How’s that?” shouted Ajay Relan across the tennis court as he swung a backhand shot to his opponent, who scampered across the court to connect but missed it by a whisker. “You are amazing at this age,” replied 30-year-old Anshuman Khurana, shaking his head in disbelief. It was a nice, sunny day at the Delhi Gymkhana and 60-year-old Relan was at the top of his game. He was enjoying every moment and his hard work of practising the game for one-and-a-half hours every morning was clearly paying off.

Just as the game ended, 25-year-old Moumita Mukherjee, who was watching the game from a distance, suddenly came over and threw her arms around Relan’s neck and gave him a peck on his cheek, saying, “Thank you so much!” Relan, who was both stunned and pleased to have a PYT gushing over him, quickly gathered his senses and retorted, “What for?” Mukherjee replied, “I just made a killing on the stock call you made earlier this year, I’m really impressed.” “Oh, that one,” grinned Relan from ear to ear, clearly enjoying the sudden adulation. “I owe you a treat. How about catching up for coffee?” “Sure, I will be there at sharp 4.20 pm,” he replied. “Thanks, because I need to know what’s up your sleeve for 2015,” trailed off Mukherjee.

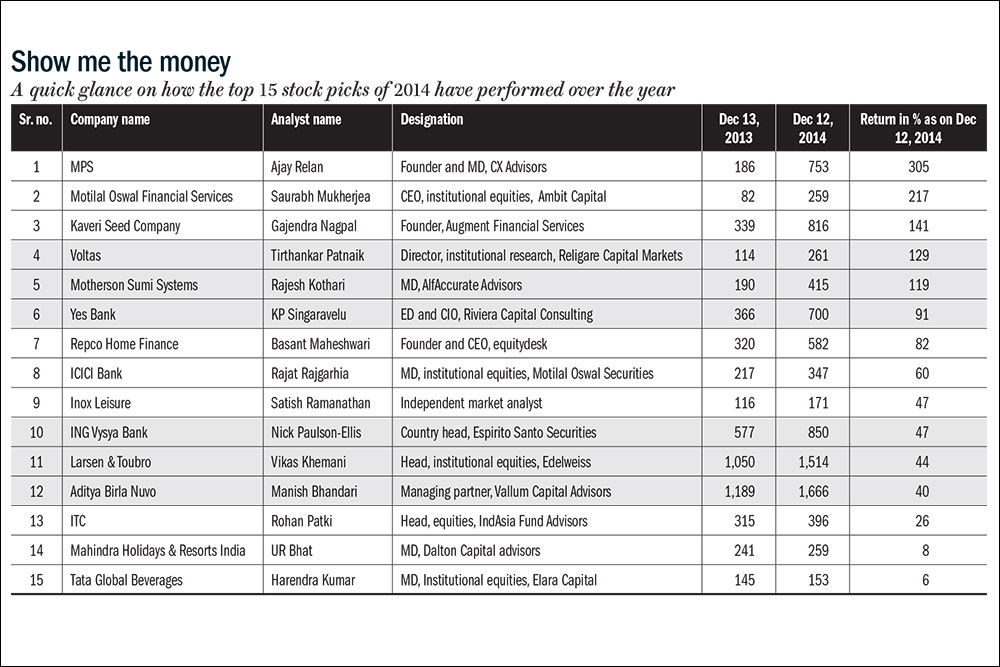

We really don’t know what happened over coffee, for the 200-odd words you just read were part of a cock-and-bull story. What’s definitely true is that Ajay Relan, founder of CX Partners, a homegrown private equity firm, does play tennis every morning at the Gymkhana and his stock pick for 2014 has indeed done well. In the Outlook Business issue dated January 4, 2014, well-known market experts had put out a list of 15 stocks to be bought in 2014 and we are pleased to state that five of them have more than doubled, dishing out between 119% and 305% return. Seven stocks surged between 40% and 91%, while only three trailed the benchmark index by giving out 6% to 26% return (see: Show me the money).

Relan’s stock pick, MPS (formerly Macmillan), which is into publishing solutions, has topped the charts by going up three-fold. The stock surged from ₹186, the price at which it was recommended, to ₹753 by December 12, 2014. [The last traded prices for the stocks recommended in the issue were as of December 13, 2014.] Over the same period, the benchmark Sensex went up 32% (20,715 on December 13, 2013, to 27,350 on December 12, 2014).

The other four stocks that more than doubled were Motilal Oswal Financial Services, Kaveri Seed Company, Voltas and Motherson Sumi. The three laggards were Tata Global Beverages, Mahindra Holdiays & Resorts and the tobacco-to-hotels conglomerate ITC.

As we head into 2015, a lot of hope and optimism seems to have been built into almost every single stock across the board, and picking up winners in such a market is pretty tough. So, what we have for 2015 are 10 stocks, of which just one — Coal India — is a large cap and the rest are small- to mid-caps.

Barring two stocks from the media and entertainment space, the rest are scattered across pharma to textiles, from agrichem to tutorials, all of which the guest writers believe are trading at attractive valuations and have a convincing story to tell. Turn the page to see what makes these 10 stocks so special.

Just one email a week

Just one email a week