There has been a buzz on dalal street this month as retail and institutional investors gear up for a wave of marquee listings, with Groww being the most-closely watched debut after Lenskart. The investment app has turned stock investing and mutual funds into everyday habits for young Indians. And now, the company is gearing up for India’s biggest-ever broking IPO.

Groww Turned Profitable, But Is That Enough for Its Lofty Valuation?

Groww’s IPO comes at a time when investor sentiment around fintechs is heating up, and the company’s strong profit growth and expanding user base have added to the buzz. With revenue topping ₹4,000 crore and over 100 million app downloads, it has clearly emerged as a retail investor favourite

At first glance, its growth story looks strong as profits have surged, revenue crossed ₹4,000 crore, and its tech-first model has outpaced legacy players. After recording profits in FY25, the company has posted a 12% year-on-year rise in its consolidated net profit for Q1 FY26 to ₹378.4 crore from ₹338 crore in the same period last year.

The brokerage platform has also shown strength in its ability to hold on to users. It has recently become the first investment app in India to cross 100 million downloads. The application has also been ranked in first spot globally in downloads and monthly users for Investing and Financial Management in 2024 by Sensor Tower.

That performance has set higher expectations, but momentum comes with a price. Groww is aiming for a valuation richer than most listed brokers. Among all listed peers, Angel One has the lowest valuation at 19.16x, while Motilal Oswal and Nuvama Wealth Management are valued at 23.38x and 25.63x. On the other hand, Groww commands an estimated post-issue market capitalisation of ₹61,700 crore and a valuation of 33-41x FY25 earnings.

This raises a question whether the dalal street sees this valuation as durable leadership or exuberance in a hot-IPO cycle.

Inside Groww’s Profit Engine

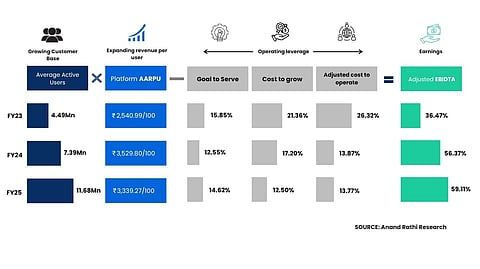

Analysts note that profitability is being driven by sustainable unit economics as well as short-term market tailwinds. With new revenue lines like margin trading, consumer credit, and commodities in the pipeline, Groww is steadily widening its product mix to deepen engagement and cross-sell to its growing base of “affluent” and “aspiration” investors.

“Temporary market tailwinds such as IPO wave and trading boom help get more customers into the fold. They have a 77% retention ratio which leads to higher operating leverage, also their entire tech is built in-house. Therefore, it is a combination of both,” said Amit Khurana, Head of Institutional Equities.

Customer retention, in particular, is emerging as a defining moat. Must churn happen in the first two quarters, after which user attrition at roughly 2% annually, Khurana noted. This gives Groww headroom to monetise customers over a longer cycle through cross-selling.

“We would track cash and F&O ADTO, transaction volume, customers added, monthly transacting users and churn trend of users (most users get churned out in the first 2Q, followed by only ~2% drop for perpetuity). MTF vertical, consumer credit and commodities are new product lines,” he added.

The analyst further stated that the platform has segregated users into 'Affluent' and 'Aspirational' and have new product offerings (such as 'W') for the affluent segment which also enables customer stickiness and cross-selling.

Sustainability on New Revenue Levers

Groww's headline profit of ₹1,824 crore in FY25 needs careful analysis. The FY24 loss of ₹805 crore stemmed from a one-time ₹1,340 crore tax hit tied to domicile restructuring. In Q1 FY26, reported profit rose 11% to ₹378 crore, but adjusting for one off items like incentive reversals reveals underlying profit fell approximately 25%.

Abhishek Kumar, founder at SahajMoney and SEBI RIA, believes that real sustainability depends on whether this profitability would hold as regulatory headwinds and slowing F&O volumes shows impact. He listed three metrics, including customer acquisition cost, retention rate, and activation rate, to judge if profits are structurally sustainable.

“I would also monitor growth in non-broking revenue through margin trading facility, lending, and wealth management. These factors could signal sustainable unit economics going forward,” he said, while adding that the right benchmark to value Groww should include comparing it with other discount brokers like Angel One and Motilal Oswal.

In FY25, Groww reported 12.92 million active clients, significantly ahead of long-established broking apps like Angel One which has 7.6 million users and Motilal Oswal with one million clients.

The platform’s active client base expanded by 35.5% year-on-year — outpacing key rivals like Angel One (24%) and Motilal Oswal (15.4%). In contrast, wealth-focused peers such as 360 One WAM, Nuvama Wealth Management, and Prudent Corporate Advisory Services saw modest or even declining client additions during the same period.

Besides comparison with its peers, analysts believe that revenue from margin trading facility (MTF) interest could be the next growth lever. Additionally, growth in wealth management through the Fisdom acquisition and new "W" brand targeting affluent users with portfolio management services and alternative investments can lift revenue per user.

Its lending via NBFC arm Groww Creditserv, insurance distribution, and fixed deposits could further diversify its revenue. “Its future success would depend on cross selling these multiple products to its user base while maintaining low customer acquisition costs through organic growth,” Kumar added.

Premium Valuation or IPO Euphoria

Even with these tailwinds, Groww trades at a premium to listed brokers and many global fintech names, a point many investors are wrestling with. “It’s a mixed bag,” Kumar said. He added that high organic acquisition (over 80% of new customers), user retention and operational profitability at scale would distinguish it from its peers.

“But the valuation would be durable only if it navigates F&O regulatory curbs, grows or sustains EBITDA margins, and successfully monetizes wealth, lending, and insurance,” he said. As Khurana notes, segmentation could be a key unlock: Groww has already bucketed users into “Affluent” (assets over ₹25 lakh) and “Aspirational” categories.

While valuations remain a point of debate, analysts believe Groww’s next phase of growth will hinge less on pricing power and more on expanding market depth. Much of that opportunity lies beyond metros, where first-time investors are entering the market in record numbers.

“Equity participation is India is still under-penetrated, next leg of growth is in tier 2 or 3 cities. 43% customers did their first-time KYC with Groww which shows the growing appetite of new-market entrants (22% of households in India want to enter the equity markets in the next 6-12 months as per SEBI data),” Khurana added.

He highlighted that around 81% of their active customers are outside the top six cities as of 30 June 2025. And financialisation data suggests that household assets as a percentage of GDP have jumped from 8% to 15% in FY25, compared to over 50% in matured markets.

Some brokerages noted that at current valuations, the IPO does appear fully priced and may not offer strong listing gains. Anand Rathi recommended that investors can subscribe it for the long-term.

The IPO got fully subscribed on the second day of share sale on Thursday. It received bids for 39,16,33,950 shares, as against 36,47,76,528 shares on offer, translating into 1.07 times subscription, as per data available with the NSE till 11:45 hours. Retail Individual Investors (RIIs) part received 3.62 times subscription, while the quota for non-institutional investors got subscribed 1.32 times.

The company, which is backed by marquee investors such as Peak XV, Tiger Capital, and Microsoft CEO Satya Nadella, plans to use proceeds from the IPO to invest in technology development and business expansion.