If you were a teenager growing up in urban India in the 1990s, it’s more than likely that you spent several hours every week at the local Archies gallery. In the pre-SMS and Facebook era, the greeting card wasn’t just used to wish people on holidays, birthdays and anniversaries; for a whole generation of teenagers and young adults, it acted as a fool-proof emotional barometer. If you liked someone, but weren’t sure you ‘like liked’ them, you didn’t need to struggle to find the right words to express your dilemma. You just bought a ‘can’t we be friends?’ card.

Or, if you were sure your liking was of the ‘like like’ variety, you moved a few feet down the aisle and picked a ‘can’t we be more than friends?’ card. Archies not only had a card for every adolescent mood, it often provided the backdrop for much angst and joy: with so many youngsters crowding its aisles, it wasn’t uncommon for relationships to begin, grow and, sometimes, end between aisles of birthday, anniversary, good luck and friendship cards.

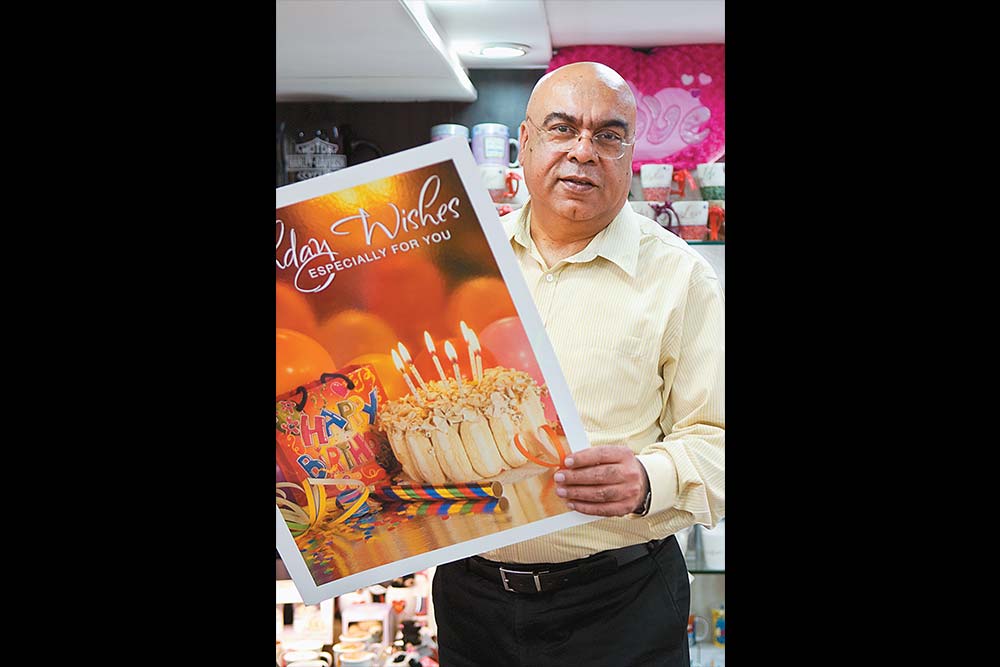

But that was then. As we outgrew our teenage and became mature adults, we left our youthful pastimes behind us. No one in our age group buys cards anymore, right? Wrong, says Archies joint managing director Pramod Arora. It’s the teenagers who’ve moved on to the internet and mobile phone; apparently, 25- to 40-year-olds are still the largest consumers of paper greeting cards (incidentally, that’s borne out in research across the world). And that insight is critical to the Delhi-based Archies, as it revamps itself yet again to stay relevant in a world where greeting cards and snail mail have largely given way to text messages, email and greetings on social media sites. New target customers, new associations, new occasions and new product lines — Archies is pulling out the stops in its bid to double in size and become a ₹400-crore company in the next four years. Will it work or are the cards stacked against it?

Changing tack

Sympathy cards first started pouring in about a decade ago when Archies appeared to be crumbling under the dotcom onslaught. With new free greeting card sites popping up almost every day, it was all too easy to create an email ID and start sending cards for all occasions — and sometimes, for no occasion at all. The impact on Archies was crushing. From ₹80.5 crore in FY02, turnover dropped to ₹66.8 crore in FY04.

At the time, though, the company had several ways to minimise the damage and it used them all. Archies closed loss-making diversifications into music and fragrances, reduced staff strength and streamlined manufacturing operations (greeting cards, from paper to design, are made completely in-house). It also took on its new competitors by starting a free website of its own, which helped boost brand visibility (though the site shut down after a couple of years).

For Archies, new technology continues to be the enemy. Access to mobile value-added services and the internet are ubiquitous and there’s an entire generation or two out there that’s never licked a stamp or posted a letter. But that doesn’t mean the greeting card industry is fading away, Arora insists. It’s just become muted. “In the 1980s and 1990s, every second retailer used to sell cards. We don’t see that anymore, so the feeling persists that there is no demand for cards,” he says. Of course, he concedes, the traditional greeting card buyer — youngsters between 13 and 20 years — is a dying breed.

For the past few years, though, that loss hasn’t pinched Archies too much. Instead, it’s turned its focus on its earlier generation of customers, who not only continue to buy greeting cards but now also have the disposable income to make more expensive (read: higher margin) purchases. Cards and other products are, therefore, being specially made to appeal to this group. Instead of the mushy cards, it’s trying quirkier humour as well as value-adds like music, voice and sound and light effects.

The company is also finding ways to work around the overall decline in sending cards on holidays. About a decade ago, half of Archies’ greeting card sales happened between Diwali and the new year; that figure is down to 14% now. The good news is that special occasion cards — Rakshabandhan, Father’s Day, Mother’s Day and so on — are picking up the slack. Which is why Archies is trying to create more such special occasions — it started off Daughter’s Day some four years ago and the response has been positive, says Arora. It’s also brought in other non-traditional occasions like Boss’ Day, Doctor’s Day and so on. Of course, Valentine’s Day remains a perennial moneyspinner, with about 16% of Archies’ revenue coming from sales during February 1-14 (incidentally, the company’s shares also moved up during that period).

Not all new occasions have to be created by the company. Changing attitudes at the workplace have meant the company’s fastest growing category is the farewell card. Arora also points out how frequent requests for cards that say “congratulations on your promotion” or “you did a great job” have prompted Archies to launch a line of “business connection” cards in association with Hallmark. Archies already used to print such cards for companies, personalised with their logos; the new range will include cards for jobs well done, good luck, promotion and farewell.

Arch-rivals for the past two decades, Archies and Hallmark came together last year after the American company didn’t renew its 20-year licensing agreement with Vintage. Under the deal, Archies will open exclusive Hallmark stores to sell cards, stationery and gifts and will pay a little under 10% of sales as licensing fee. In exchange, Archies’ festival cards will be sold in Hallmark stores across the world during Diwali, Holi, Eid, Rakhi, etc. In the past year, Archies has opened 13 Hallmark stores in Delhi/ NCR and Pune. There’s no cannibalisation, only competition, believes Arora. “With these stores, consumers have more choice. This will help grow the overall greeting card and gifts market,” he adds.

The gift shift

The emphasis at Archies isn’t only on cards. In fact, cards are no longer the company’s main source of revenue, it is gifts. Archies entered the gifts space formally in 1994, but in the past few years it has shifted its focus to becoming a one-stop gift shop for all occasions — about 60% of the ₹188.53 crore earned in FY11 was from gifts, up from just about 15% of ₹80.5 crore in FY02. Soft toys and ceramics are imported mainly from China and South East Asia, and the company has signed licensing agreements to distribute merchandise of popular cartoon characters like Garfield and Snoopy as well as the Smiley. It’s also launched its own brands — Stupid Cupid for fashion jewellery and accessories and the Ginger Lemon line of T-shirts. “While our focus is now geared towards an older clientele, we still have buyers from the younger crowd. So we ensure the store has something for everyone, which encourages impulse purchases,” says Arora.

It’s also taking its stores to where its customers are. Some three years ago, Archies relaunched its online store, not just to be closer to its customers but also because its older customer group has credit and debit cards for online transactions — one problem with the earlier avatar of the site was that teenagers preferred free stuff because they didn’t have access to credit cards. Online sales still account for only a minuscule portion of Archies’ sales (under 1%), but the company is happy with the response so far — even internationally, online greeting card purchases are just about 3% of the market. For one, at ₹700-800, the average ticket size of online transactions is higher than at brick-and-mortar stores, where average purchases are for ₹300-400. Also, Arora believes each online transaction can create two customers for the company, since the recipient could also use the website for future purchases.

Meanwhile, the focus on brick-and-mortar stores continues. Archies has some 505 stores at present (of which 225 are company-operated) and it plans to open another 40-50 company-operated stores every year for the next five years. Each store is leased at about ₹15-25 lakh a year, which means a capex of anywhere between ₹6 crore and ₹12.5 crore a year that the company will fund through internal accruals and debt.

While a majority of stores are in shopping centres and malls, as an experiment, Archies recently opened a store at the Infosys campus in Pune. The response was staggering: opened in the first week of February, the store ran out of Valentine’s Day cards long before the 14th. “People don’t have the time to go and buy a greeting card. But if you bring the card to them, they are more than happy to buy it,” Arora remarks.

Will all this be enough to make Archies grow from ₹188 crore (FY12 anticipated revenue: ₹220 crore) to a ₹400-crore company in four years? After all, it took nearly 25 years to reach its first ₹100 crore. Besides, its profit levels aren’t exactly noteworthy: on a revenue of ₹147 crore for the nine months ended December 2011, Archies made a profit of just ₹6 crore.

From FY06 to FY11, revenue has grown at 17.3% CAGR, and Archies has added 119 company stores since March 2008. Still, industry observers have their doubts: not only is the greeting card industry not future-proof, the focus on gifts has its share of critics. “This is not a vacant space like it was for cards. Consumers have so many choices for gifts, from books to electronics,” says Arvind Singhal, chairman of retail consultancy Technopak Advisors. “Earlier, with cards, Archies had the advantage of demographics. What niche will Archies identify this time?” Whether Archies gets to the ₹400-crore mark or not, it should probably get points for trying. Is there a card for that?

Just one email a week

Just one email a week