TSMC October sales growth slowed to 16.9%, weakest since Feb 2024

Nvidia's Jensen Huang requested additional TSMC wafers

Analysts expect Q4 sales growth ~27.4%; sector valuations face correction risks

TSMC’s Monthly Sales Growth Hits Lowest Since Feb 2024, Hints at AI Demand Drop

TSMC reported its slowest revenue growth since February 2024, raising concerns of cooling AI demand even as Nvidia and other tech leaders insist momentum remains strong

Chipmaking giant Taiwan Semiconductor Manufacturing Co (TSMC) reported slower revenue growth in October, signaling a potential decline in AI demand. According to Bloomberg, the company’s sales rose about 16.9% in October, the slowest pace since February 2024.

Analysts reportedly expect TSMC’s sales to grow 27.4% in the current quarter. Despite the slowdown, TSMC shares have still gained about 37% since the beginning of the year.

The report comes after global tech stocks suffered a rout last week amid investors’ growing concerns over the sector’s lofty valuations. Several Wall Street chief executives also warned of an overdue market correction, while Michael Burry’s Scion Asset Management disclosed bearish bets on Nvidia Corp.

AI Leaders Still Bullish

Despite recent market pushback, industry leaders remain optimistic about AI-driven growth and continue to invest heavily in the technology. Meta, Alphabet, Amazon and Microsoft are collectively expected to spend more than $400 billion on AI expansion next year, a 21% increase from 2025, as they compete to secure leadership in emerging technologies.

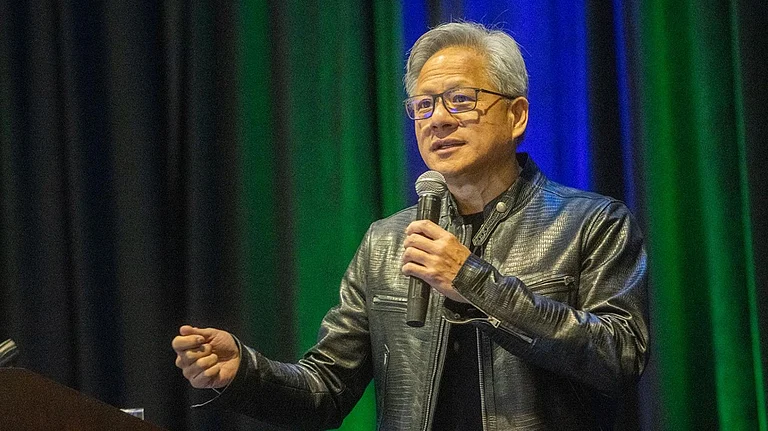

Despite a recent dip in sales, TSMC has secured a deal to supply additional AI chips to Nvidia, contradicting claims of a slowdown in AI demand. Nvidia CEO Jensen Huang said on Saturday that he has asked TSMC for more chip supplies, as demand for AI hardware, which is “growing month by month”, continues to exceed capacity.

Huang thanked the Taiwanese foundry for its crucial role in Nvidia’s success, saying, “No TSMC, no Nvidia.” He told reporters that the business remains “very strong and growing month by month, stronger and stronger.” TSMC CEO C.C. Wei confirmed that the two companies had discussed extra wafer requirements and had told employees he expects record sales to continue.

Huang’s optimism is echoed by his rivals. Qualcomm Chief Executive Officer Cristiano Amon told Bloomberg last week that the world is underestimating the scale of AI’s future growth.

In October, Wei reportedly told analysts that the company’s capacity remains very tight and that it is working hard to close the gap between demand and supply.

AI Bubble

An “AI bubble” refers to the convergence of investor euphoria, massive capital inflows, and inflated valuations that outpace the real, sustainable revenues these technologies can generate.

In recent months, the AI ecosystem has seen a flurry of headline-making deals, including Nvidia’s multi-year supply and investment commitments to OpenAI’s Stargate data centre program, OpenAI’s partnership with AMD to deploy tens of billions of dollars’ worth of chips in exchange for the chipmaker’s largest equity stake, and xAI’s $10 billion fundraise at a $200 billion valuation, among others.

Collectively, these deals have fostered a market dynamic where chipmakers, cloud operators, and AI platforms mutually reinforce one another’s valuations and access to financing.

This wave of mega-deals and accelerating data centre expansion has left investors questioning whether AI’s rise represents a lasting boom, or an emerging bubble.