Groww-backed Billionbrain shares nearly doubled, pushing market cap past ₹1 lakh crore

Short sellers suffered heavy losses due to a short squeeze and subsequent share auction

The company's low 7% free float amplified demand, leading to 30 lakh delivery defaults

Inside Groww’s 30 Lakh-Share Auction: What a Short Squeeze Is and What Triggered It

How a classic short squeeze at Groww trapped sellers, forcing 30 lakh shares into an NSE auction

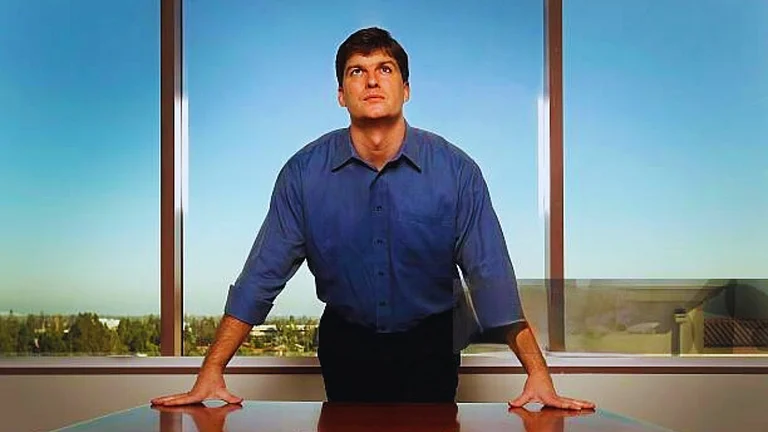

Newly listed shares of Groww-backed Billionbrain Garage Ventures have nearly doubled within a week of debuting on the market. The stock, which listed on November 12 at ₹112, surged to a record ₹193.80 by Tuesday (November 18), pushing the company’s market capitalisation past ₹1 lakh crore and propelling Groww co-founder and CEO Lalit Keshre into the billionaire ranks.

While this remarkable rally delivered substantial gains for the company and its investors, it came at a steep cost for short sellers, who were caught on the wrong side of the trade.

According to NSE data displayed on Tuesday, shares of Groww are now set to enter the auction window. The exchange bought back more than 30 lakh shares that could not be delivered on time, and these will now be auctioned at a premium.

The move highlights how several short sellers seemingly misjudged the stock’s strong post-listing momentum. Expecting the rally to cool quickly, the traders sold shares they did not yet own, assuming they could repurchase them at lower prices the same day. However, the stock continued to surge, leaving many unable to arrange delivery by the settlement deadline.

This triggered a short squeeze and pushed a significant volume of trades into the exchange’s auction segment.

What is Short Squeeze?

To understand short squeeze, one must first understand short selling. It is the practice where a trader borrows shares, sells them immediately, and hopes to buy them back later at a lower price for a profit. However, if the price moves against the short seller and goes up, their potential losses are theoretically unlimited.

Similarly, a short squeeze is a market phenomenon characterised by a rapid and sharp increase in the price of a stock or asset. This extreme price movement is triggered when an asset that has been heavily shorted begins to rise unexpectedly.

When the price of a heavily shorted stock rises, the short sellers face mounting losses, forcing them to quickly close out their positions. To close a short position, they must place buy orders to repurchase the borrowed shares. This sudden, high volume of compelled buying dramatically increases the demand for the stock, further driving the price up. This creates a self-reinforcing, upward price spiral known as the "squeeze," as more short sellers panic and rush to cover their positions, intensifying the buying pressure.

A famous, recent example of a short squeeze occurred with GameStop (GME) in early 2021. Large hedge funds held massive short positions, betting the company's stock would decline. However, individual retail investors, coordinating online, began aggressively buying the stock.

This unexpected buying pressure caused the price to skyrocket from under $20 to hundreds of dollars per share in a short period. The dramatic price increase forced the short-selling hedge funds to buy back shares at extremely high prices to mitigate their losses, causing billions of dollars in losses for them and fueling the stock's explosive temporary valuation.

Groww’s Rise in Share Price

The exponential rise in the share price of Groww cannot be attributed solely to the short squeeze. Beyond the squeeze, investors were also assigning Groww a high multiple due to its market share and strong user growth.

Kalp Jain, Research Analyst at INVasset PMS, believes Groww’s stock is surging because it has become a leveraged play on India’s retail investing boom. “With nearly 26% market share, Groww is now seen as a proxy for the entire retail participation story,” he said.

Jain says Groww’s sharp rally rests on five major pillars: “a vast and rapidly growing user base exceeding 10 million active accounts; a scalable digital-only business model with low incremental costs; a fresh IPO that attracted strong institutional interest; clear and credible plans to diversify beyond broking into wealth management, margins, commodities and lending; and powerful brand recall among first-time investors in India’s retail markets.”

Similarly, Santosh Meena, Head of Research at Swastika Investmart, believes that Groww’s rally was primarily driven by strong institutional confidence and the company’s superior fundamentals.

He said, “This confidence was bolstered by Groww's excellent financial metrics, particularly its high profitability (FY25 PAT of ₹1,824 crore) and exceptional capital efficiency (RoNW of 37.57%), which demonstrated a highly scalable, asset-light business model that was undervalued by the cautious GMP.”

Groww Short Squeeze & Shares Auction

Groww has a very low "free float," meaning only about 7% of its shares are available for trading. This scarcity caused market demand to overwhelm supply.

In stocks with such limited availability, even small trading volumes can cause sharp price fluctuations. As the stock price rose rapidly, traders who had "shorted" the stock were squeezed. To stop their losses, they were forced to panic-buy shares, driving the price up even further.

Despite this buying frenzy, NSE data indicates that sellers defaulted on the delivery of over 30 lakh shares during the settlement period.

To resolve this, the stock exchange intervened by holding an auction. During this session, the exchange purchased the missing shares from other investors and charged the extra cost to the sellers who failed to deliver. Because Groww shares are scarce and the price had already surged, these shares were likely bought at a premium price, resulting in significantly higher losses for the short sellers.