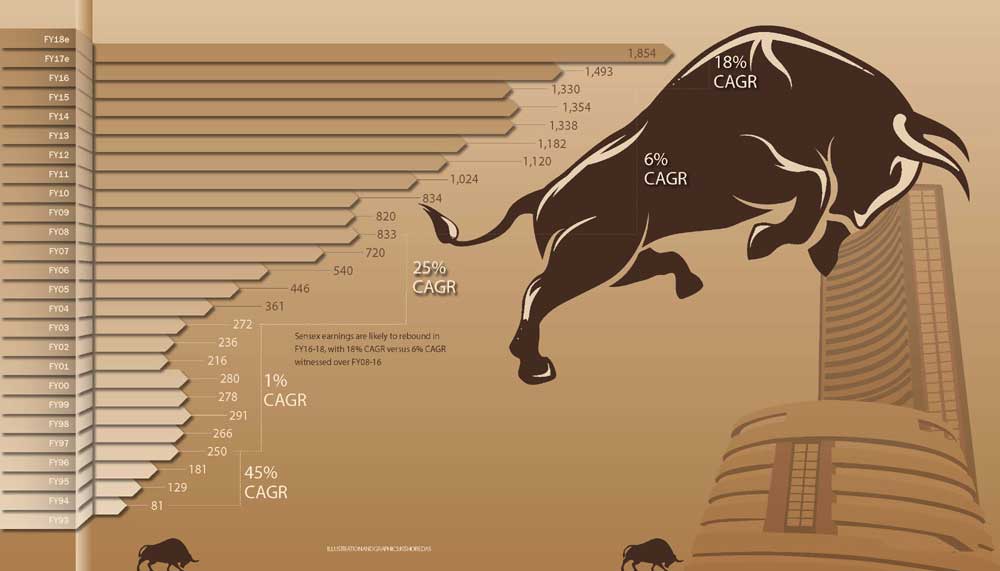

Is the tide turning on Dalal Street? After a dismal 6% CAGR witnessed during FY08-16, CY15, brokerage house Motilal Oswal (MOSL) expects Sensex EPS to compound at 18% over FY16-18. The just concluded fiscal saw earnings decline due to multi-year low commodity prices, significant NPA provisioning, two consecutive years of poor monsoon and lack of material transmission of rate cuts. But the headwind will turn into tailwind in the current and next fiscal, believes MOSL. First, a mere 1.5% PAT CAGR over FY12-16 means incremental growth will look better, thanks to the base effect. Further, a large part of NPAs being provisioned in FY16, means lesser pressure on the P&L of banks. Giving consumption a boost would be the 7th Pay Commission and a normal monsoon. As a result, the brokerage expects Sensex EPS to lock 12% growth in FY17 at Rs.1,493 and 24% in FY18 at Rs.1,854. A recovery in metal prices and impact of RBI’s rate cuts is also likely to aid the rally. Given the current resilience, it seems investors are buying the story.

The great earnings hope

There’s a bull run in store for the Sensex EPS, believes Motilal Oswal Securities

Opening

Opening