Silver has long played second fiddle to gold, but in 2025, it has started vying for the top place. Often viewed as “the poor man’s gold”, the white metal offers both a hedge against inflation and exposure to industrial growth, creating a unique dual appeal.

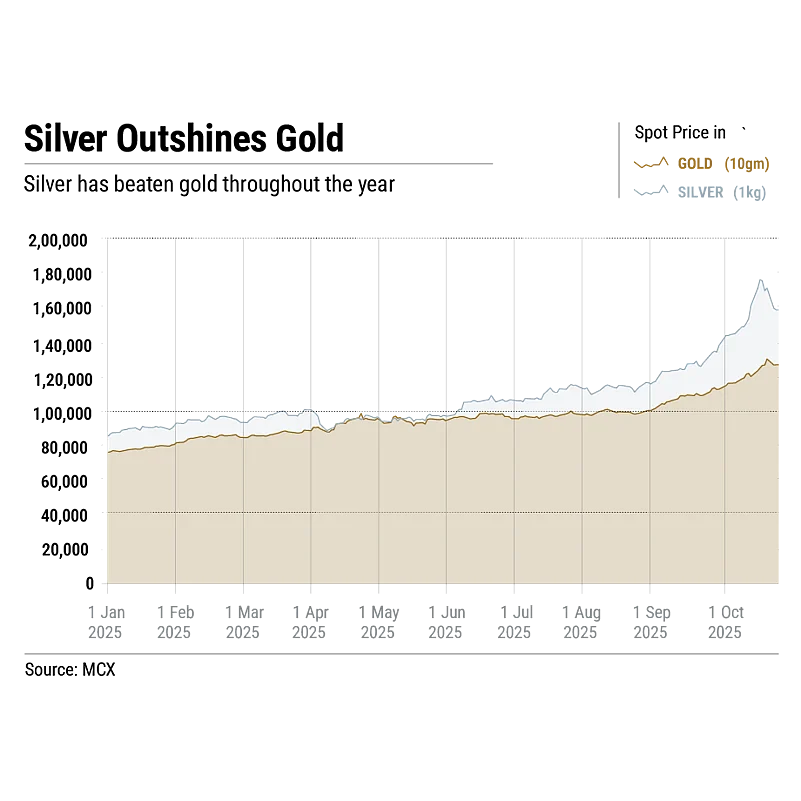

The white metal saw an extraordinary rally this year, with prices soaring to multi-year highs and breaking previous records. It breached its long-standing April 2011 high of $48.70 per ounce to reach $54.08 per ounce on October 17, 2025 in the international market. In the domestic spot market, it reached a new high of ₹1,76,304 on October 14, 2025. In fact, October 2025 will go down as a landmark month for silver as it not only touched a new all-time high, but also gave the highest-ever monthly return.

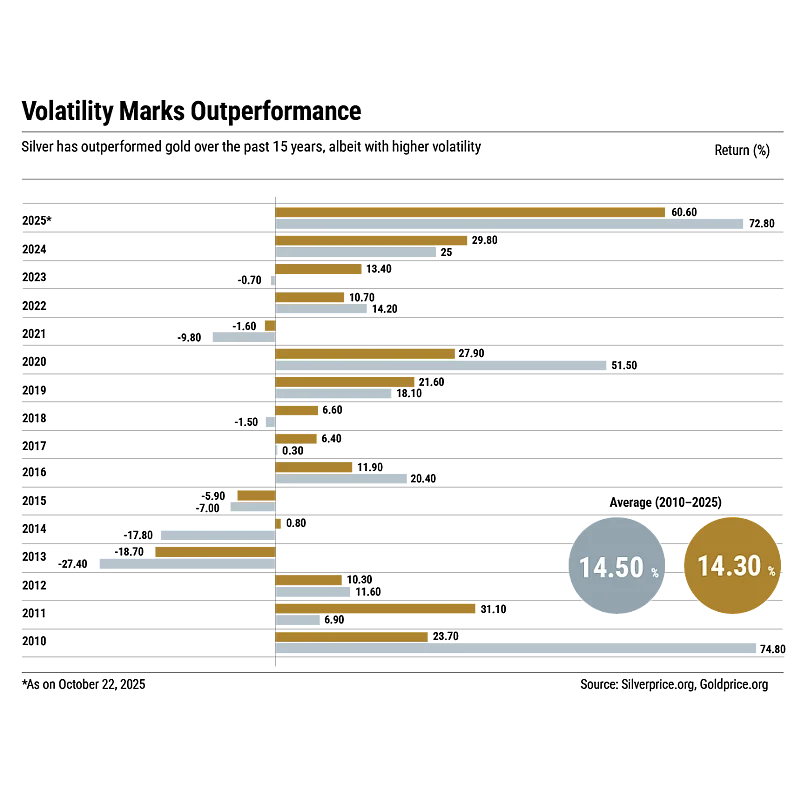

This exuberance is also significant because its year-to-date (YTD) return of over 70% has surpassed those of all asset classes, including equity, gold and other commodities, by a significant margin.

“The metal’s outperformance relative to gold has been fuelled by a mix of safe-haven demand, a weakening dollar, lower interest rates and robust industrial usage,” says Kaynat Chainwala, assistant vice-president, commodity research, Kotak Securities, a stockbroking company.

Silver lease rates surged following its addition to the US critical minerals list, reflecting tightening physical supply, she adds. Lease rate is the annual cost of borrowing silver in the London bullion market. A higher lease rate means lower supply and vice-versa.

The Rise of Silver ETFs

Historically, the demand for gold and silver surges ahead of Dhanteras and Diwali. Also, both gold and silver have been on an upward trend, on the back of escalating geopolitical tensions and global uncertainty. In such times, investors typically gravitate towards precious metals.

The sharp rally in silver prices compared to gold combined with higher demand during the festive season drew a wave of inflows into silver exchange-traded funds (ETFs), which led to a supply crunch, and silver ETFs began trading at higher premiums to the value of their underlying asset (silver). This price dislocation prompted fund houses to temporarily suspend subscriptions in their silver fund of funds (FoFs), which invest primarily in silver ETFs, to protect investors and restore market balance.

To be sure, while gold ETFs have been in the market for over two decades, silver ETFs are relatively new. In September 2021, the capital-markets regulator, the Securities and Exchange Board of India (Sebi), allowed the launch of silver ETFs by fund houses. The first ETF was launched at the beginning of 2022 by ICICI Prudential Mutual Fund.

In a short time, they managed to garner much attention. Silver ETFs registered an unprecedented surge with their assets under management (AUM) growing by over four-fold to touch ₹12,331 crore in October 2024, up from ₹2,844.76 crore in October 2023. In the past one year, till September 2025, the AUM has grown over three times from ₹12,331 crore to ₹37, 518 crore.

Returns are the major driver. In the past three years, the average return from silver ETFs is 39.14% compared to 34.86% delivered by gold ETFs.

According to data from the Association of Mutual Funds in India (Amfi), in September 2025, monthly inflows into silver ETFs was ₹5,342 crore, accounting for nearly 28% of total passive fund flows during the month, while gold ETFs attracted inflows worth ₹8,363 crore in the same period. Together, gold and silver ETFs contributed almost 72% of the overall passive inflows, a clear indication of growing preference for precious metals as portfolio diversifiers amid global uncertainty.

Before the launch of silver ETFs in India, there were mainly two ways in which one could invest in the metal—either physically through jewellery, bars and coins or through the futures market.

Investing in physical silver has limitations, such as holding risk and purity issues. The other major concern is the difference in price at different geographical locations and the gap between the buy and sell price. The futures market is for very savvy investors.

Silver ETFs have helped small investors to invest in the metal as they overcome purity, safety and liquidity issues.

Why is Silver Shining?

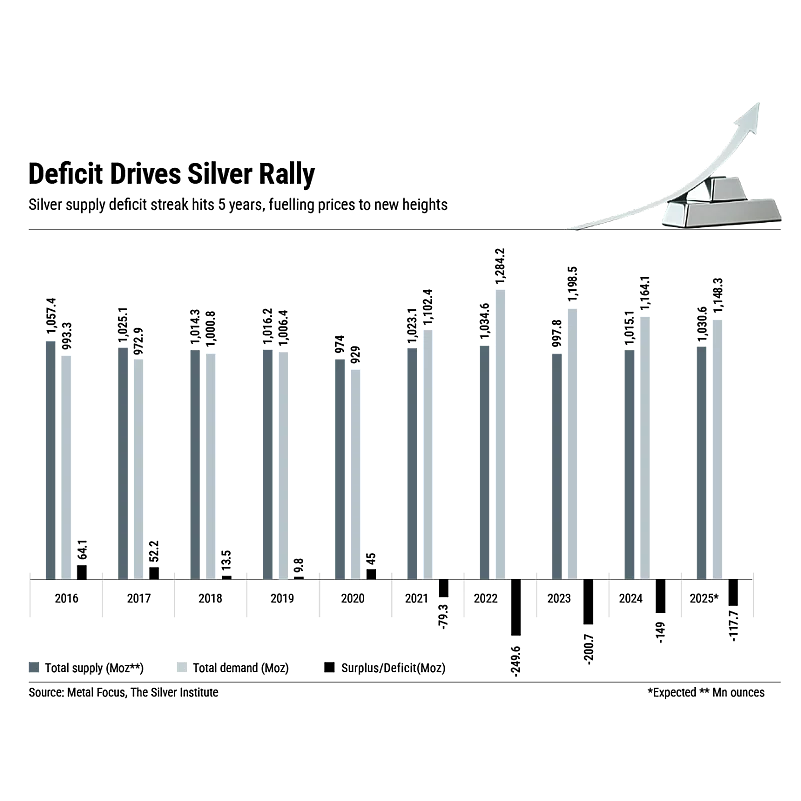

Demand-supply mismatch: At the core of the price surge in silver lies a persistent supply-demand imbalance. Global silver supply has failed to meet demand for five consecutive years, resulting in sustained market deficit. According to data from The Silver Institute, an international non-profit, 2025 is the fifth consecutive year of a structural shortfall, due to constrained mine output and limited recycling. “This has created a price floor, which has resulted in upward pressure on silver valuations,” says Vikram Dhawan, head, commodities, and fund manager, Nippon India Mutual Fund, an asset-management company.

Global silver supply, at around 1,030mn ounces in 2025, continues to lag behind total demand, estimated at 1,148mn ounces. “Over the past five years, cumulative demand has outpaced supply by nearly 800mn ounces, with another 187mn-ounce shortfall projected this year. As most silver is produced as a byproduct, supply remains inelastic amid rising prices," says Chainwala.

On the other side of the equation, demand has exploded, led by industrial applications that are deeply intertwined with the world’s clean energy transformation.

“Most emerging economies are moving towards the clean-energy segment and silver is at the centre stage,” says Dhawan.

In particular, the solar-panel sector has become a major consumer. Silver is also a vital component for the electric-vehicle (EV) industry. The global EV boom, coupled with rapid advancements in electronics, 5G technology and semiconductors, has pushed total industrial demand for silver to nearly 680mn ounces in 2025, accounting for more than half of total silver consumption.

The new safe haven: While industrial strength provides the foundation, investment sentiment has amplified silver’s rally in 2025. Persistent inflationary pressures, geopolitical uncertainties and a weaker global outlook drove investors toward tangible assets.

Silver ETFs have been at the forefront of this wave. “Global silver ETF holdings have reached 0.82bn ounces, the highest since July 2022, up 15% YTD,” says Chainwala.

Historical Performance

We examined 100 years data to take stock of silver’s performance. In October 1925, silver was priced at $0.69 per ounce, reflecting limited industrial demand and a stable monetary environment. It took nearly 37 years for the metal to breach the $1 mark in February 1962, indicating a prolonged phase of price stagnation.

Over the subsequent six years, silver prices doubled to $2.02 per ounce by November 1967, supported by rising industrial usage and moderate inflationary pressures. The momentum continued, with prices reaching $5.37 per ounce in March 1974 amid heightened global inflation and currency volatility. Within the next six years, silver witnessed an unprecedented rally, surging nearly six-fold to $35.52 per ounce in February 1980. This sharp escalation was largely driven by speculative demand and attempts to corner the silver market, culminating in the Hunt brothers’ silver squeeze.

The subsequent regulatory crackdown and market correction triggered a steep decline, with prices plummeting to around $5 per ounce by 1982. After a prolonged idle phase of around 22 years, silver started its upward journey after the 2008 financial crisis and reached $48.20 in April 2011 with volatility in the interim. After a gap of 14 years, it breached this level in October 2025.

Will Silver Keep Shining?

While the momentum remains strong, analysts caution that silver’s rally may face bouts of volatility. “Momentum has been supported by China’s clean-energy transition and supply disruptions at Freeport’s Grasberg mine in Indonesia. ETF inflows, strong physical demand in Asia and expanding use in solar and electric vehicles highlight a broader and more durable demand base,” says Chainwala.

The green transition, expanding solar capacity and surging EV production are expected to drive silver demand into the next decade. “With supply growth constrained by limited new mining projects in the next couple of years and slow recycling, the structural deficit is unlikely to close soon,” says Dhawan.

"Silver 2030—The Unprecedented Rise", a report released by Motilal Oswal, a financial-services company, in October 2025, anticipates that the ongoing rally represents an enduring structural bull market, fuelled by inelastic mine supply, accelerating green economy demand and the rapid depletion of above-ground inventories.

Silver’s dual nature makes it sensitive to shifts in both global manufacturing and macroeconomic sentiment but it also positions it for long-term appreciation as it’s a rare combination that few other assets can match. “With ongoing geopolitical risks, sticky inflation and expanding industrial relevance, silver’s dual role as a safe haven and strategic metal remains firmly in focus,” says Chainwala.

However, an economic downturn could impact silver prices more sharply than gold’s. More than half of the demand for silver comes from industries, so it’s more dependent on economic activity, which makes it more volatile than gold.

What Should You Do?

Silver could be a good portfolio diversification tool and act as a hedge against inflation, while giving better returns than gold during economic revival but over a longer period.

“Investors should resist being swayed by short-term rallies or speculative buying. Instead, they should view it as a strategic asset allocation tool that offers both inflation protection and exposure to industrial growth,” says Chintan Haria, principal investment strategist, ICICI Prudential Asset Management. “Investors add precious metals like gold and silver to their portfolio because prices of these assets tend to be not correlated with those of other asset classes,” he adds.

If your portfolio requires, say, 15% allocation to precious metals, consider dividing it equally between gold and silver. This balanced approach will help mitigate volatility and help you participate in both the monetary stability of gold and the industrial potential of silver.