Trade between the US and India has grown in the past 10 years, surging 90%. In 2024, the US was India's top export destination.

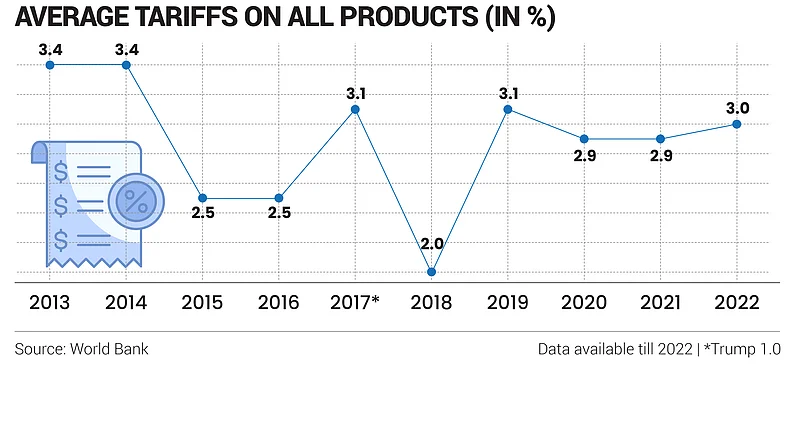

But experts worry that Trump’s protectionist policies could squeeze the profit margins of Indian exporters. In his first term, Trump revoked India’s preferential trade status. A 10% hike in tariffs on Indian imports could mean a 0.3% reduction in India’s growth, according to Morgan Stanley.

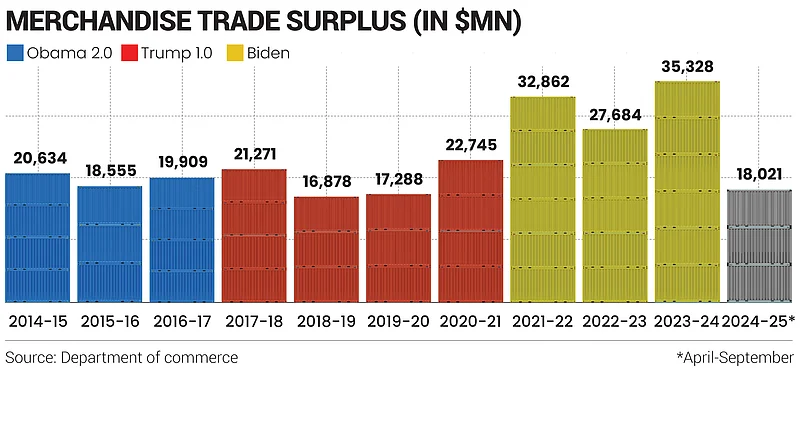

But on the flip side, high tariffs on imports from China may prove to be a comparative advantage for India. Trade data shows that India maintained its merchandise trade surplus with the US, despite high tariffs during Trump’s first presidency.

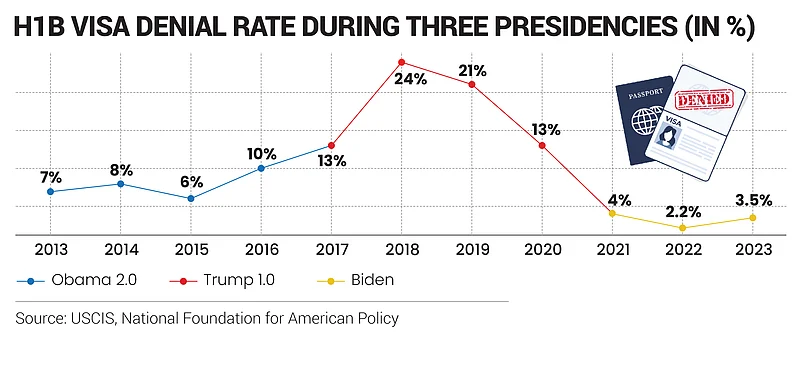

A second source of worry is H1B visas. Claiming that H1B visas took away jobs from American workers, the Trump administration sought to limit visa numbers and raise wage requirements for hiring foreign workers. If these measures return, it could force Indian IT firms to hire locally, straining their margins.

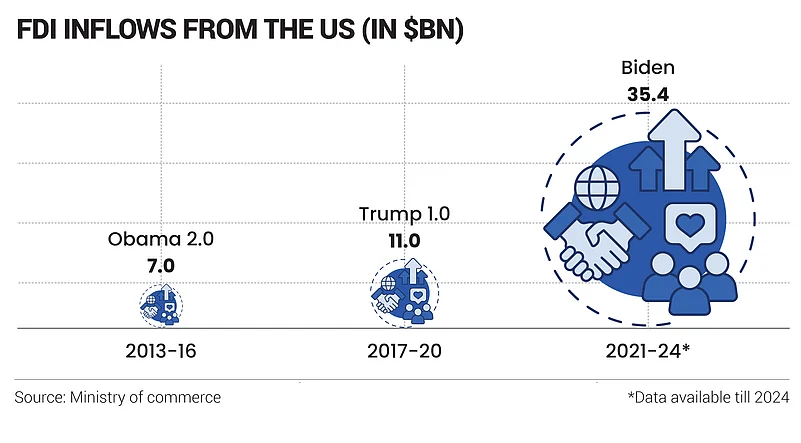

Trump 1.0 saw regulatory changes to attract investment back to the US. A similar approach would prompt multinationals to invest in the US rather than expand to other countries.

The US is India’s top source of FDI but unlike a decade ago, India now sees investment in up to 12 emerging industries. This diversification can cushion against a potential downturn.

A combination of these policies is likely to raise costs for US businesses and consumers, strengthening the dollar and weakening the rupee. This may increase India’s oil and commodity import costs, driving up inflation.

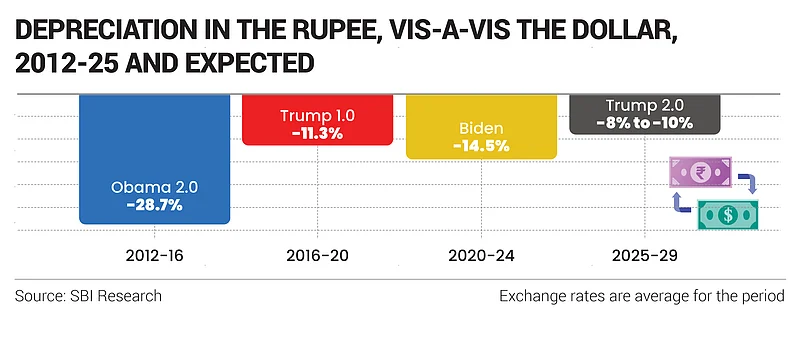

The rupee may weaken by 8–10% during Trump’s second term, although this would be less than the decline during Biden’s term.

Research: Kush Sharma | Graphics: Shriya Bhatia