Back when Indian IT companies were the rage, Rakesh Jhunjhunwala was gaining fame for his investments in ‘old economy’ businesses. One of them was his bet on pharma major Lupin, in which he had picked up 1% stake (500,000 shares) in December 2002. That he was enamoured by the Mumbai-based company was evident in the way he ramped up his holding in the subsequent four quarters to 4.25%, by December 2003. His second big pharma bet was in 2013 when he entered Aurobindo Pharma, which was trading at an average price of Rs.150 in the December quarter.

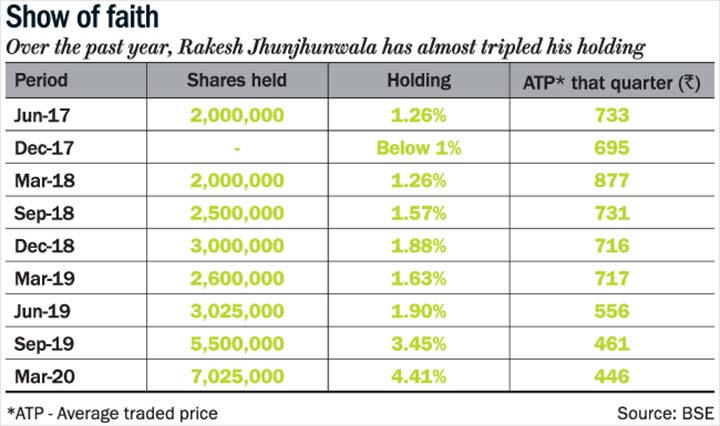

Both investments paid off — while he exited Aurobindo in December 2017 when the stock was trading at an average price of Rs.780, and made boatloads of money in Lupin, his residual stake is still worth Rs.6 billion today. After more than a decade, Jhunjhunwala has once again scooped up another pharma stock, the Rs.91-billion New Delhi-based Jubilant Life Sciences (JLS). While he entered the stock in 2017, it was followed by some offloading, which kept his stake under 1%. But since last year, he has almost tripled his stake from 1.63% in March 2019 to 4.41% as of March 2020 (See: Show of faith). So, why is the ace investor hot on JLS?

SOMETHING SPECIAL

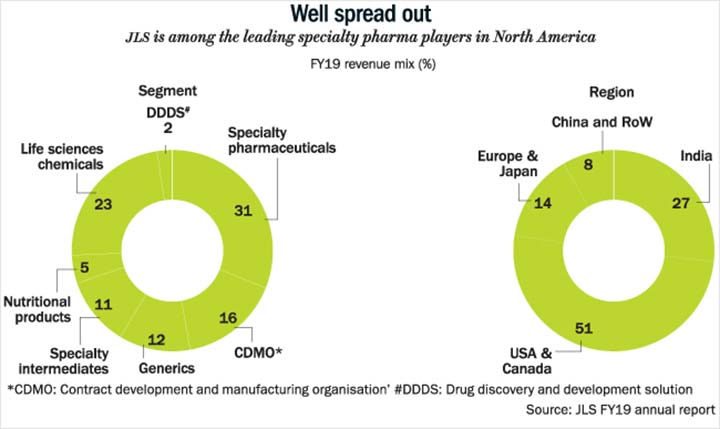

To begin with, JLS is not your regular Indian pharma player, which is overly dependent on generics or APIs. For JLS, 59% of the topline comes from specialty pharma (radiopharma and allergy therapy products), contract manufacturing (CMO) and generics (solid dosage formulations) (See: Well spread out). Meanwhile, its life sciences business gets 39%, which comprises specialty intermediates used to make bulk drugs, nutritional products and chemicals. The remaining 2% is attributed to drug discovery.

Analysts agree that the company has built leadership position in high entry barrier segments such as specialty pharma and high-quality service businesses in CMO and radio pharmacy (mostly through US acquisitions over the past two decades). In radiopharma, JLS is the sole supplier of MAA (macro aggregated albumin technology) for lung-perfusion imaging, which measures breathing and blood circulation, and DraxImage DTPA for lung ventilation and renal imaging, with 100% market share in both cases in the US.

“There is no price erosion in radiopharma and CMO businesses, like there is in generics. In the two, every new product contributes to the topline,” says Bharat Celly, research analyst, Equirus Capital. JLS has a stronghold in the radiopharma industry that is estimated to be worth $2.6 billion, and is growing at 6% annually. With 14 products, the company commands around 10% market share in the US. Ranvir Singh, analyst, IDBI Capital notes in a recent report, "We are optimistic about its innovative radiopharma product, Ruby-Fill (a machine to scan hearts for stress), which is being ramped up in North America. It also has a healthy product pipeline, which will provide better operating leverage." In fact, it has six to eight radiopharma products in the fray, which are expected to be rolled out in the next four years.

Pramod Yadav, CEO, Jubilant Pharma, shared the company’s growth strategy during their Q3FY20 concall, “We need to continue to grow Ruby-Fill and install the tech at more sites. Second, we have a very robust pipeline of products under development, which are running on schedule. And third is our forward integration of the pharmacy business, through which we are distributing products and connecting with the end customer directly.” Jubilant Pharma is achieving that by leveraging Triad Isotopes’ distribution network, a company it acquired last year. Through this, Jubilant gets direct access to hospital networks, which deliver more than three million patient doses annually. Singh of IDBI Capital says that Triad has the second-largest radiopharmacy network in the US, with more than 50 pharmacies distributing nuclear medicine products to the largest, national group-purchasing organisations.

Similarly, in the CMO business, the company has created a formidable brand in North America with four plants in the region. There, Jubilant has formed deep relationships with its key clients over a decade-long presence, says Celly. “This is a very sticky business because innovators don’t change their source so easily,” he adds. Globally, JLS caters to seven of the top 20 pharmaceuticals companies by revenue.

FDA CROSSHAIRS

Its growth prospects look good but it is not smooth sailing all the way. Two of JLS’ plants (in Roorkee and Nanjangud) had received warning letters from the FDA last year, but the company believes they will be in the clear soon. Managing director Hari Shanker Bhartia, said in the Q3FY20 analyst call that TGA Australia (regulatory equivalent of USFDA) inspected the Nanjangud plant and the regulator’s satisfaction with the facility, he hopes, will win the confidence of Health Canada and USFDA. Meanwhile, for the Roorkee plant, the company has given a detailed corrective preventive action plan to the FDA. “The kind of remediation plans we have put in place, we feel this plant should also be out of the water,” he told analysts.

But what came as great news for investors is that JLS has entered into a non-exclusive licensing agreement with Gilead Sciences. JLS is one of the three Indian companies that will receive a technology transfer of Gilead’s manufacturing process to scale up production of remdesivir, a potential COVID-19 therapy drug. By the tine rumour turned to news, JLS gained more than 25% to reach Rs.450. “This, despite lack of clarity around the commercial viability of remdesivir. We don't know what a sustainable revenue stream from remdesivir will look like," SunTrust Robinson Humphrey analysts wrote in a note, while downgrading the Gilead stock to ‘sell’ from ‘hold’. Yet, analysts remain optimistic as the agreement means JLS has bagged another client for its CMO business.

HITS AND MISSES

The strength of its pharma business has delivered well for the company, and attracted investors like Jhunjhunwala. But what hasn’t been doing too well is JLS’ life science ingredients (LSI) vertical, which includes specialty intermediates, nutritional products and life science chemicals. Although it has demonstrated good potential in the past, its growth prospect hinges upon the global commodity cycle. For instance, acetic and hydrate prices saw sharp price erosion last year. “Two years ago, a major producer had a fire incident, because of which there was a shortage of ascetic and hydrates and that resulted in a price rise that benefitted JLS. But that producer is back in the market and prices have contracted again,” says Celly. Similarly, JLS’ premix feed for cattle, under nutritional products category, has seen a hit due to demand erosion.

The low margin, cash guzzling and volatile business has been impacting JLS’ overall valuation. Tushar Manudhane, research analyst, Motilal Oswal Securities, points out, “The pharma business has a good 30-35% Ebitda margin and LSI is a volume contributor for them. Pharma more or less remains steady, but LSI can be volatile as it typically moves with raw material and final goods pricing. That could leave a favourable or an adverse impact on the profitability,” he says. Thus, the company’s decision to de-merge its pharma and LSI businesses into two separate entities comes as good news for investors, which is expected to fructify by end of 2020. The management refused to comment on Outlook Business’ queries on whether the demerger was on track. "The proposed demerger will ensure depth and focus to adopt strategies necessary for growth, unlock shareholder value with direct ownership and attract focused investors in each of the business entities," JLS chairman Shyam Shanker Bhartia had earlier said in an October 2019 statement.

The other cloud over the company is the Triad Isotopes acquisition, according to analysts. Manudhane says, “Triad was at only 3-4% Ebitda. So, there was not much hope of improving the profitability of the business. It is just that with that distribution channel under the belt, you can then supply your products.” He believes the improvement in distribution has not reflected in overall numbers yet. But Yadav of Jubilant Pharma remained confident in the analyst call and said, “We will expect results to start flowing in the next financial year,” without revealing details.

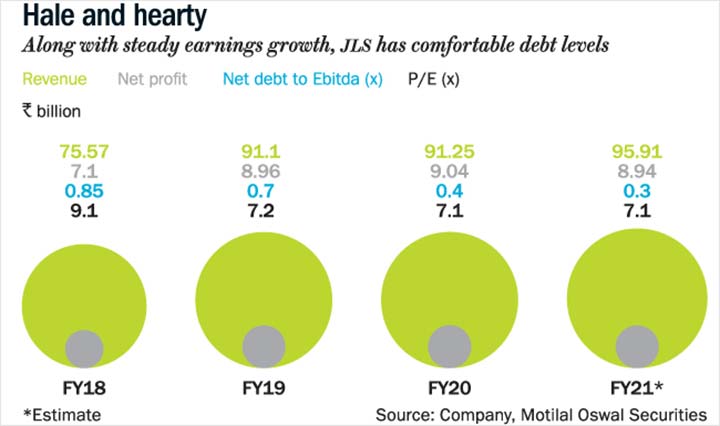

Celly believes one of the reasons Jhunjhunwala raised his stake in the company is because JLS is undervalued as compared to the sector average. Jhunjhunwala added 2.9 million shares in the September quarter, when it fell from Rs.742 in March 2019 to Rs.467. After pausing in the December quarter, he bought additional 1.52 million shares between January and March 2020 when the stock was trading at an average of Rs.488. Overall, the market carnage also pushed the stock lower to Rs.300, which made for an attractive buy according to analysts. “At Rs.300, the entire business was available for around Rs.50 billion or a multiple of 5x its estimated FY21 earnings,” says Celly. Even though it has since gained and is trading around Rs.460, it is available at 7.1x its estimated FY21 earnings. Meanwhile, peers Dr Reddy’s, Lupin, Cipla and Sun Pharma trade at 20x, 34x, 21x and 20x, respectively. Moreover, the company generates Rs.7 billion cash annually. “The overall market cap is 14-15% cash yield, which would be very lucrative, especially in pharma,” he explains.

Besides healthy cash flow and operating profit, JLS net debt/Ebitda ratio is 0.4x (See: Hale and hearty). As for the investor with the Midas touch, this is much more than a value play and he is not in a hurry. “I have held Lupin for 14 years. There were two, three-year periods when Lupin gave me no return and the market performed; and I still held on and what a return I got!” he said in an interview with ET Now. So, only time will tell if Jubilant will be another Lupin, but with Jhunjhunwala’s stamp of approval, it is sure that JLS will be closely watched.