At a Mahindra & Mahindra (M&M) showroom in Gurgaon, a man in his early 30s leans over a black Thar. He runs his hand across the rugged dash, checks the upright stance and lingers on the muscular wheel arches. To him, the Thar isn’t just a car. It’s an extension of his personality.

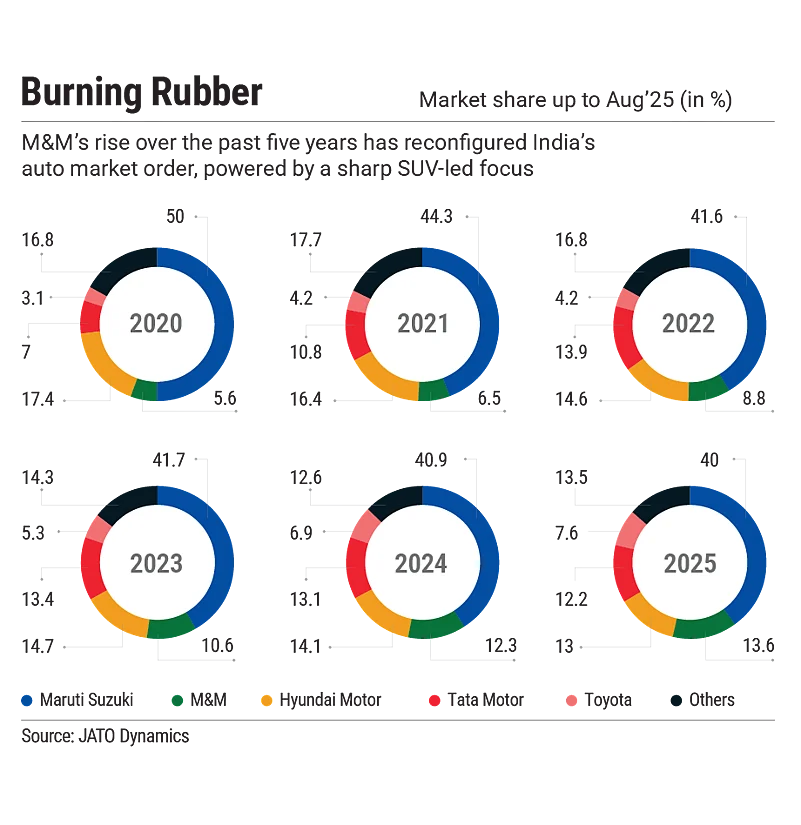

That alpha appeal has powered M&M’s return to the big league. For the first time, an Indian automaker has broken into the top two of the country’s passenger-vehicle (PV) market, overtaking Hyundai and ending the South Korean company’s 17-year hold on the runner-up slot on an annual basis.

The turning point in M&M’s comeback didn’t begin in a boardroom; it began with this car. For nearly a decade, executives debated whether the Thar deserved a modern revival.

The old model had a cult status among off-roaders but wasn’t the go-to vehicle for the more cosmopolitan. “It was treated like a passion project, a skunkworks,” recalls a former M&M executive involved in early discussions. “Everyone loved it, but no one was sure it made business sense.”

Finally, Anand Mahindra (now chairman, Mahindra group) stepped in. The result was a Thar that kept its soul but shed its rough edges—still capable off-road, yet comfortable enough to be parked outside a café or in a corporate parking lot.

When the new Thar was launched in November 2020, the response was electric. Waiting lists stretched for months. Buyers such as techies, women drivers and families, who had never considered the brand before, queued for test drives.

“The Thar clearly gave a very positive reinforcement to what Mahindra stands for,” says Anish Shah, group CEO and managing director, Mahindra Group.

Manish Singhania, an M&M dealer in Raipur, saw that shift up close. “We used to sell one or two Thars a month; now we sell 30–40,” he says.

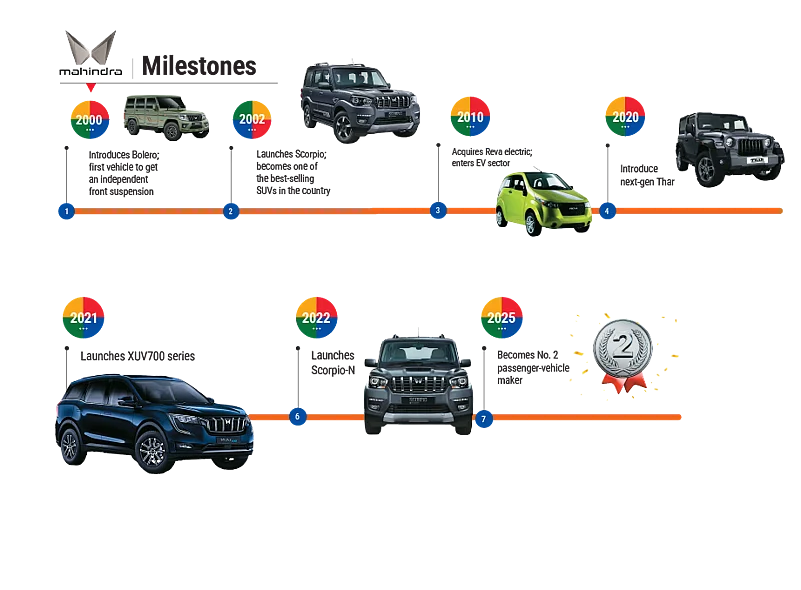

It opened the floodgates, and right behind it came the Scorpio-N and XUV700, each expanding M&M’s reach while keeping its sports utility vehicle (SUV) core intact. That surge in demand translated into a bigger slice of the pie. From a market share of 5.6% in 2020, M&M more than doubled it to 13.6% till January–August 2025, according to JATO Dynamics, an auto-analytics firm.

The Reset

But could that product surge rebuild a company that was seen to have lost its way? After years of scattered global bets and missed compact-SUV trends, M&M was searching for focus as much as momentum.

When Shah took over as group CEO in April 2021, M&M was not an obvious turnaround candidate. A decade of missteps had left the group’s auto arm struggling amid intense competition. Its SUV lineup failed to capture the compact boom, global forays like SsangYong and GenZe bled cash and rising costs eroded margins. Analysts called it “a bruised blue chip”.

Under Shah, the group underwent a sweeping overhaul. He moved fast, exiting or scaling back more than a dozen loss-making or non-core ventures within 18 months, the portfolio refocused on SUVs and electric vehicles (EVs), and product innovation accelerated.

“I had come into the group as head of strategy [in 2014] and therefore had a chance to see all the businesses closely,” Shah says. “I already had a blueprint of things that needed to be looked at.”

Shah insists the group’s fundamentals were never broken. “M&M had been the best-performing stock in Nifty from 2002 till August 2018,” he says. M&M already had an entrepreneurial DNA, deep engineering talent and a culture of purpose-driven business. “We just had to take our strengths forward into the next phase,” he adds.

He distilled that approach into a mantra that now sits at the core of everything the group does: ‘Think big. Do less. Execute flawlessly’. It also defines how M&M went from over-stretched to hyper-focused.

“M&M has been flexible and fast in decision-making,” says Vinkesh Gulati, a Delhi-NCR dealer who has been with the brand for over three decades. “If sales slow, they act immediately: refresh the product, tweak pricing, add features. In the past five years, they’ve outsmarted every OEM [original equipment manufacturer].”

The results were dramatic. At the consolidated level, M&M’s revenue rose from ₹74,277.78 crore in 2020–21 to ₹1,59,211 crore in 2024–25, while profit after tax from continuing operations quadrupled from ₹3,347 crore to ₹12,929 crore during the period. Within this, the auto segment’s revenues grew from ₹28,409 crore in 2019–20 to ₹87,443 crore in 2024-25.

“M&M became leaner, sharper and ready to ride India’s SUV wave,” says Harshvardhan Sharma, group head, automotive tech and innovation, Nomura Consulting.

The conviction to stay focused on SUVs didn’t emerge overnight. Shah traces its roots back two decades, beginning with the Scorpio in 2002. Built with an investment of ₹550 crore, the project was audacious for an Indian automaker attempting a vehicle from scratch. Its success proved that M&M’s own R&D could match global standards.

That confidence led to an even bolder move: a ₹650-crore investment to build the 125-acre Mahindra Research Valley near Chennai. The facility became the heart of M&M’s product development effort. “The vision our leaders had at that time to create a strong R&D and product technology centre in India is now paying results,” says Shah.

The group’s commitment to R&D is visible in its numbers. M&M spent ₹2,975 crore on R&D in 2019–20, rising to ₹3,143 crore by 2024–25.

“The decision then was to play only in what we call ‘authentic SUVs’. At that point, it was 19% of the PV market. Today it’s 30%. We decided to play only in 1/5th of the market because we wanted to create outstanding products in that space, show significant win there and then move on to other things,” says Shah.

For an Indian manufacturer to dislodge a global brand from the No. 2 spot was a shift in perception. “M&M’s rise to No. 2 wasn’t accidental,” Sharma says. “It was a result of strategic focus. While others diversified, M&M was committed to owning the SUV category. The Thar, Scorpio-N and XUV700 didn’t just fill segments; they redefined the brand from ‘utility-first’ to ‘desire-first’.”

Electrifying the DNA

If SUVs define M&M’s present, electric mobility will define its future.

M&M’s challenge, says Sharma, is not to diversify away but to “electrify intelligently within the SUV form factor”. The company has committed over ₹12,000 crore to its ‘Born Electric’ programme and also developed electric-origin INGLO platform that debuted with XEV 9e and BE 6e.

M&M was, in fact, an early mover in electric mobility. It acquired Reva Electric in 2010 and launched the e2o and eVerito soon after. But those cars were ahead of their time and the infrastructure was in its infancy.

So, what is different now? “We were convinced we needed a born-electric platform that would deliver a vehicle far better than one adapted from ICE [internal combustion engine] vehicles,” says Shah.

That single decision turned an experiment into conviction.

Today EVs account for roughly 8% of M&M’s total production. The company expects that share to climb to 20–30% soon and potentially to more than 50% within five to seven years. It already leads India’s electric three-wheeler market, seen as the first building block of mass EV adoption.

Ravi Bhatia, president and director, JATO Dynamics notes that while M&M’s EV announcements are ambitious, it still lags Tata Motors in product availability and sales. Tata Motors sold 8,540 electric PVs in August 2025, more than double M&M’s 3,495 units. That gap of nearly 2:1 is Shah’s next test.

Execution risk isn’t the only threat. M&M’s success has been built on diesel, a powertrain that still drives more than half its SUV sales.

Shah defends that mix: “Diesel after BS [Bharat Stage] VI is a much cleaner technology…Our petrol engines are among the best in India, and with EVs, we have a very good portfolio across all three [powertrains].”

Analysts are more cautious. “Diesel dependence is both an advantage and a risk,” says Sharma. “It’s core to M&M’s SUV DNA…but regulatory tightening will gradually make it harder to sustain.”

M&M doesn’t sell hatchbacks or sedans. Its all-SUV portfolio, once seen as limiting, now defines its edge. Back in 2020, SUVs accounted for about 29% of India’s PV market; by 2025 that share has climbed to nearly 55%. “Its market share rise came from a focused SUV portfolio and premium pricing…It has been consistently launching new models and updating existing ones,” says Bhatia.

But that single-mindedness also makes it vulnerable. “A pure SUV play is a concentration risk,” says Sharma of Nomura Consulting. “If policy or fuel price dynamics suddenly shift demand to compact or entry cars, Mahindra’s portfolio could be exposed.” However, he believes ‘SUVisation’ is a structural shift, not a temporary phase.

That exposure is something Shah acknowledges. “SUVs today account for over 60% of the market, but we currently play in only a segment of that. We have launched our Vision platform…Over time, that will help us play a bigger role in the Indian PV market,” he says.

“Sustaining the No. 2 spot will be tough but possible. M&M’s SUV pipeline is deep, its order book robust and its brand equity at a historic high,” says Sharma.

The Outlier Edge

Indian car buyers have rewritten what aspiration looks like. Industry observers call it the year of Indian OEMs: with both M&M and Tata Motors giving tough fights to global rivals.

At the Gurgaon showroom, the late-evening light shines off rows of Thars and Scorpios waiting for handover. The energy feels almost festive. M&M once powered India’s fields with tractors. Now it powers its ambitions—one muscular, unmistakably Indian SUV at a time.