says.

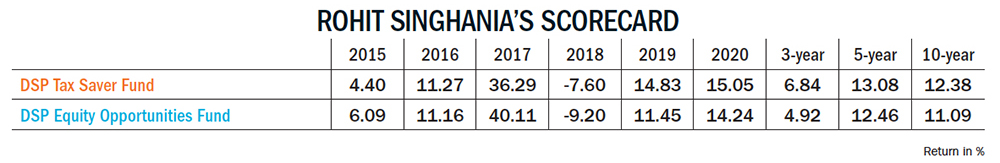

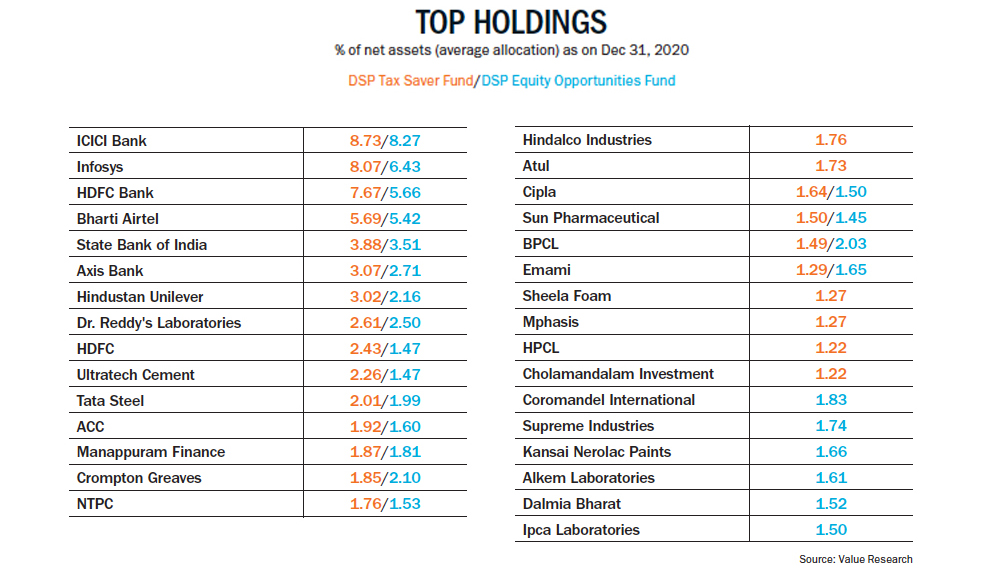

In 2015, Singhania began managing the Equity Opportunity Fund and DSP Tax Saver Fund, with AUM of Rs.57.02 billion and Rs.78.59 billion, respectively. These are diversified funds and allow Singhania room to experiment and to stay away from the herd.

Singhania says that a “stock not being in favour” has never stopped him from investing in it. His portfolio, for the last one year or more, has included certain PSUs, cyclical, value and certain engineering companies, even though they have not done well over the period. All the love has been going towards tier-1 quality stocks, which have been growing more and more expensive. “That is okay with me, because I could see the sizable earning capacity and asset values of these out-of-favour businesses. At some point, the market will realise that they are asset-earning businesses. Their return ratios are a healthy 12-13%, they pay dividends and, maybe their sector is seeing a downturn, but there is value and they will bounce back,” he says.

Singhania says that a “stock not being in favour” has never stopped him from investing in it. His portfolio, for the last one year or more, has included certain PSUs, cyclical, value and certain engineering companies, even though they have not done well over the period. All the love has been going towards tier-1 quality stocks, which have been growing more and more expensive. “That is okay with me, because I could see the sizable earning capacity and asset values of these out-of-favour businesses. At some point, the market will realise that they are asset-earning businesses. Their return ratios are a healthy 12-13%, they pay dividends and, maybe their sector is seeing a downturn, but there is value and they will bounce back,” he says.

Contrarian buying

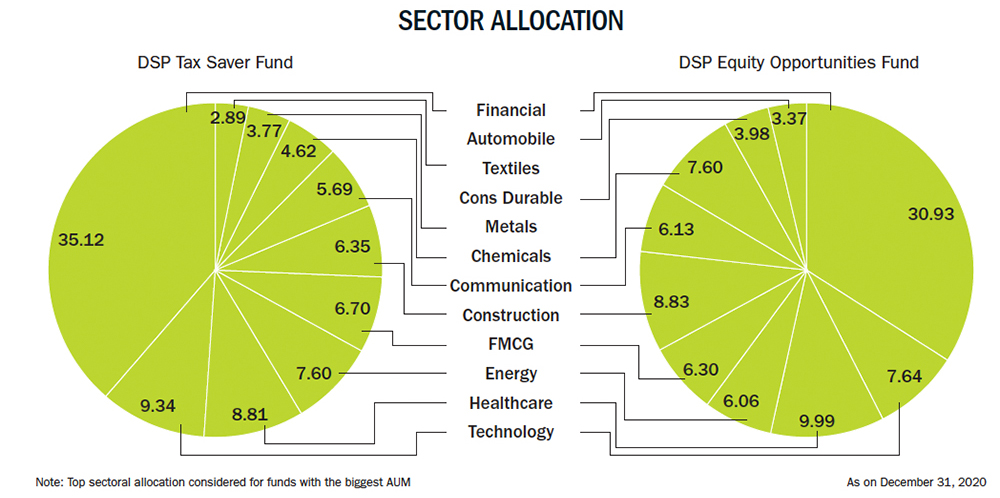

Today, Singhania is bullish on four sectors — financials, real estate, materials and telecom. It is an odd list since all these sectors seem beleaguered by legacy issues and intense competition. But Singhania suggests those are passing worries, especially for the best in the industry.

In the financial sector, he says, the NPA issues will reduce significantly leading to better ROAs and ROEs. “NPAs are under check and the provisioning that the banks have is higher than what it has been over the past four to five years. That is one part of the banking business. The other part is rising interest income. In the first half of FY22, we expect NPAs to come down and, in the second, credit growth to pick up,” says Singhania.

He sees real estate and related companies, such as those dealing in electrical or housing finance, benefiting from affordable housing and reduction in EMI interest rates by almost 1.5%. He sees materials, such as cement, metal and specialty chemicals, doing well with global liquidity and vaccine driving growth across the world. This also includes agri inputs which, Singhania says, will gain from monsoons, which have been good over the past two to three years, and from government subsidies.

“We have been bullish on telecom for some time,” he says, “Today it is a three-player market. But for it to sustain, we see either further consolidation (i.e. one of the players may not survive given unsustainable leverage level) or companies resorting to price hikes to allow them to repay debt and reinvest in capex.”

It is not that Singhania is only focused on the potential upside for a sector. When COVID-19 struck, his first instinct was to protect client portfolios from further downside. “We were looking at businesses that we thought could survive. So, if a stock is around Rs.200 today, can it stay at Rs.200 or Rs.195 and not go down to Rs.150? For that, you run through the best companies which may be consumer-facing or who do not have debt in their books. Even if their revenue has declined by 20-30% and Ebitda falls by 30-40%, we check that they don’t get into the vicious cycle of not being able to pay interest cost or repay debt,” he says. He expects the cloud of the pandemic to pass in the next six to twelve months with the successful vaccine rollout and companies bouncing back. Therefore, a better way to monitor FY22, according to him, would be to evaluate the two-year CAGR growth and not on the regular year-on-year basis.

Taking all of this into consideration, Singhania is not worried about the market at all. “Yes, valuations are expensive still, but I am not expecting a correction since global liquidity is decent and interest rates are low,” he says.

Will there be ‘value buys’ then? He does not see it like that. He does not see the market compartmentalised into value and growth stocks, or investors as value, growth or contra investors. Singhania says, “Those definitions are hardly defensible. There could be a stock in your portfolio that has been a growth stock till now but which is now a value stock.”

For him, the market is constantly changing, like a living organism. “Ultimately,” he says, “it is about being open to change and being open to move (in or out of a stock) depending on the opportunity. There is no secret sauce to success.”