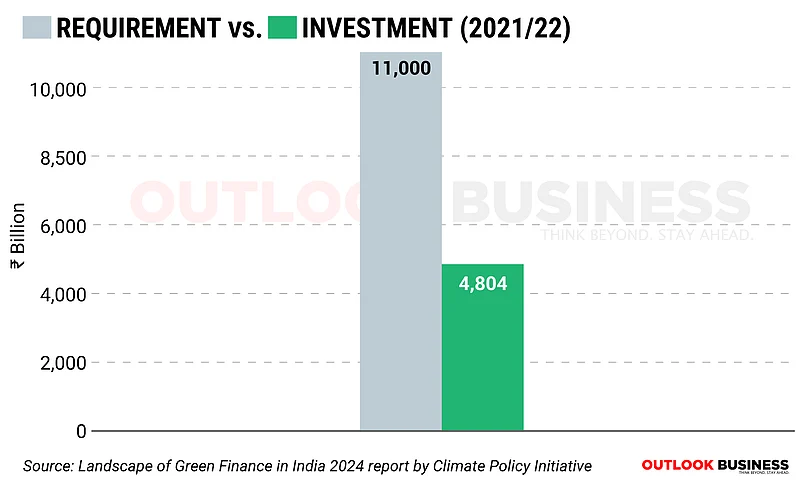

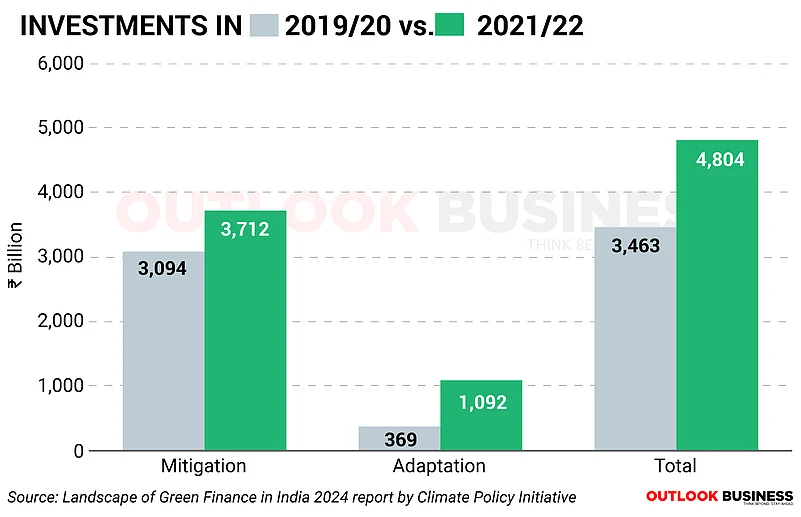

India’s tracked green finance reached an all-time high of Rs 4,804 billion ($65 billion) in FY2021/22, an average of FY 2020-21 and FY 2021-22, according to a recent report released by the Climate Policy Initiative (CPI), an analysis and advisory organisation with deep expertise in finance and policy. Annual estimates of mitigation finance for the financial year 2021/22 stood at Rs 3,712 billion ($50 billion), showing a 20 per cent increase since FY 2019/20, an average of FY 2018-19 and FY 2019-20. The report states that finance flows into adaptation also rose to Rs 1,092 billion ($15 billion) in FY2021/22.

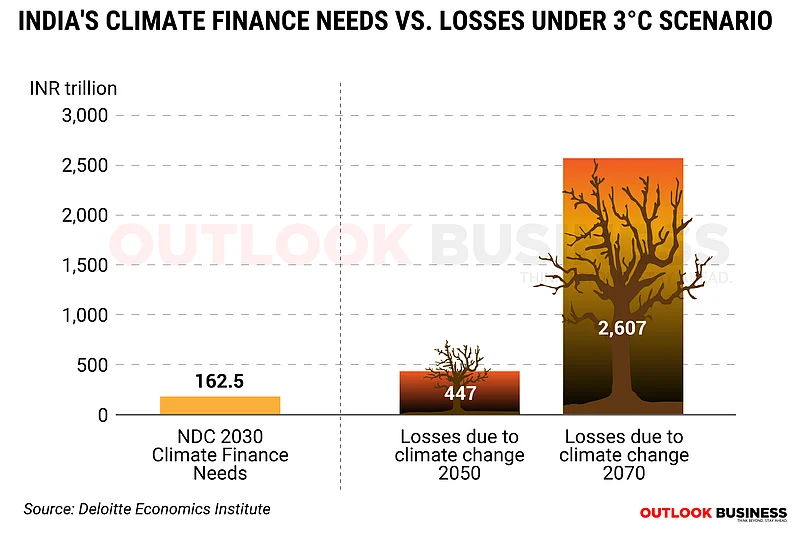

Despite the growing finance flow, available funds are unlikely to meet the overall requirement, estimated to reach Rs 162.5 trillion ($2.5 trillion) by 2030, meaning an annual inflow of Rs 11 trillion ($170 billion). Considering India faces significant challenges due to its increased vulnerability to climate change and its adverse effects, experts have cautioned that climate inaction could result in large-scale economic, human and environmental losses.

While the Indian government and private sector have been increasing investments to address the climate crisis, these efforts still fall short of the overall financing requirements outlined in the country’s nationally determined contributions (NDC).

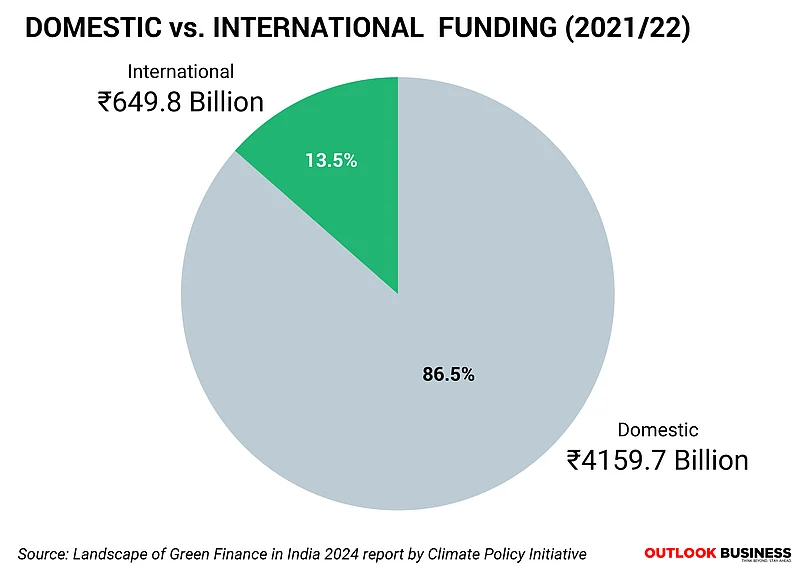

An analysis of India’s climate investments indicates that domestic sources account for 86 per cent of the total funding.

Furthermore, while most funds are allocated to mitigation efforts (reducing emissions), investments in adaptation efforts (coping with the effects of climate change) have more than doubled in the past two years.

Global climate negotiations have focused on achieving a balance between mitigation and adaptation finance. Overall, stakeholders agree that the scale of adaptation finance needs to increase across all sources to address current and future climate risks.

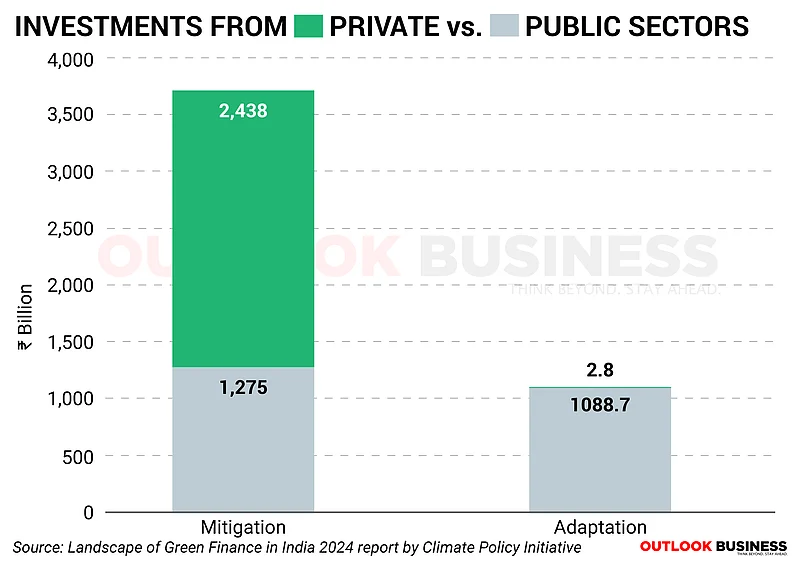

Mitigation-related investments are largely driven by private sources (66 per cent), whereas adaptation efforts rely almost entirely (99 per cent) on the public sector.

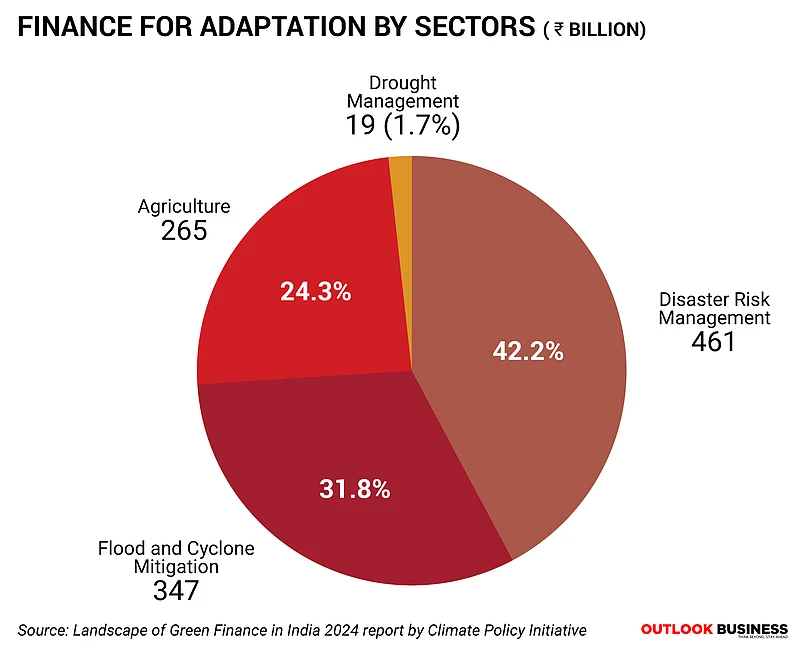

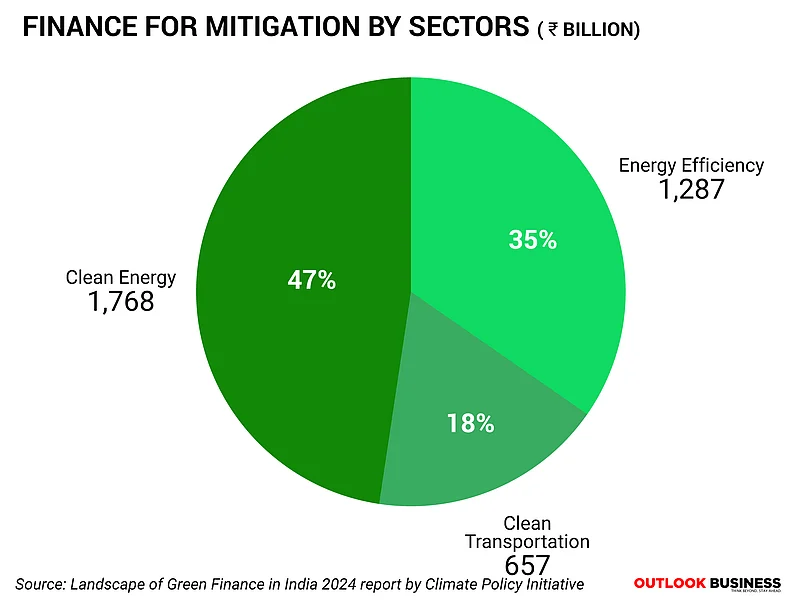

The sector-wise analysis reveals that clean energy attracts the largest share of mitigation investments, while nearly three-fourths of adaptation funds are allocated to disaster risk management and flood and cyclone mitigation.

Within sectors, the largest portion of mitigation financing goes to energy-efficient appliances (30 per cent), followed by solar photovoltaic and rooftop systems (26 per cent) and MRTS (17 per cent).

In adaptation financing, disaster risk management is mainly funded through government budgetary spending.