Swing for the fences. That’s the mantra Nalanda Capital follows when it sets its heart on a company. When the Pulak Prasad founded investment firm likes a business and the management, it does not sit quietly with a few thousand shares. Its investment approach involves grabbing a large stake and sitting tight until the cows come home. Most often than not, we are talking ballpark 10%.

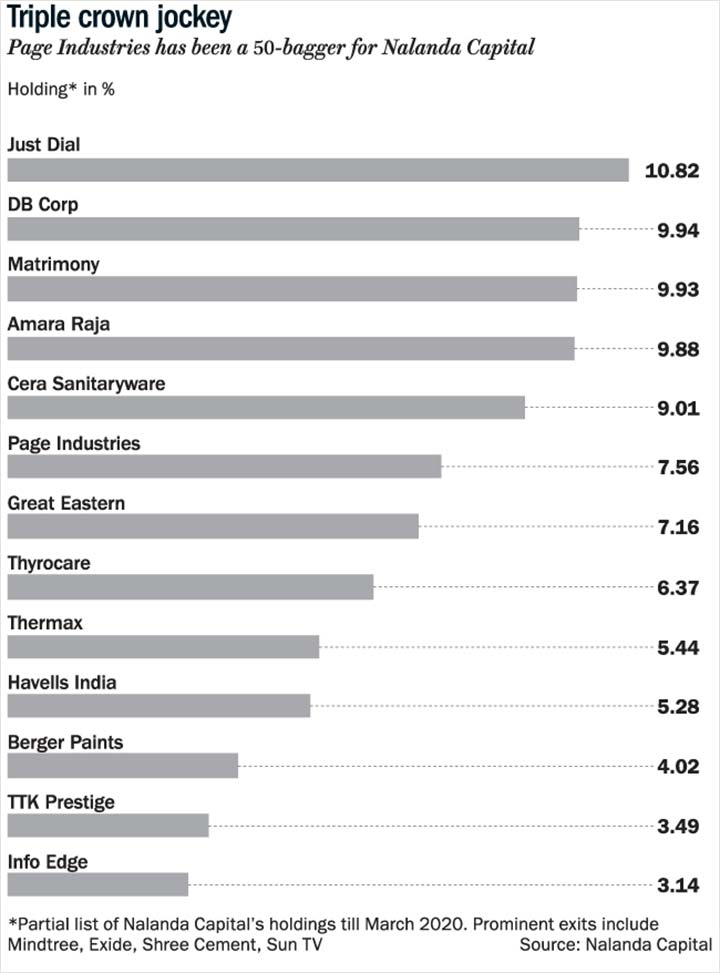

After grabbing headlines for turning a $300-million bet on Bharti Airtel into $1.9 billion for Warburg Pincus in 2005, Prasad founded Nalanda Capital and has stayed true to his investment strategy. He has made successful bets on companies such as Page Industries, Berger Paints, Mindtree and TTK Prestige to name a few. For instance, he bought 8% stake in Page Industries in October 2008, when the stock was trading at Rs.430. It bought some more and it was only in 2018 that Nalanda trimmed its holding around Rs.23,000! It still holds 7.56% in the company worth Rs.17 billion and is just one of the many multibaggers in the portfolio. Although the return on some of its bets such as DB Corp and GE Shipping don’t seem spectacular, in GE Shipping it has recovered more than half its investment by way of dividends. Even with DB Corp, dividend flow has been regular but unlike in GE, it is now trading below buying price. Still, for Nalanda Capital, the wins outweigh the laggards by a large margin (See: Triple crown jockey).

Thus, it was no surprise when Thermax, a capital goods leader in the country, rallied about 13% after Nalanda Capital increased its stake to 2.82% on March 20. That is after the stock saw a harrowing 2020 in line with the overall market, and had fallen by almost 40%. More buying followed in April and May where disclosure showed that it now held 5.44%. Much of that block has come from mutual funds trying to raise liquidity. Nalanda clearly seems to have acted as a buyer of last resort and going by history, this holding could rise even more. After all, Prasad has always been in it for the long haul. Does that mean Thermax will turn out to be another multibagger?

No stranger to challenges

If you go by the analysts at Phillip Capital, staying away from the capital goods industry would be wise for now. According to them, waiting for private capex cycle to recover is like waiting for Godot — it might be futile. It’s a sentiment shared by many analysts, since the segment is largely dependent on government and private capex for orders, which for the most part has remained dismal over the past few years amidst a weakening economy. Add to that a worldwide pandemic that has forced the economy to completely shut down. MS Unnikrishnan, managing director, Thermax tells Outlook Business, “As the downturn started, the biggest challenge was of no new projects being announced. As consumption falls, existing capacities will also be underutilised.” Then there is high fixed cost — about 20-30% of total sales of the company — which has affected margin. From 12-14% ten years ago, the margins of capital goods companies’ have come down to 7-9%. They are now “facing a double hit” and Unnikrishnan believes the sector’s future will depend on creating new capacities.

For a company whose 40% revenue comes from its exports business, the global pandemic has caused particular unease. Thermax has operational and sales exposure in countries such as Denmark, Indonesia and other European countries. Experts believe order pipelines or tendering activities may pause for at least six months affecting order intake by 20-30% in FY21. “Supply chain disruption, stress on working capital would significantly reduce cash flows and profits for capital goods companies in FY21,” estimate analysts at ICICI Securities.

For Q3FY20, Thermax announced 2% decline in its consolidated operating revenue to Rs.14.1 billion from Rs.14.37 billion in the previous quarter. Yet, its net profit rose 13.2% to Rs.850 million from Rs.750 million, due to lower interest costs and tax. Its order-book also saw year-on-year decline of 16% to Rs.54.4 billion.

An analyst at Emkay Global Financial Services says, “Even if you look at the segment pre-COVID, it was not doing that well. Capex-intensive segments in the economy — oil and gas, metals or mining — have not been spending and neither have we seen any pipeline emerging from the sectors for the next two years.”

Then, why is Nalanda Capital bullish on the company? While the investment firm did not respond to Outlook Business’ request for an interaction, Thermax’s strong balance sheet, its execution skills, high promoter holding, squeaky-clean management and consistent dividend might have played a definite role. Plus Thermax is no stranger to tough times. The company went through an existential crisis in 1996 after the untimely demise of its founder RD Aga. It was just a year after its IPO in 1995. Aga’s wife Anu stepped up, held fort alongside the management and managed a turnaround during the slowdown that followed the dotcom bust in 2000 (See: Rollercoaster ride). Since then it has not looked back except the global credit crisis in 2008-09, which got papered over by QE after QE.

From zero debt to more than 10% RoCE over the years, and efficient working capital management, the company has managed to float above its peers with a stronger balance sheet. Since the company is not burdened with any debt, Unnikrishnan says they are not too worried about the topline, but are focusing on “cash flow, for the company and the customer”. He emphasises that even during the lockdown, the company did not “face challenges with liquidity or repayments to banks”.

In March and April, when many companies were seeking moratoriums and planning to invoke force majeure, Thermax announced 350% dividend (Rs.7 per share) for FY20. Over the past five years, the company’s dividend payout has ranged between 70% and 130%. Nalanda also received a hefty credit as its first tranche of 2.82% was bought just before the record date.

Long-term play

Nitin Bhasin, head of research-institutional equities, Ambit Capital says, “Thermax scores above its peers on cash flows, working capital management and balance sheet.” Over the years, it has also transitioned itself from a domestic power sector capex play to a diversified private sector capex play with significant international exposure. Moreover, the fact that it has geographical diversity will help it perform better than Indian peers, since governments abroad have been more aggressive with economic support. According to Ambit Capital, this will boost Thermax’s international order flow from FY22, “while order flows in India will remain restricted to pockets of segments with high demand visibility such as cement, pharma and desulphurisation systems.”

Nilesh Bhaiya, research analyst at Motilal Oswal Securities adds, “One key difference between Thermax and other capital goods/EPC companies is that it is a products and services company and not an infra developer. So, its business is fungible and the company can move the business towards areas of growth.”

Thermax is also very selective in bidding for new orders. That protects the balance sheet and ensures proper working capital cycle. For instance, Unnikrishnan explains how they are being prudent about credit with new companies, even if it has a strong background. “But if it is an existing company that we have worked with earlier, we may negotiate on projects because we don’t want them to go anywhere else. But we will not bid aggressively. It is the most dangerous thing to take the wrong order at this time,” he adds.

It is this conservative decision making that could have worked its charm for Nalanda Capital, which does not invest unless it is convinced “that the management team is clean, outstanding, and open to external ideas”. Thus, even though Unnikrishnan will be handing over the rein to Ashish Bhandari after steering the company for almost 13 years, analysts are far from worried. Bhandari comes from Baker Hughes General Electric, where he has been leading operations since 2007, ultimately improving the profitability of its businesses. Unnikrishnan says Bhandari is the “ideal candidate to take the company forward”.

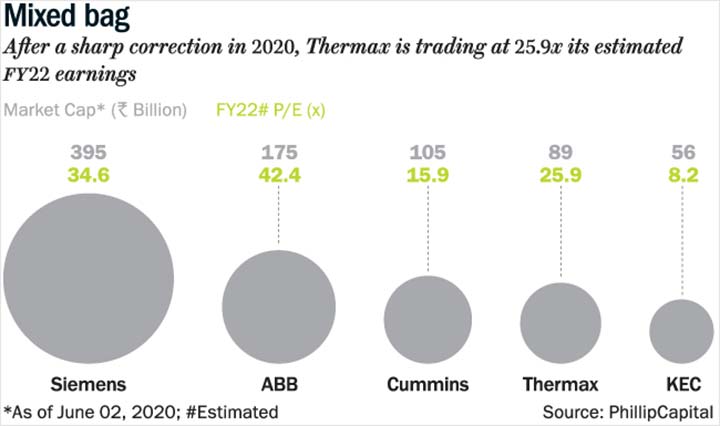

While Motilal Oswal Securites is negative on the company with a neutral call due to short- and medium-term challenges, Bhaiya adds, “Over a longer term, the company is obviously good at the product offerings, execution capability etc. The return ratios are obviously very good.” The stock is more than 45% off its all-time high of Rs.1,300, which it hit in January 2018. Trading at 25.9x its estimated FY22 earnings, Thermax is available at a valuation lower than its peers such as ABB and Siemens, which are trading at 42.4x and 34.6x, respectively (See: Mixed bag).

Unnikrishnan is keen on keeping the company’s goals realistic, while approaching the challenges ahead. “I am not expecting that the Indian economy will return to normalcy by 2021. By Q4FY21, I hope there will be a proven vaccine available. Once that happens, the fear factor will go away and we will limp back to normalcy in manufacturing,” he says. With that hope, Nalanda Capital, which puts its “eggs in very few baskets and watches it carefully”, will also be watching Thermax’s growth trajectory.

It is important to remember that two of the most important tenets of their investment approach are focus on high return on capital and an asymmetric risk-reward trade off. If Prasad’s timing is early, Thermax could well be another Exide than a GE Shipping or DB Corp.