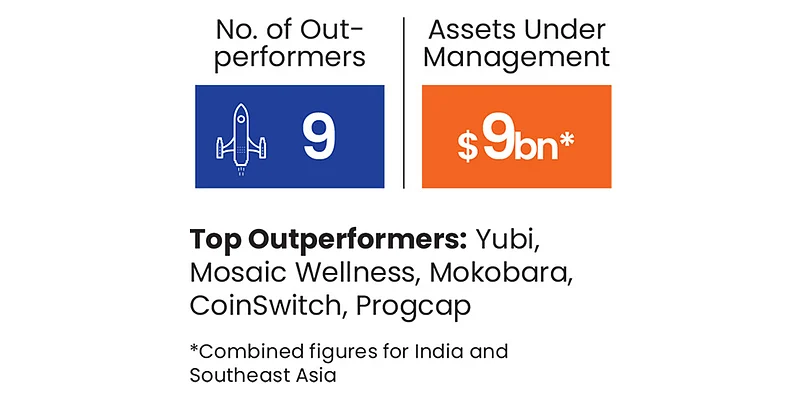

1. Peak XV

100 of 100

No. of funds: 13 | HQ: Bengaluru

Key people: Shailendra Singh, Rajan Anandan, GV Ravishankar, Mohit Bhatnagar, Sakshi Chopra

Main sectors of interest: Fintech, consumer, retail, high tech, enterprise infrastructure

The Bengaluru-based venture capital firm takes its inspiration from Mount Everest in name and spirit, defining its vision of building long-lasting businesses that stand tall and inspire greatness. Originally Sequoia Capital India & Southeast Asia, Peak XV became fully independent in mid-2023, post which it has doubled-down on its India strategy. It has 25 listed companies in its portfolio and 37 unicorns. Its team has over 60 operators that work with portfolio firms across human capital, strategic development, marketing, public policy, portfolio finance and technology & product. Like its peers, Peak XV’s partners are also bullish about artificial intelligence.

Recent exits have drawn some attention in the investor domain, but the firm is looking forward to its strategy to build a global presence. It recently hired senior operators in the US to intensify its investments overseas. Further, with many of its portfolio firms going public, its early India bets have logged multiple high-profile exits. Going forward, it is focussing on sunrise sectors like precision manufacturing, space and semiconductors alongside AI.

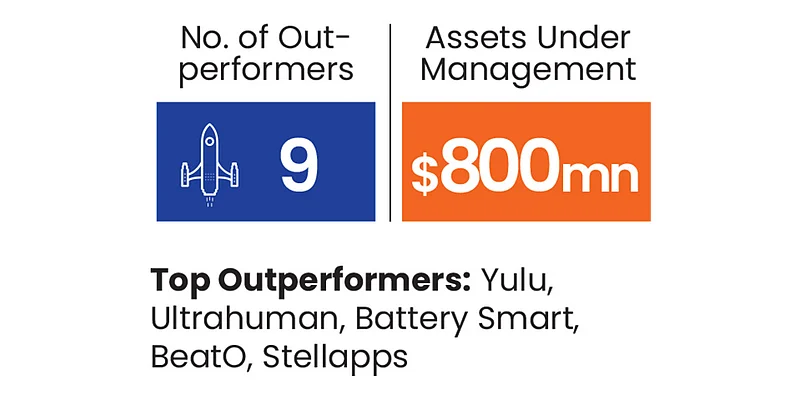

2. Blume Ventures

95.2 of 100

No. of funds: : 5 | HQ: Mumbai

Key people: Sanjay Nath, Karthik B Reddy, Arpit Agarwal, Sajith Pai, Ashish Fafadia

Main sectors of interest: Artificial inteligence, health care, financial services, B2B SaaS

In the early days of India’s start-up ecosystem, Blume Ventures made a name for itself by backing young founders when few others were willing to take a chance. Founded in 2010 by Karthik Reddy and Sanjay Nath, the venture capital firm has since emerged as one of the most respected early-stage investors, deploying patient capital and strategic support across technology and consumer companies.

Blume’s philosophy centres on finding ambitious founders solving large, real problems and supporting them through product-market fit to scale. Over the past 15 years, it has backed iconic names like Purplle, Unacademy, Spinny, Cashify, Servify, Classplus, Pixxel and Turtlemint.

As it embarks on its fifth flagship funding vehicle, Fund V, Blume has secured a first close of $175mn and is targeting a final close of up to $275mn by early 2026, with commitments from both existing and new partners. The fund continues Blume’s focus on seed and pre-Series A investments across sectors like health tech, fintech, consumer internet and deep tech, and it has already begun deploying capital into early-portfolio firms. Going ahead, Blume is bullish on AI-enabled software, deep tech and consumer-driven digital platforms.

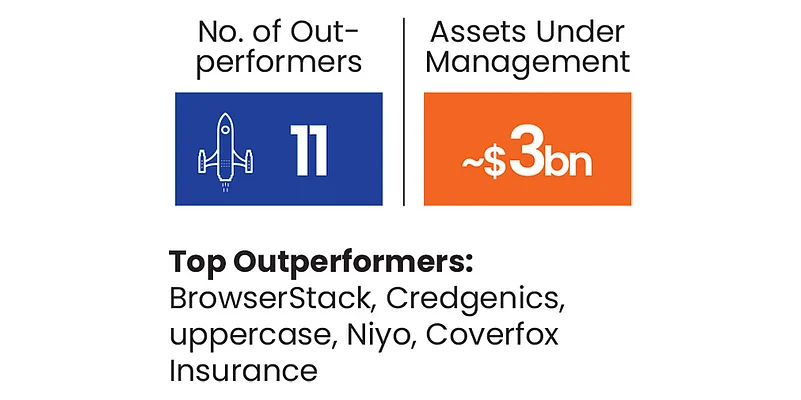

3. Accel India

95.2 of 100

No. of funds: : 8 |HQ: Bengaluru

Key people: Prashanth Prakash, Mahendran Balachandran, Prayank Swaroop, Anand Daniel, Subrata Mitra

Main sectors of interest: Consumer brands, fintech, manufacturing, artificial intelligence

Accel’s India franchise has been active since the mid-2000s and formally set up a dedicated local presence in 2008, positioning it as one of the earliest institutional backers of Indian start-ups. Over nearly two decades, it has participated in dozens of funding rounds, usually as the first institutional investor, deploying capital across seed and early stages while leveraging its global network to support founder scaling strategies.

In January 2025, Accel closed its eighth India and Southeast Asia fund with commitments of $650mn, a figure identical to its 2022 India fund. This brings the firm’s cumulative investment commitment in the region close to $3bn, as per regulatory filings and media reports.

The firm’s portfolio in India includes some of the most notable outcomes. It was among the first institutional investors in Flipkart, whose majority stake sale to Walmart generated one of the largest VC returns in India. It also backed Swiggy at seed stage in 2015, which went public in 2024, and has supported companies like Freshworks, Urban Company, BlackBuck, Zetwerk and BlueStone, many of which have achieved unicorn status or generated exit opportunities through secondary deals.

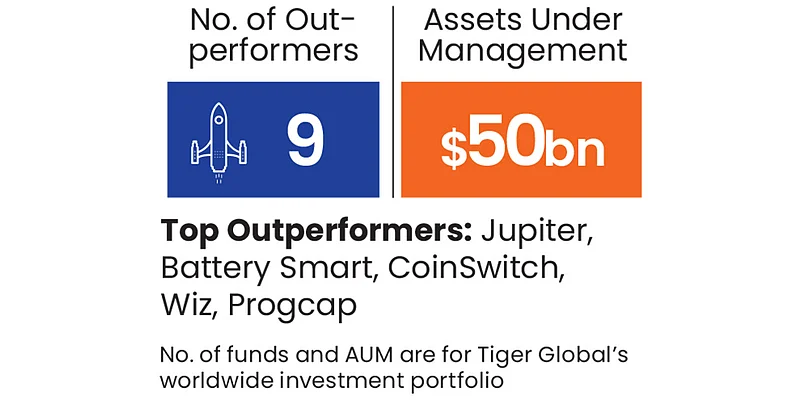

4. Tiger Global

90.5 of 100

No. of funds: 16 | HQ: New York

Key people: Chase Coleman, Eric Lane

Main sectors of interest: Enterprise applications, fintech, retail, high tech

The New York City-based hedge and venture capital fund sits at the top of the pyramid amongst its peer firms globally in terms of AUM. India serves as a major investment location for the firm with 13 of its portfolio companies, including Zomato, Ola Electric and Ather, going public in the past few years. It is known for backing during early and growth stages. It defines its strategy as a long-term approach to investing in leading, global public and private companies that leverage technological innovation. According to Tracxn data, 28 of its portfolio firms in India have attained unicorn status, underlining the extent to which its early-stage portfolio has translated into large-scale outcomes.

Over the years, Tiger Global’s investment strategy has transitioned from what is dubbed as “spray-and-pray” to a more principled approach, say analysts.

After slowing down during the post-pandemic funding winter, the firm has renewed interest in India in 2025 by investing in EatClub, Infra.Market, Spinny, Apnaklub and Meesho at different rounds.

After exiting more than 85 firms globally in recent years, it is reportedly considering a new fund of $2.2bn for fresh investments.

5. 3one4 Capital

71.4 of 100

No. of funds: : 6 | HQ: Bengaluru

Key people: Siddarth Pai, Pranav Pai

Main sectors of interest: SaaS, consumer internet, fintech

3one4 Capital was founded in 2016 by brothers Pranav Pai and Siddarth Pai as an early-stage venture-capital firm focussed on India’s seed and Series A spaces. The firm’s early positioning was clear, writing first institutional cheques to Indian founders building technology-led businesses in large domestic markets.

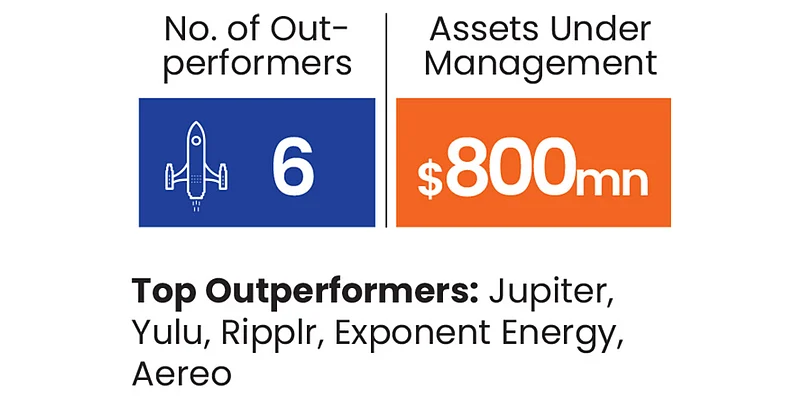

Over the years, 3one4 has built one of the more active early-stage portfolios in the ecosystem. The firm today manages more than $800mn in committed capital and has backed over 100 start-ups across multiple funds. Its investments are mainly in sectors where software adoption is key, including SaaS, fintech, enterprise software, SMB digitisation, consumer platforms and digital health. Initial cheque sizes are typically up to $5mn, with selective follow-on investments.

What has made the firm closely tracked is realised liquidity rather than just paper gains. Its first fund, launched with a corpus of about $15mn, has returned capital to limited partners. A key contributor was a reported 58x multiple on its early investment in HR tech company Darwinbox through a secondary sale in a late-stage round. Other portfolio firms like Licious, Jupiter, Tracxn, Pocket Aces and Dhan have gone on to raise large follow-on rounds, list publicly or provide liquidity through secondary transactions.

Note: Investors have been ranked based on their portfolio start-ups featuring among the outperformers. Three points have been assigned to an investor for each portfolio start-up that ranked among the top 5 start-ups. Two points for each portfolio start-up among top 6-10. One point for each portfolio start-up among the top 11-20. Blume has been ranked higher than Accel as the former has more bets among the top 5 outperformers across sectors. Final scores are normalised to the maximum (100).

Top Angel Investors

Individual investors behind early bets and high-returns game in India's start-up landscape

Research and data partner: Ayvole