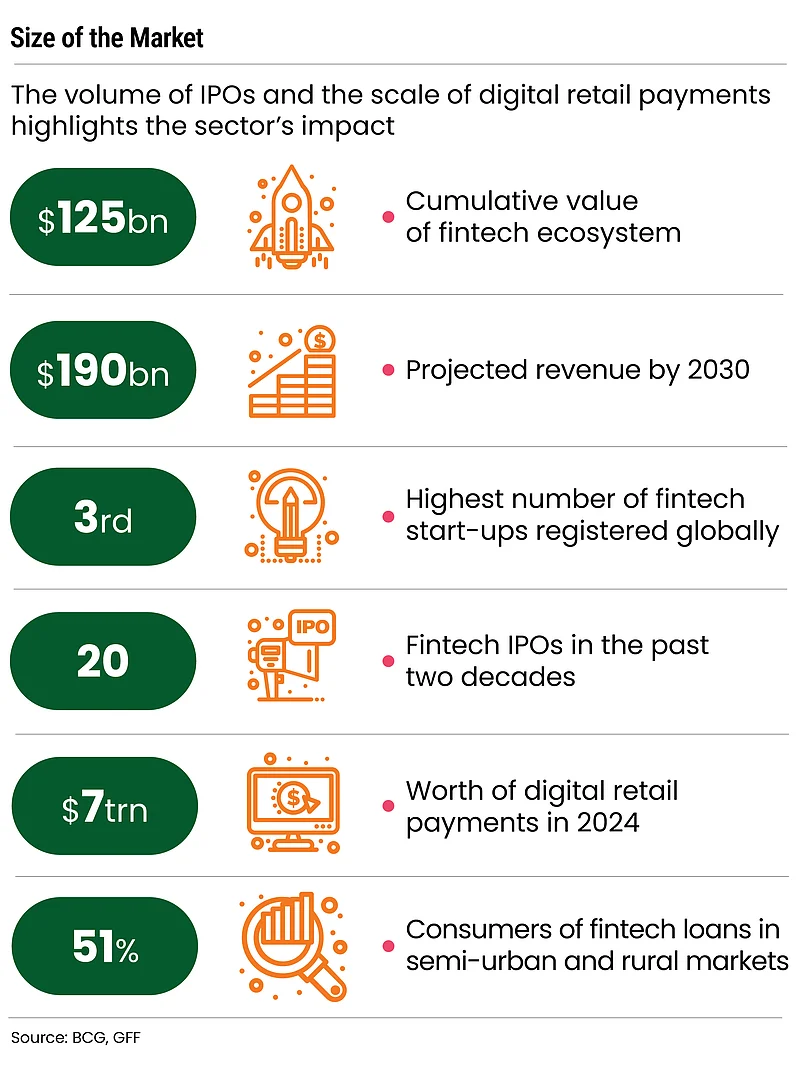

Dezerv

Backed by Azim Premji’s Premji Invest, the company manages wealth for India’s affluent first-generation investors, founders and c-suite executives helping them manage risk in the face of global uncertainties. In December 2024, Dezerv surpassed Rs 10,000 crore in assets under management (AUM).

'What sets us apart is that our investment decisions are free from human biases and past performance influence' Sandeep Jethwani, Co-founder

This year, the start-up is targeting AUM of Rs 25,000 crore. Its primary focus is on equity investments. The company already operates out of Mumbai, Bengaluru and Delhi and is now seeking to move to Tier-II cities.

About its investment strategy, the company says it has a future-focused approach with continuous monitoring with decisions taken on the basis of data using quantitative analysis to identify patterns, trends and opportunities. The start-up's philosophy is to generate long-term weath over episodic spurts of high internal rate of return (IRR).

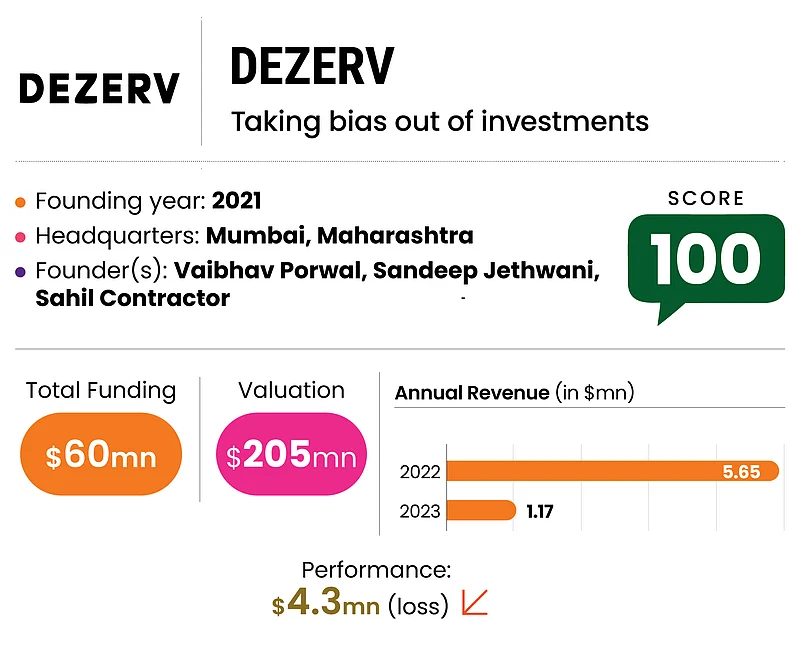

Cashfree Payments

The company was set up for payments for ecommerce businesses in 2015. It is now a prominent player in the fintech landscape and offers a comprehensive payment and application programming interface (API).

'The focus on unit economics has been integral to achieving and maintaining scalability' Akash Sinha, Co-founder and chief executive

Last year, Cashfree Payments became one of the first non-bank entities in the country to secure the central bank’s cross-border payment-aggregator licence, allowing it to facilitate international transactions for the import and export of goods and services. It also obtained Reserve Bank of India’s prepaid payment instrument (PPI) licence, authorising it to issue digital wallets and prepaid cards.

The company works with 1,000+ direct-to-consumer (D2C) brands across various product offerings in India.

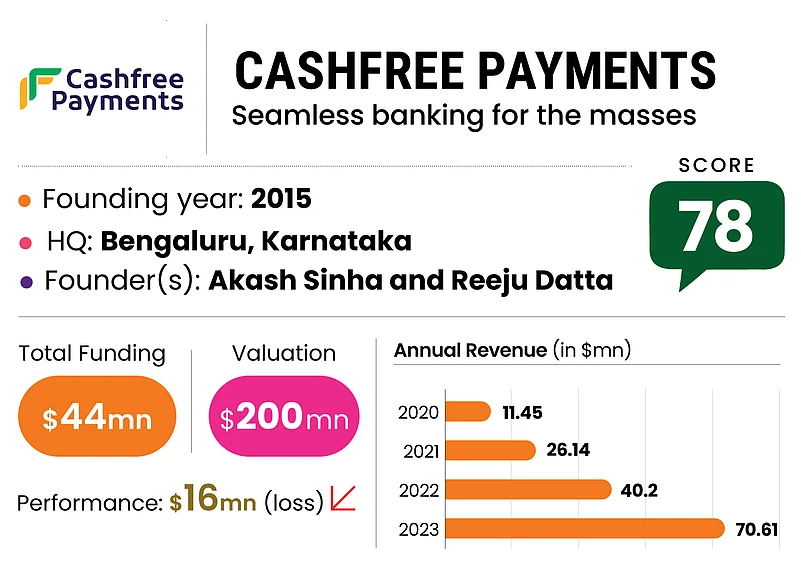

Jai Kisan

The company offers instant credit to farmers, retailers and businesses. It aims to de-risk flow of capital to emerging rural markets. Some of its products include retailer application BharatKhata, Jai Kisan Farmer for individual farmers and Bharat Credit for MSMEs and corporates.

'[We are] bringing about financial literacy and helping India unlock a better standard of living' Arjun Ahluwalia, Co-founder

In August 2024, Jai Kisan secured a non-banking financial company (NBFC) licence after it acquired a stake in Kushal Finnovation Capital, a supply chain financing company. This integration aims at doubling down on balance sheet lending opportunities, foraying into co-lending and diversification. The company claims to have a first-hand understanding of rural value chains and aims to impact 900mn people in rural India through its work.

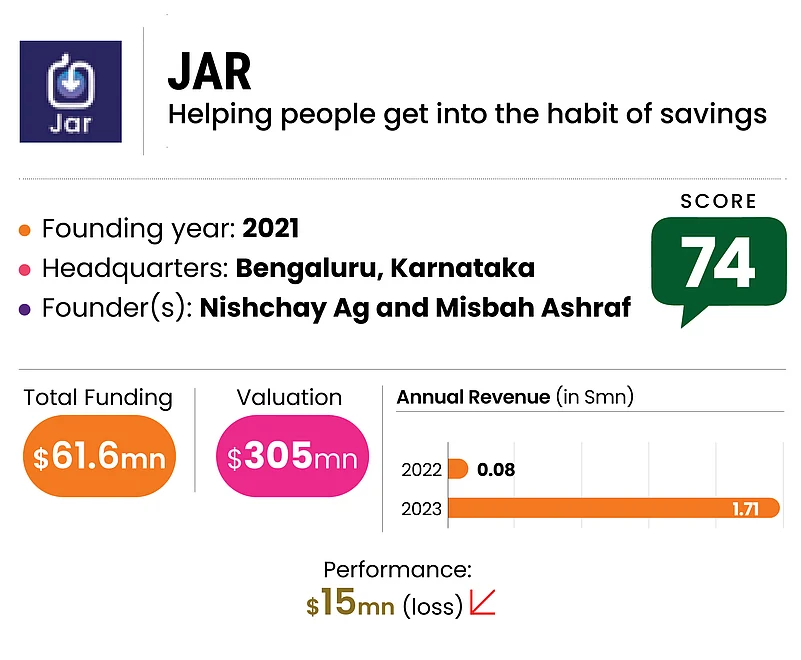

JAR

The founder’s mission was to inculcate a habit of savings, and to do that, the company chose gold. The app allows users to invest in digital gold. The platform rounds up users’ online transactions to the nearest rupee and invests spare change into 24-carat digital gold, thereby promoting a disciplined savings habit among its users. The company calls itself a digital piggy bank. Jar’s growth trajectory has been backed by investments from prominent venture capital firms, including Tiger Global, Arkam Ventures and Tribe Capital.

'The next year is all about expanding our reach. We plan to scale our B2B gold-tech solutions' Nishchay Ag, Co-founder and chief executive

Over the next year, the company plans to double down on enhancing core product experience, introduce smarter financial tools and ensure they stay ahead of the curve as the digital gold sector matures.

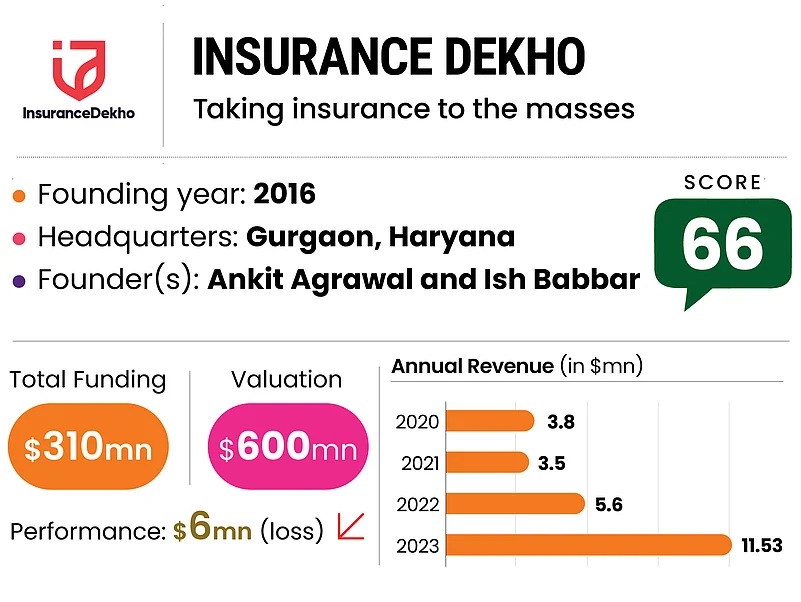

Insurance Dekho

The start-up lets users compare and purchase from among a wide range of insurance policies, including motor, health, life and commercial insurance. The company has tie-ups with over 49 insurance companies and offers 670 plans on its platform. The start-up boasts that the entire process of filling in details, comparing quotes, selecting the right policy and making payments takes just about five minutes.

'To sustain our growth, we will continue our focus on a consistent and sustainable scale' Ankit Agrawal, Founder and chief executive

In October 2024, reports suggested InsuranceDekho was in talks to acquire its competitor RenewBuy through a share-swap deal. This potential merger could value the company at approximately Rs 8,000 crore, positioning it as a leading player in the online insurance distribution space.

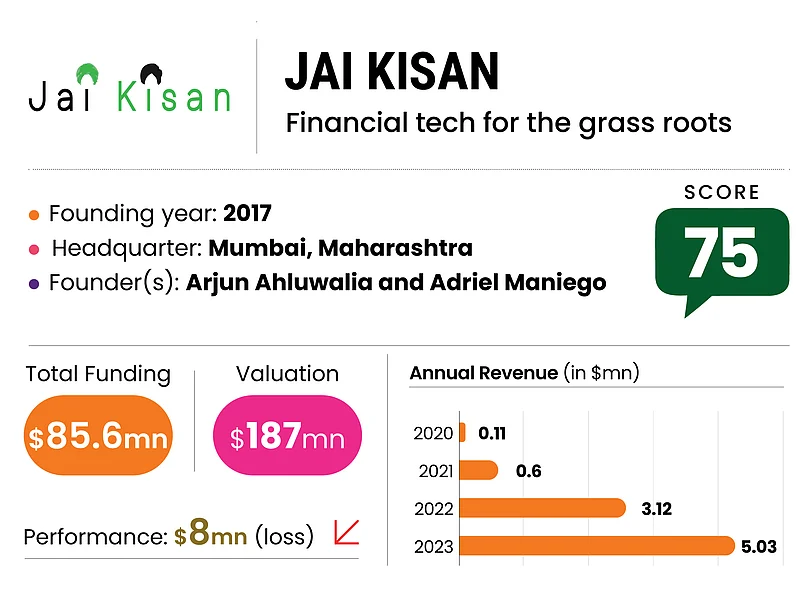

Making Money at Scale

Investor confidence is pushing valuations up, but the companies continue to make losses. Start-ups in the segment need to refine their models to achieve sustainable growth