Since its much-anticipated debut on the stock markets in 2022, Delhivery, one of India's leading logistics and supply chain players, has failed to impress Dalal Street investors. The company’s stock has seen a significant decline of over 25 per cent from its listing price, despite being a market leader in e-commerce logistics.

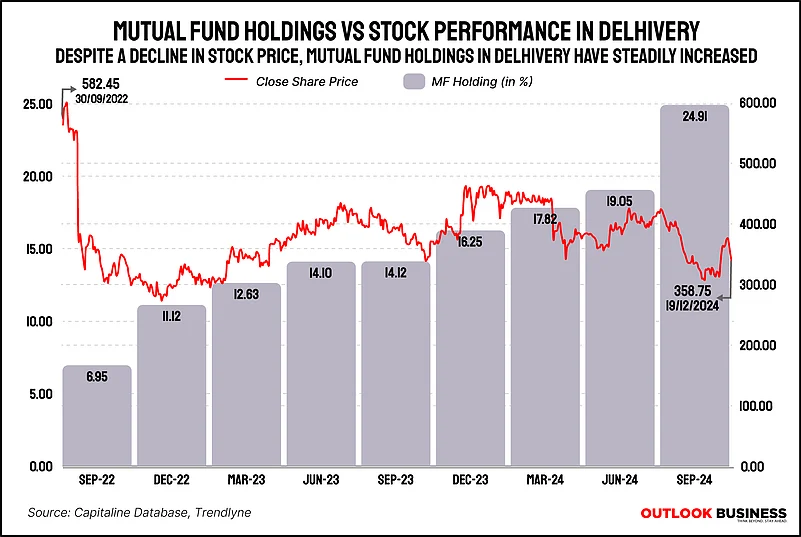

In fact, the stock has struggled to keep pace with the broader Nifty 50 index, which has surged nearly 12 per cent over the past year. While Delhivery's stock performance has been muted, domestic mutual funds (MFs), the key institutional investors, have been gradually increasing their stake in the company, with their holdings rising from 14.12 per cent in September 2023 to a significant 24.91 per cent by September 2024.

Delhivery's stock has not lived up to the expectations set at the time of its IPO. The stock has been on a steady decline, falling by over 12 per cent in the past six months, as of December 20, 2024. As of now, Delhivery’s stock is trading around Rs 350, marking a 29.3 per cent decline from its listing price and 28.27 per cent off its 52-week high of Rs 488.

The stock’s underperformance has left many investors wary, especially when compared to the broader market’s growth. However, despite these challenges institutional investors are confident in the company's long-term prospects.

Why Mutual Funds Are Betting on Delhivery

This sharp rise MF holdings in Delhivery indicates that institutional investors are betting on the company’s future, seeing potential beyond the short-term performance of the stock.

Ankita Shah of Elara Capital says Delhivery has been experiencing double-digit volume growth, especially in the PTL (Part Truck Load) segment. The issues related to the integration of SpotOn Logistics, acquired in 2021, are now behind them.

Additionally, the service EBITDA, which was negative until Q3 FY24, has turned profitable and is gaining momentum. The company is optimistic about this segment, expecting EBITDA margins to reach double digits in the long term, driving further volume growth.

In H1FY25, Delhivery’s PTL B2B segment grew at 20 per cent compared to its competitors struggling for growth. The growth is expected to continue with improvement in profitability on better efficiency of automation in hubs and network centers.

Currently, the service EBITDA margins stand at 3 per cent and likely to improve to 15-16 per cent in the long term on operating synergies.

Shah highlighted that the company is set to report its first full-year Profit After Tax (PAT) for FY25. In the first half, they reported a PAT of nearly 65 crores, and with the second half typically being stronger seasonally, profitability is expected to continue.

In Q2 FY25, company reported PAT of Rs 10 crore against loss of Rs 69 crore in the year-ago period. In Q1 FY25, it had posted a PAT of Rs 54 crore.

The Roadblocks Behind Underperformance

According to an ICICI Securities report, the company’s stock performance remained subdued due to various factors including slowing growth of the 3PL (Third Party Logistics) market as the proportion of in-sourcing at Meesho, the Bengaluru-based online marketplace, continues to increase and faster growth of quick commerce within the e-commerce space, where logistics is generally completely in-house.

In February this year, Meesho launched Valmo, its own logistics marketplace to democratize third-party logistics and reduce delivery costs, especially for the smaller players.

Concerns around some of the peers gaining significant share even within the 3PL space contributed to the muted investor sentiment.

In addition, weak financial performance in the previous financial year is also a major factor behind the weak stock performance. On May 21, 2024, Delhivery stock fell 12 per cent and its market cap slipped below Rs 30,000 crore following the announcement of Q4 results. In Q4 FY24, the company posted a loss of Rs 68.5 crore, down 57 per cent year-on-year from a loss of Rs 159 crore in Q4FY24.

Turning the Tide

While the express parcel segment saw a slowdown in the first half, primarily due to Meesho shifting more volumes to its in-house app, Valmo, and the rise of quick-commerce companies, Q3 is typically a stronger season for this business, and growth is expected to pick up, analysts suggest.

Management believes that as Meesho continues to insource, this could create an existential crisis for some of its competitors, leading to consolidation which should benefit Delhivery, according to ICICI Securities report.

According to Shah, certain categories, such as apparel, footwear, and heavier goods in electronics, will continue to be delivered through traditional logistics channels, as quick commerce cannot fully address these products. Therefore, despite slower growth in the express parcel segment, these categories will still drive growth for the company.

Additionally, Delhivery is exploring opportunities within QC by leveraging its existing strengths in warehousing, distribution and last-mile logistics for online brands.

Furthermore, the management aims to boost service quality and growth in both the PTL and express segments through several initiatives. These include increasing next-day delivery by reducing return rates, expanding into the air express segment by operating on prime flights instead of non-prime ones, launching a rapid commerce service to deliver products within 4-5 hours (with a pilot project already underway in Bengaluru), and expanding their network of 120 freight stations in smaller cities.

This expansion targets larger volumes from SMEs and individual customers, while also increasing volumes from their existing express partner centers.

Delhivery's strong growth in key logistics segments and strategic initiatives have kept mutual funds optimistic about its long-term prospects. Despite the challenges, the company’s focus on expanding service offerings and improving profitability could help it navigate these hurdles. As the company works to address these concerns, it will be interesting to see if its operational improvements can eventually translate into stock performance that aligns with its growth potential.