The lights went out across the Iberian Peninsula on April 28. In peninsular Spain, mainland Portugal and parts of southwest France, power failed in an instant. Trains stopped, hospitals leaned on emergency systems and commuters found themselves waiting for the hum of electricity to return.

The event was exceptional not only for its scale but for its lesson that even relatively small, modern grids can reveal vulnerabilities that are not obvious until they snap.

Far away in New Delhi, the outage raised eyebrows. In August, engineers and planners gathered to parse data and to imagine the impact of such situation on a grid much larger and more complex. Their worries were justified. If Spain and Portugal, with their advanced electricity markets, could be pushed to the edge, what would happen in a country where demand grows by the year and where outages can become political crises?

A Steady Supply

Analysts and an expert panel looking into the Iberian incident pointed to an interesting takeaway: when too much of the electricity comes from sources like wind and solar, which depend on the weather, it becomes harder to keep the grid stable, especially when the weather or power demand does not match forecasts. This does not mean renewables are bad; it simply means they change the way electricity flows in and out of the grid, making it more sensitive to sudden changes.

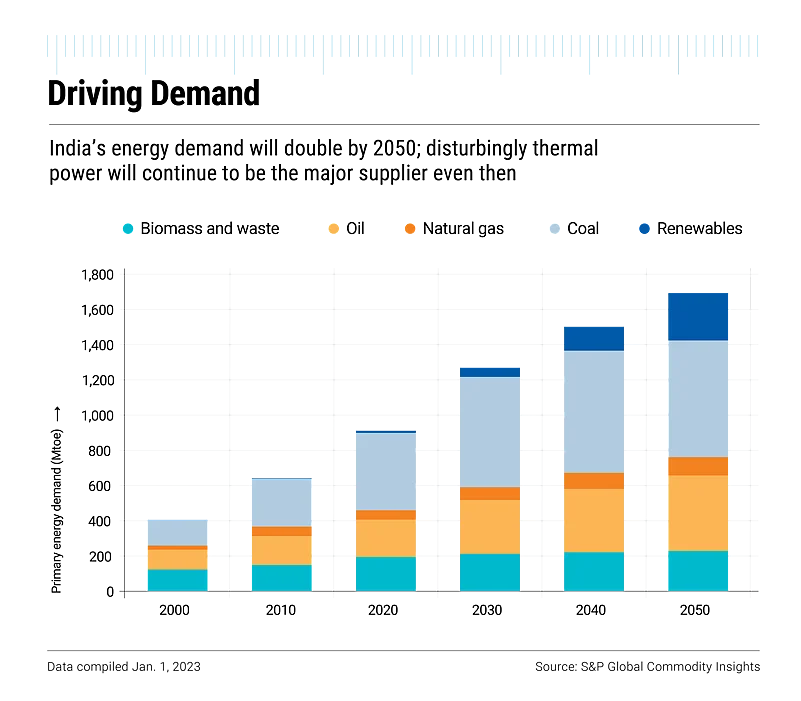

India already knows the virtues and the limits of that transition by experience. Over the last decade the country has spread solar farms and erected windmills across many of its regions. The effort has been dramatic. By mid-2025 non-fossil sources accounted for roughly half of India’s installed electricity capacity, a milestone reached earlier than many planners expected.

At the same time, however, the bulk of actual electricity generation still comes from coal-based thermal plants, which supply the steady, predictable power that growing industries and cities require. Those two facts sit uneasily together.

Solar and wind may be wonderful for cutting emissions, but they do not produce power on demand. To keep the lights on, the grid needs reliable power sources that can step in when the weather does not cooperate. That is why regulators and system planners have begun to talk openly about a parallel path.

India intends to add nearly 97GW of new coal-based capacity by 2035 to shore up grid reliability even as it expands renewables. Building more coal capacity now would blunt some of the volatility of weather-driven power, but it would also deepen India’s carbon dilemma and complicate its climate commitments.

The result is a double bind. On one side is the risk of instability, the kind that left Spain and Portugal in the dark. On the other is the risk of locking in emissions for decades to come. This limitation has forced India to place perhaps an even more audacious bet. India is turning back to the atom.

“To ensure uninterrupted and reliable power, it is essential to have a non-thermal source of energy, and nuclear energy offers a good mix,” says VK Saraswat, member, NITI Aayog, India’s premiere policy think tank (see pg 50). But this is not the first time India toyed with the idea of nuclear energy.

Mission Nuclear

In July 2008, Manmohan Singh, the then prime minister, rose in Parliament to defend the civil nuclear deal with the US. For hours, the bespectacled economist-turned-politician, known more for his silences than his speeches, argued that the agreement was not merely about access to fuel or foreign technology but about India’s future. “This is not about me,” he told allies wavering under political pressure. “This is about the destiny of India.”

Singh knew the risks. His government faced a no-confidence motion; allies were defecting and his own survival in office hung by a thread. Yet he pressed on, convinced that the nuclear deal was larger than his own political ambitions. But the nuclear promise he championed could not be realised.

Today, India’s nuclear fleet contributes just 8.8GW to the grid, around 3% of the country’s total electricity generation. This is a modest return on decades of investment and ambition, stretching back to father of India’s nuclear programme Homi Bhabha’s vision for a three-stage programme.

After India’s 1974 nuclear tests, international embargoes cut off essential technology partnerships. “The 1998 tests tightened embargoes further, making progress difficult,” recalls Anil Kakodkar, former chairman of the Atomic Energy Commission of India and ex-director, Bhabha Atomic Research Centre—BARC (see pg 56).

The decision to remain outside the Nuclear Non-Proliferation Treaty further deepened the country’s isolation, he adds. And even after Singh’s landmark civil nuclear agreement with the US opened the door to cooperation, domestic political hurdles and public scepticism hobbled new projects.

Then there are the reactors themselves. Large nuclear plants are notorious worldwide for delays and cost overruns, and India has been no exception. Under India’s three-stage nuclear power programme, the first stage—pressurised heavy water reactors (PHWR)—uses natural uranium as fuel and heavy water as both moderator and coolant. These reactors have worked but not scaled.

The second stage, based on fast breeder reactors that use plutonium to generate more fuel than they consume, has been delayed for decades. Fuel shortages have also meant that many reactors often run below capacity. But in all of this, there has been a silver lining. “Because we had to complete the reactors ourselves, it strengthened our indigenous technology,” says Kakodkar. “Indian PHWR is now among the best-performing reactors globally.”

It is against this backdrop that the Narendra Modi-led government has sought to revive India’s nuclear mission. Where Singh’s focus was on opening doors abroad, Modi has leaned on reimagining scale at home. His government has set an audacious target of 100GW of nuclear capacity as part of its Viksit Bharat vision, to be achieved by mid-century.

More importantly, nearly a third of this, officials say, could come from small modular reactors (SMRs)—compact, factory-built designs that promise shorter construction times but no proven records. As of today, no SMR has been deployed commercially at scale anywhere in the world.

Indian scientists, however, point out that the country’s 220MW PHWR reactor qualifies as a small reactor—typically defined as those under 300MW—though it is not modular in the strict sense.

Modular reactors are considered more advanced, as they are easier to operate and maintain compared to conventional designs.

India however, like many countries, is convinced of its potential. Unlike megaprojects that sprawl across acres of land, these smaller reactors will be placed closer to demand centres. “SMRs can support higher renewable-energy penetration,” says Manoj Kumar Upadhyay, deputy adviser for energy at NITI Aayog. “They can integrate with renewable energy in hybrid systems, such as solar plus SMR or wind plus SMR, by providing the baseload needed to manage intermittent generation.”

But the weight of history is undeniable. India has spent nearly 60 years building just 8GW of nuclear capacity. Now it aims to add more than 11 times that amount in less than 25 years. The question is whether the country is ready for such a sprint that involves a commercially untested technology.

Need for Speed

Union Commerce Minister Piyush Goyal returned to Delhi in mid-2025 with the satisfaction of a deal done. The UK trade agreement promised new markets for Indian exporters. But the celebrations were tinged with concern. Across Europe, policymakers are pushing ahead with the Carbon Border Adjustment Mechanism. Steel, aluminium, cement and products with a heavy carbon footprint, could soon face steep taxes at the border.

For a country like India whose industrial exports remain largely carbon-intensive, the implications could be immediate. Growth and competitiveness abroad have already begun to feel inseparable from the urgency of clean, reliable power.

The government’s approach to nuclear, under the current legal framework, therefore, reflects this urgency. Even with SMRs, it has crafted its own strategy. At its core are two stages. First in the works is the Bharat Small Reactors (BSR), based on India’s proven 220MW PHWR, but not modular like proposed in advanced economies.

Second is the Bharat Small Modular Reactors (BSMR).

India plans to gradually transition from the BSR to the more modular BSMR designs in phases, rather than leap straight to the ideal plug-and-play SMRs currently popularised by the West. Both projects are progressing in parallel. Since the BSR is the immediate focus, the government has had to work within the existing legal framework, which still bars private ownership of nuclear plants. Yet it is the private sector that needs to decarbonise its production lines the fastest.

To bridge this gap, the Nuclear Power Corporation of India (NPCIL) has floated a request for proposal (RFP) inviting companies to invest capital in BSR projects without holding ownership stakes. In return, these firms will be entitled to use the electricity generated for their own operation, an arrangement that effectively opens a new model of public-private collaboration in nuclear energy.

So much is the confidence that legal amendments are underway to allow private sector participation and plant ownerships, an effort to bring in the much-needed capital and innovation.

“We have floated an RFP for deployment of BSRs to enable hard-to-abate industries to decarbonise,” says Bhuwan Chandra Pathak, chairman and managing director (CMD), NPCIL (see pg 52). According to the plan, private participants will provide land, cooling water and capital, while NPCIL will retain control over design, quality assurance and operations.

For India Inc however, the proposition has been underwhelming as of now. NPCIL’s 90-page proposal issued in December last year has sparked confusion, raising around 700 queries by June. Companies have flagged high operating costs projected by NPCIL and the absence of financing guarantees, among other issues. Pathak, on the other hand, suggests it to be a part of the process. “The queries on technology, costing, mechanism of implementation etc have been answered,” he says.

Scientists see more promise in the BSR project than the much-touted BSMR. Unlike BSMRs, which India has tasked BARC to design with NPCIL, the BSR is not a speculative technology. It is an adaptation of the PHWR design India has built and operated for decades. On the other hand, waiting for the untested BSMRs to get developed to be deployed at scale could be risky.

Going Desi

The logic is simple. While new reactors require years of testing and validation, the BSR can be scaled today, making it not just an immediate tool for industrial decarbonisation but also a long-term strategy to give India leverage in small nuclear plants. And BARC officials concede that developing the BSMR is not so straightforward. “Design maturity is advancing steadily,” a senior official says, pointing to progress in safety features and fuel systems.

Yet regulatory clearances, vendor development and component manufacture still stand in the way. The target of operationalising five BSMRs by 2033 is as much an aspiration as a timeline. Ajit Kumar Mohanty, chairman, Atomic Energy Commission of India did not comment on the BSMR project.

But what makes the distinction between the two sharper is the narrative coming from abroad. Kakodkar has been blunt on this. “They are all descending on India and trying to brainwash us,” he says of Western vendors. For him, the global hype around SMRs has little to do with India’s needs.

In advanced economies, demand has plateaued and new reactors are meant to replace ageing ones, not power a leap in per capita energy use. Smaller units look attractive to investors there because they lower financial risk. But to make them viable, vendors need a large order book. Only a country like India can provide it.

That leaves India facing a choice between buying into the West’s marketing pitch and leaning on its own established path. For SMRs to become competitive, they would need mass manufacturing and low-cost production. Without a prototype licensed in their home countries and orders large enough to bring down costs, they remain a promise on paper.

By contrast, the BSR is already commercially viable, with scope for step-by-step modularisation. Engineers argue that one could begin with practical improvements, such as shrinking the exclusion zone through enhanced containment, then gradually introduce modular construction techniques. In other words, the very dream of modular reactors can be realised by scaling the BSR, without waiting decades.

Fuel Fears

Over a decade ago, Indian power giants like Adani Power and Tata Power faced an unexpected jolt from Indonesia, a key coal supplier. The Indonesian government issued an order linking the price of exported coal to a benchmark based on international indices, requiring all existing contracts to be revised by September 23, 2011.

For Adani, which depended heavily on coal from Bunyu Island to fuel the Mundra power project, this implied a potential 10% rise in landed coal costs, threatening the economics of one of India’s largest power plants. The move came amid domestic coal shortages that had already constrained Adani’s access to government-linked supplies, forcing the company to rethink both sourcing and operational strategies.

Public acceptance will determine whether nuclear power can expand meaningfully in India. Even a disaster in another country, like Chernobyl or Fukushima can harden domestic sentiments

For India at present, the stakes are far higher with nuclear fuel. 100GW of nuclear power would need roughly 18,000 tonnes of mined uranium annually, about a third of the world’s current output. Expansion to this scale cannot rely solely on imports and foreign resources.

Reports indicate that India plans to nearly quadruple uranium imports by 2033 to meet its 22.48GW target by 2032. But beyond that, the 2047 goal of an additional 77GW raises serious questions. By 25–30GW, India’s demand could account for 10–12% of global uranium trade.

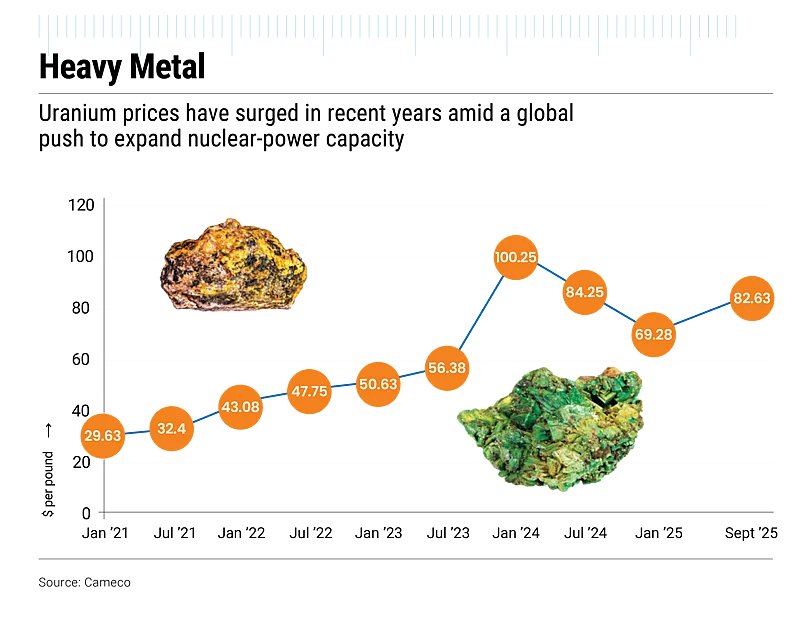

Competition is intensifying as other countries also want to expand their nuclear capacity. “Globally, uranium prices have risen sharply in the past two years as over 30 countries announced plans to triple nuclear capacity,” says Anil Parab, whole-time director, Larsen & Toubro (L&T), a manufacturing giant (see Heavy Metal).

It is safe to say uranium has already become an expensive and coveted commodity. A pound of uranium concentrate that cost $24.80 in March 2020 traded at $84.85 just over four years later. Without long-term fuel policies, India’s small nuclear projects could be jeopardised, warns Parab.

“In the current geopolitical context, we will have to develop our own supply chains,” says Robinder Nath Sachdev, a foreign-affairs expert. “India cannot rely on third-party supply chains, with the partial exception of Russia.”

The earlier trend of resource nationalisation that jolted Adani’s power project is now projected to evolve into trade wars, where Sachdev cautions that “one country might arm-twist another, especially adversaries”.

Nuclear fuel is expected to attract even greater geopolitical attention. Bhabha’s vision for India’s three-stage nuclear programme focused precisely on this—energy autonomy. The programme begins with uranium, moves to recycling fuel in fast reactors and ultimately leverages thorium, of which India has the largest reserves.

Thorium Thrust

While exploration has increased uranium stocks in India, ore grades remain low, thus leaving India dependent on imports. Scientists note that by recycling spent fuel in the second stage, fast reactors can extract 60–70 times more energy from the same mined uranium than would be possible by using it once in conventional reactors. This means India’s energy security depends more on how it uses and recycles nuclear fuel than on the type of reactors it builds, they note.

The most important third stage is where thorium comes in. But thorium alone cannot sustain a reactor. Instead, it is combined with a small amount of uranium to produce uranium-233, a fuel capable of running future reactors.

“This is high time that we switch over to thorium. The technology is not a problem, it is available,” says KN Vyas, researcher and a former BARC director. Clean Core Thorium Energy, a US company, has already developed a new fuel using a mix of enriched uranium and thorium that as per industry experts, can increase fuel efficiency 7–10 times and cut spent fuel by 85%. It has tied up with L&T for the Indian market.

Although India has mastered the first stage of its nuclear programme, constructing PHWRs fuelled by natural uranium, it remains far from realising the third stage of utilising thorium. China, by contrast, has made tangible progress by making the world’s first thorium-based molten salt reactor.

India’s second-stage fast breeder reactors, which were meant to bridge the gap, have faced repeated delays, leaving the country with a narrow window to explore direct thorium utilisation. Studies suggest that India’s thorium reserves could generate roughly 358,000GW-years of electrical energy, enough to power the nation for a century and more.

To accelerate thorium deployment, Indian scientists have been designing advanced heavy water reactors (AHWR), intended as a bridge between the first and third stages, allowing thorium to be harnessed without relying on fast breeder reactors. According to a paper by SK Jain, former CMD of NPCIL, these AHWRs are meant to advance thorium use, but the project has languished in the design phase for nearly a decade.

Therefore, the ultimate objective of the three-stage programme, which was tapping thorium for near-limitless energy, remains elusive even after 60 years. This essentially means that an ambitious target, like achieving 100GW of nuclear capacity by 2047, without fuel security only exposes India to the devils of uranium dependency and geopolitics.

Facing the Fire

In the small fishing village of Idinthakarai, in Tamil Nadu’s Tirunelveli district, memories of 2012 still linger. That year, residents faced police crackdowns as they protested against the Kudankulam Nuclear Power Plant, built in collaboration with Russia, and just 2km from their homes. On September 10, around 1,000 anti-nuclear protesters had tried to march towards the plant. The police responded with tear-gas shells.

Even as countries worldwide fall back in love with nuclear energy, attitudes towards it vary sharply.

“Even when a nuclear power plant functions ‘normally’, it is a disaster in itself. It emits radiation that contaminates water, land and air,” says SP Udayakumar, an anti-nuclear activist. “If you study cancer incidence around nuclear-power plants, you will find it significantly higher. But governments never acknowledge this.”

Small reactors, in that case, are being promoted as a possible way forward. Compact and theoretically safer, they are being envisioned as a bridge between technological ambition and social acceptance.

Even state-run giants like NTPC, planning to enter the nuclear business face uncharted territory. Historically focused on coal and gas, the company has little nuclear experience. “Many NTPC sites are now in urban areas. So, for SMRs, it is essential to assess the distance from populated zones to ensure safety, security and proper radiation management,” says an expert requesting anonymity.

Gurdeep Singh, CMD, NTPC did not comment on the company’s nuclear plans.

Former BARC director Vyas suggests, “They [NTPC] have basic capabilities, but they will need to learn the discipline of the technology from NPCIL and then finally take over on their own.”

Private players have even bigger problems. For them, the debate over safety cannot be divorced from history. India has never suffered a major nuclear reactor accident, yet the memory of the Bhopal gas tragedy of December 1984, caused by private sector negligence, remains deeply etched in public consciousness.

Nuclear energy, though relatively safer in terms of frequency of accidents, is not insulated from potential mishaps. “Even though the footprint of an SMR is relatively small, around 1sq km, issues around nuclear safety, fuel management and site regulations need to be addressed,” says Anujesh Dwivedi, partner with Deloitte, a consultancy.

Public acceptance, the so-called social licence, will determine whether nuclear power can expand meaningfully in India. Even a disaster in another country, like Chernobyl in 1986 or Fukushima in 2011, can harden domestic sentiment overnight, threatening years of planning and billions in investment.

Powering the Future

The stakes for India’s nuclear mission have now become existential. The government has realised that if the country fails to scale nuclear energy in the next three decades, the consequences will extend far beyond electricity shortages. Industries already stretched by volatile fuel prices would find themselves cornered, unable to compete with nations that have secured reliable and clean baseload power.

Dependence on coal would not be tolerated by a world tightening its climate rules; renewables, while crucial, cannot by themselves sustain the relentless pace of growth India seeks.

The experience of Spain and Portugal offers a preview. Both nations invested heavily in renewables, but without sufficient balancing power, their grids struggled with intermittency, leading to instability and the biggest blackout of modern times.

Without nuclear energy forming a strong backbone, the dual pressures of growth and clean power could strain India’s economy in ways far harsher than anything seen so far.

“If we do not take steps now, we risk falling far behind. With India’s huge energy requirements, the need to achieve net-zero targets and the necessity to maintain GDP growth, we must adapt advanced technologies,” says RK Singh, a nuclear scientist.

For decades, the West has sought to script the destinies of emerging economies be it through embargoes, technology denials or the leverage of resource control. That pressure will only intensify as the race for clean energy sharpens.

India today stands on the edge of a moment as consequential as independence or liberalisation. It has a unique growth engine in a slowing global economy, a nation with the demographic and industrial heft to become a superpower. But that promise will hold only if it secures the backbone of sovereign energy. Nuclear power is no longer just one option among many; it is the hinge on which India’s future strength may turn.