With recruitments frozen, marriages postponed, residential demand disrupted and the higher education system in a mess, Info Edge – one of India’s oldest and most formidable internet companies – is sailing through rough waters. The parent company of Naukri, Jeevansathi, 99acres and Shiksha has taken a big hit due to the pandemic and Q1FY21 results will reflect this. For the latest quarter ended March 2020, the company recorded a billing of Rs.3.32 billion, down 8% compared to the billing of Rs.3.61 billion in the corresponding quarter of FY19. The company’s consolidated net profit in Q4FY20 stood at Rs.1.19 billion, declining 63% as compared to Rs.3.28 billion in Q4FY19.

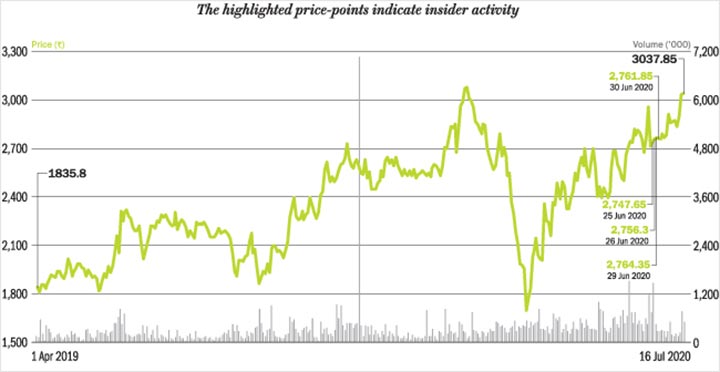

Commenting on this, the company's CFO Chintan Thakkar said, "We continue to evaluate the unfolding situation of the pandemic. The billings were growing around 13% till mid of March and it took a hit in the last two weeks of the quarter." Few days after the announcement of the results, founder Sanjeev Bikhchandani and CEO Hitesh Oberoi together offloaded shares worth Rs.225.6 million. Of this, shares worth Rs.139.5 million were sold by Oberoi, whose holding has now reduced from 5.34% to 5.3%. Meanwhile, Bikhchandani’s holding has come down from 25.9% to 25.87% after selling shares worth Rs.86.1 million. In fact, Bikhchandani has sold shares worth over Rs.304.2 million since the beginning of FY20, when his holding stood at 26.02%. The duo’s Endeavour Holding Trust also sold shares worth Rs.139.4 million after the Q4 results and the total promoter holding now stands at 40.37%. Cumulatively, insiders have sold shares worth Rs.1.2 billion since FY20 till date.

After the dull performance of the company, analysts at ICICI Securities have downgraded their rating from ‘buy’ to ‘hold’ with a target price of Rs.3,290. “In the near term, growth momentum is expected to slow down in two major segments of Naukri, 99 acres,” states their report, adding that the company may see a dip of 50% in billings in Q1FY21 and Ebitda margin is expected to see a sharp improvement only in FY22.

Maintaining a ‘neutral’ rating on the stock with a target price of Rs.2,550, analysts at Motilal Oswal Securities, too, foresee a halt in near-term momentum. “However, given the market positioning of its entities, multi-dimensional growth could be expected in the medium to long term, backed by recruitment, real estate, Zomato (its biggest investee company) and PolicyBazaar,” states their report. Due to the company’s high dependence on businesses linked to economic recovery, analysts at Edelweiss Securities have also maintained a ‘hold’ and revised down FY21 and FY22 revenue estimates by 20% and 15%, respectively.

But, despite the poor Q4FY20 results, the company’s stock rallied after the board approved fund raising of up to Rs.18.75 billion via QIP. Recovering from the 52-week low of Rs.1,580 hit in March, the stock currently trades at Rs.3,000, just 5% away from its 52-week high of Rs.3,125 touched in February this year. According to analysts, the funds will be mainly utilised for investment in standalone entities and in strategic acquisitions to boost scale in some of the businesses. Reportedly, Goldman Sachs, JP Morgan, Credit Suisse and IIFL Capital have been shortlisted as bankers for the QIP.

Meanwhile, mutual funds have cut their stake in Q4FY20, from 12.10% to 11.88%. Foreign investors, too, have reduced their stake from 36.12% in December 2019 to 35.45% in March 2020.